Home Insurance Coverage Options

Home insurance is an essential aspect of protecting one's financial well-being and peace of mind. It provides a safety net against unexpected events and covers a range of potential risks. Understanding the various coverage options available is crucial to ensure you have the right protection for your home and its contents.

Understanding Home Insurance Coverage

Home insurance, also known as homeowner’s insurance, is a contract between an insurance provider and a homeowner. It offers financial protection against losses and damages that can occur to a house and its belongings. This type of insurance is designed to cover a broad range of risks, from natural disasters to accidental damage and theft.

The primary goal of home insurance is to provide a financial safety net, ensuring that homeowners can recover from unforeseen events without facing significant financial burdens. It offers peace of mind, knowing that your home, which is likely one of your most valuable assets, is adequately protected.

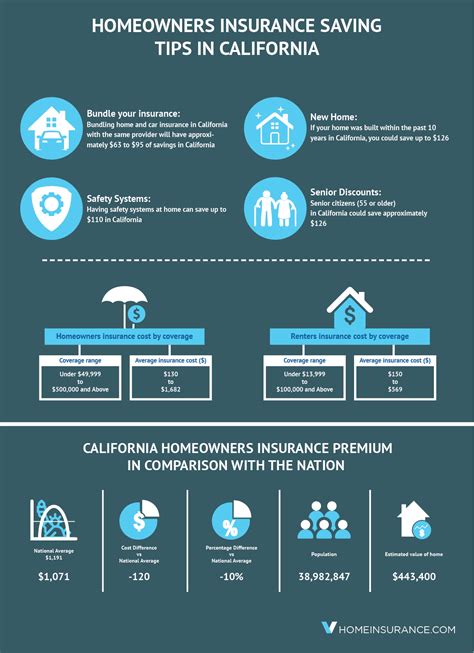

The specific coverage options and limits within a home insurance policy can vary greatly, depending on the provider, the location of the home, and the individual needs of the homeowner. Let's delve into some of the key coverage options that are typically available in a home insurance policy.

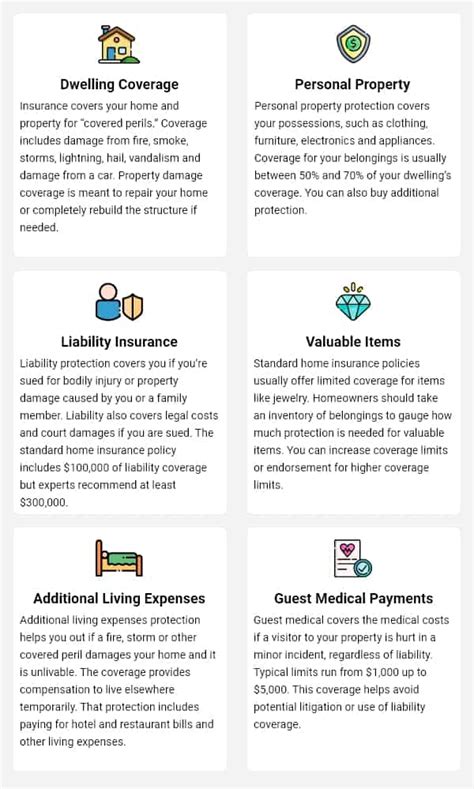

Dwelling Coverage

Dwelling coverage, also known as structural coverage, is the cornerstone of any home insurance policy. It provides protection for the physical structure of your home, including the walls, roof, floors, and any permanent fixtures. This coverage ensures that in the event of a covered loss, such as a fire, storm damage, or vandalism, the cost of repairing or rebuilding your home will be covered up to the policy limits.

It's important to note that dwelling coverage typically only covers the physical structure of the home and may not extend to all outbuildings or detached structures. For additional protection, you may need to consider separate coverage options or endorsements.

| Dwelling Coverage Highlights | Key Details |

|---|---|

| Coverage Type | Structural protection for the main residence |

| Covered Risks | Fire, storms, vandalism, and more |

| Policy Limits | Based on home's replacement cost or actual cash value |

Rebuilding Cost vs. Actual Cash Value

When it comes to dwelling coverage, there are two primary valuation methods: replacement cost and actual cash value. Replacement cost coverage ensures that you will receive enough to rebuild your home, regardless of the original purchase price or current market value. Actual cash value, on the other hand, considers depreciation and provides coverage based on the current value of the home and its contents.

While actual cash value coverage may be more affordable, it may not provide sufficient funds to fully rebuild your home. For this reason, many homeowners opt for replacement cost coverage to ensure they are fully protected.

Personal Property Coverage

Personal property coverage, also known as contents coverage, protects the belongings within your home. This includes furniture, clothing, electronics, appliances, and other personal items. In the event of a covered loss, personal property coverage will reimburse you for the cost of replacing or repairing these items up to the policy limits.

It's important to note that personal property coverage often has separate limits and deductibles, which can vary depending on the type of item. For example, high-value items like jewelry, artwork, or electronics may have specific limits or require separate coverage endorsements.

| Personal Property Coverage Essentials | Key Details |

|---|---|

| Coverage Type | Protection for personal belongings inside the home |

| Covered Items | Furniture, clothing, electronics, appliances, and more |

| Policy Limits | Based on the declared value or actual cash value of the items |

Valuation Methods for Personal Property

Similar to dwelling coverage, personal property coverage can be valued using different methods. The two primary methods are replacement cost and actual cash value. Replacement cost coverage ensures that you receive the full cost of replacing an item, while actual cash value considers depreciation and provides coverage based on the current value of the item.

For high-value items, it's often recommended to consider scheduled personal property coverage or endorsements. These options provide additional coverage limits and may offer broader protection, such as covering worldwide loss or damage, rather than just losses that occur within the home.

Liability Coverage

Liability coverage is a crucial aspect of home insurance, providing protection against claims and lawsuits resulting from injuries or property damage that occur on your property or are caused by you or a family member.

This coverage can be a lifesaver in situations where a guest is injured on your property or if you or a family member accidentally cause damage to someone else's property. It covers the cost of legal defense and any damages awarded up to the policy limits.

| Liability Coverage Essentials | Key Details |

|---|---|

| Coverage Type | Protection against third-party claims and lawsuits |

| Covered Risks | Injuries or property damage caused by the insured or on their property |

| Policy Limits | Varies, but typically ranges from $100,000 to $500,000 or more |

Understanding Policy Limits

Liability coverage typically has a set policy limit, which is the maximum amount the insurance company will pay out for a covered claim. It’s important to choose a limit that aligns with your financial situation and the potential risks you face. Higher limits provide broader protection but may result in higher premiums.

In some cases, you may also have the option to purchase an umbrella policy, which provides additional liability coverage beyond the limits of your home insurance policy. This can be especially beneficial for high-net-worth individuals or those with unique risks.

Additional Coverage Options

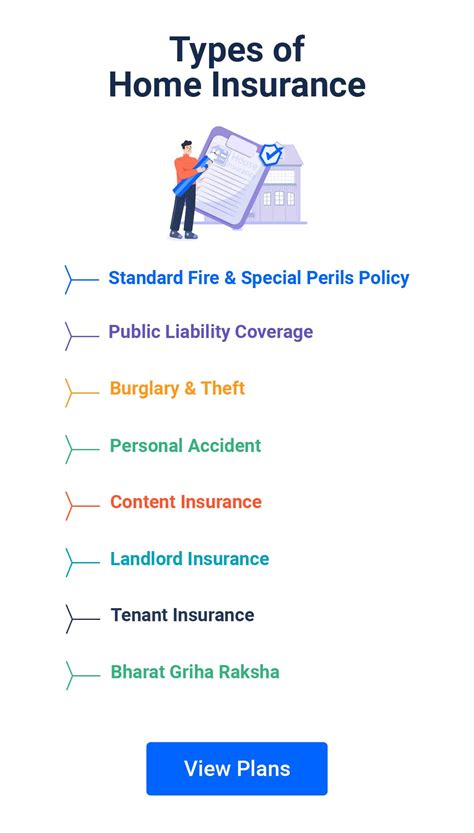

Beyond the core coverage options, home insurance policies often offer a range of additional protections and endorsements to cater to specific needs and circumstances.

Flood and Earthquake Coverage

Standard home insurance policies typically do not cover damage caused by floods or earthquakes. However, these are two of the most common natural disasters, and the potential for damage can be significant. If you live in an area prone to these events, it’s crucial to consider adding flood or earthquake coverage to your policy.

Flood coverage is typically available through the National Flood Insurance Program (NFIP) or through private insurers. Earthquake coverage, on the other hand, is often offered as a separate policy or endorsement.

Water Backup and Sewer Coverage

Water backup and sewer coverage provides protection against damage caused by water or sewage backing up into your home through drains or pipes. This coverage can be especially important for homeowners with older plumbing systems or those living in areas prone to heavy rainfall or flooding.

Personal Injury Coverage

Personal injury coverage, also known as personal liability coverage, provides protection against claims of libel, slander, false arrest, or invasion of privacy. This coverage can be valuable for individuals who frequently host guests or engage in public activities that could potentially lead to such claims.

Identity Theft Coverage

Identity theft coverage provides assistance and resources to help restore your identity and finances if you become a victim of identity theft. This coverage often includes credit monitoring services, lost wages reimbursement, and legal assistance.

Conclusion

Home insurance is a vital tool for protecting your financial well-being and ensuring the security of your home and belongings. By understanding the various coverage options available, you can tailor your policy to fit your specific needs and circumstances. From dwelling and personal property coverage to liability protection and additional endorsements, home insurance offers a comprehensive safety net against a wide range of risks.

It's important to regularly review your home insurance policy and adjust it as your needs change. Whether you're adding a new wing to your home, purchasing high-value items, or facing unique risks, your insurance coverage should evolve to provide the protection you require.

Frequently Asked Questions

How do I determine the right amount of coverage for my home?

+Determining the right amount of coverage involves assessing the replacement cost of your home and its contents. You’ll want to consider the cost of rebuilding your home, taking into account factors like construction costs and any unique features or materials. For personal property, you’ll need to estimate the value of your belongings and choose coverage limits accordingly. It’s often recommended to work with an insurance agent to ensure you have adequate coverage.

What is the difference between actual cash value and replacement cost coverage?

+Actual cash value coverage considers depreciation and provides compensation based on the current value of an item or your home. On the other hand, replacement cost coverage ensures you receive the full cost of replacing an item or rebuilding your home, regardless of depreciation. Replacement cost coverage is often preferred as it provides more comprehensive protection.

Are there any common exclusions in home insurance policies?

+Yes, there are several common exclusions in home insurance policies. These can include damage caused by floods, earthquakes, nuclear incidents, intentional acts, and wear and tear. It’s important to carefully review your policy’s exclusions to understand what risks are not covered.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever your circumstances change. This ensures that your coverage remains adequate and up-to-date. Changes in your home’s value, the addition of new possessions, or modifications to your home can all impact your insurance needs.