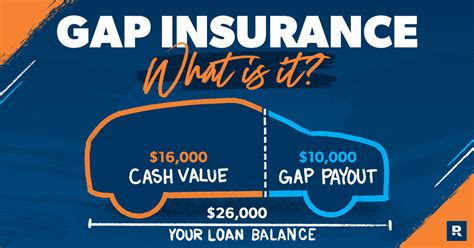

Gap Insurance

Gap insurance, also known as Guaranteed Asset Protection insurance, is a specialized form of coverage designed to protect vehicle owners from financial loss in specific scenarios. This insurance policy fills the "gap" between the actual cash value of a vehicle and any remaining loan or lease balance, ensuring individuals are not left with a substantial financial burden in the event of a total loss or write-off.

Understanding Gap Insurance and Its Importance

Gap insurance is an essential consideration for anyone financing or leasing a vehicle, particularly in the automotive industry. It provides a safety net for drivers, ensuring they are not held liable for potentially large sums of money if their vehicle is stolen, totaled, or deemed a write-off due to extensive damage. This type of insurance is especially crucial in the first few years of vehicle ownership, when the vehicle’s value depreciates rapidly, often more quickly than the loan balance decreases.

How Gap Insurance Works

In the unfortunate event of a total loss, the primary insurance policy will typically cover the vehicle’s current market value. However, this amount may not be sufficient to cover the remaining balance on the loan or lease, leaving the vehicle owner responsible for the difference. This is where gap insurance steps in. It covers the gap between the primary insurance payout and the outstanding balance, ensuring the owner is not left with a financial deficit.

For instance, if an individual owes $30,000 on their car loan and their vehicle is deemed a total loss, the primary insurance policy might only cover $25,000, reflecting the vehicle's current market value. In this scenario, the owner would typically be responsible for the remaining $5,000. However, with gap insurance, this additional cost is covered, providing financial relief to the vehicle owner.

Who Should Consider Gap Insurance

Gap insurance is highly recommended for individuals who:

- Have a car loan or lease with a high loan-to-value ratio.

- Are driving a new or recently purchased vehicle, as these tend to depreciate rapidly.

- Are concerned about potential financial liabilities in the event of a total loss.

Real-World Scenarios

Consider the following scenario: Sarah recently purchased a new car, financing 40,000 over a 60-month term. After 18 months, her car is involved in an accident and is deemed a total loss. The insurance company assesses the car's value at 32,000, which is the current market value. Without gap insurance, Sarah would be responsible for the remaining $8,000 on her loan, a significant financial burden. However, with gap insurance, this difference is covered, allowing Sarah to walk away without any additional financial obligations.

Benefits and Considerations of Gap Insurance

Gap insurance offers several key benefits:

- Financial Protection: The primary advantage of gap insurance is the financial protection it provides. By covering the difference between the vehicle’s value and the loan balance, it ensures the owner is not left with unexpected debt.

- Peace of Mind: Knowing that you are protected in the event of a total loss can provide significant peace of mind, especially for those who rely heavily on their vehicles.

- Affordability: Gap insurance is typically quite affordable, especially when compared to the potential financial risks it mitigates.

When Gap Insurance May Not Be Necessary

While gap insurance is a valuable asset, there are scenarios where it may not be as crucial. For instance, if an individual has a short-term loan or lease, the vehicle’s value may depreciate at a slower rate, making gap insurance less essential. Additionally, if an individual has significant equity in their vehicle, the gap between the vehicle’s value and the loan balance is already minimal, reducing the need for this type of coverage.

Comparative Analysis: Gap Insurance vs. Other Coverages

Gap insurance is distinct from other types of vehicle insurance. While comprehensive and collision insurance cover damages to the vehicle itself, gap insurance focuses on the financial gap that can arise when the vehicle’s value does not cover the loan or lease balance. It is an additional layer of protection, designed to complement, not replace, these primary insurance policies.

| Insurance Type | Coverage |

|---|---|

| Comprehensive Insurance | Covers damages to the vehicle from non-collision events, such as theft, fire, or natural disasters. |

| Collision Insurance | Covers damages to the insured vehicle resulting from a collision, regardless of fault. |

| Gap Insurance | Covers the financial gap between the vehicle's value and the loan or lease balance in the event of a total loss. |

The Future of Gap Insurance

As the automotive industry continues to evolve, with an increasing focus on electric vehicles (EVs) and autonomous technology, the role of gap insurance may also adapt. With EVs, the depreciation rate may differ from traditional vehicles, potentially impacting the need for and structure of gap insurance. Additionally, as autonomous technology advances and the number of accidents decreases, the frequency of total loss claims may also change, further influencing the gap insurance market.

Conclusion

Gap insurance is a critical component of vehicle ownership, providing financial security and peace of mind for drivers. By understanding the benefits and considerations of this specialized insurance, individuals can make informed decisions to protect their assets and ensure a secure financial future, even in the face of unexpected vehicle-related challenges.

How long does gap insurance typically last?

+Gap insurance typically lasts for the duration of the loan or lease term, ensuring coverage for the entire period in which the vehicle’s value may not cover the outstanding balance.

Is gap insurance required by law?

+No, gap insurance is not legally mandated, but it is strongly recommended, especially for those who finance or lease their vehicles. It provides an additional layer of protection that primary insurance policies may not cover.

Can gap insurance be purchased at any time during the loan or lease term?

+In most cases, gap insurance is most beneficial when purchased at the beginning of the loan or lease term. However, some providers may offer it at later stages, though the coverage and pricing may differ.