How To Choose The Right Life Insurance Policy

Securing a life insurance policy is a crucial financial decision, offering peace of mind and financial protection to your loved ones. However, with numerous types of policies and varying terms, choosing the right one can be daunting. This comprehensive guide will navigate you through the process, helping you make an informed decision tailored to your specific needs.

Understanding the Fundamentals of Life Insurance

Life insurance is a contract between you and an insurance company. In exchange for your premium payments, the insurer promises to pay a sum of money to your beneficiaries upon your death. This sum, often referred to as the death benefit, can provide financial stability to your loved ones, covering expenses like funeral costs, outstanding debts, and everyday living expenses.

There are two primary types of life insurance policies: term life insurance and permanent life insurance. Understanding the differences between these is key to selecting the right policy for you.

Term Life Insurance

Term life insurance is designed to provide coverage for a specified period, typically 10, 20, or 30 years. It offers a fixed death benefit, and if you pass away during the term, your beneficiaries receive the full amount. However, if you outlive the term, the coverage expires, and no benefit is paid out.

Term policies are often more affordable than permanent life insurance, making them a popular choice for those seeking coverage for a specific period, such as until their children become independent or until their mortgage is paid off.

| Key Features | Term Life Insurance |

|---|---|

| Coverage Period | Specified term (e.g., 10, 20, or 30 years) |

| Death Benefit | Fixed amount |

| Premium | Generally lower compared to permanent life insurance |

| Flexibility | Can be renewed or converted to permanent life insurance |

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for your entire life, as long as you continue to pay the premiums. It typically includes a cash value component, which accumulates over time and can be accessed through loans or withdrawals during your lifetime. The death benefit remains in place as long as the policy is active.

There are several types of permanent life insurance, including whole life, universal life, and variable life insurance. Each has its own features and benefits, catering to different financial goals and needs.

| Type of Permanent Life Insurance | Key Features |

|---|---|

| Whole Life Insurance | Provides coverage for life with a fixed premium and a guaranteed death benefit. The cash value accumulates at a fixed rate. |

| Universal Life Insurance | Offers flexible premium payments and death benefit amounts. The cash value can be invested to potentially grow faster. |

| Variable Life Insurance | Allows you to invest the cash value in a variety of investment options. The death benefit and cash value can fluctuate based on the performance of the investments. |

Factors to Consider When Choosing a Life Insurance Policy

When deciding on a life insurance policy, several factors come into play. These include your financial situation, your family’s needs, and your long-term goals. Here are some key considerations:

Your Financial Situation

Your financial circumstances play a significant role in determining the type and amount of life insurance you need. Consider your current and future expenses, debts, and assets. Do you have outstanding loans or a mortgage? Do you have dependents who rely on your income? These factors will influence the type of policy and the coverage amount you should opt for.

Your Family’s Needs

Understanding your family’s financial needs is crucial. Consider the impact of your death on their daily lives. Would they be able to maintain their current standard of living without your income? Are there specific financial goals, such as college funds for your children, that need to be addressed? Assessing these needs will help you determine the appropriate death benefit amount.

Your Long-Term Goals

Life insurance can also be a tool for achieving long-term financial goals. If you have specific financial aspirations, such as funding a child’s education or ensuring a comfortable retirement for your spouse, a permanent life insurance policy with its cash value component could be beneficial. It provides a way to save and invest, while also offering a death benefit.

Assessing Your Coverage Needs

To choose the right life insurance policy, you must first assess your coverage needs. This involves calculating the amount of money your loved ones would need to maintain their current lifestyle and achieve their financial goals in the event of your passing.

A common rule of thumb is to aim for a death benefit that is 10 to 15 times your annual income. However, this may not be sufficient for everyone. Factors like outstanding debts, funeral expenses, and future financial goals should also be considered. It's recommended to work with a financial advisor or use online life insurance calculators to get a more precise estimate.

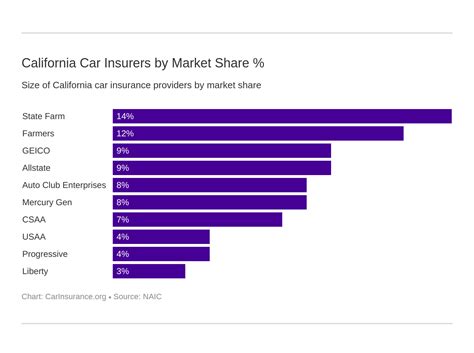

Comparing Quotes and Choosing a Provider

Once you have an idea of the type and amount of coverage you need, it’s time to compare quotes from different insurance providers. This step is crucial as prices can vary significantly between companies, and you want to ensure you’re getting the best value for your money.

When comparing quotes, pay attention to the following:

- Premium Cost: This is the amount you'll pay regularly to keep your policy active. Compare the premiums for similar coverage amounts and terms.

- Death Benefit: Ensure the death benefit amount aligns with your calculated needs.

- Policy Features: Different policies may offer additional benefits or riders, such as accelerated death benefits for terminal illnesses.

- Financial Strength: Check the financial ratings of the insurance companies to ensure they're stable and likely to be able to pay out claims.

- Customer Service and Claims Process: Research the provider's reputation for customer service and ease of claims settlement.

It's also beneficial to work with an independent insurance agent who can provide quotes from multiple companies, ensuring you get the best deal.

Finalizing Your Decision and Maintaining Your Policy

After careful consideration and comparison, you’ll be ready to choose the life insurance policy that best suits your needs. Remember, life insurance is a long-term commitment, so it’s important to regularly review and update your policy as your circumstances change.

Here are some key points to keep in mind:

- Review your policy annually to ensure it still meets your needs. Life changes such as marriage, birth of a child, or career advancement may require adjustments to your coverage.

- Keep your beneficiaries updated. Make sure the beneficiaries listed on your policy are still the people you want to receive the death benefit.

- If your financial situation improves, consider increasing your coverage to better protect your loved ones.

- Stay informed about any changes to your policy, such as rate increases or new features offered by your insurance provider.

Frequently Asked Questions

What is the difference between term and whole life insurance?

+

Term life insurance provides coverage for a specified period, often 10, 20, or 30 years. It offers a fixed death benefit and is generally more affordable. Whole life insurance, on the other hand, provides coverage for your entire life, as long as you continue to pay the premiums. It includes a cash value component that accumulates over time and can be accessed during your lifetime.

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on your financial situation, family’s needs, and long-term goals. A common rule of thumb is to aim for a death benefit that is 10 to 15 times your annual income. However, this may not be sufficient for everyone. Consider outstanding debts, funeral expenses, and future financial goals when determining your coverage needs.

Can I convert my term life insurance policy to a permanent life insurance policy?

+

Yes, many term life insurance policies allow you to convert them to permanent life insurance policies within a certain time frame, often during the first few years of the policy. This conversion privilege ensures that you can secure permanent coverage, even if your health status changes, without the need for a medical exam.

What is a rider in life insurance, and why might I need one?

+

A rider is an optional add-on to your life insurance policy that provides additional benefits or coverage. For example, an accelerated death benefit rider can provide access to a portion of your death benefit if you’re diagnosed with a terminal illness. Riders can be beneficial for addressing specific needs or concerns, so it’s worth discussing them with your insurance agent.

How often should I review my life insurance policy?

+

It’s recommended to review your life insurance policy annually or whenever your circumstances change significantly. Life changes such as marriage, birth of a child, or a major career shift can impact your coverage needs. Regular reviews ensure that your policy remains aligned with your current situation and goals.