Insurance Car Policy

In the complex world of insurance, navigating the intricacies of car insurance policies can be a daunting task. This comprehensive guide aims to demystify the process, shedding light on the essential aspects that every vehicle owner should be aware of. From understanding the fundamentals to exploring the diverse coverage options, we'll delve into the world of car insurance, ensuring you're equipped with the knowledge to make informed decisions.

The Fundamentals of Car Insurance

Car insurance is a legal contract between an individual (the policyholder) and an insurance company. This contract, known as a policy, outlines the terms and conditions of the coverage, including what is covered, the limits of that coverage, and the responsibilities of both parties. Understanding the fundamentals is crucial, as it forms the basis for making informed choices about your car insurance.

Key Components of a Car Insurance Policy

A car insurance policy typically consists of several key components, each playing a vital role in providing comprehensive coverage.

- Liability Coverage: This is the cornerstone of any car insurance policy. It covers the policyholder’s legal responsibility for bodily injury or property damage caused to others in an accident. Liability coverage is mandatory in most states and is essential for protecting the policyholder from financial ruin in the event of an at-fault accident.

- Collision Coverage: This optional coverage pays for damage to the policyholder’s vehicle in the event of a collision, regardless of fault. It is particularly valuable for newer or more expensive vehicles, as it can cover repair or replacement costs in the event of an accident.

- Comprehensive Coverage: Also known as “Other Than Collision” coverage, this optional coverage protects against damage to the insured vehicle caused by events other than collisions. This can include damage from natural disasters, vandalism, theft, or animal collisions. Comprehensive coverage is essential for protecting your vehicle from a wide range of potential risks.

- Medical Payments (MedPay) Coverage: This coverage pays for medical expenses incurred by the policyholder and their passengers in the event of an accident, regardless of fault. It can cover a wide range of medical costs, including hospital stays, surgical procedures, and even funeral expenses. MedPay coverage is a valuable addition to any car insurance policy, as it provides immediate financial assistance for medical bills.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who either has no insurance or has insufficient insurance to cover the damages. It can cover bodily injury, property damage, and even pain and suffering expenses. Uninsured/Underinsured Motorist coverage is particularly important in states with a high number of uninsured drivers.

- Additional Coverages: Depending on the policy and the insurance provider, there may be additional coverages available. These can include rental car coverage, gap coverage (which covers the difference between the vehicle’s value and the amount owed on a lease or loan), and roadside assistance. While these coverages are optional, they can provide added peace of mind and financial protection.

Understanding Policy Limits

Policy limits refer to the maximum amount an insurance company will pay for a covered claim. These limits are typically specified in the policy and can vary depending on the type of coverage. For example, liability coverage limits are often expressed as three numbers, such as 100/300/100, which represent the maximum payout for bodily injury per person, bodily injury per accident, and property damage per accident, respectively. Understanding policy limits is crucial, as it ensures that you have adequate coverage to protect your assets in the event of a serious accident.

| Coverage Type | Policy Limits |

|---|---|

| Liability Coverage | 100/300/100 (Bodily Injury/Property Damage) |

| Collision Coverage | $5,000 Deductible |

| Comprehensive Coverage | $1,000 Deductible |

| Medical Payments Coverage | $5,000 Maximum Payout |

| Uninsured/Underinsured Motorist Coverage | 100/300/100 (Bodily Injury/Property Damage) |

The Importance of Personalized Coverage

Car insurance is not a one-size-fits-all solution. Every driver and vehicle has unique needs and risks. That’s why personalized coverage is essential. By tailoring your car insurance policy to your specific circumstances, you can ensure that you have the right protection at the right price.

Factors Influencing Personalized Coverage

Several factors come into play when determining the appropriate coverage for your vehicle. These include:

- Vehicle Type and Value: The make, model, and year of your vehicle can significantly impact the cost and coverage options. Newer or more expensive vehicles may require higher levels of coverage, particularly for collision and comprehensive protection.

- Driving Record: Your driving history plays a crucial role in determining your insurance rates and coverage options. A clean driving record with no accidents or violations can lead to more favorable rates and broader coverage choices. On the other hand, a history of accidents or traffic violations may result in higher premiums and more limited coverage options.

- Location and Usage: Where you live and how you use your vehicle can also impact your coverage needs. Urban areas with higher crime rates may require additional comprehensive coverage to protect against theft or vandalism. Additionally, if you use your vehicle for business purposes, you may need to consider commercial auto insurance.

- Personal Preferences: Your individual preferences and comfort level with risk can influence the coverage you choose. For example, some policyholders may opt for higher liability limits to provide greater protection against lawsuits, while others may prioritize lower deductibles for collision and comprehensive coverage to minimize out-of-pocket expenses in the event of a claim.

Working with an Insurance Professional

Navigating the complexities of car insurance can be challenging, especially when it comes to personalized coverage. That’s where working with an experienced insurance professional can make a significant difference. They can guide you through the process, assessing your unique needs and circumstances to tailor a policy that provides the right balance of coverage and affordability.

An insurance professional can:

- Evaluate your current coverage and suggest improvements based on your specific needs.

- Compare policies from multiple insurance providers to find the best fit for your situation.

- Explain the nuances of different coverage options and help you understand the potential risks and benefits.

- Assist with claims, providing support and guidance throughout the process.

Navigating the Car Insurance Landscape

The world of car insurance is vast and ever-changing. Staying informed and making informed decisions is crucial to ensure you have the right coverage at the right price. Here are some key considerations when navigating the car insurance landscape.

Shopping for Car Insurance

When shopping for car insurance, it’s essential to compare policies and providers to find the best fit for your needs. Consider the following steps:

- Research Multiple Providers: Don’t settle for the first insurance quote you receive. Research and compare quotes from multiple providers to get a sense of the market and find the best value.

- Understand Coverage Options: Familiarize yourself with the different coverage types and their benefits. This will help you make informed choices and ensure you have the protection you need.

- Consider Bundle Discounts: If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts for bundling multiple policies, making it a cost-effective option.

- Review Policy Exclusions: Carefully review the exclusions and limitations of each policy. Understanding what is not covered can help you make informed decisions and avoid surprises down the line.

- Read Reviews and Ratings: Check online reviews and ratings of insurance providers to gauge their reputation and customer satisfaction. This can provide valuable insights into the quality of their service and claims handling.

Understanding Insurance Rates

Insurance rates can vary significantly between providers and policies. Several factors influence these rates, including:

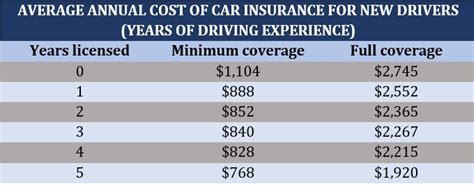

- Age and Gender: Younger drivers, particularly males, often face higher insurance rates due to their perceived higher risk of accidents.

- Credit Score: In many states, insurance companies can use credit scores as a factor in determining insurance rates. A higher credit score may result in lower premiums.

- Vehicle Type: The make, model, and year of your vehicle can impact your insurance rates. Sports cars and luxury vehicles often carry higher premiums due to their higher repair costs and increased risk of theft.

- Location: Where you live can significantly impact your insurance rates. Urban areas with higher crime rates and accident statistics often result in higher premiums.

- Driving Record: A clean driving record with no accidents or violations can lead to lower insurance rates. Conversely, a history of accidents or traffic violations can result in higher premiums.

The Impact of Claims

Filing a claim can impact your insurance rates and coverage options. Here’s what you need to know:

- Frequency of Claims: Filing multiple claims, even for minor incidents, can lead to increased insurance rates. Insurance companies may view you as a higher risk and adjust your premiums accordingly.

- Severity of Claims: The severity of a claim can also impact your rates. Major accidents or claims with high payout amounts may result in significant rate increases.

- Claim-Free Discounts: Many insurance providers offer discounts for policyholders who maintain a claim-free record for a certain period. These discounts can provide significant savings on your premiums.

- Claims Handling Process: Understanding the claims handling process and your responsibilities can help ensure a smooth and efficient experience. Familiarize yourself with your policy’s claims process and keep important documents, such as your policy number and contact information, readily available.

Future Trends and Innovations in Car Insurance

The car insurance industry is evolving, and several trends and innovations are shaping the future of coverage. Here’s a glimpse into what lies ahead.

Telematics and Usage-Based Insurance

Telematics is a technology that uses sensors and data transmission to track and analyze driving behavior. Usage-based insurance (UBI) is a type of policy that uses telematics to offer customized rates based on an individual’s driving habits. This innovation allows insurance providers to offer more accurate and personalized premiums, rewarding safe drivers with lower rates.

AI and Machine Learning

Artificial intelligence (AI) and machine learning are revolutionizing the insurance industry. These technologies are being used to streamline claims processing, improve fraud detection, and enhance customer service. By analyzing vast amounts of data, insurance companies can make more informed decisions and provide faster, more efficient service to policyholders.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is set to have a significant impact on the car insurance industry. Electric vehicles, with their advanced safety features and reduced maintenance needs, may lead to lower insurance rates. Autonomous vehicles, while still in their early stages, have the potential to revolutionize road safety and further reduce accident rates, leading to even more affordable insurance options.

Digital Transformation

The digital transformation of the insurance industry is underway, with many providers embracing online and mobile platforms. This shift allows policyholders to manage their policies, file claims, and receive support more conveniently and efficiently. Digital tools also enable insurance companies to offer more personalized experiences, catering to the unique needs of individual policyholders.

Conclusion

Car insurance is a complex but essential aspect of vehicle ownership. By understanding the fundamentals, exploring personalized coverage options, and staying informed about the latest trends, you can navigate the insurance landscape with confidence. Remember, your car insurance policy is a crucial investment in your financial security and peace of mind on the road. Take the time to review and tailor your coverage to ensure you have the protection you need, when you need it.

Frequently Asked Questions

How often should I review my car insurance policy?

+

It’s a good practice to review your car insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains up-to-date and aligned with your needs. Factors such as changes in your vehicle, driving record, or personal situation can impact your coverage requirements.

Can I switch car insurance providers mid-policy term?

+

Yes, you can switch car insurance providers at any time, even mid-policy term. However, it’s important to carefully review your current policy’s terms and conditions, as some providers may charge a fee for canceling your policy early. Make sure to compare quotes and understand the coverage offered by the new provider to ensure a smooth transition.

What should I do if I’m involved in an accident?

+

If you’re involved in an accident, remain calm and follow these steps: (1) Ensure the safety of yourself and others involved. (2) Call the police to report the accident and obtain a police report, if necessary. (3) Exchange information with the other driver(s), including names, contact details, and insurance information. (4) Document the scene by taking photos and notes. (5) Notify your insurance company as soon as possible and provide them with all the relevant details. They will guide you through the claims process.

How can I lower my car insurance premiums?

+

There are several strategies to lower your car insurance premiums. These include maintaining a clean driving record, shopping around for the best rates, considering higher deductibles, taking advantage of discounts (such as multi-policy or safe driver discounts), and exploring usage-based insurance options. Additionally, keeping your vehicle well-maintained and secure can also help reduce premiums.

What is the difference between collision and comprehensive coverage?

+

Collision coverage pays for damage to your vehicle caused by a collision, regardless of fault. It covers repairs or replacement costs in the event of an accident. Comprehensive coverage, on the other hand, protects against damage caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. It provides broader protection for your vehicle beyond accidents.