Insurance Agents Salary

The insurance industry is a vast and diverse sector, offering a range of career paths and opportunities. Among the professionals who play a crucial role in this industry are insurance agents, who serve as intermediaries between insurance companies and policyholders. Their responsibilities involve guiding clients through the process of selecting suitable insurance policies, providing expert advice, and ensuring a smooth claims process. The income of insurance agents can vary significantly depending on numerous factors, including their specialization, experience, geographical location, and the type of insurance products they sell. This article aims to delve into the various aspects that influence an insurance agent's salary, providing a comprehensive understanding of this profession's financial prospects.

Understanding the Compensation Structure for Insurance Agents

The earnings of insurance agents can be categorized into several components, each influenced by unique factors. Firstly, there’s the commission-based income, which is a primary source of revenue for most insurance agents. Commissions are typically calculated as a percentage of the insurance premiums paid by the clients. This means that the more policies an agent sells and the higher the premiums, the greater their potential earnings.

Secondly, insurance agents often receive bonuses and incentives from insurance companies. These bonuses are designed to motivate agents and reward high performance. They can be based on various metrics, such as the number of policies sold, the total premium volume, or even the retention rate of existing clients.

In addition to commissions and bonuses, some insurance agents also earn a salary or draw, especially those working for captive agencies that represent a single insurance company. This salary can provide a stable income stream, especially for new agents who are building their client base. However, it's important to note that salaries for insurance agents are generally lower compared to commissions, as they are meant to supplement income during the initial stages of an agent's career.

Commission Rates and Structures

Commission rates vary widely across different types of insurance and can significantly impact an agent’s earnings. For instance, life insurance policies often have higher commission rates compared to property and casualty insurance, as life insurance policies tend to have larger premium amounts and longer-term commitments.

Furthermore, the commission structure can vary depending on whether an agent sells individual or group policies. Group policies, such as those offered by employers for their employees, often have lower commission rates but can provide a steady stream of income due to the larger number of policies sold at once.

| Insurance Type | Average Commission Rate |

|---|---|

| Life Insurance | 5-10% of first-year premiums, with potential renewals |

| Property & Casualty Insurance | 2-4% of first-year premiums, with potential bonuses for volume |

| Health Insurance | Varies widely, often 2-6% of premiums, with potential performance bonuses |

It's worth noting that commission rates can also be influenced by the insurance company an agent represents and their individual performance. Some companies offer higher commissions to attract top talent or as part of special promotions, while high-performing agents might negotiate better commission structures with their companies.

Factors Influencing Insurance Agent Salaries

Beyond the type of insurance sold, several other factors contribute to the earnings of insurance agents. These include:

Experience and Expertise

As with many professions, experience plays a crucial role in determining an insurance agent’s income. Veteran agents with a proven track record of success and a loyal client base often command higher commissions and earn more from renewals and referrals. They also have the expertise to sell more complex insurance products, which typically come with higher premiums and, consequently, higher commissions.

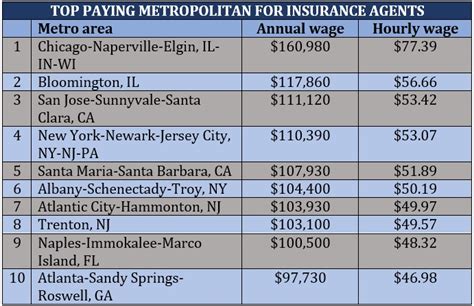

Geographical Location

The cost of living and insurance market dynamics in a particular region can significantly impact an agent’s earnings. In areas with a higher cost of living, insurance agents might need to charge more for their services to maintain a comfortable income. Similarly, regions with a competitive insurance market might offer agents higher commissions to attract and retain business.

Specialization and Niche Markets

Insurance agents who specialize in a particular field or niche market can often command higher earnings. For example, health insurance brokers who focus on small businesses or commercial property and casualty agents who work with high-value clients often have access to higher-premium policies and, thus, higher commissions.

Agency Type and Structure

The type of agency an insurance agent works for can also affect their income. Captive agents, who work exclusively for a single insurance company, often have a more stable income stream but might earn less in commissions compared to independent agents who have the freedom to represent multiple companies and choose the products that best suit their clients’ needs.

Performance and Productivity

Insurance companies often reward agents for their performance and productivity. This can include bonuses for hitting sales targets, achieving high client satisfaction scores, or maintaining a low number of canceled policies. These incentives can significantly boost an agent’s earnings and provide motivation to excel in their role.

The Role of Renewals and Referrals

A key aspect of an insurance agent’s long-term financial success is the retention of clients and the ability to secure policy renewals. Unlike one-time sales, renewals provide a steady income stream year after year. Additionally, satisfied clients often refer their friends and family to their trusted agent, leading to more business and higher earnings.

The Impact of Client Retention

Retaining clients is not only important for maintaining a steady income but also for building an agent’s reputation and credibility. Happy, loyal clients are more likely to purchase additional insurance products from their trusted agent, leading to increased earnings over time. Furthermore, high client retention rates can make an agent more attractive to insurance companies, potentially leading to better commission structures and other incentives.

Referrals and Word-of-Mouth Marketing

Word-of-mouth referrals are a powerful tool for insurance agents. When clients are satisfied with the service and expertise they receive, they often recommend their agent to others. This can lead to a steady stream of new business without the agent having to spend significant time and resources on marketing and lead generation. Referrals can be particularly valuable for independent agents who rely on building personal relationships with their clients.

The Future of Insurance Agent Compensation

The insurance industry is continually evolving, and this evolution is reflected in the changing landscape of agent compensation. With the rise of technology and digital platforms, insurance companies are increasingly leveraging data and analytics to inform their compensation strategies. This shift is leading to more performance-based compensation models, where agents are rewarded not only for the volume of policies sold but also for the quality of their work and the value they bring to the company.

Performance-Based Compensation Models

Performance-based compensation models are designed to motivate agents to deliver exceptional service and achieve specific business objectives. These models often incorporate metrics such as client satisfaction scores, the number of successful cross-sales, and the quality of referrals generated. By incentivizing agents to focus on long-term client relationships and value-added services, insurance companies aim to enhance their overall business performance and customer satisfaction.

Adapting to Changing Market Dynamics

The insurance industry is subject to various regulatory changes, market shifts, and technological advancements. As a result, insurance companies are increasingly adapting their compensation strategies to remain competitive and attract top talent. This includes offering more flexible compensation packages, providing opportunities for career advancement, and investing in agent training and development to ensure they can meet the evolving needs of policyholders.

Conclusion

The income of insurance agents is a multifaceted topic, influenced by a wide range of factors. From commission rates and bonus structures to experience, specialization, and performance, each aspect plays a crucial role in determining an agent’s financial success. As the insurance industry continues to evolve, insurance agents who stay abreast of industry trends, invest in their professional development, and prioritize delivering exceptional service are well-positioned to thrive in this dynamic and rewarding profession.

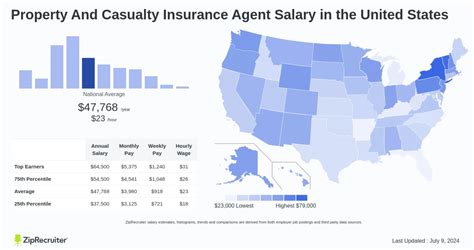

What is the average salary of an insurance agent in the United States?

+According to recent data, the average annual salary for insurance agents in the United States is approximately $55,000. However, this figure can vary significantly based on the factors discussed in this article, such as experience, specialization, and geographical location.

How do insurance agents maximize their earnings potential?

+Insurance agents can maximize their earnings by focusing on high-value insurance products, such as life insurance policies, building a strong client base through referrals and excellent service, and negotiating favorable commission structures with insurance companies.

What are the career prospects for insurance agents in the digital age?

+The digital age presents both challenges and opportunities for insurance agents. While online platforms and digital tools may disrupt traditional sales methods, they also provide new avenues for agent-client interaction and the ability to reach a wider audience. Agents who embrace technology and adapt their strategies can thrive in this evolving landscape.