Health Insurance Marketplace Utah

The Health Insurance Marketplace, also known as the Health Insurance Exchange, is a vital platform for individuals and families to access affordable healthcare coverage. In the state of Utah, the Marketplace plays a crucial role in providing insurance options to its residents. This article aims to delve into the specifics of the Health Insurance Marketplace in Utah, exploring its unique features, available plans, and the impact it has on the state's healthcare landscape.

Understanding the Health Insurance Marketplace in Utah

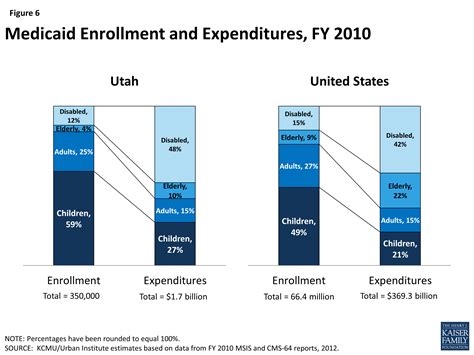

The Health Insurance Marketplace in Utah, established under the Affordable Care Act (ACA), serves as a centralized platform where individuals and small businesses can compare and purchase health insurance plans. It acts as a regulator, ensuring that insurance companies offering plans on the Marketplace adhere to certain standards and provide essential health benefits. The Marketplace in Utah is operated by the state government, allowing for localized control and customization of the healthcare system.

One of the key advantages of the Marketplace is its role in promoting competition among insurance providers. By offering a wide range of plans from various carriers, individuals have the opportunity to choose the coverage that best suits their needs and budget. The Marketplace also provides valuable resources and tools to assist consumers in understanding their options and making informed decisions.

Enrollment Periods and Special Circumstances

The standard Open Enrollment Period for the Health Insurance Marketplace in Utah typically occurs from November 1st to December 15th each year. During this time, individuals can enroll in a new plan, switch to a different plan, or renew their existing coverage for the upcoming year. However, it's important to note that qualifying life events, such as marriage, birth of a child, or loss of other health coverage, allow for Special Enrollment Periods outside of the standard timeframe.

Available Health Insurance Plans

Utah's Health Insurance Marketplace offers a diverse range of plans to cater to the varying needs of its residents. These plans are categorized into different metal tiers based on the level of coverage and cost-sharing they provide. Here's a breakdown of the plan types available on the Utah Marketplace:

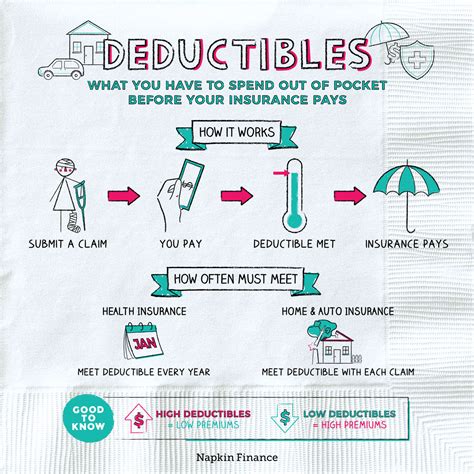

- Bronze Plans: These plans typically have lower premiums but higher deductibles and out-of-pocket costs. They are suitable for individuals who prioritize lower monthly payments and expect minimal healthcare needs.

- Silver Plans: Silver plans strike a balance between premiums and cost-sharing. They offer a reasonable cost structure and include a wider range of benefits, making them a popular choice for many Utah residents.

- Gold Plans: Gold plans provide a higher level of coverage with lower deductibles and out-of-pocket expenses. While the premiums may be higher, they offer comprehensive benefits and are ideal for those with significant healthcare needs.

- Platinum Plans: Platinum plans offer the highest level of coverage with minimal cost-sharing. They are designed for individuals who require extensive medical care and are willing to pay higher premiums for the most comprehensive benefits.

Additionally, Utah's Marketplace offers Catastrophic Plans for individuals under the age of 30 or those who qualify due to hardship exemptions. These plans provide basic coverage and are intended for emergencies and unexpected medical events.

| Plan Type | Premium | Deductible | Out-of-Pocket Limit |

|---|---|---|---|

| Bronze | $350/month | $5,000 | $7,500 |

| Silver | $420/month | $3,000 | $6,000 |

| Gold | $550/month | $2,000 | $4,000 |

| Platinum | $700/month | $1,500 | $3,000 |

Qualifications and Premium Tax Credits

The Health Insurance Marketplace in Utah is designed to assist individuals and families with limited financial means. Those who meet certain income requirements may qualify for premium tax credits, which can significantly reduce the cost of their monthly premiums. The amount of the tax credit depends on factors such as household income, family size, and the cost of insurance plans in their area.

Additionally, individuals with low incomes may also be eligible for cost-sharing reductions, which further lower their out-of-pocket costs for medical services. These reductions can include lower deductibles, copays, and coinsurance, making healthcare more affordable for those who need it most.

Impact and Benefits of the Health Insurance Marketplace in Utah

The establishment of the Health Insurance Marketplace in Utah has had a significant positive impact on the state's healthcare system. Here are some key benefits and outcomes:

- Increased Access to Healthcare: The Marketplace has expanded healthcare coverage to a larger portion of Utah's population. Individuals who previously lacked insurance due to pre-existing conditions or limited income now have access to affordable plans, improving their overall health and well-being.

- Enhanced Competition: By creating a competitive environment, the Marketplace has driven insurance providers to offer more comprehensive and affordable plans. This has resulted in improved benefits, lower premiums, and increased consumer satisfaction.

- Consumer Protection: The Marketplace ensures that insurance companies adhere to essential health benefits and consumer protection regulations. This includes prohibiting discrimination based on pre-existing conditions and ensuring that plans cover a minimum set of essential health services.

- Transparency and Education: The Marketplace provides a wealth of information and resources to help consumers understand their insurance options. This transparency empowers individuals to make informed choices and navigate the complex world of healthcare coverage.

Future Implications and Innovations

Looking ahead, the Health Insurance Marketplace in Utah is poised for further growth and innovation. As the state continues to implement strategies to improve healthcare access and affordability, the Marketplace will play a crucial role in shaping the future of healthcare in Utah. Here are some potential future developments:

- Expanded Coverage Options: Utah may explore partnerships with healthcare providers and insurance companies to offer innovative plans that cater to specific demographics or healthcare needs. This could include plans focused on mental health, dental care, or specialized medical treatments.

- Technology Integration: The Marketplace could leverage technology to enhance the consumer experience. This may involve implementing online portals for easier plan comparisons, streamlined enrollment processes, and personalized healthcare recommendations.

- Community Outreach: Utah may invest in community education initiatives to ensure that all residents, regardless of their background or financial status, understand the importance of healthcare coverage and how to access it through the Marketplace.

- Data-Driven Improvements: By analyzing consumer feedback and healthcare utilization data, the Marketplace can identify areas for improvement and implement targeted strategies to enhance plan offerings and consumer satisfaction.

Frequently Asked Questions

What is the enrollment deadline for the Health Insurance Marketplace in Utah for the upcoming year?

+The standard Open Enrollment Period for Utah's Health Insurance Marketplace typically ends on December 15th. However, it's important to note that this deadline may vary slightly from year to year. It's recommended to check the official website or contact the Marketplace directly for the most up-to-date information on enrollment deadlines.

Can I enroll in a health insurance plan outside of the Open Enrollment Period?

+Yes, you may be eligible for a Special Enrollment Period if you experience a qualifying life event, such as losing your job, getting married, or having a baby. These events allow you to enroll in a health insurance plan outside of the standard Open Enrollment Period. It's important to provide documentation to support your eligibility for a Special Enrollment Period.

How do I know if I qualify for premium tax credits or cost-sharing reductions?

+Premium tax credits and cost-sharing reductions are based on your household income and family size. You can use the official Health Insurance Marketplace website's eligibility calculator to determine if you qualify for these financial assistance programs. It's important to accurately report your income and family composition to ensure you receive the correct level of support.

Can I enroll in a health insurance plan if I have a pre-existing condition?

+Absolutely! One of the key benefits of the Health Insurance Marketplace is that insurance companies are prohibited from discriminating against individuals with pre-existing conditions. Whether you have a chronic illness, a previous injury, or a genetic condition, you have the right to enroll in a health insurance plan through the Marketplace. Your coverage and premiums will be the same as for any other enrollee.

The Health Insurance Marketplace in Utah continues to be a vital resource for residents seeking affordable and comprehensive healthcare coverage. With its range of plan options, consumer protections, and financial assistance programs, the Marketplace empowers individuals to take control of their healthcare and access the care they need. As the state moves forward, the Marketplace will undoubtedly play a pivotal role in shaping a healthier future for all Utahns.