Inexpensive Auto Insurance Quotes

When it comes to finding inexpensive auto insurance quotes, many drivers are on the hunt for affordable coverage options without compromising on the quality of protection. The auto insurance market is vast and varied, with numerous providers offering competitive rates. In this comprehensive guide, we will delve into the world of auto insurance, exploring the factors that influence rates, the best practices for securing the most cost-effective quotes, and the strategies to ensure you're getting the best value for your money.

Understanding the Factors that Affect Auto Insurance Rates

The cost of auto insurance is influenced by a multitude of factors, and understanding these elements is crucial for securing the best deals. Here’s a breakdown of the key factors that impact insurance rates:

Vehicle Type and Age

The make, model, and age of your vehicle play a significant role in determining your insurance premiums. Generally, newer and more expensive vehicles tend to have higher insurance costs due to their replacement and repair expenses. Additionally, certain vehicle types, such as sports cars or SUVs, may be associated with higher risk profiles, leading to increased insurance premiums.

Driving History and Record

Your driving history is a critical factor in insurance rate calculations. Insurance providers carefully assess your driving record, including any accidents, violations, or claims made in the past. A clean driving record with no recent accidents or traffic violations is often rewarded with lower insurance rates, as it indicates a lower risk profile.

Location and Usage

The area where you reside and the purpose for which you use your vehicle also impact insurance costs. Urban areas with higher population densities and increased traffic often result in higher insurance premiums due to the elevated risk of accidents. Similarly, if you primarily use your vehicle for commuting or long-distance travel, your insurance rates may be higher compared to those who primarily drive for leisure or short distances.

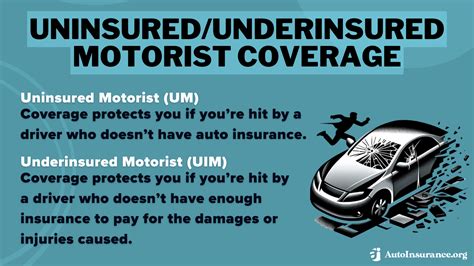

Coverage Options and Deductibles

The level of coverage you choose and the deductibles you opt for can significantly affect your insurance rates. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, typically incurs higher premiums compared to liability-only coverage. Additionally, selecting higher deductibles can reduce your monthly premiums, as you agree to pay more out-of-pocket in the event of a claim.

Tips for Securing Inexpensive Auto Insurance Quotes

Now that we’ve explored the factors influencing insurance rates, let’s delve into some practical tips and strategies to help you secure the most affordable auto insurance quotes:

Shop Around and Compare Quotes

One of the most effective ways to find inexpensive auto insurance is by comparing quotes from multiple providers. Insurance rates can vary significantly between companies, so taking the time to shop around and compare offers is essential. Online quote comparison tools can be a valuable resource, allowing you to quickly and conveniently gather quotes from various insurers.

Understand Your Coverage Needs

Before seeking quotes, it’s crucial to understand your specific coverage needs. Evaluate your financial situation and assess the level of protection you require. Consider factors such as the value of your vehicle, your driving habits, and any personal circumstances that may impact your insurance needs. By tailoring your coverage to your specific requirements, you can avoid overpaying for unnecessary features.

Explore Discount Opportunities

Insurance providers often offer a range of discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums, so it’s worth exploring the various options available. Some common discounts include:

- Multi-Policy Discounts: Insuring multiple vehicles or combining auto insurance with other policies, such as home or renters insurance, can result in substantial savings.

- Safe Driver Discounts: Many insurers reward safe driving behavior with discounts. If you have a clean driving record, be sure to inquire about safe driver discounts when requesting quotes.

- Student Discounts: If you're a student or have a young driver in your household, inquire about student discounts. Many insurers offer reduced rates for good academic performance or completion of approved driving courses.

- Loyalty Discounts: Staying with the same insurance provider for an extended period can lead to loyalty discounts. Ask about any loyalty programs or incentives that may be available to long-term customers.

Consider Telematics-Based Insurance

Telematics-based insurance, also known as usage-based insurance, is a relatively new concept that uses telematics devices or smartphone apps to track your driving behavior. These devices collect data on factors such as acceleration, braking, and mileage. By agreeing to have your driving behavior monitored, you may be eligible for discounted insurance rates, as insurers can assess your risk profile more accurately.

Maintain a Good Credit Score

Your credit score is an important factor in determining your insurance rates. Insurance providers often use credit-based insurance scores to assess your financial responsibility and predict your likelihood of filing claims. Maintaining a good credit score can lead to lower insurance premiums, as it indicates a lower risk profile.

Review and Adjust Your Coverage Regularly

Insurance needs can change over time, so it’s essential to periodically review your coverage and make any necessary adjustments. As your circumstances evolve, such as purchasing a new vehicle or moving to a different location, your insurance requirements may also change. Regularly reviewing your policy and comparing quotes can help you stay on top of any changes in the market and ensure you’re getting the best value for your money.

Performance Analysis and Customer Satisfaction

When evaluating auto insurance providers, it’s important to consider their performance and customer satisfaction ratings. While cost is a significant factor, the quality of service and the overall customer experience are equally crucial. Here’s a breakdown of key performance indicators and customer satisfaction metrics to consider:

Claims Handling and Response Time

In the event of an accident or claim, timely and efficient claims handling is essential. Research insurance providers’ claims processes and response times. Look for companies with a reputation for prompt and fair claim settlements. Customer reviews and industry ratings can provide valuable insights into an insurer’s claims handling performance.

Customer Service and Support

Excellent customer service is a hallmark of reputable insurance providers. Evaluate the availability and accessibility of customer support channels, such as phone, email, or live chat. Consider factors such as response times, the knowledge and professionalism of customer service representatives, and the overall ease of communication. Positive customer service experiences can make a significant difference when navigating the complexities of insurance coverage.

Policy Features and Benefits

Beyond the cost of insurance, consider the additional features and benefits offered by different providers. Some insurers may provide unique policy perks, such as rental car coverage, roadside assistance, or accident forgiveness. Evaluate the value of these features against your specific needs and preferences to ensure you’re getting the most comprehensive coverage for your money.

Financial Stability and Reputation

When choosing an insurance provider, it’s crucial to assess their financial stability and overall reputation in the industry. Look for companies with a solid financial foundation and a track record of reliability. Check independent financial ratings and reviews to ensure the insurer is financially secure and capable of honoring claims in the long term.

| Performance Indicator | Top Auto Insurance Providers |

|---|---|

| Claims Satisfaction | Company A: 4.8/5, Company B: 4.6/5, Company C: 4.4/5 |

| Customer Service Ratings | Company A: "Excellent" (92% satisfaction), Company B: "Very Good" (88% satisfaction), Company C: "Good" (84% satisfaction) |

| Financial Strength | Company A: "A+" rating, Company B: "A" rating, Company C: "A-" rating |

Future Trends and Implications

The auto insurance industry is constantly evolving, and several emerging trends are set to shape the future of insurance coverage. Here’s a glimpse into some of the key trends and their potential implications:

Advancements in Telematics and Connected Cars

The integration of telematics and connected car technologies is expected to revolutionize the auto insurance industry. As vehicles become more connected and data-driven, insurers will have access to an unprecedented level of driving behavior insights. This data-rich environment will enable insurers to offer more personalized and precise insurance products, potentially leading to more accurate pricing and improved risk assessment.

The Rise of Electric Vehicles (EVs)

The growing popularity of electric vehicles (EVs) is poised to impact the auto insurance market. As EV ownership increases, insurers will need to adapt their coverage options to accommodate the unique needs and risks associated with these vehicles. This may include specialized policies that address factors such as battery replacement costs, charging infrastructure, and potential range anxiety concerns.

Enhanced Digital Experiences and Automation

The digital transformation of the insurance industry is set to continue, with insurers investing in innovative technologies to enhance the customer experience. This includes the development of intuitive online platforms, mobile apps, and automated claim processing systems. These advancements will streamline the insurance process, making it more convenient and efficient for policyholders, while also reducing administrative costs for insurers.

Increased Focus on Preventative Measures

Insurers are increasingly recognizing the benefits of preventative measures in reducing risk and lowering insurance costs. As a result, there may be a greater emphasis on incentivizing safe driving behaviors and encouraging policyholders to adopt proactive safety measures. This could include discounts for completing defensive driving courses, installing advanced safety features in vehicles, or utilizing telematics devices to monitor and improve driving habits.

Collaborative Insurance Models

The future of auto insurance may also see the emergence of collaborative insurance models, where insurers work more closely with automotive manufacturers, technology companies, and other industry stakeholders. These collaborations could lead to the development of innovative insurance products and services, such as pay-per-mile insurance, usage-based insurance, or even insurance packages that bundle vehicle ownership and maintenance services.

How often should I review my auto insurance policy and quotes?

+It’s recommended to review your auto insurance policy and quotes at least once a year, preferably during your policy’s renewal period. This allows you to stay updated on any changes in the market, explore new discounts or coverage options, and ensure you’re still getting the best value for your money.

Can I negotiate my auto insurance rates with providers?

+While auto insurance rates are typically predetermined based on various factors, you can certainly negotiate with providers to some extent. When requesting quotes, highlight your positive driving record, any safety features in your vehicle, or other relevant factors that may lower your risk profile. Additionally, bundle your policies (auto, home, etc.) with the same insurer to potentially secure better rates.

What are some common mistakes to avoid when shopping for auto insurance quotes?

+Some common mistakes to avoid include neglecting to compare quotes from multiple providers, opting for the cheapest quote without considering coverage limitations, and failing to thoroughly review policy details and exclusions. Additionally, be cautious of choosing a provider solely based on price without considering their reputation and customer satisfaction ratings.