Insurance Agents License Lookup

Obtaining an insurance agent's license is a critical step for professionals looking to enter the insurance industry and provide valuable services to clients. The process of becoming a licensed insurance agent involves rigorous training, exams, and compliance with state-specific regulations. This comprehensive guide will delve into the details of how to look up insurance agent licenses, offering insights into the importance of this process for both consumers and industry professionals.

The Significance of Insurance Agent License Lookup

The insurance industry is highly regulated, and for good reason. Insurance agents play a pivotal role in guiding individuals and businesses through the complex world of insurance coverage, helping them secure the protection they need. With financial security and risk management at stake, it is crucial for consumers to engage with licensed and reputable agents.

License lookup tools provide a transparent and accessible way for individuals to verify the credentials of insurance agents. These tools are essential for consumers to make informed decisions about their insurance needs and to ensure they are working with qualified professionals. For insurance agents, a verifiable license is a cornerstone of their professional reputation and a requirement for practicing legally.

Understanding the Process of Obtaining an Insurance Agent License

Becoming an insurance agent involves several key steps, which vary slightly depending on the state in which the agent operates. Generally, the process includes the following:

- Education and Training: Aspiring agents typically need to complete specific education requirements, which may include college-level courses or industry-recognized certifications. This ensures that agents have a solid foundation of knowledge about insurance products and practices.

- Examinations: Most states require agents to pass one or more exams to demonstrate their understanding of insurance concepts, regulations, and ethics. These exams are often administered by state regulatory bodies or third-party testing services.

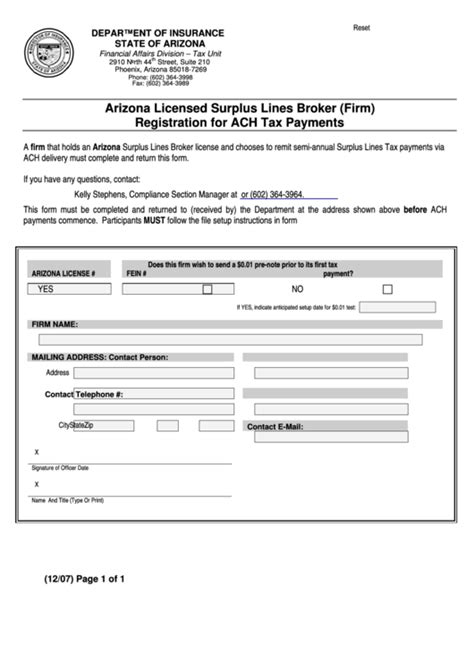

- Licensure: Upon successful completion of education and examinations, agents can apply for their license. This involves submitting an application, paying a fee, and providing any necessary documentation to the state insurance department or regulatory body.

- Continuing Education: To maintain their license, insurance agents are often required to participate in ongoing education to stay up-to-date with industry changes and regulations. This ensures that agents provide the most relevant and accurate advice to their clients.

State-Specific Requirements

While the general process for obtaining an insurance agent license is similar across states, each state may have unique requirements. These can include additional exams, background checks, or specific insurance lines that agents are permitted to sell. It is crucial for agents to understand and comply with these state-specific regulations to avoid legal issues and maintain their professional standing.

How to Look Up an Insurance Agent’s License

Verifying an insurance agent’s license is a straightforward process, thanks to the availability of online license lookup tools provided by state insurance departments or regulatory bodies. These tools are designed to be user-friendly and accessible to the public.

Using Online License Lookup Tools

To look up an insurance agent’s license, you can follow these steps:

- Visit the State Insurance Department Website: Begin by navigating to the official website of the state insurance department where the agent operates. Each state will have its own website, which can typically be found by searching for "State Name Insurance Department."

- Locate the License Lookup Tool: On the state insurance department's website, look for a section or page dedicated to license lookups. These tools are often prominently displayed and may be labeled as "Agent/Broker Search," "License Verification," or something similar.

- Enter Agent Information: Use the provided search fields to enter the agent's name, license number, or other identifying details. Some tools may also allow you to search by the agent's business name or location.

- Review License Details: Once you submit the search, the tool will display the agent's license status, including whether the license is active, expired, or suspended. It may also provide additional details such as the types of insurance the agent is licensed to sell, their license number, and the date the license was issued.

It's important to note that while online license lookup tools are a convenient way to verify an agent's license, they may not provide a complete picture of an agent's professional history or any disciplinary actions taken against them. For more comprehensive information, you may need to contact the state insurance department directly.

Tips for Consumers: Choosing the Right Insurance Agent

When seeking an insurance agent, it’s not enough to simply verify their license. Here are some additional tips to help consumers make informed decisions:

- Check Credentials and Experience: In addition to license verification, ask the agent about their professional credentials and experience. Look for agents who have relevant industry certifications and a track record of successful client relationships.

- Understand Their Specialization: Insurance agents often specialize in specific types of insurance, such as auto, home, life, or business insurance. Ensure that the agent you choose has expertise in the area of insurance you need.

- Read Reviews and Testimonials: Check online reviews and testimonials from past clients to gauge the agent's reputation and the quality of their services. This can provide valuable insights into their professionalism, communication skills, and overall customer satisfaction.

- Consider Referrals: Ask friends, family, or colleagues for referrals to trusted insurance agents. Personal recommendations can be a great way to find a reputable agent who has a history of providing excellent service.

The Importance of Maintaining License Compliance

For insurance agents, maintaining license compliance is not just a legal requirement but also a key aspect of their professional reputation. Here’s why license compliance matters:

- Legal Protection: Operating without a valid license or in violation of state regulations can result in serious legal consequences, including fines, penalties, and even the loss of the right to practice. License compliance ensures that agents are protected from these risks.

- Professional Reputation: A valid and compliant license is a hallmark of a reputable insurance agent. It demonstrates to clients and peers that the agent is committed to maintaining high standards of professionalism and ethical conduct.

- Client Trust and Confidence: Clients rely on insurance agents to guide them through complex insurance decisions. A valid license builds trust and confidence, assuring clients that the agent is knowledgeable, qualified, and committed to their best interests.

The Role of Insurance Agents in the Industry

Insurance agents are the face of the insurance industry, serving as trusted advisors to individuals and businesses. Their role extends beyond simply selling insurance policies. Here’s a closer look at the vital functions they perform:

Providing Expert Guidance

Insurance agents are knowledgeable about a wide range of insurance products and can offer tailored advice based on a client’s unique needs. They help clients understand the complexities of insurance, explain policy terms and conditions, and guide them in making informed decisions.

Customized Solutions

Every client’s insurance needs are different. Insurance agents work closely with clients to assess their risks, financial situation, and goals. They then design customized insurance solutions that provide adequate coverage without unnecessary costs.

Claims Advocacy

When clients need to file an insurance claim, agents step in to provide support and guidance. They assist with the claims process, ensuring that all necessary information is provided and that the claim is processed efficiently. In many cases, agents act as advocates for their clients, negotiating with insurance companies to ensure fair and prompt settlements.

Ongoing Support and Education

Insurance needs can change over time, and agents are there to provide ongoing support and advice. They keep clients informed about new insurance products, changing regulations, and any other factors that may impact their coverage. Agents also offer educational resources to help clients better understand their insurance policies and make informed decisions.

Conclusion

The insurance industry is a vital part of our financial system, and insurance agents are the professionals who help navigate this complex landscape. By obtaining a license and maintaining compliance, agents demonstrate their commitment to professionalism, ethics, and client service. For consumers, verifying an agent’s license is a critical step in ensuring they receive the highest level of service and protection.

As the insurance industry continues to evolve, the role of insurance agents will remain essential. By staying informed about license requirements, consumers can make confident decisions about their insurance needs, while agents can continue to provide valuable guidance and support.

Frequently Asked Questions

What should I do if I suspect an insurance agent is practicing without a valid license?

+

If you suspect an insurance agent is practicing without a valid license, it is important to report this to the state insurance department or regulatory body. They have the authority to investigate and take appropriate action against unlicensed individuals. Reporting unlicensed activity helps protect consumers and uphold the integrity of the insurance industry.

Can an insurance agent have multiple licenses in different states?

+

Yes, insurance agents can hold multiple licenses to sell insurance in different states. This is common for agents who work with clients across state lines or who have a national clientele. Obtaining a license in each state where the agent conducts business ensures compliance with local regulations and allows them to provide services legally.

How often do insurance agents need to renew their licenses?

+

The renewal frequency for insurance agent licenses varies by state. Typically, licenses need to be renewed every 1 to 3 years. Renewal often involves completing continuing education requirements and paying a renewal fee. It’s important for agents to stay aware of their renewal deadlines to maintain uninterrupted licensure.

Are there any exceptions to the requirement for insurance agents to have a license?

+

In general, insurance agents must have a valid license to sell insurance products. However, there may be some limited exceptions, such as for certain types of insurance or for individuals who are not the primary sellers of insurance but have a tangential role (e.g., insurance support staff). It’s crucial to check the specific regulations in each state to understand any potential exceptions.

How can I report a complaint against an insurance agent?

+

If you have a complaint or concern about an insurance agent’s conduct or services, you can report it to the state insurance department or regulatory body. They will investigate the complaint and take appropriate action, which may include disciplinary measures or referrals to other agencies. Reporting complaints helps maintain high standards in the insurance industry and protects consumers’ rights.