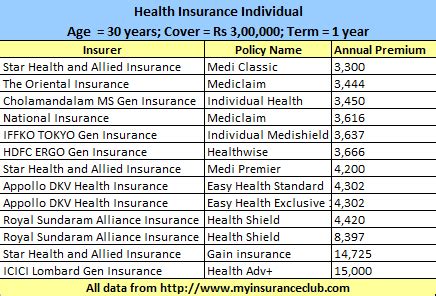

Individual Healthcare Insurance Plans

In today's evolving healthcare landscape, having a comprehensive understanding of your insurance options is crucial. For those seeking tailored coverage, individual healthcare insurance plans offer a flexible and personalized approach. This article delves into the intricacies of these plans, exploring their benefits, features, and the factors to consider when selecting the right policy for your unique needs.

Understanding Individual Healthcare Insurance Plans

Individual healthcare insurance plans, often referred to as private health insurance, are policies purchased directly by individuals or families rather than through an employer or government-sponsored program. These plans provide coverage for a wide range of medical services, including doctor visits, hospital stays, prescription medications, and specialty care. The key advantage lies in the customization and flexibility they offer, allowing individuals to choose a plan that aligns perfectly with their healthcare requirements and budget.

One of the primary benefits of individual healthcare insurance is the ability to tailor coverage to your specific needs. Unlike group plans, which often have standardized benefits, individual plans can be customized to include the features and services most important to you. This could mean higher coverage limits for certain conditions, additional benefits for mental health or dental care, or even wellness programs to promote a healthier lifestyle.

Key Features and Benefits

- Comprehensive Coverage: Individual plans typically offer a wide range of coverage options, including preventive care, specialist visits, emergency services, and prescription drug benefits. Some plans even cover alternative therapies and wellness programs.

- Customization: You can choose the level of coverage that suits your needs and budget. This includes selecting the annual deductible, co-insurance, and out-of-pocket maximum, giving you control over your healthcare expenses.

- Portability: Unlike employer-sponsored plans, individual health insurance is not tied to your job. This means you can keep your coverage even if you change jobs, move to a different state, or retire.

- Flexible Payment Options: Many insurers offer flexible payment plans, allowing you to pay your premiums monthly, quarterly, or annually, depending on what works best for your financial situation.

- Pre-Existing Condition Coverage: In many countries, individual health insurance plans must cover pre-existing conditions, ensuring that you receive the care you need without being penalized for past health issues.

Factors to Consider When Choosing an Individual Plan

Selecting the right individual healthcare insurance plan involves careful consideration of several factors. Here are some key aspects to evaluate:

| Factor | Considerations |

|---|---|

| Coverage Needs | Assess your current and potential future healthcare needs. Consider any ongoing medical conditions, the age and health of your family members, and any specific treatments or procedures you anticipate requiring. |

| Premiums and Costs | Examine the monthly premiums, deductibles, co-payments, and out-of-pocket maximums. Remember, the cheapest plan may not always provide the best value if it leaves you with high out-of-pocket expenses. |

| Network of Providers | Check if your preferred doctors, specialists, and hospitals are in the plan's network. Out-of-network care can be more expensive, so it's crucial to understand the network coverage. |

| Prescription Drug Coverage | Review the plan's prescription drug formulary to ensure it covers the medications you regularly take. Some plans offer different tiers of coverage for brand-name and generic drugs. |

| Additional Benefits | Look for plans that offer extra benefits like vision or dental coverage, wellness programs, or access to telemedicine services. These can enhance your overall healthcare experience. |

| Renewability and Portability | Understand the plan's renewability terms and conditions. Ensure that the plan can be renewed annually and is portable so you can keep your coverage if your circumstances change. |

The Role of Individual Healthcare Insurance in Personal Finance

From a personal finance perspective, individual healthcare insurance plays a crucial role in managing healthcare-related expenses. Here’s how it impacts your financial well-being:

Protecting Your Assets

One of the primary financial benefits of individual healthcare insurance is its ability to protect your assets. A serious illness or accident can lead to substantial medical bills, potentially draining your savings or even forcing you to sell assets to cover costs. With comprehensive insurance coverage, you can safeguard your financial stability and ensure that unexpected healthcare expenses don’t derail your long-term financial goals.

Tax Advantages

In many countries, individual health insurance premiums are tax-deductible, providing a significant financial advantage. This means you can reduce your taxable income by the amount you spend on premiums, potentially lowering your tax liability and increasing your after-tax income.

Budgeting for Healthcare Costs

Individual health insurance plans often come with a predictable monthly premium, allowing you to budget for healthcare expenses more effectively. By understanding your premium and out-of-pocket costs, you can plan your finances accordingly and avoid unexpected financial burdens.

Financial Stability in Retirement

As you approach retirement, maintaining individual health insurance becomes increasingly important. Retirement savings and pension plans may not cover all healthcare costs, especially if you require specialized or long-term care. By continuing your individual health insurance plan or transitioning to a Medicare supplement plan, you can ensure financial stability and access to necessary healthcare services during your retirement years.

Navigating the Enrollment Process

Enrolling in an individual healthcare insurance plan can be a straightforward process, especially with the right guidance. Here’s a step-by-step guide to help you navigate the enrollment journey:

- Research and Compare Plans: Start by researching different insurance providers and their available plans. Compare coverage, premiums, deductibles, and additional benefits to find the plan that best suits your needs.

- Understand Eligibility: Check the eligibility criteria for the plan you're interested in. Some plans may have specific requirements or limitations based on age, pre-existing conditions, or other factors.

- Gather Necessary Documents: Prepare the required documentation, which may include proof of identity, income verification, and details of any existing health conditions. Having these ready can streamline the enrollment process.

- Choose Your Coverage Level: Decide on the level of coverage you need. Consider your healthcare needs, budget, and the potential for future health issues. A higher coverage level may provide more financial protection but come with a higher premium.

- Apply Online or Through an Agent: You can apply for individual health insurance either directly through the insurer's website or with the help of an insurance agent. Agents can provide valuable guidance and ensure you understand the plan's details.

- Review and Confirm Coverage: Once your application is approved, carefully review the policy documents. Ensure that the coverage, premiums, and other details match your expectations. If there are any discrepancies, contact the insurer promptly.

Special Considerations During Open Enrollment

Many countries have specific enrollment periods, often referred to as Open Enrollment, during which individuals can enroll in or switch health insurance plans. These periods typically occur annually, and it’s important to be aware of the deadlines to ensure you don’t miss out on coverage.

During Open Enrollment, you have the opportunity to assess your current plan and make changes if necessary. This could involve switching to a different plan with better coverage or lower premiums, or adding dependents to your existing policy. It's a crucial time to review your healthcare needs and ensure your insurance remains aligned with your life circumstances.

Future Trends and Innovations in Individual Healthcare Insurance

The world of individual healthcare insurance is evolving, driven by technological advancements and changing consumer preferences. Here are some trends and innovations that are shaping the future of this industry:

Digital Health Solutions

The integration of digital health solutions is revolutionizing individual healthcare insurance. Insurers are leveraging technology to offer more efficient and personalized services. This includes the use of mobile apps for policy management, telemedicine for remote consultations, and wearable devices for tracking health metrics and providing personalized health recommendations.

Value-Based Care

There is a growing shift towards value-based care models, where insurers and healthcare providers focus on the quality and outcomes of care rather than the quantity of services provided. This approach aims to improve patient health while controlling costs, often through preventive care initiatives and coordinated care management.

Telemedicine and Virtual Care

The COVID-19 pandemic accelerated the adoption of telemedicine and virtual care services. Many individual health insurance plans now include coverage for virtual consultations, allowing policyholders to access medical advice and treatment from the comfort of their homes. This trend is expected to continue, offering convenience and accessibility to policyholders.

Data-Driven Insights

Advancements in data analytics and artificial intelligence are enabling insurers to make more informed decisions. By analyzing large datasets, insurers can identify trends, predict health risks, and develop targeted interventions to improve patient outcomes. This data-driven approach can lead to more efficient and effective healthcare delivery.

Wellness and Prevention Programs

Individual healthcare insurance plans are increasingly emphasizing wellness and prevention. Many insurers offer incentives and discounts for policyholders who participate in wellness programs, such as smoking cessation, weight management, or stress reduction initiatives. By promoting healthy lifestyles, insurers aim to reduce the incidence of chronic diseases and lower overall healthcare costs.

Conclusion

Individual healthcare insurance plans offer a powerful tool for individuals and families to take control of their healthcare journey. By understanding the benefits, features, and factors involved in choosing the right plan, you can make informed decisions that align with your unique needs and financial situation. As the industry continues to evolve, staying abreast of the latest trends and innovations will ensure you remain at the forefront of personalized healthcare coverage.

How do I choose the right individual healthcare insurance plan for my needs?

+Selecting the right plan involves assessing your specific healthcare needs, considering your budget, and researching different options. Evaluate coverage, premiums, and additional benefits to find the plan that provides the best value for your circumstances.

Can I enroll in an individual healthcare insurance plan outside of Open Enrollment periods?

+In some cases, yes. Certain life events, such as losing your job, getting married, or having a baby, may qualify you for a Special Enrollment Period, allowing you to enroll outside of the standard Open Enrollment window.

What are some tips for saving money on individual healthcare insurance premiums?

+Consider choosing a plan with a higher deductible if you’re generally healthy and don’t anticipate frequent medical expenses. You can also explore plans that offer discounts for healthy lifestyle choices or those that cover generic drugs at a lower cost.