Inexpensive Medical Insurance

Unveiling Affordable Healthcare: Navigating Inexpensive Medical Insurance Options

In today's world, accessing affordable healthcare is a paramount concern for individuals and families. With rising medical costs, finding inexpensive medical insurance has become a priority for many. This comprehensive guide aims to shed light on the landscape of affordable healthcare options, providing insights into how individuals can navigate the complex world of medical insurance while keeping costs manageable.

Understanding the intricacies of medical insurance and the various plans available is crucial. It empowers individuals to make informed decisions, ensuring they receive the coverage they need without straining their finances. This guide will delve into the different types of inexpensive medical insurance, offering a detailed analysis of their features, benefits, and potential drawbacks.

We will explore the key factors that influence the cost of medical insurance, from individual health status to the choice of healthcare providers. Additionally, we will discuss strategies to maximize savings, such as understanding deductibles, copayments, and out-of-pocket maximums. By the end of this article, readers should have a clearer understanding of how to access affordable healthcare and make the most of their medical insurance plans.

Types of Inexpensive Medical Insurance

The world of medical insurance offers a range of options, each designed to cater to different needs and budgets. Understanding these options is key to making informed decisions about healthcare coverage. Here, we delve into the primary types of inexpensive medical insurance, highlighting their unique features and considerations.

High-Deductible Health Plans (HDHPs)

High-deductible health plans are a popular choice for those seeking affordable healthcare coverage. As the name suggests, these plans have higher deductibles, which means policyholders pay more out-of-pocket before the insurance coverage kicks in. However, the trade-off is often lower monthly premiums, making HDHPs an attractive option for those who prioritize saving money on a monthly basis.

One of the significant advantages of HDHPs is their compatibility with Health Savings Accounts (HSAs). HSAs are tax-advantaged savings accounts that can be used to pay for qualified medical expenses. Individuals enrolled in HDHPs can contribute to HSAs, providing an opportunity to save for future healthcare needs while enjoying tax benefits.

However, it's important to note that HDHPs may not be suitable for everyone. Those with frequent medical needs or high prescription costs may find the upfront costs challenging. Additionally, choosing a healthcare provider within the plan's network is crucial to avoid higher out-of-network costs.

Short-Term Health Insurance

Short-term health insurance plans offer a temporary solution for individuals between jobs, awaiting eligibility for other plans, or simply seeking a bridge coverage option. These plans typically have lower premiums and shorter durations, ranging from a few months to a year. They are an attractive option for those seeking immediate coverage without the commitment of a long-term plan.

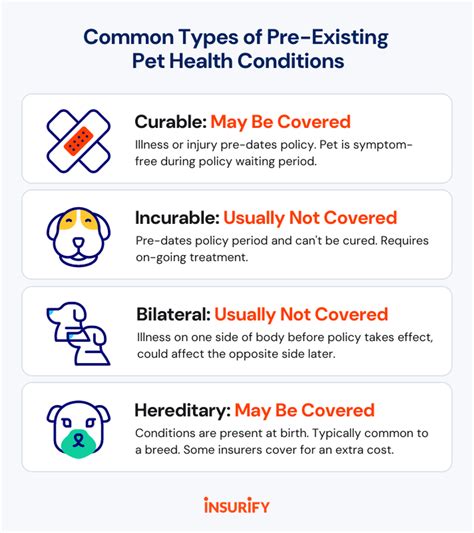

However, it's essential to understand the limitations of short-term health insurance. These plans often have restricted benefits, and pre-existing conditions may not be covered. Furthermore, they may not comply with the Affordable Care Act's (ACA) requirements, which means policyholders may face tax penalties. It's crucial to thoroughly review the plan's terms and conditions to ensure it meets individual healthcare needs.

Catastrophic Health Insurance

Catastrophic health insurance plans are designed to provide coverage for major medical events, such as accidents or serious illnesses. These plans have low monthly premiums but high deductibles, making them an affordable option for those seeking basic coverage. Catastrophic plans often cover essential health benefits, including hospitalization, emergency services, and preventive care.

One of the key advantages of catastrophic health insurance is its affordability. These plans are particularly beneficial for young, healthy individuals who prioritize low monthly costs. However, it's essential to note that catastrophic plans may not cover all healthcare needs. Policyholders should carefully review the plan's coverage limits and ensure they understand the potential out-of-pocket costs associated with major medical events.

State-Based Health Insurance Programs

Many states offer their own health insurance programs, providing affordable coverage options for residents. These programs often cater to specific demographics, such as low-income individuals, seniors, or those with disabilities. State-based programs can offer comprehensive coverage at reduced costs, making them a valuable resource for those who qualify.

Understanding the eligibility criteria and benefits of state-based health insurance programs is crucial. These programs can vary significantly from state to state, offering different levels of coverage and financial assistance. By researching and comparing these options, individuals can access affordable healthcare tailored to their specific needs and circumstances.

Maximizing Savings: Strategies for Affordable Healthcare

Navigating the world of medical insurance requires a strategic approach to ensure the best value for money. Here, we explore key strategies that individuals can employ to maximize their savings on healthcare costs while maintaining the coverage they need.

Understanding Deductibles, Copayments, and Out-of-Pocket Maximums

Deductibles, copayments, and out-of-pocket maximums are crucial components of medical insurance plans. Understanding how these work can significantly impact an individual's overall healthcare costs. Deductibles represent the amount an individual must pay out-of-pocket before the insurance coverage begins. Copayments are fixed amounts paid for specific services, such as doctor visits or prescriptions. Out-of-pocket maximums, on the other hand, are the maximum amounts individuals will pay for covered services in a year.

By carefully reviewing these components, individuals can make informed decisions about their healthcare coverage. For instance, a plan with a higher deductible may be more affordable in the short term but may require higher out-of-pocket costs for major medical events. Conversely, a plan with lower deductibles may offer more immediate coverage but may have higher monthly premiums.

Utilizing Preventive Care Services

Preventive care services are an essential component of many medical insurance plans, offering a range of benefits to policyholders. These services, which often include annual check-ups, screenings, and immunizations, are designed to detect potential health issues early on, preventing more serious and costly medical conditions down the line.

By actively utilizing preventive care services, individuals can maintain their health and potentially reduce their overall healthcare costs. Many insurance plans cover these services at no additional cost, providing an opportunity to access valuable healthcare services without incurring additional expenses. It's crucial for individuals to stay informed about the preventive care services covered by their insurance plan and take advantage of these benefits.

Exploring Discounted Healthcare Options

Discounted healthcare options provide an alternative to traditional insurance plans, offering cost-effective solutions for accessing medical care. These options, such as healthcare sharing ministries or discount medical cards, can provide significant savings on healthcare services, including doctor visits, laboratory tests, and even prescription medications.

Healthcare sharing ministries, for instance, operate on a community-based model where members contribute to a shared pool of funds used to cover each other's medical needs. These ministries often have lower monthly fees compared to traditional insurance plans, making them an attractive option for those seeking affordable healthcare coverage. Similarly, discount medical cards offer savings on a range of healthcare services, providing an additional layer of financial protection.

Managing Chronic Conditions

Managing chronic conditions is a critical aspect of healthcare, and insurance plans play a significant role in providing coverage for these long-term health issues. Many insurance plans offer specialized programs and resources to help individuals manage their chronic conditions effectively, often at reduced costs.

By actively engaging with these programs, individuals can access valuable resources, such as disease management tools, educational materials, and support groups. These resources can empower individuals to take control of their health, potentially reducing the severity and impact of their chronic conditions. Additionally, many insurance plans offer discounted medications and services for those managing chronic illnesses, providing further cost savings.

Future Implications: Evolving Landscape of Affordable Healthcare

The landscape of affordable healthcare is continually evolving, influenced by a range of factors, including technological advancements, policy changes, and societal trends. Understanding these future implications is crucial for individuals and families seeking long-term healthcare solutions.

Technological Advancements in Healthcare

Technological advancements are revolutionizing the healthcare industry, offering new opportunities for affordable and accessible care. Telemedicine, for instance, allows individuals to access medical consultations and treatments remotely, often at reduced costs. This technology is particularly beneficial for those in rural areas or with limited mobility, providing an efficient and cost-effective solution for accessing healthcare services.

Additionally, advancements in medical technology, such as wearable health devices and artificial intelligence, are transforming the way healthcare is delivered. These technologies can improve disease management, enhance patient monitoring, and potentially reduce healthcare costs by preventing unnecessary hospital visits and improving overall health outcomes.

Policy Changes and Healthcare Reform

Policy changes and healthcare reforms have a significant impact on the availability and affordability of medical insurance. Changes in government policies, such as the Affordable Care Act (ACA), can influence the coverage options and financial assistance available to individuals and families. Keeping abreast of these policy changes is crucial for understanding the evolving landscape of affordable healthcare.

Healthcare reform efforts often aim to expand coverage, improve access, and reduce costs. These initiatives can include expanding Medicaid eligibility, implementing tax credits or subsidies for insurance premiums, and improving the efficiency of healthcare delivery systems. By understanding these policy changes, individuals can navigate the healthcare system more effectively and access the coverage they need.

Changing Consumer Trends and Expectations

Consumer trends and expectations are shaping the future of healthcare, influencing the demand for affordable and accessible care. The rise of consumer-driven healthcare, for instance, emphasizes the role of individuals in managing their own healthcare needs and costs. This trend is driving the development of innovative insurance plans and healthcare services that prioritize affordability, transparency, and consumer choice.

Additionally, changing societal attitudes towards health and wellness are influencing the demand for preventive care and holistic healthcare approaches. This shift is prompting insurance providers to offer more comprehensive coverage for preventive services and wellness programs, aligning with consumer expectations for proactive health management.

Frequently Asked Questions

What is the difference between a high-deductible health plan (HDHP) and a traditional health insurance plan?

+

High-deductible health plans (HDHPs) typically have lower monthly premiums but higher deductibles, meaning policyholders pay more out-of-pocket before insurance coverage begins. Traditional health insurance plans often have lower deductibles but higher monthly premiums. The choice between the two depends on individual healthcare needs and financial considerations.

Are short-term health insurance plans suitable for long-term healthcare needs?

+

Short-term health insurance plans are designed for temporary coverage, typically lasting a few months to a year. They are not intended for long-term healthcare needs and may have limited benefits and coverage for pre-existing conditions. It’s important to carefully review the terms and conditions of short-term plans before enrolling.

How do I know if I’m eligible for state-based health insurance programs?

+

Eligibility for state-based health insurance programs varies by state and often depends on factors such as income, age, and disability status. It’s recommended to research and review the specific eligibility criteria for your state’s programs. Many states provide online resources and application processes to assist individuals in determining their eligibility.

What are some tips for negotiating lower healthcare costs with providers?

+

Negotiating lower healthcare costs with providers can be challenging but not impossible. Some tips include requesting itemized bills to identify potential errors or overcharges, negotiating cash discounts for services, and considering alternative payment plans or financing options. It’s also beneficial to research the average costs for specific procedures or services to ensure you’re not overpaying.

How can I stay informed about policy changes and healthcare reforms that may impact my insurance coverage?

+

Staying informed about policy changes and healthcare reforms is crucial for understanding the evolving landscape of insurance coverage. Follow reputable news sources and healthcare industry publications, subscribe to relevant newsletters or alerts, and engage with healthcare advocacy groups or organizations that provide updates on policy changes. Additionally, stay connected with your insurance provider to receive timely notifications about any updates or changes to your coverage.