Out Of Pocket Medical Insurance

In the complex world of healthcare and insurance, understanding the financial implications of medical treatments is crucial. This article delves into the concept of out-of-pocket (OOP) expenses related to medical insurance, exploring its intricacies, real-world examples, and potential solutions to help individuals navigate this challenging aspect of healthcare.

Unraveling Out-of-Pocket Expenses

Out-of-pocket expenses are the direct costs an individual pays for healthcare services, medications, and treatments that are not fully covered by their insurance plan. These costs can include deductibles, co-pays, co-insurance, and expenses for non-covered services or treatments.

OOP expenses can vary significantly depending on the type of insurance plan, the healthcare provider, and the specific treatment or service. Understanding these costs is essential to managing healthcare finances effectively.

The Impact of Out-of-Pocket Costs

High out-of-pocket expenses can create financial burdens for individuals, especially those with chronic illnesses or unexpected medical emergencies. In the United States, for instance, the average OOP cost for a hospital stay is 1,500</strong>, while a visit to the emergency room can result in expenses ranging from <strong>150 to $3,000, depending on the treatment required.

| Healthcare Service | Average Out-of-Pocket Cost |

|---|---|

| Hospital Stay | $1,500 |

| Emergency Room Visit | $150 - $3,000 |

| Specialist Consultation | $50 - $300 |

| Prescription Medication | Varies based on insurance coverage and medication type |

These expenses can quickly add up, leading to financial strain for individuals and families. Moreover, the unpredictability of medical needs makes budgeting for OOP costs challenging.

Navigating Out-of-Pocket Challenges

Managing out-of-pocket expenses requires a strategic approach. Here are some key strategies to consider:

1. Understand Your Insurance Plan

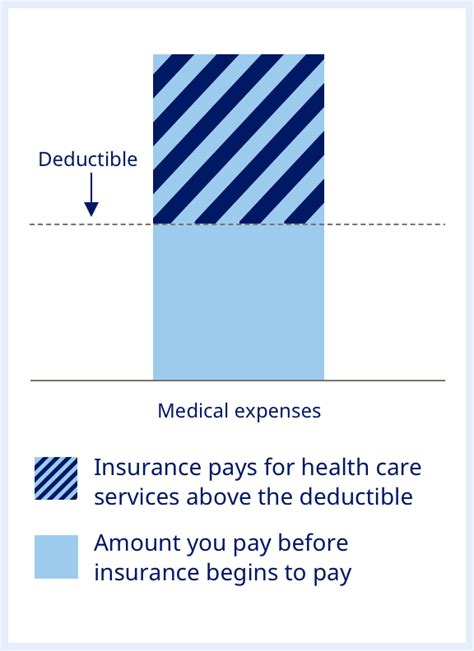

Familiarize yourself with the details of your insurance policy. Know your deductible (the amount you pay before insurance coverage begins), co-pays (fixed amounts for specific services), and co-insurance (the percentage of costs you share with the insurance provider). Understanding these terms will help you anticipate OOP costs.

2. Explore Cost-Sharing Programs

Some insurance providers offer cost-sharing programs or discounts for specific treatments or services. These programs can reduce your OOP expenses significantly. For instance, certain insurance plans may cover 100% of the cost for preventive care services like annual check-ups and vaccinations.

3. Negotiate Healthcare Bills

Healthcare providers often have flexibility in billing, especially for uninsured or underinsured patients. Negotiating medical bills is a valid strategy to reduce OOP costs. This approach may involve discussing payment plans, requesting discounts, or negotiating the overall bill amount.

4. Utilize Health Savings Accounts (HSAs)

Health Savings Accounts are tax-advantaged accounts designed to help individuals save for medical expenses. Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. HSAs can be a powerful tool to manage OOP costs, as they allow individuals to save pre-tax dollars specifically for healthcare needs.

5. Shop Around for Providers

The cost of healthcare services can vary significantly between providers. Shopping around for different healthcare facilities or specialists can lead to substantial savings. Online resources and healthcare price comparison tools can assist in finding more affordable options without compromising quality.

The Future of Out-of-Pocket Expenses

The landscape of healthcare and insurance is evolving, and efforts are underway to reduce the financial burden of out-of-pocket expenses. Here’s a glimpse into potential future developments:

1. Enhanced Transparency in Pricing

Advocacy groups and policymakers are pushing for greater transparency in healthcare pricing. Initiatives to require providers to disclose their prices upfront can empower patients to make more informed choices and potentially reduce OOP costs.

2. Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while controlling costs. These models aim to provide better patient outcomes and reduce unnecessary spending. As value-based care gains traction, it could lead to more affordable and efficient healthcare, thus lowering OOP expenses.

3. Improved Insurance Plan Designs

Insurance providers are continually refining their plans to offer more comprehensive coverage and reduce out-of-pocket costs. This includes designing plans with lower deductibles, expanded coverage for essential services, and more flexible cost-sharing options.

4. Technology-Driven Solutions

Digital health technologies are transforming the healthcare industry. From telemedicine to health apps, technology is making healthcare more accessible and cost-effective. These innovations can reduce the need for in-person visits and lower associated OOP costs.

5. Expanded Healthcare Coverage

Policy changes at the government level can significantly impact out-of-pocket expenses. Expanding healthcare coverage, such as through universal healthcare initiatives, can reduce the financial burden on individuals by providing more comprehensive insurance options.

How can I estimate my out-of-pocket expenses for a specific treatment or procedure?

+Estimating OOP expenses involves understanding your insurance coverage and the specific costs associated with the treatment. Contact your insurance provider and healthcare facility to request an itemized cost estimate. Additionally, review your insurance plan’s benefits summary to identify potential costs and consider utilizing online tools for healthcare cost estimates.

Are there any tax benefits associated with out-of-pocket medical expenses?

+Yes, certain out-of-pocket medical expenses may be tax-deductible. These deductions are subject to specific criteria and limits. Consult with a tax professional or refer to IRS guidelines for details on eligible expenses and the process for claiming deductions.

What steps can I take to reduce out-of-pocket expenses for prescription medications?

+To reduce OOP costs for medications, consider generic alternatives, which are typically more affordable. Utilize prescription discount cards or coupons, and explore patient assistance programs offered by pharmaceutical companies. Additionally, some insurance plans have preferred pharmacies or mail-order options that can provide savings.