Cheap Ca Car Insurance

Welcome to the ultimate guide on finding the best car insurance deals in the state of California! In this comprehensive article, we will delve into the world of affordable car insurance options specifically tailored for California residents. Whether you're a student, a senior, or a budget-conscious driver, we've got you covered with expert insights and practical tips to secure the most cost-effective insurance plan without compromising on quality.

California, known for its vibrant cities, stunning natural landscapes, and diverse population, presents a unique challenge when it comes to car insurance. With a vast network of roads and a wide range of driving conditions, it's crucial to find insurance that suits your specific needs and budget. That's why we've dedicated this article to exploring the ins and outs of cheap car insurance in the Golden State.

Understanding the Cost of Car Insurance in California

California is renowned for its high cost of living, and this extends to the realm of car insurance as well. The average cost of car insurance in the state can be significantly higher compared to other parts of the country. Several factors contribute to these elevated insurance rates, including:

- Population Density: California is one of the most populous states in the US, with a high concentration of drivers on its roads. This increased traffic volume often leads to a higher incidence of accidents and claims, impacting insurance premiums.

- Vehicle Theft and Vandalism: The state's vibrant urban centers and diverse landscapes can attract vehicle theft and vandalism, which insurance companies factor into their risk assessments.

- Traffic Congestion: California's major cities, such as Los Angeles and San Francisco, experience heavy traffic congestion, increasing the likelihood of accidents and claims.

- Natural Disasters: The state's susceptibility to earthquakes, wildfires, and other natural disasters can affect insurance rates, as these events can lead to extensive property damage and insurance claims.

Despite these challenges, there are still ways to navigate the California car insurance market and find affordable options. By understanding the key factors that influence insurance costs and implementing smart strategies, you can significantly reduce your insurance premiums.

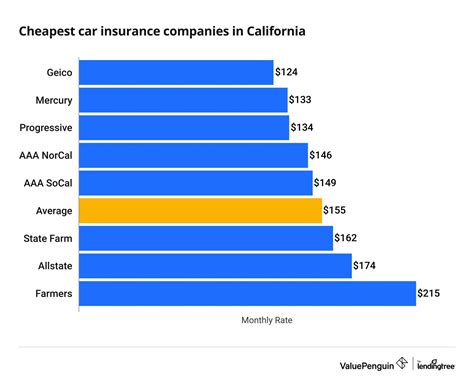

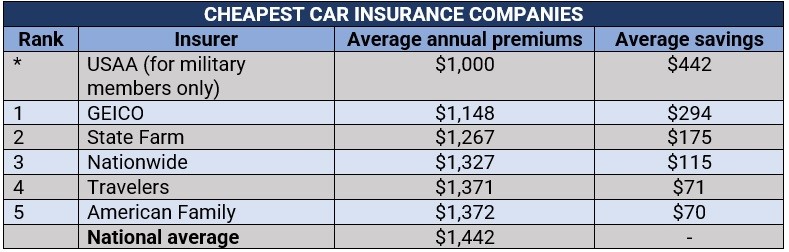

Comparing Insurance Providers and Policies

One of the most effective ways to secure cheap car insurance in California is by conducting a thorough comparison of different insurance providers and their policies. Each insurance company offers unique features, coverage options, and pricing structures, so it’s essential to shop around and evaluate multiple options.

Key Considerations When Comparing Insurance Providers:

- Coverage Options: Ensure that the insurance provider offers the specific coverage types you require, such as liability, collision, comprehensive, and personal injury protection (PIP). Some providers might also offer additional coverage options like rental car reimbursement or roadside assistance.

- Discounts and Bundles: Look for insurance companies that offer discounts for various factors, including safe driving records, good student status, multi-policy bundles (combining car and home insurance), and loyalty programs. These discounts can significantly reduce your overall insurance costs.

- Customer Service and Claims Handling: Assess the insurance provider’s reputation for customer service and claims handling. Look for companies with a strong track record of prompt and efficient claim processing, as this can be crucial in times of need.

- Financial Stability: Verify the financial stability of the insurance provider to ensure they can provide reliable coverage and timely payouts in the event of a claim. You can check their financial ratings through reputable agencies like AM Best or Moody’s.

To facilitate your comparison process, consider using online tools and resources that allow you to obtain quotes from multiple insurance providers simultaneously. These platforms can provide a comprehensive overview of available options and help you identify the most cost-effective plans.

Maximizing Discounts and Savings

One of the most effective ways to reduce your car insurance premiums is by taking advantage of the various discounts and savings opportunities offered by insurance providers. Here are some strategies to help you maximize your savings:

Discounts to Look For:

- Safe Driving Discounts: Many insurance companies offer discounts for drivers with clean driving records, free of accidents or serious traffic violations. These discounts can be substantial and are often applied automatically based on your driving history.

- Good Student Discounts: If you’re a student, you may be eligible for a good student discount. Some insurance providers offer reduced rates for students who maintain a certain GPA or academic standing.

- Multi-Policy Discounts: Bundling your car insurance with other insurance policies, such as home or renters’ insurance, can result in significant savings. Insurance companies often provide discounts when you purchase multiple policies from them.

- Loyalty Discounts: Staying with the same insurance provider for an extended period can lead to loyalty discounts. Some companies offer reduced rates for long-term customers as a way of rewarding their loyalty.

In addition to these standard discounts, keep an eye out for special promotions or seasonal offers that insurance providers may introduce. These temporary discounts can provide an excellent opportunity to save on your insurance premiums.

Optimizing Your Car Insurance Coverage

While it’s essential to find affordable car insurance, it’s equally crucial to ensure that your coverage is adequate for your needs. Balancing cost and coverage is an art, and we’ll guide you through the process of optimizing your insurance plan.

Evaluating Your Coverage Needs:

Assess your specific driving habits, the value of your vehicle, and any unique circumstances that might impact your insurance requirements. For instance, if you drive an older car with low resale value, you might consider reducing your collision and comprehensive coverage to save on premiums.

On the other hand, if you frequently drive in high-risk areas or have a newer vehicle, you may want to opt for higher coverage limits to protect yourself financially in the event of an accident.

Understanding Minimum Liability Requirements:

California has specific minimum liability requirements that all drivers must meet. These requirements dictate the minimum amount of coverage you must carry to drive legally in the state. It’s crucial to ensure that your insurance policy meets or exceeds these minimums to avoid penalties and legal issues.

Here's a table outlining the minimum liability requirements in California:

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

While these are the minimum requirements, it's often recommended to carry higher limits to provide better protection in the event of a serious accident. Consult with your insurance agent to determine the optimal coverage limits based on your individual circumstances.

Additional Strategies for Affordable Car Insurance

Beyond comparing providers, maximizing discounts, and optimizing coverage, there are additional strategies you can employ to further reduce your car insurance costs.

Tips for Lowering Your Insurance Premiums:

- Increase Your Deductible: Opting for a higher deductible can lower your insurance premiums. However, it’s essential to ensure that you can afford the increased deductible in the event of a claim.

- Take a Defensive Driving Course: Completing a defensive driving course can not only improve your driving skills but also qualify you for insurance discounts. Many insurance providers offer reduced rates for drivers who complete these courses.

- Maintain a Good Credit Score: Insurance companies often use credit-based insurance scores to assess the risk of insuring a driver. Maintaining a good credit score can positively impact your insurance premiums, as it indicates a lower risk of filing claims.

- Shop Around Regularly: Insurance rates can fluctuate over time, so it’s beneficial to shop around for new quotes periodically. Doing so can help you identify better deals and ensure you’re not overpaying for your insurance.

By implementing these strategies and staying proactive in managing your car insurance, you can find the best balance between cost and coverage, ensuring that you're adequately protected without breaking the bank.

Frequently Asked Questions (FAQ)

What are some ways to lower my car insurance premiums in California?

+There are several strategies to reduce your car insurance costs in California. These include comparing quotes from multiple providers, taking advantage of discounts (such as safe driver, good student, or multi-policy discounts), increasing your deductible, maintaining a good credit score, and regularly shopping around for new quotes.

Are there any state-specific discounts or programs for car insurance in California?

+Yes, California offers specific programs and discounts to help drivers reduce their insurance costs. For example, the California Low Cost Auto Insurance Program (CLCIP) provides low-cost auto insurance to eligible drivers. Additionally, some insurance companies may offer discounts for electric or hybrid vehicles, as these are more environmentally friendly and may result in lower claims.

How can I ensure I’m getting the best deal on car insurance in California?

+To ensure you’re getting the best deal, it’s crucial to compare quotes from multiple insurance providers. Use online comparison tools or directly contact insurance companies to obtain quotes. Additionally, ask about any available discounts and negotiate with your current provider to see if they can match or beat competing offers.