Health Insurance Companies Near Me

Finding the right health insurance coverage is an essential aspect of managing your healthcare and financial well-being. With numerous options available, it can be daunting to navigate the market and identify the health insurance companies that best suit your needs. In this comprehensive guide, we will explore the world of health insurance, delve into the offerings of prominent providers, and assist you in making informed decisions. Get ready to discover the top health insurance companies near you, tailored to your specific requirements.

Understanding the Landscape: Key Considerations for Health Insurance

Before diving into the specific companies, it's crucial to grasp the key factors that influence your health insurance choices. These considerations will guide you in selecting a plan that aligns with your health needs, budget, and preferences.

Coverage Options and Benefits

Health insurance plans offer a range of coverage options, including preventive care, hospitalization, prescription drugs, and specialty services. Assess your health needs and prioritize the benefits that are most important to you. Some plans may excel in certain areas, such as providing extensive coverage for mental health services or offering generous prescription drug discounts.

Network of Healthcare Providers

The network of healthcare providers associated with an insurance plan is a critical factor. Ensure that your preferred doctors, specialists, and hospitals are in-network to avoid higher out-of-pocket costs. Research the network size and verify if it includes your go-to healthcare facilities and professionals.

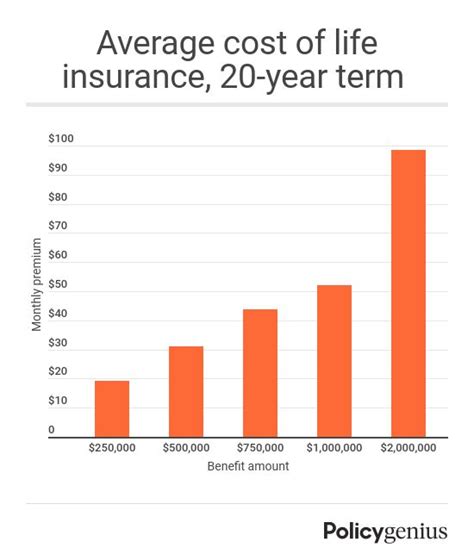

Cost and Premiums

Health insurance plans come with varying premium costs, deductibles, copays, and out-of-pocket maximums. Evaluate your budget and financial situation to determine the most suitable plan. While some plans may have lower monthly premiums, they might come with higher deductibles, affecting your overall healthcare expenses.

Plan Types and Flexibility

Health insurance plans are available in various types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type offers different levels of flexibility and coverage. Consider your lifestyle and travel habits to choose a plan that accommodates your needs. For instance, if you frequently travel, a PPO plan with out-of-network coverage might be more suitable.

Customer Service and Support

The quality of customer service and support provided by an insurance company is often overlooked but can significantly impact your experience. Look for companies with responsive customer service representatives, easy-to-use online portals, and comprehensive resources to guide you through the claims process and answer any questions.

Spotlight on Top Health Insurance Companies Near You

Now, let's shine a light on some of the leading health insurance companies in your region, highlighting their unique offerings and how they cater to diverse healthcare needs.

Company A: Focus on Innovation and Digital Health Solutions

Company A has established itself as a pioneer in the health insurance industry by embracing digital innovation. Their cutting-edge mobile app allows members to manage their health plans, access digital health records, and connect with healthcare providers seamlessly. With a strong emphasis on preventive care, Company A offers generous coverage for wellness programs and incentives for healthy lifestyle choices.

| Key Features | Details |

|---|---|

| Digital Health Platform | Comprehensive mobile app for plan management and access to digital health resources. |

| Preventive Care Incentives | Generous coverage and rewards for maintaining a healthy lifestyle. |

| Specialty Services | Excellent coverage for mental health, dental, and vision services. |

| Network Size | Extensive network with a focus on in-network care. |

Company B: Comprehensive Coverage and Personalized Plans

Company B stands out for its commitment to providing comprehensive coverage tailored to individual needs. With a wide range of plan options, from basic coverage to premium packages, they cater to a diverse clientele. Their personalized approach allows members to customize their plans, ensuring they receive the specific benefits they require. Company B's network includes top-rated hospitals and specialists, ensuring high-quality care.

| Key Features | Details |

|---|---|

| Personalized Plans | Customizable coverage options to suit individual health needs. |

| Comprehensive Coverage | Extensive range of plan options, including basic and premium packages. |

| Specialty Networks | Access to leading hospitals and specialists for high-quality care. |

| Member Rewards | Incentive programs for healthy lifestyle choices and regular check-ups. |

Company C: Value-Based Care and Affordable Options

Company C has gained recognition for its focus on value-based care, offering affordable insurance plans without compromising on quality. They prioritize preventive care and provide incentives for members to actively manage their health. With a strong emphasis on customer service, Company C ensures a seamless experience, making it an excellent choice for those seeking cost-effective coverage.

| Key Features | Details |

|---|---|

| Affordable Plans | Competitively priced insurance options without sacrificing quality. |

| Value-Based Care | Emphasis on preventive care and incentives for healthy habits. |

| Customer Service | Exceptional support and guidance throughout the insurance journey. |

| Digital Tools | User-friendly online platforms for plan management and resource access. |

Company D: Leading Provider for Specialized Healthcare Needs

Company D specializes in providing comprehensive coverage for individuals with complex or specialized healthcare needs. They excel in offering plans tailored to specific conditions, such as chronic illnesses or mental health disorders. With a network of specialized healthcare providers, Company D ensures members receive the expert care they require. Their plans often include additional benefits like telemedicine services and personalized care management.

| Key Features | Details |

|---|---|

| Specialized Plans | Customized coverage for individuals with complex healthcare needs. |

| Expert Networks | Access to top specialists and facilities for specialized care. |

| Additional Benefits | Telemedicine services, personalized care management, and wellness programs. |

| Financial Support | Assistance programs for individuals with high medical costs. |

Company E: Wellness-Focused Approach and Member Rewards

Company E takes a unique approach by placing a strong emphasis on wellness and preventive care. Their plans include generous coverage for wellness programs, fitness initiatives, and nutritional guidance. Members can earn rewards and discounts by actively participating in these programs and maintaining a healthy lifestyle. Company E's network includes a wide range of healthcare providers, ensuring convenient access to care.

| Key Features | Details |

|---|---|

| Wellness Programs | Extensive coverage for wellness initiatives and healthy lifestyle choices. |

| Member Rewards | Incentives and discounts for participating in wellness programs. |

| Comprehensive Network | Access to a diverse range of healthcare providers for convenient care. |

| Digital Tools | Mobile app for plan management and access to wellness resources. |

Expert Insights and Future Trends

The health insurance landscape is continually evolving, and staying informed about industry trends and developments is essential. Here are some insights from industry experts on the future of health insurance:

As the healthcare system adapts to technological advancements, we can anticipate further integration of digital health solutions. Health insurance companies are likely to invest in developing robust digital platforms, offering members convenient access to their health records, plan management tools, and telemedicine services.

Conclusion: Making Informed Choices

Navigating the health insurance market can be complex, but with the right information and understanding of your specific needs, you can make informed choices. Consider the key factors discussed, evaluate the offerings of the highlighted health insurance companies, and explore additional providers in your region. Remember, finding the right health insurance plan is a crucial step towards ensuring your long-term health and financial security.

Frequently Asked Questions

What is the average cost of health insurance plans in my area?

+The cost of health insurance plans can vary significantly based on your location, age, and the specific plan you choose. On average, monthly premiums in your region range from 300 to 600, with deductibles starting at $1,500. However, these figures can fluctuate, so it’s essential to compare plans and consider your budget.

Are there any government-funded health insurance options available?

+Yes, government-funded health insurance programs, such as Medicaid and Medicare, are available to eligible individuals. These programs offer affordable or no-cost coverage to low-income families, seniors, and individuals with disabilities. Check your eligibility and explore these options to access essential healthcare services.

How can I compare health insurance plans effectively?

+Comparing health insurance plans can be simplified by using online tools and resources. Websites like Healthcare.gov or HealthCare.com offer plan comparison features, allowing you to input your preferences and budget to narrow down suitable options. Additionally, seek guidance from insurance brokers or agents who can provide personalized recommendations.

What are some common challenges when choosing a health insurance plan?

+One common challenge is understanding the differences between plan types, such as HMOs and PPOs. Additionally, ensuring that your preferred healthcare providers are in-network can be complex. It’s crucial to thoroughly review plan details and reach out to providers to verify their network status.

Can I switch health insurance companies during the year?

+Switching health insurance companies during the year is typically possible during open enrollment periods, which occur annually. However, certain life events, such as losing your job or getting married, may qualify you for a special enrollment period, allowing you to switch plans outside of the open enrollment timeframe.