How To Pick Health Insurance

Navigating the world of health insurance can be a daunting task, especially for those who are new to the process or seeking a better understanding of their options. Health insurance is a vital aspect of healthcare, providing financial protection and access to essential medical services. In this comprehensive guide, we will delve into the intricacies of selecting the right health insurance plan, ensuring you make informed decisions to safeguard your well-being and peace of mind.

Understanding Your Health Insurance Needs

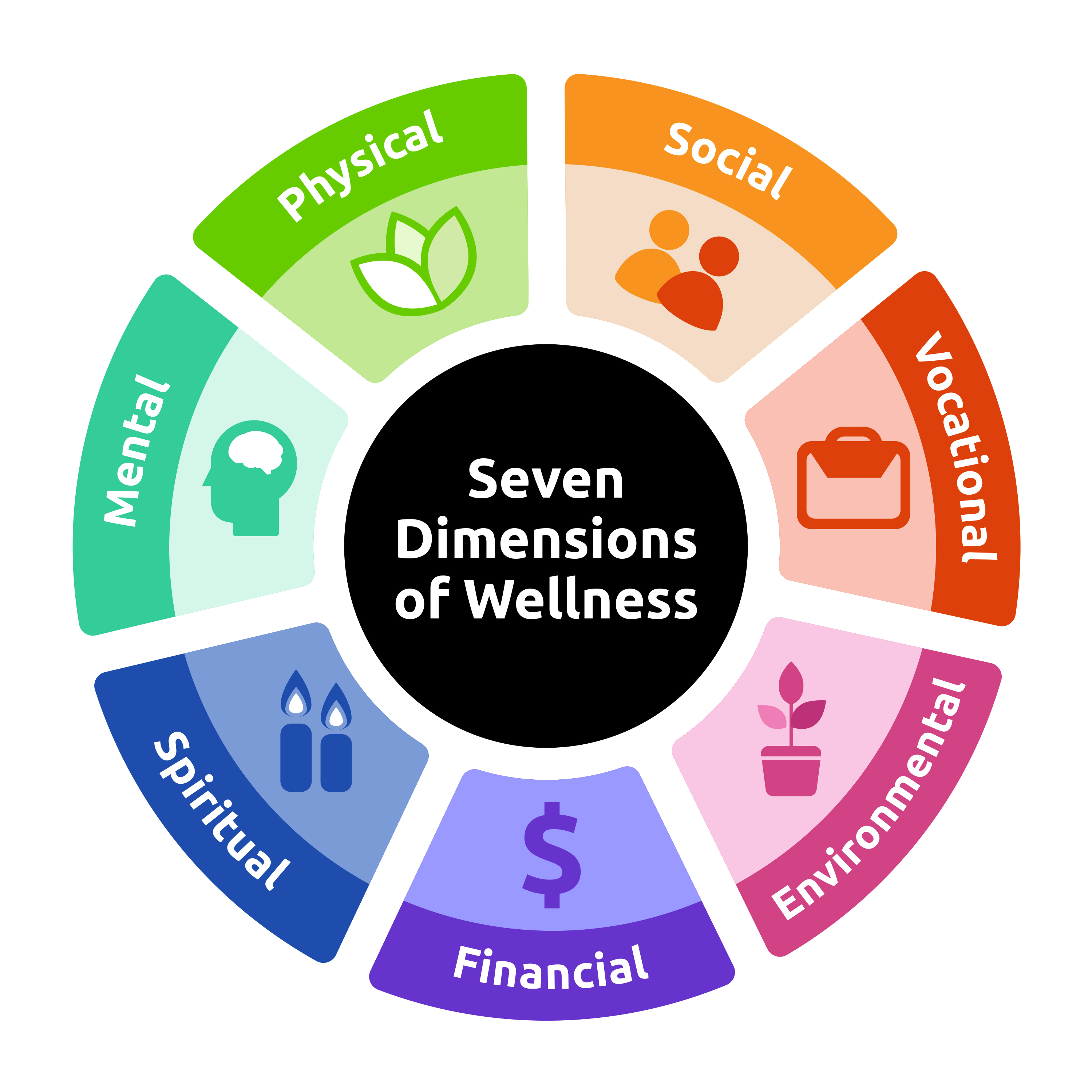

Before embarking on your health insurance journey, it is crucial to assess your unique needs and circumstances. Consider the following factors to tailor your search effectively:

- Your Health Status: Evaluate your current and anticipated health needs. Do you have any pre-existing conditions or chronic illnesses? Are you expecting major medical events, such as pregnancy or surgeries? Understanding your health profile will help you choose a plan that provides adequate coverage.

- Family Size and Composition: Health insurance plans often offer different coverage options for individuals, couples, and families. Consider the number of dependents you wish to cover and their specific healthcare requirements. Plans that cater to families may include pediatric care, vision, and dental benefits.

- Preferred Healthcare Providers: Identify the doctors, specialists, and hospitals you prefer or frequently visit. Check if these providers are in-network for the plans you are considering. In-network providers offer lower out-of-pocket costs, ensuring more affordable healthcare.

- Prescription Drug Needs: If you rely on prescription medications, ensure your plan includes a comprehensive drug formulary. Review the list of covered medications and their associated costs to avoid unexpected expenses.

- Financial Considerations: Health insurance plans come with various cost structures, including premiums, deductibles, copayments, and coinsurance. Assess your budget and determine the level of financial risk you are comfortable with. Consider plans that offer cost-sharing options or flexible payment structures.

Exploring Health Insurance Options

Once you have a clear understanding of your needs, it’s time to explore the diverse range of health insurance plans available. Here are some key options to consider:

Private Health Insurance Plans

Private health insurance plans are offered by commercial insurance companies and are typically purchased individually or through employers. These plans offer a wide range of coverage options and may include additional benefits such as wellness programs and preventive care services.

Employer-Sponsored Plans

Many employers offer health insurance as part of their employee benefits package. These plans often provide a convenient and cost-effective option, as employers may contribute to the premium costs. Explore the coverage options and contributions available through your employer.

Government-Sponsored Programs

Government-sponsored health insurance programs, such as Medicare and Medicaid, provide coverage to specific populations. Medicare is primarily for individuals aged 65 and older, while Medicaid caters to low-income individuals and families. These programs offer comprehensive coverage and may have lower out-of-pocket costs.

Short-Term Health Insurance

Short-term health insurance plans are designed for temporary coverage needs. They offer more limited benefits and may be suitable for individuals transitioning between jobs or waiting for a permanent plan to take effect. However, it’s important to note that these plans often exclude coverage for pre-existing conditions.

Key Factors to Consider in Health Insurance Plans

When comparing health insurance plans, several critical factors should be taken into account to ensure you select the most suitable option. Here are some key considerations:

- Network of Providers: Review the network of healthcare providers associated with each plan. Ensure that your preferred doctors, specialists, and hospitals are in-network to minimize out-of-pocket expenses.

- Coverage Limits and Exclusions: Carefully read the plan’s benefits summary to understand any coverage limits, exclusions, and restrictions. Some plans may have specific limitations on certain procedures or treatments, so be aware of these potential gaps in coverage.

- Prescription Drug Coverage: Evaluate the plan’s prescription drug formulary. Look for a plan that covers the medications you require and offers cost-effective options, such as generic drugs or preferred brands.

- Cost-Sharing Structures: Understand the cost-sharing arrangements, including deductibles, copayments, and coinsurance. Assess how these costs align with your anticipated healthcare needs and budget.

- Additional Benefits and Services: Consider any additional benefits or services offered by the plan, such as telemedicine consultations, wellness programs, or alternative therapy coverage. These extras can enhance your overall healthcare experience.

The Role of Health Insurance Brokers and Advisors

Navigating the complex world of health insurance can be overwhelming, and that’s where health insurance brokers and advisors come into play. These professionals are licensed experts who specialize in guiding individuals and businesses through the maze of insurance options.

Benefits of Working with a Broker or Advisor

- Expertise and Guidance: Brokers and advisors possess in-depth knowledge of the health insurance market. They can provide valuable insights and recommendations based on your specific needs, ensuring you make informed decisions.

- Customized Solutions: These professionals tailor their advice to your unique circumstances. Whether you’re an individual, a family, or a business owner, they will present options that align with your healthcare requirements and budget.

- Access to Multiple Carriers: Brokers and advisors have established relationships with various insurance carriers, giving them access to a wide range of plans. This allows them to present you with a diverse selection of options, ensuring you find the best fit.

- Negotiation and Advocacy: Brokers often negotiate on your behalf with insurance companies, securing competitive rates and favorable terms. They can also advocate for you if you encounter issues or need assistance with claims.

How to Choose a Reliable Broker or Advisor

When selecting a health insurance broker or advisor, it’s essential to ensure they are reputable and trustworthy. Here are some tips to help you make the right choice:

- Licensing and Credentials: Verify that the broker or advisor is licensed and certified to sell health insurance in your state. Check their professional credentials and affiliations.

- Experience and Expertise: Look for brokers or advisors with a proven track record and extensive experience in the health insurance industry. Ask about their areas of specialization and the types of clients they typically serve.

- Personalized Approach: Choose a broker or advisor who takes the time to understand your specific needs and provides tailored recommendations. They should offer a comprehensive assessment of your circumstances and present a range of suitable options.

- Communication and Transparency: Effective communication is key. Opt for a broker or advisor who communicates clearly, explains complex terms, and provides regular updates. Transparency regarding fees and potential conflicts of interest is also crucial.

Understanding Health Insurance Costs and Coverage

Health insurance plans come with a range of costs and coverage options, and it’s essential to understand these elements to make informed choices. Here’s a breakdown of the key components:

Premiums

Premiums are the regular payments you make to your health insurance provider to maintain coverage. These costs can vary based on factors such as age, location, and the type of plan chosen. It’s important to find a balance between affordable premiums and comprehensive coverage.

Deductibles

Deductibles represent the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles may incur higher premiums. Consider your anticipated healthcare needs and choose a deductible that aligns with your financial comfort.

Copayments and Coinsurance

Copayments, or copays, are fixed amounts you pay for specific services or prescriptions. Coinsurance, on the other hand, is a percentage of the total cost that you are responsible for paying. These cost-sharing structures vary across plans and impact your overall out-of-pocket expenses.

Out-of-Pocket Maximums

Out-of-pocket maximums refer to the maximum amount you will pay for covered services in a given year. Once you reach this limit, your insurance provider covers 100% of eligible expenses. Understanding out-of-pocket maximums is crucial for managing your financial exposure.

Coverage Limits and Exclusions

Health insurance plans may have specific coverage limits or exclusions. These limits dictate the maximum amount the insurer will pay for certain services or treatments. Exclusions refer to services or conditions that are not covered by the plan. Carefully review these limits and exclusions to ensure your anticipated healthcare needs are adequately covered.

The Future of Health Insurance: Trends and Innovations

The health insurance landscape is continually evolving, driven by technological advancements and changing consumer expectations. Here are some key trends and innovations shaping the future of health insurance:

Telemedicine and Virtual Care

Telemedicine and virtual care platforms have gained significant traction, especially in the wake of the COVID-19 pandemic. These technologies enable remote consultations, diagnostics, and even certain procedures, offering convenience and accessibility to patients. Health insurance plans are increasingly incorporating telemedicine benefits to enhance coverage and reduce costs.

Value-Based Care Models

Value-based care models focus on delivering high-quality, patient-centric healthcare while reducing costs. These models incentivize healthcare providers to improve patient outcomes and overall health, rather than simply billing for services rendered. Health insurance plans are adopting value-based care strategies to encourage preventative care, manage chronic conditions, and reduce unnecessary hospitalizations.

Consumer-Driven Health Plans

Consumer-driven health plans (CDHPs) are gaining popularity, empowering individuals to take a more active role in their healthcare decisions. CDHPs typically offer lower premiums and higher deductibles, encouraging consumers to become more cost-conscious. These plans often include health savings accounts (HSAs) or health reimbursement arrangements (HRAs) to help individuals save for future medical expenses.

Data-Driven Insights

Advancements in data analytics and artificial intelligence are revolutionizing the health insurance industry. Insurers are leveraging data to identify trends, predict healthcare needs, and personalize coverage options. By analyzing vast amounts of medical data, insurers can develop more accurate risk assessments and offer tailored plans to meet individual needs.

Wellness and Prevention Programs

Health insurance providers are recognizing the importance of wellness and prevention in reducing long-term healthcare costs. Many plans now offer incentives and rewards for adopting healthy behaviors, such as exercising regularly, maintaining a balanced diet, and quitting smoking. These programs aim to improve overall population health and reduce the burden of chronic diseases.

Conclusion: Empowering Your Health Insurance Journey

Selecting the right health insurance plan is a crucial decision that impacts your well-being and financial security. By understanding your unique needs, exploring your options, and leveraging the expertise of brokers and advisors, you can navigate the complex world of health insurance with confidence. Remember to carefully consider coverage limits, costs, and additional benefits to make an informed choice.

As the health insurance landscape continues to evolve, stay informed about emerging trends and innovations. Embrace technologies like telemedicine and value-based care models to enhance your healthcare experience. By staying proactive and engaged, you can take control of your health and financial future.

What is the difference between PPO and HMO plans?

+PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to choose any healthcare provider, both in and out of network. HMO (Health Maintenance Organization) plans typically require you to select a primary care physician and use in-network providers, with some exceptions for emergencies or specialized care.

How can I save on health insurance costs?

+To save on health insurance costs, consider plans with higher deductibles and lower premiums, especially if you anticipate minimal healthcare needs. Additionally, shop around and compare plans, as prices can vary significantly between providers. Don’t forget to explore employer-sponsored plans or government programs for potential cost savings.

What happens if I have a pre-existing condition?

+Under the Affordable Care Act, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. However, it’s essential to carefully review plan details, as some plans may have specific exclusions or limitations for certain conditions. Working with a broker or advisor can help you find a plan that provides adequate coverage for your needs.