Health & Insurance

In today's world, where healthcare costs are rising and access to quality medical services is a growing concern, having a solid understanding of health insurance and its intricacies is more important than ever. This comprehensive guide aims to demystify the world of health and insurance, offering an in-depth analysis of the industry, its trends, and its impact on individuals and societies.

The Evolving Landscape of Health Insurance

Health insurance has evolved significantly over the years, adapting to the changing needs of individuals and the advancements in medical science. Once seen as a luxury, it has become an essential component of financial planning and overall well-being.

Understanding Health Insurance Basics

At its core, health insurance is a contractual agreement between an individual or group and an insurance company. The insured pays a premium, typically on a monthly basis, and in return, the insurance provider agrees to cover a portion or all of the costs associated with medical services. These services can range from routine check-ups and preventive care to specialized treatments and hospital stays.

The specific coverage and benefits provided by a health insurance plan can vary greatly. Factors such as the type of plan (e.g., HMO, PPO, EPO), the insurance provider, and the individual's or group's needs all play a role in determining the scope of coverage. For instance, some plans may focus heavily on preventive care, while others may offer more comprehensive coverage for specific conditions or treatments.

| Plan Type | Description |

|---|---|

| Health Maintenance Organization (HMO) | Emphasizes preventive care and typically requires members to select a primary care physician who coordinates their healthcare. |

| Preferred Provider Organization (PPO) | Offers more flexibility, allowing members to choose from a network of providers without a referral. Typically, out-of-network care is covered at a lower rate. |

| Exclusive Provider Organization (EPO) | Similar to a PPO, but members are usually not covered for out-of-network care unless it's an emergency situation. |

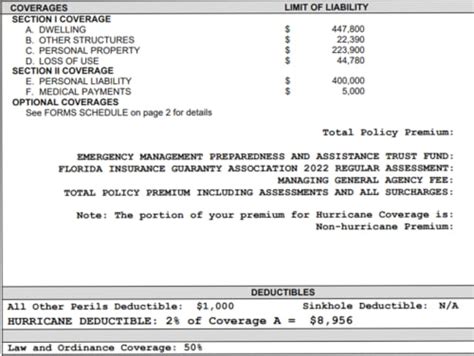

Health insurance plans also come with various cost-sharing mechanisms, such as deductibles, copayments, and coinsurance. A deductible is the amount an insured individual must pay out of pocket before the insurance coverage kicks in. Copayments are fixed amounts paid by the insured for a specific service, while coinsurance is a percentage of the total cost of a covered service that the insured is responsible for.

The Impact of Technology and Innovation

The health insurance industry has been significantly influenced by technological advancements and digital innovations. The rise of telemedicine, for instance, has revolutionized the way healthcare services are delivered and accessed. With telemedicine, individuals can now consult with healthcare professionals remotely, often via video calls or secure messaging platforms. This not only improves access to care, especially in rural or underserved areas, but also reduces the need for in-person visits, cutting down on transportation costs and time.

Furthermore, the integration of artificial intelligence (AI) and machine learning into the health insurance landscape is transforming the way claims are processed and risks are assessed. AI algorithms can analyze vast amounts of medical data, identify patterns, and make predictions, helping insurance companies streamline their operations and make more informed decisions. For instance, AI can assist in detecting fraudulent claims, improving the accuracy of risk assessments, and even personalizing insurance plans based on an individual's unique health profile and needs.

Navigating the Complex World of Health Insurance

With the plethora of health insurance options available, navigating the system can be daunting. It requires a careful consideration of one’s unique health needs, financial situation, and long-term goals. Here’s a closer look at some key aspects to consider when selecting a health insurance plan.

Evaluating Coverage and Benefits

When evaluating health insurance plans, it’s crucial to understand the specific coverage and benefits offered. This includes assessing the breadth of services covered, the quality of healthcare providers in the network, and the potential for out-of-network coverage. For instance, some plans may offer comprehensive coverage for prescription drugs, while others may have limited formularies or require higher copayments for certain medications.

Additionally, it's important to consider the plan's approach to chronic disease management and preventive care. Plans that offer robust coverage for preventive services, such as annual physicals, screenings, and immunizations, can be highly beneficial in maintaining overall health and potentially reducing future healthcare costs. Moreover, plans that provide support and resources for managing chronic conditions, such as diabetes or heart disease, can be invaluable for individuals with these conditions.

Understanding Cost-Sharing and Premium Payments

The cost-sharing mechanisms and premium payments associated with a health insurance plan are key factors to consider. While lower premiums may be appealing, they often come with higher deductibles, copayments, or coinsurance rates. It’s essential to strike a balance between affordable premiums and manageable out-of-pocket expenses, especially for those with ongoing medical needs or a higher likelihood of requiring medical services.

Additionally, it's important to understand the potential for cost-sharing to change over time. Some plans may have annual or lifetime maximums for out-of-pocket expenses, beyond which the insurance provider covers 100% of the costs. Others may have flexible cost-sharing structures that adjust based on the insured's healthcare utilization or financial situation.

The Role of Employer-Sponsored Plans

For many individuals, employer-sponsored health insurance plans are a significant part of their overall benefits package. These plans are often more comprehensive and cost-effective than individual plans, as employers can negotiate better rates due to the larger group size. Additionally, employer-sponsored plans may offer additional perks, such as flexible spending accounts (FSAs) or health savings accounts (HSAs), which can further reduce the insured’s out-of-pocket expenses.

However, it's important to note that employer-sponsored plans may have limitations. For instance, they typically require the employee to remain with the same employer to maintain coverage, and they may not offer the same level of flexibility as individual plans. Furthermore, the specific coverage and benefits can vary greatly depending on the employer and the plan selected.

The Future of Health Insurance: Trends and Predictions

The health insurance industry is continually evolving, and several key trends are shaping its future trajectory. These trends are driven by advancements in technology, changing demographics, and shifts in healthcare policy and regulation.

Personalized Medicine and Health Insurance

The concept of personalized medicine, where healthcare is tailored to an individual’s unique genetic makeup and health profile, is gaining traction. This approach has the potential to revolutionize the way health insurance plans are designed and offered. Insurance companies are increasingly leveraging genetic testing and other personalized health data to develop more targeted and effective coverage options.

For instance, an insurance provider may offer customized plans for individuals with a higher genetic risk for certain conditions, providing more comprehensive coverage and support for preventive measures and early interventions. This shift towards personalized insurance plans could lead to more efficient healthcare utilization and improved health outcomes.

The Rise of Value-Based Care Models

Value-based care models, which focus on delivering high-quality care while controlling costs, are becoming increasingly prevalent in the healthcare industry. These models reward healthcare providers for achieving positive patient outcomes rather than simply delivering a high volume of services. As value-based care gains traction, health insurance plans are likely to shift their focus towards supporting and incentivizing these models.

For instance, insurance companies may offer higher reimbursement rates for healthcare providers who consistently deliver high-quality care and achieve positive patient outcomes. They may also develop partnerships with healthcare organizations to improve the coordination and efficiency of care, leading to better patient experiences and potentially reduced costs.

The Impact of Healthcare Policy and Regulation

Healthcare policy and regulation play a significant role in shaping the health insurance landscape. Changes in government policies, such as the implementation or modification of laws like the Affordable Care Act (ACA) in the United States, can have far-reaching effects on the availability, affordability, and quality of health insurance coverage.

Additionally, global trends such as the aging population and the increasing prevalence of chronic diseases are putting pressure on healthcare systems worldwide. As a result, governments and insurance providers are exploring new strategies to manage costs and improve access to care. This may include the adoption of innovative payment models, the expansion of telemedicine services, and the promotion of health and wellness initiatives to prevent chronic conditions.

Conclusion: The Ever-Changing Health Insurance Landscape

The world of health insurance is dynamic and ever-evolving, shaped by technological advancements, demographic shifts, and policy changes. As individuals, it’s crucial to stay informed about the latest trends and developments in the industry to make informed decisions about our health and financial well-being. By understanding the intricacies of health insurance and staying engaged with the evolving landscape, we can better navigate the complex world of healthcare and ensure access to quality medical services when we need them most.

How do I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves careful consideration of your unique health needs, financial situation, and long-term goals. Start by evaluating the coverage and benefits offered by different plans, including the breadth of services covered, the quality of healthcare providers in the network, and the potential for out-of-network coverage. Consider your chronic conditions, if any, and the plan’s support for managing them. Assess the cost-sharing mechanisms and premium payments, aiming for a balance between affordable premiums and manageable out-of-pocket expenses. If you have access to employer-sponsored plans, evaluate the specific coverage and benefits they offer, as these plans often provide more comprehensive coverage and cost-effective options.

What is the role of deductibles, copayments, and coinsurance in health insurance plans?

+Deductibles, copayments, and coinsurance are cost-sharing mechanisms in health insurance plans. A deductible is the amount an insured individual must pay out of pocket before the insurance coverage kicks in. Copayments are fixed amounts paid by the insured for a specific service, while coinsurance is a percentage of the total cost of a covered service that the insured is responsible for. These mechanisms help distribute the financial risk between the insurance provider and the insured, influencing the overall cost and accessibility of healthcare services.

How is the future of health insurance likely to be shaped by technology and innovation?

+Technology and innovation are expected to play a significant role in shaping the future of health insurance. The integration of artificial intelligence (AI) and machine learning will likely enhance the efficiency and accuracy of claims processing and risk assessments. Telemedicine will continue to improve access to care, especially in underserved areas. Additionally, the concept of personalized medicine, where healthcare is tailored to an individual’s unique genetic makeup, is gaining traction and could lead to more targeted and effective insurance coverage options.