California Compare Car Insurance

California, known for its diverse landscapes and vibrant cities, is a state with a unique car insurance landscape. With a population of over 39 million and a vast road network, the Golden State presents a complex environment for drivers and insurers alike. Understanding the intricacies of car insurance in California is crucial for residents seeking the best coverage and value.

Understanding Car Insurance in California

Car insurance in California operates under a tort system, which means that fault is determined after an accident. This system holds at-fault drivers responsible for the damages they cause. The state requires all registered vehicles to carry a minimum amount of liability insurance to cover potential accidents. However, the cost and availability of car insurance can vary significantly across different regions of California.

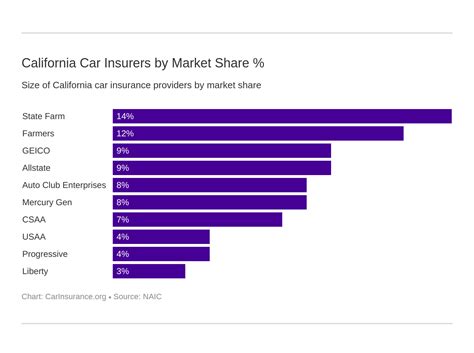

The insurance market in California is highly competitive, with a mix of national and regional insurers offering a wide range of policies. This competition can benefit consumers, as it often leads to a variety of coverage options and potentially lower rates. However, it also means that shopping around and comparing quotes is essential to find the best deal.

Key Factors Influencing Car Insurance Rates in California

Several factors play a crucial role in determining car insurance rates in the state:

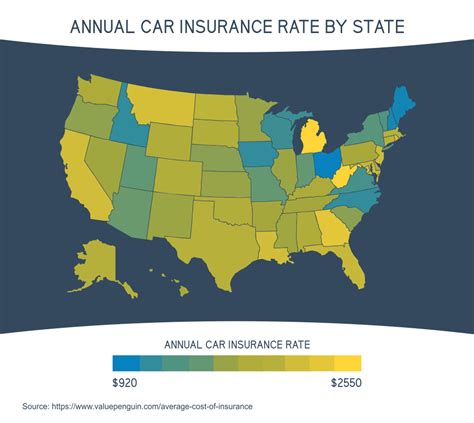

- Location: Insurance rates can vary greatly between cities and even neighborhoods. Urban areas with higher populations and traffic density often have higher premiums due to increased accident risks.

- Demographics: Age, gender, and driving history are key factors. Younger drivers and those with a history of accidents or violations may face higher premiums.

- Vehicle Type: The make, model, and year of your vehicle impact insurance costs. Sports cars and luxury vehicles, for instance, may require more expensive coverage.

- Usage: How you use your vehicle matters. Commuters and those who drive frequently may pay more due to increased exposure to risks.

- Insurance Company: Different insurers have varying rate structures and discounts. Shopping around and comparing quotes is vital to finding the best deal.

Comparing Car Insurance in California’s Top Cities

To illustrate the variations in car insurance rates, let’s compare some of California’s major cities:

Los Angeles

Los Angeles, the largest city in California, presents a complex insurance landscape due to its dense population and heavy traffic. The average annual premium for minimum liability coverage in LA is approximately 600</strong>, while full coverage can cost upwards of <strong>1,800. However, rates can vary significantly based on the neighborhood. For instance, in areas like Beverly Hills and West Hollywood, where luxury vehicles are common, premiums may be even higher.

| Coverage Type | Average Annual Premium |

|---|---|

| Minimum Liability | $600 |

| Full Coverage | $1,800 |

San Francisco

San Francisco, known for its steep hills and dense urban environment, also has unique insurance considerations. The average annual premium for minimum liability coverage in SF is around 750</strong>, while full coverage can exceed <strong>2,500. Factors like the city’s high cost of living and stringent parking regulations can impact insurance rates.

| Coverage Type | Average Annual Premium |

|---|---|

| Minimum Liability | $750 |

| Full Coverage | $2,500 |

San Diego

San Diego, with its mild climate and beachfront communities, offers a more affordable insurance landscape. The average annual premium for minimum liability coverage is approximately 550</strong>, while full coverage can be found for under <strong>1,500. The city’s lower population density and milder weather contribute to more competitive rates.

| Coverage Type | Average Annual Premium |

|---|---|

| Minimum Liability | $550 |

| Full Coverage | $1,500 |

Sacramento

Sacramento, the state capital, has a more balanced insurance market. The average annual premium for minimum liability coverage is around 650</strong>, with full coverage typically ranging from <strong>1,600 to $2,000. Sacramento’s insurance rates reflect its status as a mid-sized city with a diverse population and moderate traffic.

| Coverage Type | Average Annual Premium |

|---|---|

| Minimum Liability | $650 |

| Full Coverage | $1,600 - $2,000 |

Fresno

Fresno, located in California’s Central Valley, offers some of the most affordable car insurance rates in the state. The average annual premium for minimum liability coverage is under 500</strong>, and full coverage can be obtained for around <strong>1,200. The city’s lower population density and fewer traffic-related risks contribute to these competitive rates.

| Coverage Type | Average Annual Premium |

|---|---|

| Minimum Liability | $500 |

| Full Coverage | $1,200 |

Tips for Finding the Best Car Insurance in California

Navigating the complex world of car insurance in California requires a strategic approach. Here are some tips to help you find the best coverage at the right price:

- Compare Quotes: Obtain multiple quotes from different insurers. Online comparison tools can be a great starting point, but also consider getting quotes from local agents.

- Understand Your Coverage Needs: Assess your specific needs and risks. Consider factors like your vehicle's value, your driving habits, and any unique circumstances (e.g., teen drivers or high-risk areas).

- Explore Discounts: Many insurers offer discounts for safe driving records, low mileage, multiple vehicles, and safety features. Ask about available discounts and see if you qualify.

- Consider Bundle Deals: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings.

- Review Your Policy Regularly: Insurance needs and rates can change over time. Review your policy annually and compare it with other options to ensure you're still getting the best deal.

Conclusion

Car insurance in California is a complex but essential aspect of driving in the state. By understanding the key factors that influence rates and comparing quotes from multiple insurers, you can find the coverage that best suits your needs and budget. Remember, the right car insurance policy provides peace of mind and financial protection in case of accidents or other unexpected events.

What is the average cost of car insurance in California for a single driver with a clean record?

+On average, a single driver with a clean record can expect to pay around 1,200 to 1,500 annually for full coverage car insurance in California. However, rates can vary significantly based on location and other factors.

Are there any discounts available for car insurance in California?

+Yes, there are several discounts available. Common discounts include safe driver discounts, multi-policy discounts (bundling car insurance with other policies), good student discounts, and low mileage discounts. It’s worth checking with insurers to see which discounts you may qualify for.

How does my driving record impact my car insurance rates in California?

+Your driving record is a significant factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums. However, even a single violation or accident can result in higher rates for several years. It’s important to maintain a safe driving record to keep insurance costs down.