Average Car Insurance Payment

When it comes to car insurance, one of the most common questions on every driver's mind is, "How much will I be paying on average?" The cost of car insurance can vary significantly depending on numerous factors, including location, driving history, vehicle type, and coverage options. Understanding the average car insurance payment is crucial for budgeting and financial planning. In this comprehensive guide, we delve into the factors that influence these payments, explore regional variations, discuss the impact of driving records, and provide insights into how you can potentially reduce your insurance costs. Get ready to navigate the world of car insurance with expertise and confidence.

Unveiling the Average Car Insurance Payment: A Comprehensive Overview

The average car insurance payment is a pivotal metric for anyone seeking to understand the financial obligations associated with vehicle ownership. This metric serves as a cornerstone for financial planning, providing a baseline for budgeting and expense management. While it is essential to recognize that car insurance costs can vary significantly based on an array of factors, including location, driving history, vehicle type, and coverage options, gaining insight into the average payment offers a valuable starting point for exploration.

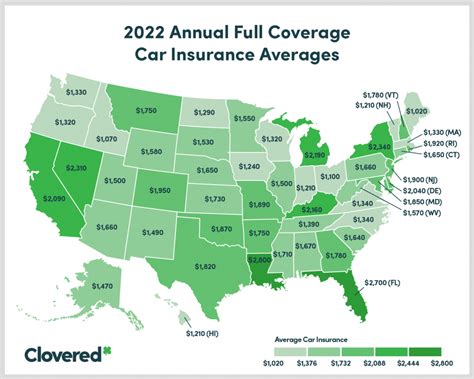

Delving into the specifics, the average car insurance payment in the United States stands at approximately $1,674 annually, according to recent data from the Insurance Information Institute. This figure serves as a benchmark, offering a general understanding of the financial commitment required for vehicle insurance. However, it is crucial to note that this average can fluctuate considerably based on individual circumstances and regional variations.

For instance, when examining state-by-state averages, it becomes evident that car insurance costs can differ dramatically. Take the case of Michigan, where the average annual premium surpasses $3,000, in stark contrast to the significantly lower average of $1,042 in Ohio. These disparities underscore the influence of regional factors on insurance costs, emphasizing the importance of personalized assessments for an accurate understanding of financial obligations.

Factors Influencing Car Insurance Costs

Several key factors play a pivotal role in determining the average car insurance payment. Understanding these elements is essential for making informed decisions about coverage and potential cost savings.

- Location: One of the most significant influences on car insurance costs is the geographical location of the driver. Regional variations in insurance rates can be attributed to factors such as traffic density, crime rates, and the prevalence of accidents. For instance, urban areas often experience higher insurance premiums due to increased congestion and the potential for accidents.

- Driving History: An individual's driving record is a critical factor in determining insurance rates. A clean driving history, free from accidents and traffic violations, can lead to lower insurance costs. Conversely, a history of accidents or traffic citations may result in higher premiums as insurance providers assess the risk associated with insuring a particular driver.

- Vehicle Type: The type of vehicle being insured can also impact insurance costs. High-performance sports cars, for example, often carry higher insurance premiums due to their association with higher accident risks and more expensive repair costs. In contrast, sedans and compact cars may be more affordable to insure.

- Coverage Options: The level of coverage chosen by the policyholder also affects insurance costs. Comprehensive and collision coverage, which provide protection against damage to the insured vehicle, can increase premiums. Conversely, opting for liability-only coverage, which covers damage to other vehicles and property, may result in lower premiums.

Regional Variations in Car Insurance Costs

Car insurance costs can vary significantly across different regions within the United States. This variation is primarily driven by factors such as the cost of living, the prevalence of accidents and traffic violations, and the level of competition among insurance providers.

| State | Average Annual Premium |

|---|---|

| Michigan | $3,225 |

| Louisiana | $2,549 |

| Rhode Island | $2,338 |

| Florida | $2,295 |

| New Jersey | $2,197 |

| Connecticut | $2,152 |

| California | $2,095 |

| Massachusetts | $1,944 |

| Nevada | $1,930 |

| New York | $1,875 |

As the table illustrates, states like Michigan, Louisiana, and Rhode Island have significantly higher average annual premiums compared to states like Ohio, Idaho, and Maine. These variations highlight the importance of conducting a thorough analysis of regional insurance rates when planning vehicle ownership expenses.

The Impact of Driving Records on Insurance Costs

An individual's driving record is a critical factor in determining insurance rates. A clean driving history, devoid of accidents and traffic violations, is generally rewarded with lower insurance premiums. Insurance providers assess the risk associated with insuring a particular driver based on their past driving behavior. A history of safe driving demonstrates a lower likelihood of future accidents and claims, leading to more favorable insurance rates.

Conversely, a driving record marred by accidents and traffic violations can result in significantly higher insurance costs. Insurance providers view these events as indicators of increased risk and may adjust premiums accordingly. For instance, a driver with a history of multiple accidents or traffic citations may face insurance rates that are twice as high as those with a clean record. This penalty for poor driving behavior serves as an incentive for drivers to maintain safe driving habits.

Moreover, the impact of a single accident or violation on insurance rates can be substantial. Even a minor fender bender can lead to an average increase of 24% in insurance costs, while a more severe accident can result in an increase of 51% or more. These statistics underscore the importance of maintaining a safe driving record to minimize insurance expenses.

| Violation or Accident | Average Increase in Insurance Costs |

|---|---|

| Minor accident (no injuries) | 24% |

| Speeding ticket | 18% |

| DUI conviction | 41% |

| Severe accident (with injuries) | 51% or more |

It is worth noting that the impact of a driving violation or accident on insurance rates can vary depending on factors such as the severity of the incident, the insurance provider's policies, and the driver's overall driving record. Some insurance companies may offer programs or discounts that help mitigate the increase in premiums after an accident or violation.

Strategies to Reduce Car Insurance Costs

While the average car insurance payment provides a valuable reference point, it is possible to take proactive steps to potentially reduce your insurance costs. Here are some strategies to consider:

- Shop Around for Quotes: Obtain quotes from multiple insurance providers to compare rates. This competitive analysis can help you identify the most affordable option for your specific circumstances.

- Bundle Policies: If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who consolidate their coverage.

- Increase Deductibles: Opting for higher deductibles can lower your insurance premiums. However, it's essential to choose a deductible amount that aligns with your financial capabilities to ensure you can cover the cost in the event of a claim.

- Review Coverage Options: Assess your current coverage to ensure it aligns with your needs. You may be able to reduce costs by eliminating unnecessary coverage or adjusting your policy limits.

- Take Advantage of Discounts: Many insurance providers offer discounts for various reasons, such as good student discounts, safe driver discounts, or loyalty discounts. Inquire about available discounts and take steps to qualify for them.

Conclusion

Understanding the average car insurance payment is a crucial step toward financial preparedness and responsible vehicle ownership. By delving into the factors that influence insurance costs, exploring regional variations, and recognizing the impact of driving records, you can make informed decisions about your coverage and potential cost savings. Remember, while the average provides a valuable benchmark, your unique circumstances will ultimately determine your insurance costs. Stay proactive, shop around for quotes, and consider the strategies outlined above to potentially reduce your car insurance expenses.

How do I find the best car insurance rates for my specific needs?

+To find the best car insurance rates for your specific needs, it’s crucial to shop around and compare quotes from multiple insurance providers. Factors such as your driving history, vehicle type, and coverage options will impact your rates, so tailor your search to your unique circumstances. Additionally, consider bundling policies and increasing deductibles to potentially lower your premiums.

What factors can cause my car insurance rates to fluctuate over time?

+Car insurance rates can fluctuate due to various factors, including changes in your driving record, vehicle usage, or personal circumstances. Additionally, insurance providers may adjust their rates periodically based on market conditions and claim trends. Regularly reviewing your coverage and shopping around for quotes can help you stay informed and potentially save on insurance costs.

Are there any ways to lower my car insurance costs without compromising coverage?

+Yes, there are strategies to lower your car insurance costs without compromising coverage. Consider increasing your deductibles, which can lead to lower premiums. Additionally, maintaining a clean driving record, taking advantage of available discounts, and regularly reviewing your coverage options can help you identify potential cost-saving opportunities without sacrificing the level of protection you need.