How Much Will Insurance Go Up After An Accident

Insurance Premium Increases: Navigating the Aftermath of an Accident

An accident, whether a fender-bender or a more severe collision, can be a stressful and challenging experience. Aside from the immediate concerns of safety and vehicle damage, one question often looms: How much will my insurance premiums increase as a result of this incident? Understanding the factors that influence premium adjustments is crucial for managing the financial impact post-accident.

In this comprehensive guide, we will delve into the intricate world of insurance premium adjustments, exploring the key determinants, potential scenarios, and strategies to navigate this complex landscape. By unraveling the intricacies of post-accident insurance, we aim to empower individuals with the knowledge needed to make informed decisions and mitigate the financial repercussions of an accident.

The Impact of Accidents on Insurance Premiums

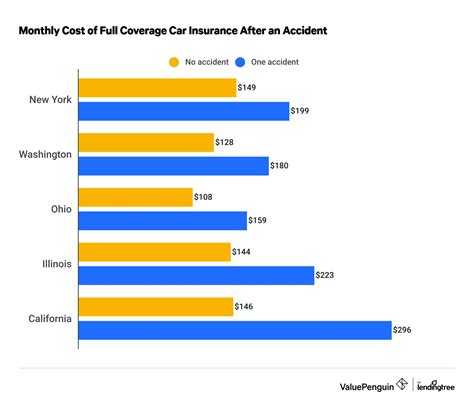

When an accident occurs, it triggers a series of events that can directly influence insurance premiums. Insurance companies operate on a risk-based model, where they assess the likelihood of future claims based on past incidents. Accidents, particularly those deemed at-fault, are considered high-risk factors, leading to potential premium increases.

Understanding the Risk Assessment Process

Insurance providers employ sophisticated algorithms and data analysis to evaluate risk. These systems consider various factors, including the nature and severity of the accident, the number of claims filed, and the insured's driving history. By assessing these elements, insurance companies assign a risk profile to each policyholder, which directly influences premium rates.

For instance, a minor accident with no injuries and minimal property damage may result in a lower risk assessment compared to a severe collision with multiple claims and injuries involved. The insurance company's response to such incidents will vary, leading to different premium adjustments.

| Accident Scenario | Potential Impact on Premiums |

|---|---|

| Minor Accident (No Injuries, Minimal Damage) | Slight increase or no change |

| Moderate Accident (Injuries, Moderate Damage) | Moderate to significant increase |

| Severe Accident (Multiple Claims, Serious Injuries) | Significant increase or policy cancellation |

Factors Influencing Premium Increases

The magnitude of premium increases post-accident depends on several key factors:

- At-Fault Determination: Accidents deemed at-fault result in higher premium increases compared to no-fault or partially at-fault incidents.

- Number of Claims: Multiple claims filed for the same accident can significantly impact premium adjustments.

- Severity of Injuries: Accidents involving serious injuries tend to lead to more substantial premium increases.

- Property Damage: Extensive property damage, especially to other vehicles or structures, can influence insurance companies' risk assessments.

- Previous Claims History: A clean claims history may help mitigate premium increases, while a history of multiple claims can worsen the impact.

Navigating Premium Adjustments

Managing the financial implications of an accident requires a strategic approach. Here are some steps to consider:

Review Your Policy

Familiarize yourself with the terms and conditions of your insurance policy. Understand the specific coverage, deductibles, and any applicable provisions related to accident claims. This knowledge will help you navigate the claims process and assess potential premium changes.

Communicate with Your Insurer

Open and transparent communication with your insurance provider is crucial. Notify them promptly about the accident and provide accurate details. Be prepared to discuss the incident, answer any questions, and cooperate fully during the claims investigation.

Explore Mitigation Strategies

While you may not be able to prevent premium increases entirely, certain strategies can help mitigate their impact:

- Consider a Higher Deductible: Increasing your deductible can lower your premium, but it means you'll pay more out of pocket for future claims.

- Review Coverage Options: Assess your coverage needs and consider adjusting your policy to a more basic plan to reduce costs.

- Maintain a Clean Driving Record: A history of safe driving can work in your favor. Avoid future accidents and violations to improve your risk profile.

- Shop Around: Compare quotes from different insurance providers to find the best rates. Switching insurers can sometimes lead to lower premiums.

Understand Your Rights

Insurance policies and regulations vary by jurisdiction. Familiarize yourself with your rights and obligations as an insured individual. Understand the appeal processes and dispute resolution mechanisms available to you in case of disagreements with your insurance provider.

The Long-Term Impact of Accidents

Accidents can have lasting effects on insurance premiums. Even after the initial increase, your rates may remain elevated for several years. Insurance companies often consider accident history when setting premiums, and multiple accidents within a short timeframe can significantly impact your insurance costs.

Managing Long-Term Financial Implications

To manage the long-term financial impact, consider the following strategies:

- Maintain a Safe Driving Record: Focus on defensive driving and avoid accidents to improve your risk profile over time.

- Review Your Policy Regularly: Periodically assess your insurance needs and explore options for reducing costs without compromising essential coverage.

- Consider Bundle Discounts: Insuring multiple vehicles or combining auto and home insurance policies can sometimes lead to lower overall premiums.

- Explore Discount Programs: Many insurance providers offer discounts for safe driving, accident-free periods, or other qualifications. Stay informed about these programs and take advantage of any applicable discounts.

Conclusion

Navigating the financial aftermath of an accident requires a combination of knowledge, strategy, and proactive management. By understanding the factors that influence premium adjustments and implementing effective mitigation strategies, individuals can minimize the long-term impact of accidents on their insurance costs. Remember, while accidents may lead to premium increases, maintaining a safe driving record and making informed insurance choices can help mitigate these financial challenges.

Frequently Asked Questions

Will my insurance premiums increase after every accident, regardless of fault?

+

No, insurance premiums may increase only if the accident is deemed at-fault or if it results in multiple claims. No-fault accidents or minor incidents with no claims may not necessarily lead to premium increases.

Can I negotiate my insurance premiums after an accident to avoid increases?

+

Negotiating premiums is challenging, but you can try discussing your situation with your insurer. Highlight your clean driving record, safe driving practices, and any extenuating circumstances surrounding the accident. However, insurers have set guidelines, and significant premium adjustments are often non-negotiable.

Are there any ways to avoid premium increases entirely after an accident?

+

While it’s challenging to avoid premium increases entirely, you can minimize their impact by promptly notifying your insurer, providing accurate details, and maintaining a clean driving record going forward. Additionally, exploring alternative insurance providers or adjusting your coverage can sometimes lead to lower premiums.

How long do accident-related premium increases typically last?

+

The duration of premium increases varies. In some cases, the increase may last for several years, especially if the accident was severe or involved multiple claims. However, with a clean driving record and no subsequent accidents, your premiums may gradually return to pre-accident levels over time.