Medical Insurance Tax Form

The Medical Insurance Tax Form is a crucial document for individuals and businesses alike, as it serves as a means to report and manage the tax obligations associated with health insurance plans. In the United States, this form plays a vital role in ensuring compliance with the Affordable Care Act (ACA) and other healthcare-related tax regulations. As we delve into the specifics of this tax form, we will explore its purpose, the key sections it encompasses, and the implications it has for taxpayers.

Understanding the Medical Insurance Tax Form

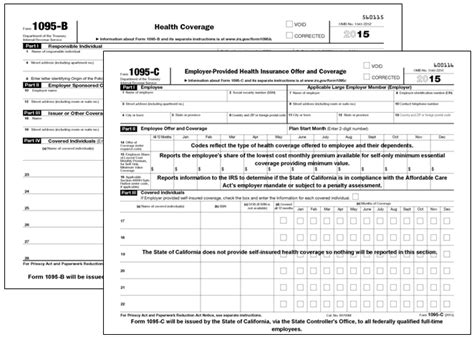

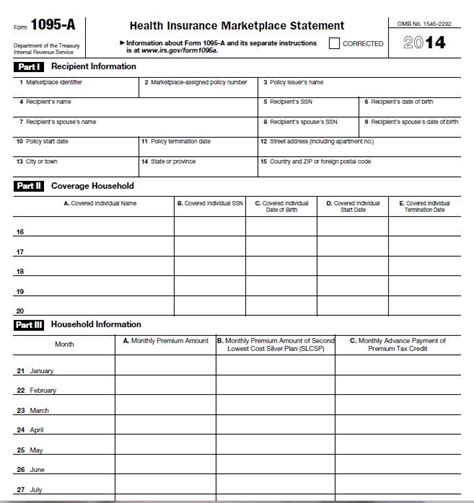

The Medical Insurance Tax Form, often referred to as the Form 1095, is a critical component of the U.S. healthcare system’s tax framework. It is issued by health insurance providers and covers various aspects related to health insurance coverage, including individual and employer-sponsored plans. This form is typically distributed to individuals and businesses by January 31st of each year, providing a detailed record of their healthcare coverage for the previous tax year.

The primary purpose of this tax form is to facilitate the accurate reporting of healthcare-related expenses and to ensure compliance with the Affordable Care Act's mandates. It serves as a tool for taxpayers to verify their eligibility for certain tax credits and subsidies, as well as to demonstrate compliance with the individual mandate, which requires most Americans to have qualifying health insurance coverage.

For employers, the Medical Insurance Tax Form is crucial for documenting their provision of health insurance benefits to employees. It helps employers demonstrate their compliance with the ACA's employer mandate, which requires certain employers to offer minimum essential coverage to their full-time employees or face potential penalties.

Key Sections of the Medical Insurance Tax Form

The Medical Insurance Tax Form consists of several important sections, each serving a specific purpose in reporting healthcare coverage and related expenses. Let’s explore some of the key sections and their significance:

Part I: Personal Information

This section collects basic personal information about the taxpayer, including their name, address, Social Security number, and contact details. It is essential for identifying the taxpayer and ensuring the accuracy of the form’s contents.

Part II: Coverage Information

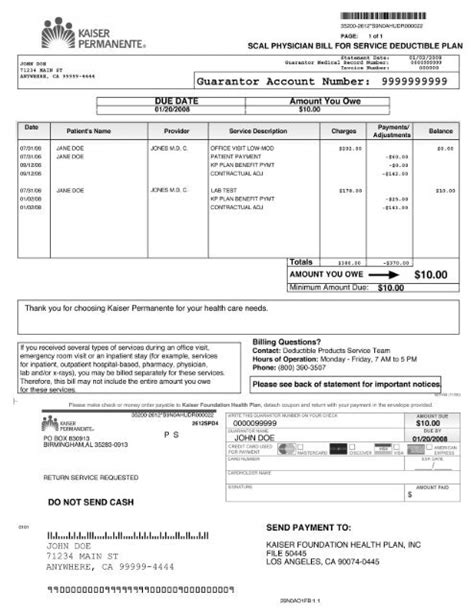

Part II is dedicated to providing comprehensive details about the taxpayer’s health insurance coverage. It includes information such as the type of coverage (individual or employer-sponsored), the name of the insurance provider, and the coverage period. This section is crucial for verifying the taxpayer’s compliance with the individual mandate and for determining eligibility for tax credits and subsidies.

Part III: Employer Information (For Employer-Sponsored Plans)

For individuals covered under employer-sponsored health insurance plans, Part III of the form collects information about the employer. This includes the employer’s name, address, and Employer Identification Number (EIN). It helps the IRS track employer compliance with the ACA’s employer mandate and ensures proper reporting of employer-provided health benefits.

Part IV: Tax Credits and Subsidies

Part IV is where taxpayers can claim tax credits and subsidies related to their healthcare coverage. It includes sections for reporting Advance Premium Tax Credits (APTC) and Cost-Sharing Reductions (CSR) received during the year. This part of the form is essential for individuals who received financial assistance to help cover the cost of their health insurance premiums.

Part V: Reconciliation of Advance Payments (For Employers)

Employers who offered health insurance coverage to their employees and received advance payments of the employer’s portion of the premium tax credit must complete Part V. This section helps employers reconcile the advance payments they received with the actual premium tax credit they are eligible for based on their employees’ coverage and eligibility.

Implications and Compliance

The Medical Insurance Tax Form has significant implications for taxpayers and their tax obligations. Failure to accurately complete and file this form can result in penalties and fines. For individuals, non-compliance with the individual mandate can lead to a penalty known as the “shared responsibility payment,” which is calculated based on household income and the number of months without qualifying health insurance coverage.

For employers, non-compliance with the employer mandate can result in substantial penalties. These penalties are imposed on applicable large employers (ALEs) who fail to offer affordable, minimum essential coverage to their full-time employees. The penalty amount is determined based on the number of full-time employees and the duration of non-compliance.

It is essential for taxpayers to understand their responsibilities and the potential consequences of non-compliance. Seeking professional tax advice and ensuring accurate reporting on the Medical Insurance Tax Form are crucial steps toward maintaining compliance with healthcare-related tax regulations.

| Section | Description |

|---|---|

| Part I | Collects personal information for taxpayer identification. |

| Part II | Provides details about health insurance coverage, including type and provider. |

| Part III | Captures employer information for employer-sponsored plans, including name and EIN. |

| Part IV | Allows taxpayers to claim tax credits and subsidies for healthcare coverage. |

| Part V | Employers reconcile advance payments of premium tax credits with actual eligibility. |

Frequently Asked Questions

Who needs to file the Medical Insurance Tax Form (Form 1095)?

+Individuals who had health insurance coverage during the tax year, whether through an employer-sponsored plan or an individual plan, are typically required to receive and file Form 1095. Additionally, employers who provide health insurance benefits to their employees must also file this form.

What happens if I don’t receive my Medical Insurance Tax Form on time?

+If you do not receive your Form 1095 by the deadline, it is advisable to contact your insurance provider or employer to request a copy. In some cases, you may also be able to access the form online through your insurance provider’s portal.

Can I file my taxes without receiving the Medical Insurance Tax Form first?

+While it is not ideal, you can still file your taxes without the Medical Insurance Tax Form. However, you should estimate your health insurance coverage and related expenses as accurately as possible. Once you receive the form, you may need to make adjustments to your tax return.

Are there any penalties for non-compliance with the Medical Insurance Tax Form requirements?

+Yes, failure to comply with the Medical Insurance Tax Form requirements can result in penalties. For individuals, non-compliance with the individual mandate can lead to a shared responsibility payment. Employers who fail to offer minimum essential coverage to their full-time employees may face substantial penalties.

How can I ensure accurate reporting on the Medical Insurance Tax Form?

+To ensure accurate reporting, it is essential to carefully review and verify the information provided on the form. Compare the details with your insurance records and tax documents. If any discrepancies are found, contact your insurance provider or tax professional for guidance.