Insurance Companies Allstate

The insurance industry is a vast and complex landscape, with numerous players vying for market share and customer loyalty. Among these, Allstate stands out as a prominent player, offering a wide array of insurance products and services to individuals and businesses across the United States. In this comprehensive analysis, we delve into the world of Allstate, exploring its history, products, customer experience, and future prospects.

A Legacy of Innovation: Allstate’s Journey

Allstate Insurance Company, often simply referred to as Allstate, has a rich history that dates back to its founding in 1931. Headquartered in Northfield Township, Illinois, Allstate was born out of a vision to provide reliable and affordable auto insurance to the masses. The company’s founders, consisting of a group of Northwestern Mutual Life Insurance Company executives, recognized the need for a more accessible and customer-centric insurance provider.

Over the decades, Allstate has solidified its position as a leading insurer, expanding its offerings beyond auto insurance. Today, the company boasts a comprehensive suite of products, including homeowners, renters, life, and business insurance. Its commitment to innovation and customer satisfaction has propelled Allstate to become a household name, trusted by millions of Americans for their insurance needs.

Products and Services: A Comprehensive Overview

Allstate’s product portfolio is diverse and tailored to meet the varying needs of its customers. Here’s a closer look at some of their key offerings:

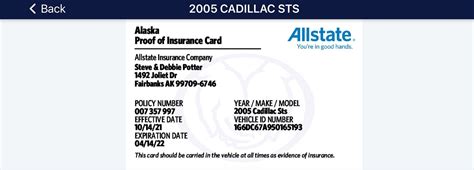

Auto Insurance

Auto insurance remains at the core of Allstate’s business. The company offers a range of coverage options, from basic liability to comprehensive plans that include collision, uninsured/underinsured motorist coverage, and personal injury protection. Allstate’s Drivewise program, which uses telematics technology to monitor driving behavior, is a unique offering that rewards safe drivers with discounts.

Homeowners and Renters Insurance

Allstate provides customized coverage for homeowners and renters. Their homeowners insurance policies cover a wide range of perils, including fire, theft, and weather-related damage. Additionally, Allstate offers optional endorsements for specific risks, such as water backup, identity theft, and jewelry/fine arts protection. Renters insurance, tailored for tenants, provides coverage for personal property and liability protection.

Life Insurance

Allstate offers a variety of life insurance products to help individuals and families plan for the future. Term life insurance, whole life insurance, and universal life insurance are among the options available. These policies can provide financial protection in the event of untimely death, ensuring loved ones are taken care of.

Business Insurance

Allstate’s business insurance division caters to small and medium-sized enterprises. They offer a range of commercial insurance products, including general liability, commercial property, workers’ compensation, and professional liability insurance. Allstate’s business insurance policies are designed to protect businesses from a variety of risks, helping them stay afloat during challenging times.

Additional Services

Beyond traditional insurance products, Allstate provides a host of additional services to enhance the customer experience. This includes access to a 24⁄7 claims hotline, a digital claims center, and a network of trusted repair shops. Allstate also offers financial services, such as retirement planning and investment advice, through its subsidiary, Allstate Financial.

| Product Category | Key Features |

|---|---|

| Auto Insurance | Customizable coverage, Drivewise program, accident forgiveness |

| Homeowners Insurance | Flexible coverage options, identity theft protection, optional endorsements |

| Life Insurance | Term, whole, and universal life policies, financial protection for beneficiaries |

| Business Insurance | Commercial property, liability, and workers' comp coverage, risk management services |

Customer Experience: A Focus on Service

Allstate understands that customer experience is a critical differentiator in the competitive insurance market. The company has invested significantly in technology and digital innovation to enhance its customer service offerings.

Allstate's Digital Locker is a prime example of its commitment to customer convenience. This digital platform allows policyholders to store and manage important documents, such as insurance policies, vehicle registration, and home inventories. In the event of a claim, this streamlined digital process simplifies the experience, reducing the stress often associated with insurance claims.

Additionally, Allstate's network of local agents plays a crucial role in providing personalized service. These agents, often embedded in local communities, offer face-to-face advice and support, ensuring customers receive tailored insurance solutions. The company's emphasis on agent training and development ensures that policyholders receive expert guidance and a seamless experience.

Claim Handling and Customer Satisfaction

Allstate’s claim handling process is designed to be efficient and customer-centric. The company’s Quick Response initiative ensures that claims are acknowledged and processed within 24 hours, with many claims resolved within a matter of days. This rapid response not only speeds up the compensation process but also helps build trust and satisfaction among policyholders.

Allstate's commitment to customer satisfaction is evident in its consistent ranking as one of the top insurance providers in customer service surveys. The company's focus on transparency, timely communication, and fair claim settlements has earned it a reputation for excellence in this regard.

Financial Performance and Market Presence

Allstate’s financial performance has been robust, with a steady growth trajectory over the years. In 2022, the company reported a net income of $2.1 billion, an increase of 14% over the previous year. This growth is attributed to a combination of factors, including strategic acquisitions, effective risk management, and a focus on digital innovation.

Allstate's market presence is significant, with a network of over 13,000 exclusive agencies and more than 30,000 employees. The company's strong brand recognition and customer loyalty have contributed to its success, positioning it as a major player in the highly competitive insurance landscape.

Industry Recognition and Awards

Allstate’s dedication to customer service and innovation has been recognized by industry peers and experts. The company has consistently ranked highly in customer satisfaction surveys, including the J.D. Power U.S. Auto Claims Satisfaction Study. Additionally, Allstate has been recognized for its digital initiatives, winning awards for its mobile app and online customer service.

Future Outlook and Industry Disruption

As the insurance industry continues to evolve, Allstate is well-positioned to adapt and thrive. The company’s focus on digital transformation and data analytics positions it to leverage emerging technologies, such as artificial intelligence and machine learning, to enhance its products and services.

Allstate's recent investments in InsurTech startups and its own internal innovation labs demonstrate its commitment to staying ahead of the curve. By embracing technological advancements, Allstate aims to offer more personalized and efficient insurance solutions, catering to the changing needs and expectations of its customers.

Sustainability and Social Responsibility

Allstate has also demonstrated a commitment to sustainability and social responsibility. The company has set ambitious goals to reduce its environmental impact, including a pledge to achieve net-zero greenhouse gas emissions by 2050. Additionally, Allstate’s community involvement initiatives, such as its support for disaster relief efforts and educational programs, reinforce its commitment to making a positive impact beyond insurance.

Conclusion

Allstate Insurance Company is a stalwart in the insurance industry, with a legacy of innovation and a commitment to customer service. From its humble beginnings in the 1930s to its current position as a leading insurer, Allstate has consistently adapted to the changing needs of its customers. With a diverse product portfolio, a focus on digital transformation, and a commitment to social responsibility, Allstate is well-equipped to navigate the challenges and opportunities of the future.

FAQ

What is Allstate’s unique selling proposition in the competitive insurance market?

+

Allstate’s unique selling proposition lies in its focus on customer service and innovation. The company’s commitment to providing personalized insurance solutions, coupled with its investment in digital technologies, sets it apart from competitors. Allstate’s Drivewise program and Digital Locker, for instance, offer unique value propositions that enhance the customer experience.

How does Allstate’s financial performance compare to its competitors?

+

Allstate’s financial performance has been strong, with consistent growth and profitability. In terms of market share, Allstate ranks among the top insurance providers in the United States. While specific financial metrics may vary, Allstate’s focus on risk management and strategic investments has contributed to its overall financial success.

What are some of Allstate’s recent initiatives to enhance customer experience?

+

Allstate has undertaken several initiatives to enhance customer experience. This includes the expansion of its digital services, such as the Allstate Mobile app, which offers policyholders convenient access to their accounts and claims information. Additionally, Allstate has invested in agent training and development to ensure a high level of service across its network of local agents.