Edu

Insurance Com

<!DOCTYPE html>

In the intricate world of financial protection, insurance policies stand as a cornerstone, safeguarding individuals and businesses from unforeseen events. Yet, navigating the complexities of insurance can be a daunting task. This comprehensive guide aims to demystify insurance, offering an in-depth exploration of its various facets and providing valuable insights for those seeking to make informed decisions.

<h2>Understanding the Fundamentals of Insurance</h2>

<p>Insurance, at its core, is a mechanism designed to mitigate risks and financial losses. It operates on the principle of <strong>risk pooling</strong>, where a group of individuals or entities contribute premiums to create a fund that can be utilized to compensate those who suffer losses covered by the policy.</p>

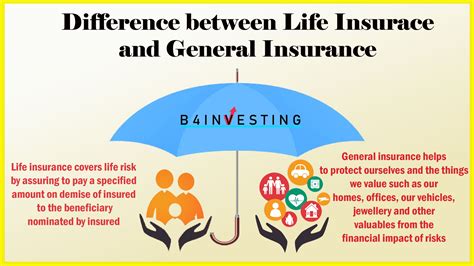

<p>The insurance industry offers a myriad of policies tailored to address diverse needs. From <strong>life insurance</strong>, which provides financial security to beneficiaries upon the policyholder's demise, to <strong>health insurance</strong>, safeguarding individuals against costly medical expenses, the range of options is vast.</p>

<p>Additionally, <strong>property insurance</strong> protects assets like homes and vehicles, while <strong>liability insurance</strong> shields individuals and businesses from legal claims arising from accidents or negligence. <strong>Business insurance</strong>, on the other hand, caters to the unique risks faced by enterprises, covering everything from property damage to employee-related issues.</p>

<h3>Key Principles and Terminology</h3>

<p>Grasping the fundamentals involves understanding key insurance concepts. The <strong>premium</strong>, for instance, is the amount paid by the policyholder to the insurer for coverage. It is typically calculated based on factors like the type of coverage, the amount of risk involved, and the policyholder's personal characteristics.</p>

<p>The <strong>policy term</strong> refers to the duration of coverage, which can range from a few months to several years. Within this term, the policyholder is protected against the specified risks. The <strong>deductible</strong>, another crucial concept, is the amount the policyholder must pay out of pocket before the insurance coverage kicks in.</p>

<p>Furthermore, the <strong>benefit</strong> or <strong>payout</strong> is the monetary compensation provided by the insurer when a covered loss occurs. It is important to note that insurance policies often have <strong>exclusions</strong>, which are specific events or circumstances not covered by the policy.</p>

<table>

<tr>

<th>Policy Type</th>

<th>Key Features</th>

</tr>

<tr>

<td>Life Insurance</td>

<td>Provides financial security to beneficiaries after the policyholder's death. Offers different types like term life and whole life insurance.</td>

</tr>

<tr>

<td>Health Insurance</td>

<td>Covers medical expenses, including doctor visits, hospitalization, and prescription drugs. Can include dental and vision coverage.</td>

</tr>

<tr>

<td>Property Insurance</td>

<td>Protects homes, vehicles, and other assets from damage or loss due to perils like fire, theft, or natural disasters.</td>

</tr>

<tr>

<td>Liability Insurance</td>

<td>Provides coverage for legal claims and damages arising from accidents or negligence. Common for businesses and professionals.</td>

</tr>

<tr>

<td>Business Insurance</td>

<td>Tailored to cover specific risks faced by businesses, including property damage, liability claims, and employee-related issues.</td>

</tr>

</table>

<h2>The Process of Acquiring Insurance: A Step-by-Step Guide</h2>

<p>Embarking on the journey to secure insurance coverage involves several critical steps. Understanding this process is essential for making informed decisions and ensuring the right coverage is obtained.</p>

<h3>Assessing Your Insurance Needs</h3>

<p>The first step is to <strong>identify the specific risks you or your business face</strong>. This could include health issues, property damage, liability concerns, or financial risks associated with running a business. By understanding these risks, you can determine the type and extent of coverage required.</p>

<p>Consider factors such as your age, health status, family size, and lifestyle when evaluating <strong>life insurance</strong> needs. For <strong>health insurance</strong>, assess your current and future healthcare needs, including any pre-existing conditions. When it comes to <strong>property insurance</strong>, evaluate the value of your assets and the potential risks they face.</p>

<p>Additionally, <strong>liability insurance</strong> is crucial for protecting yourself against legal claims. This is especially important for businesses or professionals who may be exposed to such risks. Finally, <strong>business insurance</strong> should cover a range of potential issues, from property damage to employee-related concerns.</p>

<h3>Researching and Comparing Insurance Providers</h3>

<p>With a clear understanding of your insurance needs, the next step is to <strong>research and compare various insurance providers</strong>. Look for reputable companies with a solid track record of paying claims promptly and fairly. Check customer reviews and ratings to gauge their reliability and customer service.</p>

<p>Compare <strong>policy terms and conditions</strong>, including coverage limits, deductibles, and exclusions. Ensure that the policies align with your specific needs and provide adequate protection. Consider the financial stability of the insurance company, as this is crucial for ensuring they can meet their obligations in the long term.</p>

<p>Also, take into account the <strong>premium costs</strong> and whether they fit within your budget. Remember, the cheapest policy might not always offer the best value, especially if it comes with significant exclusions or limitations.</p>

<h3>Obtaining Quotes and Selecting a Policy</h3>

<p>Once you've narrowed down your options, it's time to <strong>obtain quotes</strong> from the selected insurance providers. A quote will detail the premium, coverage limits, and any additional fees or discounts applicable to your policy.</p>

<p>Compare the quotes carefully, considering not just the premium but also the coverage provided. Look for policies that offer comprehensive coverage without unnecessary add-ons that drive up the cost. It's important to find a balance between affordability and adequate protection.</p>

<p>When selecting a policy, ensure you understand the <strong>terms and conditions</strong> thoroughly. Pay attention to any exclusions or limitations, as these could impact your coverage in the event of a claim. If you have any doubts or questions, don't hesitate to reach out to the insurance provider for clarification.</p>

<h3>Applying for and Finalizing Your Policy</h3>

<p>After choosing the right policy, the next step is to <strong>apply for coverage</strong>. This typically involves filling out an application form, providing personal and financial details, and sometimes undergoing a medical examination (for life insurance). It's important to provide accurate information to avoid issues with your policy later on.</p>

<p>Once your application is approved, you'll receive a policy document outlining the terms and conditions of your coverage. Review this document carefully and ensure it matches the coverage you selected. If there are any discrepancies or changes you wish to make, contact your insurance provider immediately.</p>

<p>Finally, <strong>pay your initial premium</strong> to activate your policy. Keep in mind that some policies may require payment in full, while others allow for installment payments. Make sure to keep a record of your payments and policy documents for future reference.</p>

<h2>Maximizing the Benefits of Your Insurance Policy</h2>

<p>Securing an insurance policy is just the first step. To fully benefit from your coverage, it's essential to understand how to navigate the claims process and make the most of your policy's features.</p>

<h3>Understanding the Claims Process</h3>

<p>When an insured event occurs, it's crucial to <strong>act promptly</strong> and initiate the claims process. Most insurance policies have specific time frames within which a claim must be filed, so staying aware of these deadlines is vital.</p>

<p>The claims process typically involves <strong>completing a claim form</strong>, providing documentation to support your claim, and sometimes undergoing an investigation or assessment by the insurance company. It's important to keep detailed records and provide accurate information to expedite the process.</p>

<p>In the case of <strong>health insurance</strong>, you may need to provide medical records and bills. For <strong>property insurance</strong> claims, photographs and estimates of damage are often required. <strong>Liability insurance</strong> claims may involve legal documents and evidence.</p>

<p>Throughout the process, maintain open communication with your insurance provider. If you have any questions or concerns, don't hesitate to reach out to their customer support. Remember, the goal is to resolve your claim efficiently and receive the compensation you're entitled to.</p>

<h3>Leveraging Additional Policy Features</h3>

<p>Beyond the basic coverage, many insurance policies offer additional features and benefits that can enhance your protection. These might include <strong>discounts for multiple policies</strong> or <strong>loyalty rewards</strong> for long-term customers.</p>

<p>For instance, some <strong>life insurance</strong> policies provide the option to convert term life insurance into permanent coverage, which can be beneficial as your needs change over time. <strong>Health insurance</strong> policies may offer <strong>preventative care coverage</strong> or <strong>wellness programs</strong> that encourage healthy lifestyles.</p>

<p>Additionally, <strong>property insurance</strong> policies often include <strong>replacement cost coverage</strong>, ensuring you receive the full cost of replacing your belongings without depreciation. <strong>Liability insurance</strong> may provide <strong>legal defense coverage</strong>, protecting you against legal fees arising from covered claims.</p>

<p>It's important to explore these additional features and consider how they might benefit you. However, remember that not all policies offer the same features, so it's crucial to compare and choose a policy that aligns with your specific needs and circumstances.</p>

<h3>Regular Policy Review and Updates</h3>

<p>Insurance policies are not set in stone. Your needs and circumstances can change over time, and it's essential to <strong>review your policies regularly</strong> to ensure they continue to provide adequate coverage.</p>

<p>Life events such as marriage, the birth of a child, purchasing a new home, or starting a business can significantly impact your insurance needs. It's crucial to <strong>update your policies accordingly</strong> to ensure you're not underinsured or paying for coverage you no longer require.</p>

<p>Regular policy reviews also allow you to take advantage of <strong>changes in the insurance market</strong>, such as new policy options or improved coverage at competitive rates. By staying informed, you can make adjustments to your coverage that align with your current lifestyle and financial situation.</p>

<p>Consider scheduling an annual review with your insurance provider or broker to discuss any changes and updates to your policies. They can guide you through the process and ensure you have the right coverage in place.</p>

<h2>Conclusion: Empowering Yourself with Insurance Knowledge</h2>

<p>Insurance is a complex but essential aspect of modern life. By understanding the fundamentals, the process of acquiring insurance, and how to maximize your policy's benefits, you can make informed decisions and protect what matters most.</p>

<p>Remember, insurance is a tool to manage risk, and with the right coverage, you can navigate life's uncertainties with confidence. Stay informed, review your policies regularly, and don't hesitate to seek professional advice when needed. Your financial security and peace of mind are worth the effort.</p>

<h2>Frequently Asked Questions</h2>

<div class="faq-section">

<div class="faq-container">

<div class="faq-item">

<div class="faq-question">

<h3>What is the main purpose of insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Insurance serves as a financial safety net, providing protection against unforeseen events and risks. It ensures that individuals and businesses can recover from losses and maintain financial stability.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I choose the right insurance policy for my needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Assess your specific risks and needs, research reputable insurance providers, compare policy terms and coverage, and consider your budget. It's essential to find a balance between affordability and adequate protection.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What should I do if I need to file an insurance claim?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Act promptly and contact your insurance provider to initiate the claims process. Gather the necessary documentation and be prepared to provide detailed information. Maintain open communication with your insurer throughout the process.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I switch insurance providers if I'm not satisfied with my current policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you have the freedom to switch insurance providers if you find a policy that better suits your needs or offers more competitive rates. However, ensure that your new policy provides the coverage you require without gaps in protection.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review my insurance policies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's recommended to review your insurance policies annually or whenever significant life changes occur. This ensures that your coverage remains up-to-date and aligned with your evolving needs and circumstances.</p>

</div>

</div>

</div>

</div>

<footer>

<p>Explore more at <a href="https://www.insurancecom.com">InsuranceCom</a></p>

</footer>