Groups Insurance

In today's fast-paced and dynamic world, where uncertainty and unforeseen circumstances can arise at any moment, the importance of having robust insurance coverage is undeniable. Whether it's safeguarding your health, protecting your assets, or ensuring the financial well-being of your loved ones, insurance plays a pivotal role in our lives. One often overlooked yet highly beneficial type of insurance is Groups Insurance, which offers a comprehensive range of coverage tailored specifically for groups and communities.

Understanding Groups Insurance: A Comprehensive Overview

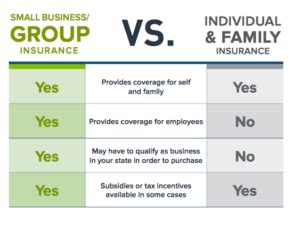

Groups Insurance, also known as group insurance plans or group policies, is a unique form of insurance designed to cater to the needs of groups, organizations, or even entire communities. Unlike traditional individual insurance policies, Groups Insurance provides a cost-effective and efficient way to ensure that a large number of people are adequately covered against various risks and uncertainties.

This type of insurance is particularly advantageous for employers, employee groups, and associations, as it offers a streamlined approach to providing insurance benefits to a large group of individuals. By pooling resources and negotiating group rates, Groups Insurance can often result in significant cost savings and enhanced coverage options compared to individual policies.

Key Features of Groups Insurance

Groups Insurance offers a multitude of benefits and features that make it an attractive option for both individuals and organizations. Here are some of the key characteristics and advantages of Groups Insurance:

- Cost-Effectiveness: One of the primary advantages of Groups Insurance is its ability to reduce costs for individuals within the group. By leveraging the group's collective bargaining power, insurance providers can offer more competitive rates and premiums. This cost-effectiveness is especially beneficial for small businesses or organizations with limited budgets, as it allows them to provide valuable insurance benefits to their employees or members without placing a significant financial burden on the group.

- Comprehensive Coverage: Groups Insurance policies are designed to provide a wide range of coverage options to address the diverse needs of the group. From health insurance and life insurance to disability coverage and even specialized policies for specific industries, Groups Insurance offers a comprehensive suite of benefits. This ensures that individuals within the group have access to the protection they need, whether it's safeguarding their health, providing financial security for their families, or protecting their livelihoods.

- Convenience and Streamlined Administration: Groups Insurance simplifies the insurance process by centralizing the administration and management of policies. Instead of each individual navigating the complex world of insurance on their own, the group's administrator or representative can handle the paperwork, enrollments, and claim processes on behalf of the entire group. This convenience not only saves time and effort but also ensures that all members of the group receive the same level of coverage and benefits.

- Flexibility and Customization: Insurance providers understand that every group is unique, and as such, Groups Insurance policies can be tailored to meet the specific needs and requirements of the organization. Whether it's adjusting coverage limits, adding or removing certain benefits, or incorporating additional riders, Groups Insurance offers a high degree of flexibility. This customization allows organizations to create insurance plans that align perfectly with their culture, values, and the unique risks they face.

- Community Building and Employee Satisfaction: Groups Insurance can foster a sense of community and camaraderie within an organization or group. By offering valuable insurance benefits, employers or association leaders demonstrate their commitment to the well-being of their employees or members. This can boost morale, improve job satisfaction, and enhance overall productivity. Additionally, Groups Insurance can provide a sense of security and peace of mind, knowing that the group is prepared for unforeseen circumstances and can support one another in times of need.

The Evolution of Groups Insurance: A Historical Perspective

The concept of Groups Insurance has its roots in the early 20th century when businesses began to recognize the importance of providing insurance benefits to their employees. The first group insurance policy was issued in 1911, marking a significant milestone in the history of insurance. Since then, Groups Insurance has evolved and expanded to cater to a wide range of groups and organizations, including small businesses, large corporations, unions, professional associations, and even social clubs.

Over the years, Groups Insurance has adapted to the changing needs and demands of society. With advancements in technology and a growing awareness of the importance of insurance, Groups Insurance policies have become more sophisticated and comprehensive. Today, Groups Insurance covers not only traditional health and life insurance but also offers innovative solutions such as critical illness coverage, long-term care insurance, and even pet insurance for groups of pet owners.

The Impact of Groups Insurance on Society

Groups Insurance has had a profound impact on society, playing a crucial role in promoting financial stability and security for individuals and communities. By providing access to affordable and comprehensive insurance coverage, Groups Insurance has helped bridge the gap between those with adequate protection and those who may otherwise struggle to obtain insurance. This has resulted in improved health outcomes, reduced financial strain during challenging times, and enhanced overall well-being for individuals and their families.

Furthermore, Groups Insurance has fostered a sense of community and solidarity. When individuals within a group are covered by the same insurance policy, it creates a shared sense of responsibility and support. This collective approach to insurance not only strengthens social bonds but also encourages a culture of mutual assistance and collaboration. In times of crisis or unexpected events, Groups Insurance can serve as a safety net, ensuring that the group as a whole can weather the storm together.

Groups Insurance in Action: Real-World Examples

To better understand the impact and benefits of Groups Insurance, let’s explore some real-world examples of how this type of insurance has made a difference in the lives of individuals and organizations.

Example 1: Small Business Insurance

Imagine a small startup company with a team of 20 employees. As a new business, the company’s budget is tight, and providing individual insurance policies to each employee may not be feasible. However, by opting for a Groups Insurance policy, the company can offer comprehensive health insurance coverage to its employees at a significantly reduced cost. This not only ensures that the employees have access to essential healthcare services but also boosts morale and loyalty within the company.

Furthermore, the Groups Insurance policy can be tailored to include additional benefits such as dental and vision coverage, disability insurance, and even life insurance. By providing a comprehensive benefits package, the company demonstrates its commitment to the well-being of its employees, attracting and retaining top talent in the process.

Example 2: Employee Benefits for Large Corporations

Large corporations often employ thousands of individuals, and providing insurance benefits to such a vast workforce can be a complex and expensive endeavor. However, Groups Insurance simplifies this process by offering a single policy that covers all employees. By leveraging their size and negotiating power, large corporations can secure favorable group rates, resulting in significant cost savings.

Additionally, Groups Insurance allows corporations to offer a diverse range of coverage options to their employees. From basic health insurance plans to specialized policies for high-risk occupations, Groups Insurance ensures that employees have the protection they need, regardless of their job role or personal circumstances. This comprehensive approach to employee benefits enhances employee satisfaction and retention, contributing to the overall success of the organization.

Example 3: Union and Association Insurance

Unions and professional associations play a vital role in advocating for the rights and well-being of their members. Groups Insurance provides an excellent opportunity for these organizations to fulfill their mission by offering insurance benefits to their members. By negotiating group rates, unions and associations can provide affordable insurance options to their members, ensuring they have access to quality healthcare, life insurance, and other essential coverage.

Moreover, Groups Insurance allows unions and associations to customize the insurance plans to meet the unique needs of their members. For example, a union representing construction workers may include additional coverage for occupational hazards, while a professional association for teachers may offer specialized insurance for educational professionals. This level of customization ensures that members receive insurance benefits that are tailored to their specific professions and circumstances.

The Future of Groups Insurance: Emerging Trends and Innovations

As the insurance industry continues to evolve, Groups Insurance is also undergoing exciting transformations and innovations. Here are some emerging trends and developments that are shaping the future of Groups Insurance:

- Digitalization and Online Platforms: With the increasing adoption of technology, Groups Insurance is embracing digital platforms and online tools to enhance the insurance experience. From online enrollment and policy management to digital claim submission and real-time updates, Groups Insurance is becoming more accessible and convenient for both administrators and policyholders. This digitalization not only streamlines the insurance process but also allows for greater transparency and efficiency.

- Wellness Programs and Incentives: Recognizing the importance of preventative care and healthy lifestyles, Groups Insurance providers are incorporating wellness programs and incentives into their policies. These programs may include discounts on gym memberships, incentives for healthy habits, and access to wellness resources. By promoting a culture of wellness within the group, insurance providers aim to reduce healthcare costs and improve overall health outcomes.

- Personalized Insurance Solutions: Groups Insurance is moving towards a more personalized approach, allowing individuals within the group to customize their insurance coverage based on their unique needs and preferences. This may include flexible benefit options, where employees can choose the coverage that best suits their circumstances, or even customizable deductibles and copayments. By offering personalized insurance solutions, Groups Insurance can better meet the diverse needs of individuals within the group.

- Telehealth and Remote Services: The rise of telehealth and remote healthcare services has revolutionized the way individuals access medical care. Groups Insurance providers are integrating telehealth options into their policies, enabling policyholders to consult with healthcare professionals remotely. This not only improves accessibility to healthcare services but also reduces costs associated with in-person visits. Additionally, remote services can be particularly beneficial for individuals living in rural areas or those with limited mobility.

- Data-Driven Analytics and Risk Management: With the advancements in data analytics and technology, Groups Insurance providers are leveraging data-driven insights to enhance risk management and claim processes. By analyzing large datasets and utilizing predictive analytics, insurance providers can identify trends, detect fraud, and improve the accuracy of risk assessments. This data-driven approach enables insurance providers to offer more tailored coverage options and efficient claim handling, ultimately benefiting the group as a whole.

Conclusion: The Power of Groups Insurance

Groups Insurance is a powerful tool that empowers individuals, organizations, and communities to take control of their financial well-being and prepare for unforeseen circumstances. By offering cost-effective, comprehensive coverage, Groups Insurance ensures that a large number of people have access to essential insurance benefits. Whether it’s protecting employees, supporting members of an association, or fostering a sense of community, Groups Insurance plays a vital role in our society.

As we move forward into an increasingly uncertain future, the importance of Groups Insurance will only continue to grow. With its ability to adapt to changing needs, incorporate technological advancements, and provide personalized solutions, Groups Insurance remains a dynamic and invaluable asset for individuals and organizations alike. By embracing the power of Groups Insurance, we can build a more resilient and secure future, one group at a time.

How does Groups Insurance benefit small businesses?

+Groups Insurance is particularly advantageous for small businesses as it allows them to offer comprehensive insurance benefits to their employees at a reduced cost. By pooling resources with other small businesses or organizations, they can negotiate group rates and provide valuable coverage without placing a significant financial burden on the company.

Can Groups Insurance be customized to meet specific needs?

+Absolutely! One of the key strengths of Groups Insurance is its flexibility and customization options. Insurance providers work closely with groups to understand their unique needs and requirements. Whether it’s adjusting coverage limits, adding specialized riders, or incorporating industry-specific coverage, Groups Insurance policies can be tailored to perfectly align with the group’s culture and values.

How does Groups Insurance impact employee satisfaction and retention?

+Groups Insurance plays a vital role in boosting employee satisfaction and retention. By offering comprehensive insurance benefits, employers demonstrate their commitment to the well-being of their workforce. This not only improves job satisfaction and morale but also attracts and retains top talent. Employees feel valued and supported, knowing that their employer cares about their financial security and overall health.