Is Vanguard Fdic Insured

Vanguard, a well-known investment management company, is not a traditional bank, and as such, it does not carry the same type of insurance coverage as banks do. The Federal Deposit Insurance Corporation (FDIC) insures deposits at banks and savings associations, but investment firms like Vanguard are not covered by FDIC insurance.

Understanding Vanguard’s Investment Services

Vanguard specializes in providing a range of investment services, including mutual funds, exchange-traded funds (ETFs), and brokerage accounts. Their focus is on offering low-cost, high-quality investment options to investors. While Vanguard’s products and services may carry various levels of risk, the company itself does not provide deposit accounts that are insured by the FDIC.

What is FDIC Insurance and Why is it Important?

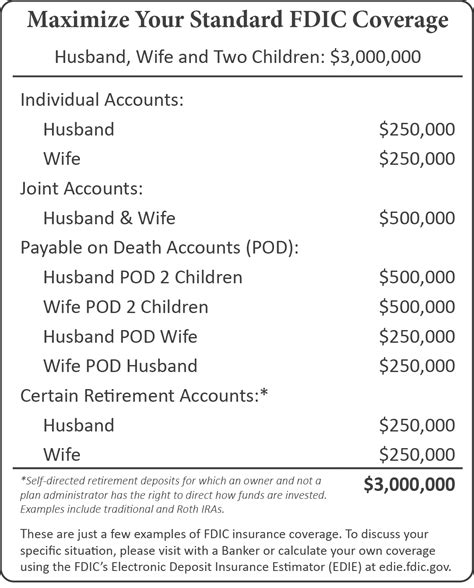

The FDIC is an independent agency of the United States government that was created in 1933 to maintain stability and public confidence in the nation’s financial system. FDIC insurance protects depositors against the loss of their insured deposits if an FDIC-insured bank or savings association fails. It provides a safety net for consumers, ensuring that their hard-earned savings are secure even in the event of a bank failure.

FDIC insurance covers deposit accounts, such as checking and savings accounts, certificates of deposit (CDs), and money market deposit accounts. The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. This means that if you have multiple accounts at the same bank, each with a different owner or different beneficial interests, they may be separately insured up to $250,000.

| FDIC Insurance Coverage | Amount |

|---|---|

| Single Accounts | $250,000 |

| Joint Accounts | $250,000 per co-owner |

| Trust Accounts | $250,000 per beneficiary |

| Corporations, Partnerships, and Unincorporated Associations | $250,000 per ownership category |

It's important to note that FDIC insurance does not cover other financial products like stocks, bonds, mutual funds, life insurance policies, annuities, or municipal securities. These products are regulated by other government agencies and carry their own forms of investor protection.

Vanguard’s Commitment to Investor Protection

While Vanguard is not FDIC-insured, it is still dedicated to protecting investor assets. Vanguard operates under the oversight of various regulatory bodies, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulatory frameworks ensure that Vanguard’s operations are transparent, fair, and compliant with industry standards.

Vanguard's investment products are subject to various forms of investor protection. For example, mutual funds and ETFs are regulated by the SEC, which requires these funds to provide detailed information about their investments, risks, and fees in their prospectuses. This transparency allows investors to make informed decisions about their investments.

Security Measures and Risk Management

Vanguard takes numerous security measures to safeguard investor assets. These include robust cyber security protocols to protect digital assets and personal information, as well as physical security measures for their facilities. Vanguard also employs risk management strategies to mitigate potential losses and ensure the stability of their investment products.

One of Vanguard's core principles is to keep costs low for investors. By offering low-cost investment options, Vanguard aims to help investors retain more of their returns, thereby reducing their overall risk exposure. This approach has made Vanguard a popular choice among investors seeking cost-effective, long-term investment strategies.

| Vanguard's Average Expense Ratio | Value |

|---|---|

| Mutual Funds | 0.10% |

| Index Funds | 0.05% |

| ETF's | 0.06% |

Vanguard's commitment to keeping costs low extends to its brokerage services as well. Their brokerage accounts offer commission-free trading on many of their funds and ETFs, further reducing investment costs for their clients.

Alternatives to FDIC Insurance for Investors

For investors who are concerned about the safety of their investments beyond FDIC insurance, there are other forms of protection to consider. These include:

- Securities Investor Protection Corporation (SIPC) Coverage: SIPC is a non-governmental agency that protects investors in the event of a brokerage firm failure. It provides insurance for securities and cash up to $500,000, including a $250,000 limit for cash.

- Excess SIPC Insurance: Some brokerage firms, including Vanguard, purchase additional insurance to cover client assets above the SIPC limits. This excess insurance provides an extra layer of protection for investors.

- Diversification: Diversifying your investment portfolio across different asset classes and sectors can help reduce risk. By spreading your investments, you minimize the impact of any single investment's performance on your overall portfolio.

- Risk Assessment and Management: Understanding and managing risk is crucial. Investors should carefully assess the risks associated with different investments and ensure they align with their financial goals and risk tolerance.

Conclusion: Understanding Vanguard’s Role in Investor Protection

Vanguard plays a significant role in the investment landscape by providing low-cost, high-quality investment options to a wide range of investors. While Vanguard is not FDIC-insured, it operates under a robust regulatory framework and employs various security measures to protect investor assets. Understanding the different forms of investor protection available, including FDIC insurance, SIPC coverage, and diversification strategies, can help investors make informed decisions about their financial portfolios.

As with any investment, it's important to conduct thorough research, assess risks, and consult with financial professionals to ensure your investment choices align with your financial goals and risk tolerance. By staying informed and proactive, investors can navigate the financial markets with confidence and peace of mind.

Is Vanguard a Bank?

+

No, Vanguard is not a bank. It is an investment management company that offers a range of investment services, including mutual funds, ETFs, and brokerage accounts.

What Types of Accounts Does Vanguard Offer?

+

Vanguard offers a variety of investment accounts, including individual brokerage accounts, retirement accounts (such as IRAs and 401(k)s), and trust and custodial accounts. They also provide access to a wide range of investment products, such as mutual funds, ETFs, stocks, and bonds.

How Does Vanguard Protect Investor Assets?

+

Vanguard operates under the oversight of regulatory bodies like the SEC and FINRA. They employ security measures to protect digital and physical assets, and their low-cost investment approach helps reduce overall risk exposure for investors.

Are There Any Other Forms of Investor Protection Beyond FDIC Insurance?

+

Yes, investors can consider SIPC coverage, which protects against brokerage firm failures, and excess SIPC insurance for additional coverage. Diversification and risk management strategies are also essential for protecting investment portfolios.

Is Vanguard a Good Choice for Investors?

+

Vanguard’s commitment to low-cost investment options, regulatory compliance, and security measures make it a popular choice for investors seeking cost-effective, long-term investment strategies. However, individual investors should assess their own financial goals and risk tolerance before making investment decisions.