How Much For Motorcycle Insurance

Motorcycle insurance is an essential aspect of owning and riding a bike, offering financial protection and peace of mind to riders. The cost of insurance can vary significantly based on numerous factors, and understanding these variables is crucial for making informed decisions about coverage. This comprehensive guide delves into the factors influencing motorcycle insurance rates, providing insights to help riders secure the best coverage at the most competitive prices.

Understanding the Key Factors

The price of motorcycle insurance is determined by a combination of individual and environmental factors. These include the rider’s age, gender, riding experience, location, and the type of bike being insured. Additionally, the insurance provider and the level of coverage chosen play significant roles in determining the overall cost.

Rider Characteristics

The demographics of the rider are a primary consideration for insurance companies. Age is a critical factor; younger riders, typically considered more prone to risky behavior, often face higher premiums. Gender can also impact rates, with male riders often associated with higher-risk riding behaviors. Riding experience is another key factor; experienced riders with a clean driving record usually benefit from lower premiums.

Furthermore, an individual's riding habits and location can influence insurance costs. Those who commute long distances or ride frequently in high-traffic areas may face higher premiums due to the increased risk of accidents. The rider's claim history also plays a role; a history of frequent claims can lead to higher insurance rates or even policy cancellation.

The Bike Itself

The type of motorcycle being insured is a significant factor. High-performance bikes, often associated with higher speeds and a younger demographic, tend to attract higher insurance premiums. Similarly, sports bikes and customized motorcycles may also command higher rates due to their perceived riskiness and the potential for higher repair costs.

The age and value of the bike are also considered. Older bikes, especially vintage or classic models, may require specialized coverage and therefore command higher premiums. On the other hand, newer bikes, while potentially more expensive to repair, may benefit from discounts due to their advanced safety features.

Insurance Provider and Coverage

The insurance company chosen by the rider can significantly impact the cost of coverage. Different providers offer varying rates and discounts, so it’s beneficial to shop around for the best deal. Additionally, the level of coverage selected will directly affect the premium. Comprehensive coverage, including collision and liability insurance, will cost more than basic liability-only coverage.

Many insurance companies offer discounts to riders who take additional safety courses or install anti-theft devices on their bikes. These discounts can significantly reduce the overall cost of insurance.

| Factor | Impact on Premium |

|---|---|

| Rider Age | Higher premiums for younger riders |

| Gender | Male riders may face higher rates |

| Riding Experience | Experienced riders with clean records benefit from lower rates |

| Location | Riding in high-risk areas can increase premiums |

| Bike Type | High-performance and customized bikes attract higher rates |

| Insurance Provider | Different providers offer varying rates and discounts |

| Coverage Level | Comprehensive coverage is more expensive than basic liability |

Real-World Examples and Case Studies

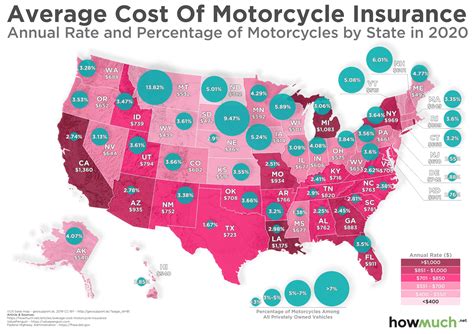

To illustrate the variation in insurance rates, let’s look at some real-world examples. In the United States, the average annual cost of motorcycle insurance ranges from 300 to 500. However, this can vary significantly based on the factors mentioned earlier.

For instance, a 25-year-old male rider with a sports bike in a high-risk urban area could expect to pay upwards of $1,000 annually for comprehensive coverage. On the other hand, a 40-year-old female rider with a standard bike in a suburban area may pay closer to $500 for the same level of coverage.

The Impact of Discounts

Discounts can significantly reduce insurance costs. For example, an anti-theft device discount of 10% on a premium of 500 would save the rider 50 annually. Additionally, some insurance providers offer loyalty discounts for long-term customers, further reducing the overall cost of insurance.

International Variations

Insurance rates can also vary significantly across different countries. In the United Kingdom, for example, the average motorcycle insurance premium is around £250, but this can range from as low as £100 to over £500 depending on the factors outlined above.

Performance Analysis and Expert Insights

Understanding the factors that influence insurance rates allows riders to make informed decisions about their coverage. By evaluating their personal circumstances and shopping around for the best insurance provider, riders can secure the coverage they need at a competitive price.

Furthermore, staying informed about insurance trends and being proactive in maintaining a clean driving record can help riders manage their insurance costs effectively. Regularly reviewing and updating insurance policies to reflect changes in personal circumstances or the value of the bike is also essential.

Future Implications

As the motorcycle market evolves, so too will insurance rates. The increasing popularity of electric motorcycles, for instance, may lead to changes in insurance pricing as these bikes become more prevalent on the road. Additionally, technological advancements in safety features and theft prevention could potentially lead to reduced insurance costs over time.

What is the average cost of motorcycle insurance in the United States?

+The average annual cost of motorcycle insurance in the United States ranges from 300 to 500, but this can vary significantly based on factors like age, gender, riding experience, location, and the type of bike being insured.

Can I get discounts on my motorcycle insurance?

+Yes, many insurance providers offer discounts for various reasons. These can include discounts for installing anti-theft devices, completing additional safety courses, or being a long-term customer. These discounts can significantly reduce the overall cost of insurance.

How does the type of motorcycle impact insurance rates?

+The type of motorcycle being insured is a significant factor in determining insurance rates. High-performance bikes, sports bikes, and customized motorcycles often attract higher premiums due to their association with higher speeds and potentially higher repair costs.

Are there any ways to reduce my motorcycle insurance costs?

+Yes, there are several strategies to reduce insurance costs. These include shopping around for the best insurance provider, taking advantage of available discounts, maintaining a clean driving record, and regularly reviewing and updating your insurance policy to reflect changes in your circumstances or the value of your bike.

What impact does age have on motorcycle insurance rates?

+Age is a critical factor in determining insurance rates. Younger riders, typically considered more prone to risky behavior, often face higher premiums. As riders age and gain more experience, their insurance rates may decrease, especially if they maintain a clean driving record.