How To Apply For Cobra Insurance

Cobra insurance, officially known as the Consolidated Omnibus Budget Reconciliation Act, is a federal law that provides eligible individuals with the right to continue their group health insurance coverage under certain circumstances. This article will guide you through the process of applying for Cobra insurance, explaining the steps, requirements, and considerations to help you navigate this crucial benefit.

Understanding Cobra Eligibility and Benefits

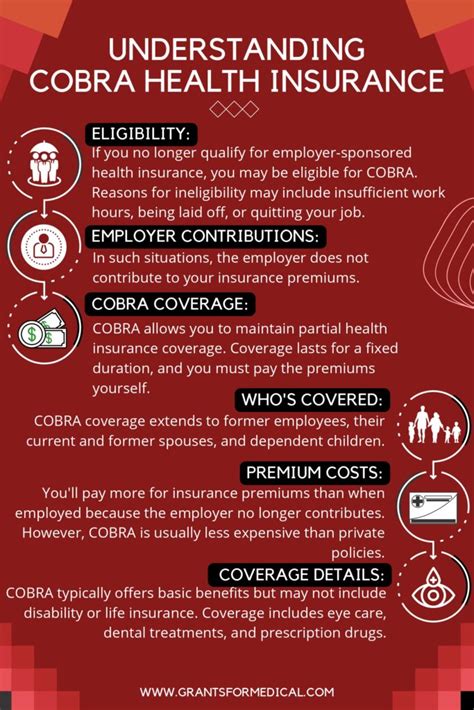

Before applying for Cobra insurance, it’s essential to understand your eligibility and the benefits it offers. Cobra primarily applies to group health plans sponsored by employers with 20 or more employees. Here’s an overview:

- Eligibility: Typically, you're eligible for Cobra if you experience a qualifying event that leads to a loss of coverage under the group plan. Qualifying events include voluntary or involuntary job loss, reduction in work hours, divorce or legal separation, death of the covered employee, or a covered employee's entitlement to Medicare.

- Benefits: Cobra allows you to continue your existing health insurance coverage for a specified period, usually up to 18 months. In some cases, this period can be extended to 29 months for certain qualifying events. It's important to note that Cobra coverage is not as comprehensive as traditional employer-sponsored plans and may have additional costs.

The Application Process

Applying for Cobra insurance involves several key steps. Here’s a detailed guide to help you through the process:

Step 1: Notify Your Employer or Plan Administrator

Upon experiencing a qualifying event, you must promptly notify your employer or the plan administrator. This notification triggers the start of your Cobra coverage period. It’s crucial to do this within the required timeframe, which is typically 60 days from the date of the qualifying event.

Step 2: Receive Cobra Election Notice

Once your employer or plan administrator receives your notification, they are required to send you a Cobra election notice within 44 days. This notice will outline your rights and responsibilities, including the cost of coverage and the deadline for electing Cobra.

| Notice Contents | Description |

|---|---|

| Qualifying Event Date | The date the qualifying event occurred. |

| Coverage Continuation Period | The duration for which you can continue your coverage. |

| Cost of Coverage | The amount you'll need to pay for Cobra insurance. |

| Election Deadline | The date by which you must decide and inform the plan administrator. |

Step 3: Evaluate Your Options

Upon receiving the Cobra election notice, carefully review the information provided. Consider the following:

- Cost: Cobra insurance is generally more expensive than traditional employer-sponsored plans. You'll be responsible for paying the full premium, including the portion previously paid by your employer. Compare the cost with other available options, such as individual plans or government-sponsored programs.

- Coverage Details: Evaluate the benefits and coverage limits of your current plan. Ensure that Cobra coverage aligns with your healthcare needs and any pre-existing conditions you may have.

- Alternatives: Explore other insurance options. Depending on your situation, you might be eligible for Medicaid, Medicare, or the Health Insurance Marketplace. These alternatives may offer more affordable and comprehensive coverage.

Step 4: Make an Informed Decision

Based on your evaluation, decide whether Cobra insurance is the right choice for you. If you choose to proceed, complete and return the Cobra election form to your plan administrator within the specified deadline.

Step 5: Pay the Premium

Once you’ve elected Cobra coverage, you’ll need to pay the premium. This payment is typically due within 45 days of your election. Ensure you understand the payment schedule and methods accepted by your plan administrator.

Frequently Asked Questions

Can I apply for Cobra insurance if I’m not the employee but a dependent family member?

+

Yes, dependent family members are eligible for Cobra insurance if the employee experiences a qualifying event. They must meet the same eligibility criteria and follow the same application process as the employee.

What happens if I miss the deadline to elect Cobra coverage?

+

Missing the election deadline may result in losing your right to Cobra coverage. However, in certain exceptional circumstances, you may be able to request a special enrollment period. Contact your plan administrator to discuss your options.

Can I switch to a different health insurance plan while on Cobra coverage?

+

Yes, you have the flexibility to explore and switch to other health insurance plans during your Cobra coverage period. However, ensure you understand the potential consequences, such as losing your Cobra coverage or facing new waiting periods.

Are there any income restrictions for Cobra insurance eligibility?

+

No, there are no income restrictions for Cobra eligibility. Anyone who experiences a qualifying event and meets the other eligibility criteria can apply for Cobra insurance, regardless of their income level.