How To Get Health Insurance In Texas

Texas, known for its vibrant culture and diverse landscapes, offers a unique healthcare landscape. Understanding how to navigate the health insurance options in this vast state is crucial for residents seeking accessible and affordable healthcare coverage. This guide aims to provide an in-depth analysis of the steps and considerations involved in securing health insurance in Texas.

Understanding the Texas Health Insurance Market

The health insurance market in Texas is a complex ecosystem, shaped by federal and state regulations, as well as the unique needs of its diverse population. With a strong emphasis on individual choice and a history of limited government intervention, Texas has a reputation for fostering a competitive insurance market. This competitive environment can present both opportunities and challenges for residents seeking coverage.

One key aspect of the Texas insurance market is the role of the Affordable Care Act (ACA), also known as Obamacare. The ACA has significantly influenced the availability and affordability of health insurance plans in the state. Despite some political resistance, the ACA's marketplace, HealthCare.gov, remains a vital platform for Texans to compare and enroll in qualified health plans.

The Texas Insurance Landscape

Texas has a large number of insurance providers, offering a wide range of plans. These plans can vary significantly in terms of coverage, cost, and network of healthcare providers. Understanding the differences between these plans is crucial for making an informed decision.

| Plan Type | Description |

|---|---|

| Individual Plans | Designed for single individuals or families, these plans offer a range of coverage options and are often purchased directly from insurance companies or through the ACA marketplace. |

| Group Plans | Offered through employers, these plans typically provide more comprehensive coverage at a lower cost, as the risk is spread across a larger group. However, eligibility is tied to employment. |

| Medicaid | A federal and state program providing health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Eligibility criteria vary by state. |

| Medicare | A federal program providing health coverage primarily to Americans aged 65 or older, as well as younger people with disabilities. Medicare Advantage plans, offered by private companies approved by Medicare, provide an alternative to original Medicare. |

Steps to Getting Health Insurance in Texas

Securing health insurance in Texas involves several key steps, each requiring careful consideration and research. Here’s a comprehensive guide to help you navigate the process effectively.

1. Determine Your Eligibility and Coverage Needs

The first step in securing health insurance is understanding your eligibility and specific coverage needs. Eligibility criteria can vary based on factors such as age, income, family size, and employment status. For instance, if you’re a young adult, you may be eligible to remain on your parents’ health insurance plan until you turn 26, regardless of your employment status.

Your coverage needs will depend on various factors, including your current health status, anticipated healthcare requirements, and personal financial situation. Consider whether you need coverage for prescription medications, mental health services, or specific medical procedures. Understanding your needs will help you choose a plan that provides adequate coverage without unnecessary costs.

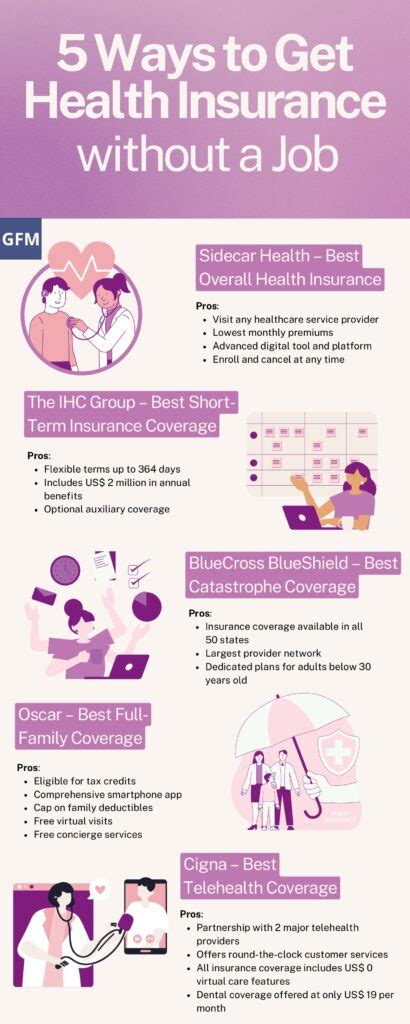

2. Explore Insurance Options

Texas residents have several avenues to explore when seeking health insurance. The most common options include:

- Employer-Sponsored Plans: Many Texans receive health insurance through their employers. These plans often provide comprehensive coverage and may be more affordable due to the shared cost between the employer and employee. However, eligibility is typically tied to employment status.

- Individual Plans: For those who don't have access to employer-sponsored insurance, individual plans are an option. These plans can be purchased directly from insurance companies or through the ACA marketplace. The marketplace offers a range of plans with different levels of coverage and cost, and may provide subsidies to make coverage more affordable.

- Medicaid and CHIP: Texas residents who meet certain income and other eligibility criteria may qualify for Medicaid or CHIP. These programs provide comprehensive health coverage at little to no cost. Eligibility for Medicaid in Texas is primarily based on income, with some exceptions for certain populations like pregnant women and individuals with disabilities.

- Medicare: Texans aged 65 or older, or those with certain disabilities, are eligible for Medicare. Original Medicare (Part A and Part B) provides hospital and medical insurance coverage, while Medicare Advantage plans (Part C) offer an alternative, often with additional benefits like dental and vision coverage.

3. Compare Plans and Costs

Once you’ve identified your eligible options, it’s crucial to compare plans based on coverage, network of providers, and cost. Consider factors such as deductibles, copayments, and out-of-pocket maximums. These can significantly impact the overall cost of your healthcare, especially if you require frequent medical services.

Use online tools and resources to compare plans side-by-side. The ACA marketplace provides a platform to compare plans based on your specific needs and preferences. Don't forget to factor in any potential subsidies or tax credits you may be eligible for, which can reduce the cost of your premiums.

4. Enroll in a Plan

Once you’ve chosen a plan, the next step is to enroll. Enrollment periods vary depending on the type of plan you’re seeking. For instance, the ACA marketplace has an annual Open Enrollment Period, typically from November to December, during which anyone can enroll in a plan. Outside of this period, you may only be able to enroll if you qualify for a Special Enrollment Period due to a life event like losing other health coverage, getting married, or having a baby.

For employer-sponsored plans, enrollment periods may be limited to specific times of the year, often coinciding with the employer's fiscal year. Medicaid and CHIP typically have ongoing enrollment, allowing individuals to apply at any time.

5. Understand Your Coverage and Rights

After enrolling, take the time to thoroughly understand your coverage. This includes knowing which healthcare providers are in-network, what services are covered, and how to file claims. It’s also essential to be aware of your rights as a healthcare consumer in Texas.

Texas law protects consumers from certain insurance practices, such as denying coverage for pre-existing conditions. However, it's important to note that Texas has not adopted all the consumer protections offered by the ACA. For instance, Texas does not mandate coverage for certain essential health benefits like maternity care and mental health services, which may be excluded from some plans.

FAQs

Can I get health insurance in Texas if I’m not a citizen or legal resident?

+

Non-citizens and undocumented immigrants may face challenges in obtaining health insurance in Texas. While they may be eligible for emergency Medicaid services, they are generally not eligible for most other health insurance plans, including those offered through the ACA marketplace. However, certain plans may be available depending on individual circumstances.

What if I miss the Open Enrollment Period for the ACA marketplace?

+

If you miss the Open Enrollment Period, you may still be able to enroll in a plan if you qualify for a Special Enrollment Period due to a qualifying life event. These events can include losing other health coverage, getting married, or having a baby. It’s important to check the specific criteria and documentation required for these Special Enrollment Periods.

Are there any low-cost health insurance options in Texas for young adults?

+

Yes, young adults in Texas have several options for low-cost health insurance. These include remaining on a parent’s health insurance plan until age 26, exploring short-term health insurance plans (which offer more limited coverage but can be more affordable), or looking into catastrophic health plans, which have lower premiums but higher deductibles.