How To Get Medical Insurance To Pay For Dental Work

Maximizing Medical Insurance Coverage for Dental Procedures: A Comprehensive Guide

When it comes to dental work, understanding how to leverage your medical insurance coverage can make a significant difference in managing your healthcare expenses. While dental insurance is often the primary source of coverage for dental procedures, medical insurance plans may also provide benefits that can help alleviate the financial burden of certain dental treatments. In this comprehensive guide, we will delve into the intricacies of using medical insurance to pay for dental work, exploring the factors, processes, and strategies involved.

Understanding the Scope of Medical Insurance for Dental Procedures

Medical insurance policies typically cover a wide range of healthcare services, including treatments for illnesses, injuries, and certain medical conditions. However, the level of coverage for dental procedures can vary greatly depending on the specific plan and the terms outlined in the policy. Some medical insurance plans may offer limited dental coverage as an add-on or rider, while others may provide more comprehensive benefits for specific dental treatments.

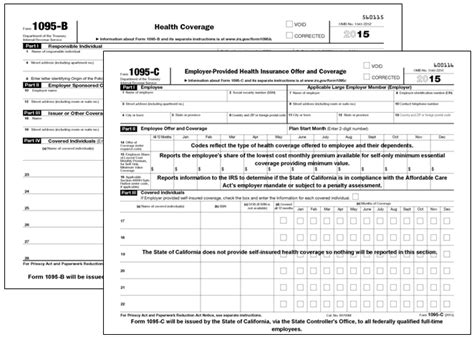

It is crucial to carefully review your medical insurance policy documents to understand the extent of dental coverage it provides. Look for sections such as "Dental Benefits" or "Dental Coverage" to identify the specific procedures and services that are covered. Pay close attention to any limitations, exclusions, or conditions that may apply, as these can significantly impact the coverage you receive.

Common Dental Procedures Covered by Medical Insurance

While the coverage may vary, there are several dental procedures that are commonly included in medical insurance plans. These typically involve dental treatments that are directly related to medical conditions or are considered medically necessary. Here are some examples of dental procedures that may be covered by medical insurance:

- Emergency Dental Care: Medical insurance often covers urgent dental treatments, such as tooth extractions, root canals, or dental trauma repair, especially when they are a result of an accident or sudden illness.

- Oral Surgery: Certain oral surgeries, such as jaw reconstruction or surgery to address TMJ (temporomandibular joint) disorders, may be covered if they are deemed medically necessary.

- Dental Anesthesia: Medical insurance may cover the cost of anesthesia for dental procedures, especially if the patient has a medical condition that requires it.

- Dental Treatments for Medical Conditions: Dental procedures that are directly related to managing a medical condition, such as periodontal disease treatment for patients with diabetes, may be covered.

- Orthodontic Treatment: In some cases, medical insurance plans may provide coverage for orthodontic treatments, particularly if they are required to correct a medical condition or address a functional issue.

Exclusions and Limitations to Consider

While medical insurance can provide coverage for certain dental procedures, it is important to be aware of the exclusions and limitations that may apply. These can vary widely depending on the insurance provider and the specific plan.

Common exclusions in medical insurance plans for dental work include routine dental care, such as regular check-ups, cleanings, fillings, and routine X-rays. These procedures are typically considered preventative and are not covered under medical insurance. Additionally, cosmetic dental procedures, such as teeth whitening, veneers, and dental implants for aesthetic purposes, are generally not covered by medical insurance.

It is essential to review your policy's exclusions and limitations section to understand what is not covered. This will help you manage your expectations and plan accordingly when seeking dental treatment.

Maximizing Medical Insurance Coverage for Dental Work

Maximizing your medical insurance coverage for dental work requires careful planning and an understanding of the processes involved. Here are some strategies to consider:

Review Your Medical Insurance Policy

Before pursuing any dental treatment, take the time to thoroughly review your medical insurance policy. Understand the types of dental procedures that are covered, the specific benefits, and any limitations or exclusions. This knowledge will help you make informed decisions and avoid unexpected costs.

Seek Preauthorization for Dental Procedures

For more complex or costly dental procedures, it is advisable to seek preauthorization from your medical insurance provider. Preauthorization involves submitting a request for approval before undergoing the treatment. This process helps ensure that the procedure is covered by your insurance and provides clarity on the level of coverage you can expect.

When requesting preauthorization, be sure to provide detailed information about the proposed treatment, including the diagnosis, recommended procedure, and any supporting medical documentation. Your dentist or dental specialist can assist you in gathering the necessary information and completing the preauthorization process.

Choose In-Network Dental Providers

When selecting a dentist or dental specialist, consider choosing an in-network provider. In-network providers have negotiated rates with your insurance company, which often results in lower out-of-pocket costs for you. Check your insurance provider's website or call their customer service to find a list of in-network dental providers in your area.

Understand Co-Payments and Deductibles

Medical insurance plans typically require you to pay a certain amount out of pocket for covered services. This may include co-payments (a fixed amount you pay for each service) and deductibles (the amount you must pay before insurance coverage kicks in). Understanding these costs and how they apply to dental procedures will help you budget effectively.

Consider Dental Savings Plans

If your medical insurance does not provide adequate dental coverage, you may want to explore dental savings plans. These plans are not insurance but offer discounted rates on dental services through a network of participating providers. Dental savings plans can be a cost-effective option for routine dental care and may also provide savings on more extensive procedures.

Case Studies: Real-World Examples of Medical Insurance Coverage for Dental Work

To further illustrate the application of medical insurance coverage for dental work, let's explore a few real-world case studies:

Case Study 1: Emergency Dental Surgery

Mr. Johnson, a 35-year-old man, experienced severe tooth pain and swelling, indicating an urgent dental issue. He visited an emergency dentist, who diagnosed him with an infected tooth requiring immediate surgery. Fortunately, Mr. Johnson's medical insurance policy covered emergency dental surgeries, and he was able to receive the necessary treatment without incurring significant out-of-pocket expenses.

Case Study 2: Orthodontic Treatment for Medical Reasons

Ms. Garcia, a 28-year-old woman, suffered from severe jaw pain and headaches due to a misaligned bite. Her dentist recommended orthodontic treatment to correct the alignment and alleviate her symptoms. Ms. Garcia's medical insurance plan covered orthodontic treatment as it was deemed medically necessary to address her specific condition. She was able to undergo the treatment with reduced financial burden.

Case Study 3: Dental Anesthesia Coverage

Mr. Lee, a 45-year-old man with a severe dental phobia, required extensive dental work. His dentist recommended general anesthesia to ensure his comfort and safety during the procedures. Mr. Lee's medical insurance plan covered the cost of dental anesthesia, allowing him to receive the necessary treatment without the added financial stress.

Future Implications and Advancements in Dental Coverage

As the healthcare industry continues to evolve, there are ongoing discussions and initiatives aimed at improving dental coverage and making it more accessible. Here are some future implications and advancements to consider:

Increased Awareness and Education

Educating individuals about the potential for medical insurance coverage for dental work can empower them to make informed decisions about their healthcare. Increased awareness can lead to better utilization of existing benefits and potentially drive changes in insurance policies to include more comprehensive dental coverage.

Advancements in Dental Technology

Advancements in dental technology, such as digital dentistry and precision dentistry, may influence the scope of medical insurance coverage for dental procedures. As these technologies become more widely adopted, they could lead to more efficient and cost-effective treatments, potentially influencing insurance companies to offer broader coverage.

Policy Changes and Industry Trends

Insurance providers and industry experts are continuously evaluating the benefits and costs associated with dental coverage. Policy changes and industry trends may result in expanded dental coverage options, particularly for medically necessary procedures. Keeping an eye on industry developments can provide insights into potential future changes.

Government Initiatives and Regulations

Government initiatives and regulations play a significant role in shaping the healthcare landscape, including dental coverage. Changes in legislation and regulatory frameworks can impact the availability and affordability of dental insurance. Monitoring these developments can help individuals and healthcare providers stay informed about potential shifts in coverage.

Can medical insurance cover routine dental check-ups and cleanings?

+Routine dental check-ups and cleanings are typically not covered by medical insurance. These procedures are considered preventative and are generally covered by dental insurance plans. However, it’s always advisable to review your specific policy to understand the extent of coverage.

What if my medical insurance doesn’t cover the specific dental procedure I need?

+If your medical insurance doesn’t cover the specific dental procedure you require, you may have other options. Consider exploring dental savings plans, which offer discounted rates on dental services. Additionally, some dental offices may offer financing options or payment plans to make treatment more affordable.

How can I find an in-network dentist for my medical insurance plan?

+To find an in-network dentist for your medical insurance plan, you can visit your insurance provider’s website or contact their customer service. They will provide you with a list of in-network dental providers in your area. You can then schedule an appointment with a dentist who accepts your insurance.

Are there any limitations on the number of dental procedures covered by medical insurance?

+Yes, medical insurance plans often have limitations on the number of dental procedures they cover. These limitations can vary depending on the specific plan and insurance provider. It’s important to review your policy documents to understand any caps or limitations on dental coverage.