Health Insurance For Business

Welcome to a comprehensive guide on health insurance for businesses. In today's complex healthcare landscape, providing effective health coverage to employees is not only a legal obligation but also a crucial aspect of attracting and retaining talent. This article aims to delve into the intricacies of health insurance, offering a deep understanding of its importance, types, selection process, and future trends for businesses of all sizes.

Understanding the Importance of Health Insurance for Businesses

Health insurance is a vital component of any business's benefits package. It not only ensures the well-being of employees but also significantly impacts a company's productivity, reputation, and overall success. Here's a closer look at why health insurance is indispensable for businesses:

1. Employee Well-being and Satisfaction

Providing comprehensive health insurance demonstrates an organization's commitment to its employees' physical and mental health. It enables employees to access necessary medical care, manage chronic conditions, and seek preventive services, leading to improved overall well-being. Satisfied and healthy employees are more engaged, productive, and loyal to the company.

2. Financial Protection for Employees

Health insurance acts as a safety net, protecting employees from the financial burden of medical expenses. By offering coverage, businesses ensure that their workforce can afford essential healthcare services without facing significant financial hardship. This financial security enhances employees' peace of mind and enables them to focus on their work without worrying about medical costs.

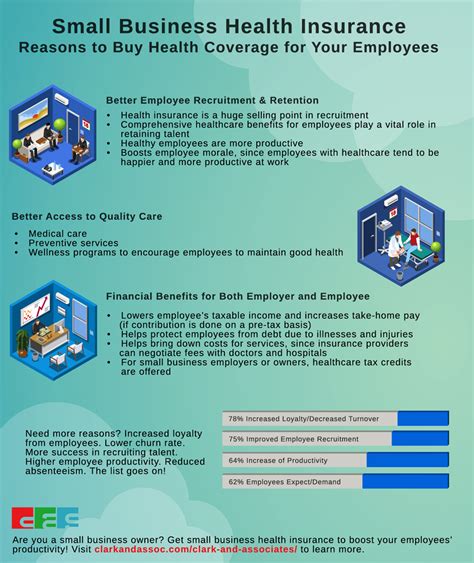

3. Talent Attraction and Retention

In today's competitive job market, offering competitive health insurance benefits is crucial for attracting top talent. Employees often prioritize companies that provide robust healthcare coverage, as it demonstrates a genuine concern for their welfare. Furthermore, providing comprehensive health insurance can significantly reduce employee turnover, as satisfied and secure employees are more likely to remain with the organization long-term.

4. Legal Compliance and Regulatory Requirements

Depending on the jurisdiction, businesses may be legally required to offer health insurance to their employees. Failure to comply with these regulations can result in significant penalties and legal complications. Staying informed about the latest health insurance mandates and ensuring compliance is essential for businesses to avoid legal pitfalls and maintain a positive relationship with regulatory bodies.

5. Improved Productivity and Business Performance

When employees have access to quality healthcare, they are more likely to maintain good health, which translates to reduced absenteeism and presenteeism (when employees are physically present but unproductive due to health issues). Additionally, health insurance encourages employees to seek early treatment for health concerns, preventing minor issues from becoming major health problems that could impact their productivity.

Types of Health Insurance for Businesses

Health insurance options for businesses can vary widely, depending on factors such as industry, location, and the specific needs of the workforce. Here's an overview of some common types of health insurance plans that businesses can consider:

1. Preferred Provider Organization (PPO) Plans

PPO plans offer employees the flexibility to choose from a network of healthcare providers, both in and out of network. While out-of-network care may be more expensive, employees are not required to obtain referrals for specialists. This type of plan provides a good balance between flexibility and cost-effectiveness, making it a popular choice for businesses.

2. Health Maintenance Organization (HMO) Plans

HMO plans typically require employees to select a primary care physician (PCP) from a network of providers. The PCP acts as a gatekeeper, referring employees to specialists within the network when necessary. HMO plans often have lower out-of-pocket costs compared to other plans, but employees may have limited flexibility in choosing providers.

3. Exclusive Provider Organization (EPO) Plans

EPO plans are similar to PPO plans in that they offer a network of providers, but they do not cover out-of-network care. Employees must choose providers within the network, and referrals are not typically required for specialists. EPO plans can be a cost-effective option for businesses, as they encourage employees to utilize in-network providers.

4. Point of Service (POS) Plans

POS plans combine elements of both PPO and HMO plans. Employees can choose to receive care from in-network or out-of-network providers, but the cost of care varies depending on the choice. POS plans often require employees to select a PCP and obtain referrals for specialist care. This type of plan offers flexibility while maintaining some cost control.

5. High Deductible Health Plans (HDHP) with Health Savings Accounts (HSAs)

HDHPs have higher deductibles than traditional plans, but they are often paired with Health Savings Accounts (HSAs) to provide tax advantages. Employees can contribute pre-tax dollars to their HSAs, which can be used to cover eligible medical expenses. HDHPs with HSAs can be an attractive option for businesses, as they offer cost savings and tax benefits for both the employer and employees.

Key Considerations for Selecting Health Insurance Plans

When choosing a health insurance plan for your business, there are several critical factors to consider. These factors will help ensure that the selected plan aligns with your company's goals and the needs of your employees. Here are some key considerations:

1. Cost and Budget

Health insurance plans can vary significantly in cost, and it's essential to select a plan that fits within your company's budget. Consider the premium costs, as well as any potential out-of-pocket expenses that employees may incur. Evaluate the balance between cost and the coverage provided to ensure that the plan offers value for money.

2. Coverage and Benefits

Examine the scope of coverage offered by different plans. Consider factors such as the range of medical services covered, prescription drug benefits, mental health coverage, and preventive care services. Ensure that the plan provides comprehensive coverage for the specific healthcare needs of your employees.

3. Network of Providers

Review the network of healthcare providers associated with each plan. Assess whether the plan's network includes preferred hospitals, specialists, and other providers that your employees frequently utilize. A robust network can ensure that employees have convenient access to quality healthcare services.

4. Employee Feedback and Preferences

Seek input from your employees regarding their healthcare needs and preferences. Conduct surveys or focus groups to understand their priorities, such as flexibility in choosing providers, coverage for specific conditions, or access to certain specialists. Involving employees in the selection process can lead to higher satisfaction and better plan utilization.

5. Administrative Simplicity and Technology

Evaluate the administrative aspects of different health insurance plans. Consider factors such as ease of enrollment, claim processing, and access to digital tools and resources. Plans that offer user-friendly platforms and streamlined processes can simplify the administration of health benefits for both employers and employees.

Future Trends in Health Insurance for Businesses

The landscape of health insurance is constantly evolving, and businesses need to stay informed about emerging trends to make informed decisions. Here are some key trends that are shaping the future of health insurance for businesses:

1. Focus on Preventive Care and Wellness

There is a growing emphasis on preventive care and employee wellness initiatives. Health insurance plans are increasingly incorporating wellness programs, offering incentives for employees to adopt healthier lifestyles. This trend aims to reduce long-term healthcare costs by preventing chronic diseases and promoting overall well-being.

2. Integration of Digital Health Solutions

The integration of digital health technologies is transforming the healthcare industry. Health insurance providers are leveraging telemedicine, mobile apps, and wearable devices to offer remote consultations, monitor health metrics, and provide personalized health recommendations. These digital solutions enhance access to care, improve convenience, and enable better health management for employees.

3. Emphasis on Value-Based Care

Value-based care models are gaining traction, shifting the focus from volume of services to the quality and outcomes of care. Health insurance plans are incentivizing providers to deliver high-quality, cost-effective care. This trend aims to improve patient outcomes, reduce unnecessary healthcare utilization, and lower overall healthcare costs for businesses.

4. Expansion of Mental Health Coverage

Mental health coverage is becoming a priority for health insurance plans. With increasing awareness about the importance of mental well-being, plans are expanding their coverage for mental health services, including therapy, counseling, and access to mental health professionals. This trend recognizes the critical role of mental health in overall employee health and productivity.

5. Rise of Consumer-Directed Health Plans

Consumer-directed health plans, such as Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs), are gaining popularity. These plans give employees more control over their healthcare spending and encourage them to make informed decisions about their health. The rise of consumer-directed plans reflects a shift towards personalized healthcare and financial responsibility.

FAQ

How can businesses choose the right health insurance plan for their employees?

+Businesses should consider factors such as cost, coverage, network of providers, employee feedback, and administrative simplicity. It’s crucial to evaluate plans based on their alignment with the specific needs and preferences of the workforce.

What are the potential benefits of offering high-quality health insurance to employees?

+Offering comprehensive health insurance can lead to improved employee well-being, satisfaction, and loyalty. It can also attract top talent, reduce absenteeism, and enhance overall business productivity and performance.

Are there any legal requirements for businesses to provide health insurance to their employees?

+Legal requirements vary by jurisdiction, but many countries and regions have laws mandating health insurance coverage for employees. It’s essential for businesses to stay informed about these regulations to ensure compliance.

How can businesses stay updated with the latest trends in health insurance?

+Businesses can stay informed by regularly reviewing industry publications, attending healthcare conferences and seminars, and collaborating with insurance brokers and consultants who specialize in healthcare.

What is the role of technology in the future of health insurance for businesses?

+Technology will play a crucial role in transforming health insurance, with a focus on telemedicine, digital health solutions, and personalized healthcare. These advancements will enhance access to care, improve convenience, and enable better health management for employees.