Quotes Of Car Insurance

Car insurance is a vital aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. In the realm of automotive coverage, quotes play a crucial role in helping individuals secure the right insurance policy for their needs. Understanding the intricacies of car insurance quotes is essential for making informed decisions and navigating the complex world of insurance providers. In this comprehensive article, we delve into the world of car insurance quotes, exploring their significance, the factors that influence them, and the steps one can take to secure the most favorable rates.

Unraveling the Mystery of Car Insurance Quotes

A car insurance quote is a personalized estimate of the cost of coverage for an individual’s vehicle. It serves as a roadmap, guiding drivers towards the most suitable insurance plan based on their specific circumstances. Insurance companies use a variety of factors to calculate these quotes, aiming to assess the potential risk associated with insuring a particular driver and vehicle.

Key Factors Influencing Car Insurance Quotes

Several elements come into play when determining car insurance quotes. Here’s an in-depth look at some of the most significant factors:

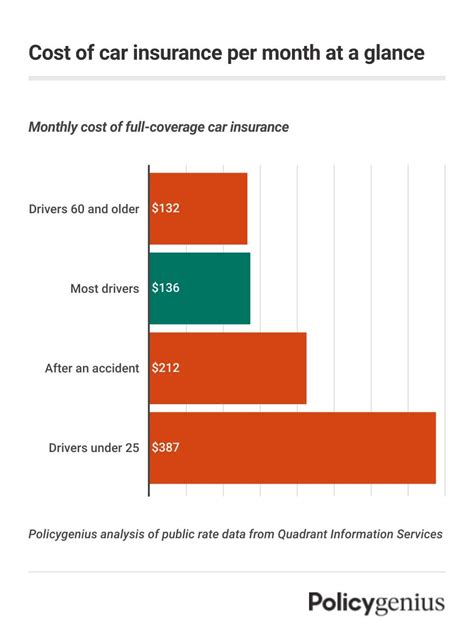

- Driver's Profile: Personal information such as age, gender, driving history, and location play a pivotal role. Younger drivers, for instance, are often considered higher risk and may face higher premiums. Similarly, a clean driving record with no accidents or violations can lead to more favorable quotes.

- Vehicle Type and Usage: The make, model, and year of the vehicle are crucial. Sports cars and luxury vehicles typically command higher insurance costs due to their higher replacement value and potential for higher repair costs. Additionally, the primary usage of the vehicle, whether for personal or business purposes, can impact the quote.

- Coverage Requirements: The level of coverage desired is a critical factor. Comprehensive coverage, which includes collision, liability, and additional perks like rental car reimbursement, will generally result in higher premiums compared to basic liability-only coverage.

- Insurance Company and Discounts: Different insurance providers offer varying rates and discounts. Some companies specialize in certain types of coverage or cater to specific demographics, providing tailored policies and competitive prices. Additionally, discounts for safe driving, multiple policies, or loyalty can significantly reduce overall costs.

The Art of Securing Favorable Car Insurance Quotes

Navigating the world of car insurance quotes can be a complex task, but with the right strategies, individuals can improve their chances of obtaining affordable coverage. Here are some expert tips to secure the most favorable quotes:

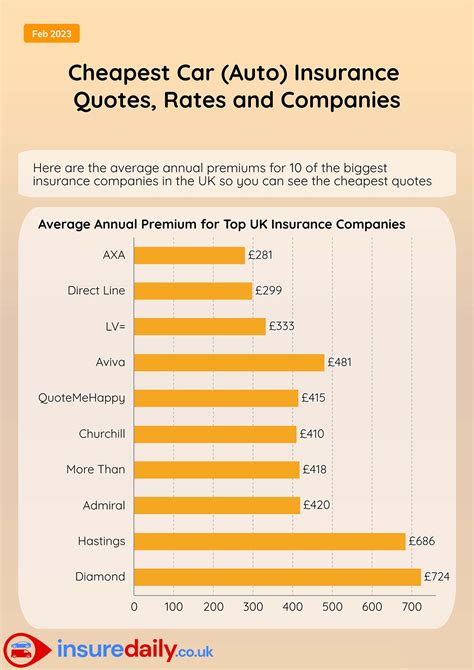

- Compare Multiple Quotes: Don't settle for the first quote you receive. Take the time to obtain estimates from several insurance providers. Online comparison tools can be incredibly useful for this purpose, allowing you to quickly assess a range of options.

- Understand Your Coverage Needs: Assess your specific requirements and prioritize the coverage that matters most to you. While comprehensive coverage offers extensive protection, it may not always be necessary, especially if you have an older vehicle. Tailor your coverage to your needs to avoid unnecessary expenses.

- Maintain a Clean Driving Record: A spotless driving record is a powerful tool in securing favorable quotes. Avoid violations, practice safe driving habits, and consider taking defensive driving courses to demonstrate your commitment to road safety.

- Explore Discount Opportunities: Insurance companies offer a variety of discounts, and it's worth investigating which ones you may be eligible for. From safe driver discounts to student discounts or multi-policy discounts, these savings can significantly reduce your overall premium.

- Bundle Policies: If you have multiple insurance needs, such as home and auto coverage, consider bundling your policies with the same provider. Many insurance companies offer substantial discounts for customers who bundle multiple policies, making it a cost-effective option.

The Impact of Technology on Car Insurance Quotes

The advent of technology has revolutionized the car insurance landscape, making it more accessible and efficient for both consumers and providers. Online quote comparison tools, mobile apps, and telematics devices have transformed the way quotes are obtained and tailored to individual needs.

Online Quote Comparison

Online quote comparison platforms have emerged as powerful tools, allowing individuals to quickly and easily compare multiple insurance providers and their respective quotes. These platforms often provide comprehensive information about coverage options, customer reviews, and even personalized recommendations based on individual profiles. With just a few clicks, drivers can explore a wide range of options and make informed decisions.

| Platform | Features |

|---|---|

| Insurify | Offers real-time quotes from top providers, personalized recommendations, and a seamless user experience. |

| The Zebra | Provides a vast database of insurance providers, allowing users to compare rates, coverage, and customer satisfaction ratings. |

| Policygenius | Focuses on providing expert guidance and education, helping users understand their coverage needs and compare quotes accordingly. |

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs have introduced a new era of personalized car insurance. These technologies track driving behavior, including speed, acceleration, braking, and mileage, providing insurance companies with real-time data to assess risk more accurately. Drivers who exhibit safe driving habits can benefit from lower premiums, as these programs reward responsible driving.

- Progressive Snapshot: Progressive's Snapshot program offers drivers the opportunity to save on insurance by installing a small device in their vehicle. The device tracks driving behavior, and based on the data collected, eligible drivers can receive discounts on their premiums.

- Metromile: Metromile specializes in usage-based insurance, offering policies that charge based on actual miles driven. This pay-per-mile model is particularly beneficial for low-mileage drivers, as they can significantly reduce their insurance costs.

The Future of Car Insurance Quotes

As technology continues to advance, the future of car insurance quotes looks promising. The industry is moving towards a more personalized and data-driven approach, leveraging artificial intelligence and machine learning to enhance risk assessment and pricing accuracy. Additionally, the rise of autonomous vehicles and connected car technologies is expected to bring about further innovations in the way insurance quotes are calculated and tailored to individual needs.

Emerging Trends in Car Insurance

Several emerging trends are shaping the future of car insurance quotes, including:

- Artificial Intelligence and Machine Learning: AI-powered systems are being utilized to analyze vast amounts of data, including driving behavior, weather patterns, and accident trends, to predict and mitigate risks more effectively.

- Connected Car Technologies: With the increasing integration of advanced telematics and connectivity features in vehicles, insurance providers can access real-time data, enabling more precise risk assessment and personalized quotes.

- Autonomous Vehicles: As self-driving cars become more prevalent, insurance models will need to adapt. Liability and coverage for autonomous vehicles will likely shift, with a focus on the technology and its manufacturers rather than individual drivers.

Conclusion

Car insurance quotes are an essential component of vehicle ownership, offering drivers the opportunity to secure the right coverage at a competitive price. By understanding the factors that influence quotes and adopting strategic approaches, individuals can navigate the complex world of insurance providers with confidence. With the continuous evolution of technology and emerging trends, the future of car insurance quotes promises enhanced personalization, accuracy, and accessibility, ensuring that drivers can make informed decisions to protect their vehicles and themselves on the road.

How often should I review my car insurance quotes and coverage?

+It is recommended to review your car insurance quotes and coverage annually or whenever significant life changes occur. Life events such as getting married, purchasing a new vehicle, or relocating to a different state can impact your insurance needs and rates. Regular reviews ensure that your coverage remains adequate and cost-effective.

Can I negotiate car insurance quotes with providers?

+While car insurance quotes are typically calculated based on standardized formulas, there may be room for negotiation. Some providers offer flexible pricing or discounts for loyal customers. Contact your insurance provider and inquire about any potential discounts or adjustments to your policy that could lower your premiums.

Are there any alternative methods to reduce car insurance costs besides comparing quotes?

+Yes, there are several alternative strategies to reduce car insurance costs. These include increasing your deductible, which can lower your premium but requires you to pay more out-of-pocket in the event of a claim. You can also consider lowering your coverage limits, especially if you have an older vehicle. Additionally, maintaining a good credit score can positively impact your insurance rates, as many providers use credit-based insurance scores in their calculations.