Healthcare Insurance Quotes

Healthcare is a vital aspect of our lives, and having adequate insurance coverage is essential to ensure financial protection and access to quality medical services. Obtaining healthcare insurance quotes is a crucial step in the process of securing the right coverage for individuals and families. In this comprehensive guide, we will delve into the world of healthcare insurance quotes, exploring the factors that influence them, the process of comparison, and the strategies to find the most suitable and affordable plans.

Understanding Healthcare Insurance Quotes

Healthcare insurance quotes are personalized estimates provided by insurance companies, detailing the cost of healthcare coverage for an individual or a group. These quotes take into account various factors to determine the premium, including age, location, medical history, and the desired level of coverage. Understanding the components that contribute to these quotes is essential for making informed decisions about your healthcare insurance.

Factors Influencing Healthcare Insurance Quotes

Several key factors play a role in shaping the quotes you receive for healthcare insurance. Let’s explore these factors and their impact on the cost of coverage:

- Age: Age is a significant determinant of insurance quotes. Generally, younger individuals tend to have lower premiums as they are perceived to have fewer health risks. However, as we age, the cost of insurance typically increases due to the higher likelihood of developing health conditions.

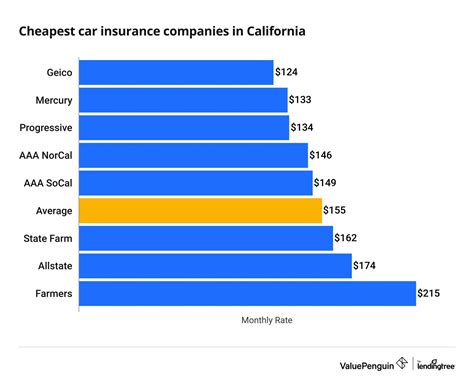

- Location: The geographic location where you reside can influence your insurance quotes. Healthcare costs and the availability of medical services vary across regions, leading to differences in insurance rates. Urban areas, for instance, may have higher costs compared to rural areas.

- Medical History: Your personal medical history is a crucial factor in determining insurance quotes. Pre-existing conditions, chronic illnesses, and previous medical treatments can impact the cost of your insurance. Insurance companies carefully assess your medical records to assess the potential risks and associated costs.

- Coverage Level: The level of coverage you choose greatly affects your insurance quotes. Comprehensive plans with a wide range of benefits and low deductibles often come with higher premiums. On the other hand, basic plans with limited coverage and higher deductibles may offer more affordable options.

- Tobacco Use: Insurance companies often consider tobacco use as a risk factor. Smokers and tobacco users may face higher premiums due to the increased health risks associated with tobacco consumption.

- Family Size: The size of your family impacts insurance quotes, as larger families typically require more extensive coverage. Insurance companies offer family plans with varying levels of coverage and premiums to accommodate different household needs.

- Occupation: Certain occupations with higher risk factors, such as hazardous work environments or stressful professions, may lead to increased insurance quotes. Insurance companies assess the potential health risks associated with different occupations when determining premiums.

The Importance of Comparing Quotes

Comparing healthcare insurance quotes is a critical step in finding the best coverage for your needs and budget. By evaluating multiple quotes, you can identify the plans that offer the most comprehensive benefits at the most competitive prices. Here’s why comparison is essential:

- Cost-Effectiveness: Comparing quotes allows you to assess the value of different insurance plans. You can identify plans that provide a good balance between coverage and cost, ensuring you get the most bang for your buck.

- Coverage Options: Different insurance companies offer a variety of coverage options, each with its own set of benefits and limitations. By comparing quotes, you can explore the range of available plans and find the one that aligns with your specific healthcare needs.

- Network of Providers: Insurance companies often have preferred provider networks, which are lists of healthcare professionals and facilities that they work with. Comparing quotes gives you the opportunity to assess the network of providers associated with each plan, ensuring you have access to the medical services you require.

- Customer Satisfaction: Customer reviews and feedback can provide valuable insights into the experiences of individuals who have previously used a particular insurance company. By comparing quotes, you can consider customer satisfaction ratings and make an informed decision based on real-world experiences.

Strategies for Obtaining Accurate Healthcare Insurance Quotes

To ensure you receive accurate and reliable healthcare insurance quotes, it’s important to follow certain strategies. Here are some tips to help you navigate the process effectively:

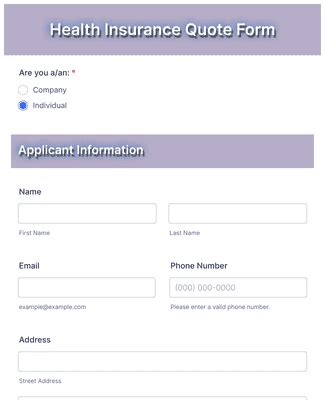

Gather Necessary Information

Before requesting quotes, gather all the necessary information to provide an accurate representation of your healthcare needs. This includes your age, location, medical history, and the desired level of coverage. Having this information readily available will streamline the quote comparison process.

Use Online Comparison Tools

Utilize online comparison tools and websites that specialize in providing healthcare insurance quotes. These platforms allow you to input your details and compare quotes from multiple insurance companies in one place. This saves time and effort, making it easier to find the most suitable plans.

Engage with Insurance Brokers

Insurance brokers can be valuable allies in your quest for the right healthcare insurance. They have extensive knowledge of the industry and can provide personalized advice based on your specific needs. Brokers can help you understand the intricacies of different plans and guide you towards the most advantageous options.

Consider Group Plans

If you are part of a group, such as an employer-sponsored plan or a professional organization, consider the benefits of group insurance plans. Group plans often offer more affordable rates and additional perks, as the risk is spread across a larger pool of individuals. Explore the options available through your employer or professional association.

Understand Exclusions and Limitations

When comparing quotes, pay close attention to the exclusions and limitations outlined in each plan. Certain procedures, treatments, or conditions may not be covered, and understanding these limitations is crucial to avoid unexpected out-of-pocket expenses. Read the fine print and clarify any doubts with the insurance provider.

Analyzing and Choosing the Right Healthcare Insurance Plan

Once you have obtained a range of healthcare insurance quotes, it’s time to analyze and make an informed decision. Here are some key considerations to help you choose the right plan:

Assess Your Healthcare Needs

Evaluate your current and future healthcare needs. Consider your medical history, any ongoing treatments or medications, and the likelihood of requiring specialized care. Choose a plan that provides adequate coverage for your specific requirements.

Compare Deductibles and Out-of-Pocket Costs

Deductibles and out-of-pocket costs are important factors to consider. Evaluate the deductibles and copayments associated with each plan. Higher deductibles may result in lower premiums, but you’ll need to consider your financial capacity to cover these expenses when needed.

Evaluate Network Flexibility

Assess the flexibility of the provider network offered by each plan. Some plans may have a narrower network, limiting your choice of healthcare providers. Consider whether you prefer a more open network that allows you to choose from a wider range of doctors and hospitals.

Read the Fine Print

Always read the policy documents and fine print carefully. Understand the coverage limits, waiting periods, and any exclusions or limitations that may apply. This ensures you are fully aware of what is and isn’t covered by the plan you choose.

Consider Long-Term Costs

When comparing plans, don’t just focus on the initial premiums. Consider the long-term costs and potential changes in premiums over time. Some plans may have attractive initial rates but may increase significantly in the future. Assess the stability and affordability of the plan over the long term.

Seek Professional Advice

If you are unsure about which plan to choose or have specific concerns, seek advice from healthcare insurance professionals or financial advisors. They can provide expert guidance based on your individual circumstances and help you make a well-informed decision.

The Future of Healthcare Insurance Quotes

The landscape of healthcare insurance is continually evolving, and the way we obtain quotes is no exception. As technology advances, we can expect to see further innovations in the quote comparison process. Here are some potential future developments:

- Artificial Intelligence (AI) Integration: AI-powered tools and chatbots may become more prevalent in the insurance industry. These technologies can streamline the quote comparison process, providing personalized recommendations based on your needs and preferences.

- Blockchain Technology: Blockchain has the potential to revolutionize the insurance industry by enhancing data security and transparency. It can facilitate secure data sharing between insurance companies and healthcare providers, improving the accuracy and efficiency of quote generation.

- Telehealth Integration: With the rise of telehealth services, insurance companies may start offering plans that specifically cater to virtual healthcare needs. Quotes for telehealth-inclusive plans could become more prevalent, providing convenient and affordable access to remote medical consultations.

- Personalized Health Tracking: The integration of health tracking devices and apps with insurance quotes is a possibility. Insurance companies may offer incentives or discounted rates to individuals who actively monitor their health and engage in preventive care, encouraging a healthier lifestyle.

Conclusion

Obtaining healthcare insurance quotes is a crucial step towards securing the financial protection and access to quality healthcare that you deserve. By understanding the factors that influence quotes, comparing multiple plans, and utilizing the right strategies, you can find the most suitable and affordable healthcare insurance coverage. Remember to assess your needs, compare deductibles, evaluate network flexibility, and seek professional advice when needed. Stay informed about the evolving landscape of healthcare insurance, as new technologies and innovations continue to shape the industry. With the right knowledge and tools, you can navigate the world of healthcare insurance quotes with confidence and make informed decisions to protect your health and well-being.

How often should I review my healthcare insurance plan?

+It is recommended to review your healthcare insurance plan annually or whenever there are significant changes in your personal circumstances, such as a new job, marriage, or the birth of a child. Regularly assessing your plan ensures that it continues to meet your evolving needs and provides the best value.

Can I negotiate healthcare insurance quotes?

+While insurance quotes are typically based on standardized rates, there may be opportunities to negotiate in certain situations. If you have multiple policies with an insurance company or if you represent a large group, you may have some leverage to negotiate better rates. However, it’s important to approach negotiations with caution and consult with professionals.

What if I have pre-existing conditions? Will I be able to find affordable healthcare insurance?

+Under the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, the cost of insurance may still be influenced by your medical history. It’s important to explore your options and consider government-sponsored programs or state-specific initiatives that provide coverage for individuals with pre-existing conditions.