Homeowners Insurance Brokers

Homeowners insurance is an essential aspect of protecting one's property and assets. In the dynamic and often complex world of insurance, homeowners rely on brokers to navigate the intricacies of coverage, risks, and potential claims. This article delves into the critical role of homeowners insurance brokers, exploring their expertise, services, and impact on policyholders.

The Significance of Homeowners Insurance Brokers

Homeowners insurance brokers serve as trusted advisors, offering invaluable guidance to individuals seeking comprehensive protection for their homes and possessions. With a deep understanding of the insurance market and the unique needs of homeowners, brokers provide a personalized and efficient approach to securing adequate coverage.

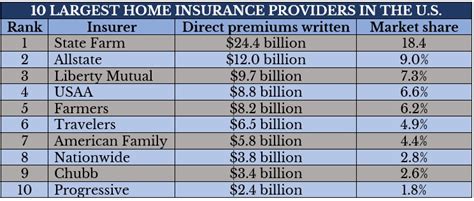

In today's competitive insurance landscape, brokers play a pivotal role in helping homeowners make informed decisions. They ensure that policyholders receive the right coverage for their specific circumstances, taking into account factors such as location, property value, and personal assets. By leveraging their industry knowledge and connections, brokers can negotiate the best rates and terms, providing homeowners with peace of mind and financial security.

Expertise and Services Offered by Brokers

The expertise of homeowners insurance brokers spans a wide range of areas, ensuring that policyholders receive comprehensive and tailored advice.

Risk Assessment and Coverage Customization

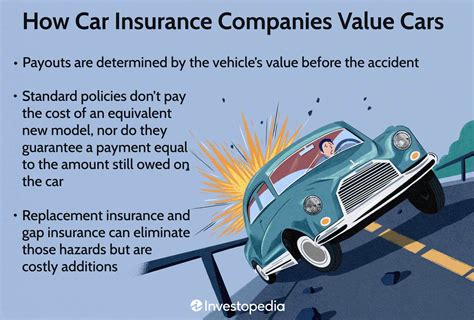

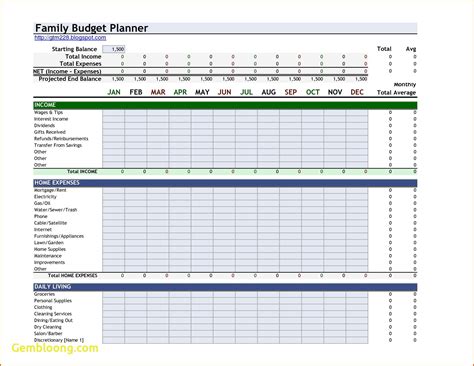

Brokers conduct thorough risk assessments, evaluating the unique characteristics of each homeowner’s property. This includes analyzing factors such as location-specific hazards, the age and condition of the home, and the value of personal belongings. Based on these assessments, brokers tailor coverage options to address specific risks, ensuring that policyholders are adequately protected without paying for unnecessary coverage.

| Risk Factor | Assessment Approach |

|---|---|

| Natural Disasters | Historical data, geographical analysis, and local regulations. |

| Property Age and Condition | In-person inspections, maintenance records, and building code compliance. |

| Personal Belongings | Detailed inventory, valuation, and assessment of unique items. |

Policy Comparison and Negotiation

With access to multiple insurance carriers, brokers can compare policies side by side, highlighting the advantages and disadvantages of each. This comparative analysis ensures that homeowners receive the most suitable coverage at the best possible price. Brokers leverage their relationships with insurance companies to negotiate better terms and rates, often securing exclusive discounts and benefits for their clients.

Claims Assistance and Advocacy

In the event of a claim, homeowners insurance brokers step in as advocates, guiding policyholders through the claims process. They assist with filing claims, ensuring all necessary documentation is submitted, and providing ongoing support throughout the settlement process. Brokers have a deep understanding of insurance policies and can navigate complex claims scenarios, ensuring that homeowners receive fair and timely compensation.

Continuous Policy Review and Updates

The insurance landscape is dynamic, with policy changes, new coverage options, and evolving risks. Homeowners insurance brokers provide ongoing policy review and updates, ensuring that coverage remains current and adequate. They stay informed about industry developments and changes in regulations, promptly notifying policyholders of any necessary adjustments to their coverage.

Benefits of Engaging a Homeowners Insurance Broker

Engaging the services of a homeowners insurance broker offers numerous advantages to policyholders, ensuring a seamless and advantageous insurance experience.

Personalized Coverage

Brokers tailor insurance policies to the unique needs of each homeowner, ensuring that coverage is neither excessive nor insufficient. This personalized approach provides peace of mind, knowing that assets are adequately protected without unnecessary financial burden.

Cost Savings

By negotiating with multiple insurance carriers, brokers can secure competitive rates and discounts. Their expertise in policy comparison and negotiation often results in significant cost savings for policyholders, ensuring they receive the best value for their insurance premium.

Expert Guidance and Support

Homeowners insurance brokers provide invaluable guidance throughout the insurance journey. From initial policy selection to claims assistance, brokers offer expert advice, ensuring policyholders make informed decisions and receive the support they need.

Convenience and Efficiency

Brokers streamline the insurance process, handling the complexities of policy selection, renewal, and claims on behalf of their clients. This level of convenience saves homeowners time and effort, allowing them to focus on their daily lives while their insurance needs are expertly managed.

Choosing the Right Homeowners Insurance Broker

With the importance of homeowners insurance brokers established, it is essential to choose a reputable and qualified professional. Here are some key considerations when selecting a broker:

- Experience and Expertise: Look for brokers with extensive experience in the insurance industry, particularly in homeowners insurance. Their expertise should cover a wide range of coverage options, risk assessments, and claims processes.

- Personalized Approach: Seek brokers who offer a tailored and personalized service. They should take the time to understand your unique circumstances and provide customized recommendations accordingly.

- Carrier Relationships: Brokers with strong relationships with multiple insurance carriers can provide a wider range of coverage options and potentially negotiate better rates.

- Claims Advocacy: Choose a broker who actively assists with claims, offering guidance and support throughout the process. Their experience in navigating claims can be invaluable in ensuring a fair and timely settlement.

- Reputation and Reviews: Research the broker's reputation and read reviews from past clients. This can provide insights into their level of service, responsiveness, and overall satisfaction.

Conclusion

Homeowners insurance brokers play a vital role in the insurance industry, offering expertise, personalized service, and peace of mind to policyholders. Their comprehensive understanding of the market, coupled with their ability to negotiate and advocate on behalf of their clients, makes them an invaluable asset in securing adequate and cost-effective homeowners insurance coverage.

How do homeowners insurance brokers determine the right coverage for a policyholder?

+Brokers conduct a comprehensive risk assessment, considering factors such as property location, value, and personal belongings. This assessment guides the customization of coverage options to address specific risks.

What is the advantage of using a broker over directly purchasing insurance from a carrier?

+Brokers offer personalized advice, negotiate better rates, and provide ongoing support. They have access to multiple carriers, ensuring policyholders receive the best coverage and value.

How can I ensure my broker is reputable and qualified?

+Research their experience, carrier relationships, and client reviews. Look for brokers with a strong track record of providing tailored advice and excellent service.