Grange Insurance

Grange Insurance: Protecting What Matters Most

In the world of insurance, Grange Insurance stands as a prominent name, offering comprehensive coverage solutions tailored to meet the diverse needs of individuals and businesses alike. With a rich history spanning decades, this company has solidified its position as a trusted provider, delivering reliable insurance services to customers across the United States.

But what sets Grange Insurance apart from its competitors? How has it evolved to adapt to the ever-changing insurance landscape? And most importantly, how can individuals and businesses benefit from the array of insurance products and services it offers? This article aims to provide a detailed exploration of Grange Insurance, shedding light on its history, product offerings, customer experience, and future prospects.

A Legacy of Innovation: The History of Grange Insurance

The story of Grange Insurance dates back to the early 20th century, specifically to the year 1935. Founded by a group of Ohio farmers, the company's initial mission was to provide affordable insurance coverage to farmers and rural communities. This noble endeavor was driven by the belief that insurance should be accessible to all, regardless of their socioeconomic status.

Over the years, Grange Insurance experienced significant growth, expanding its reach beyond Ohio and branching out into various insurance sectors. The company's commitment to innovation and customer satisfaction has been instrumental in its success. By embracing technological advancements and staying abreast of industry trends, Grange Insurance has consistently delivered cutting-edge insurance solutions to its customers.

A Comprehensive Range of Insurance Products

One of the key strengths of Grange Insurance lies in its diverse product portfolio, catering to a wide array of insurance needs. Whether you're an individual seeking personal coverage or a business owner looking for comprehensive protection, Grange Insurance has tailored solutions to meet your specific requirements.

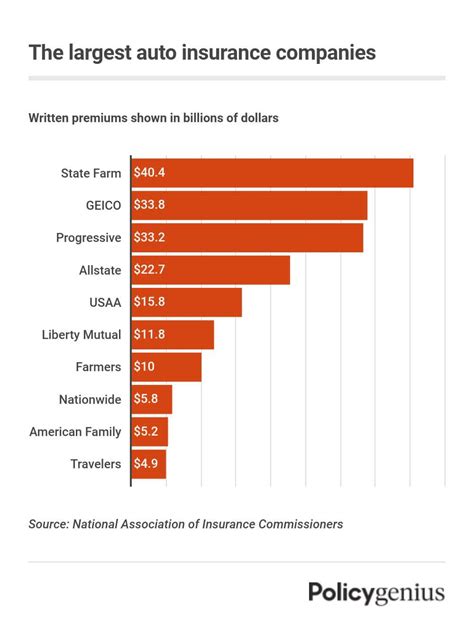

Auto Insurance

Grange Insurance offers a range of auto insurance policies designed to protect your vehicle and provide peace of mind while on the road. From comprehensive coverage that safeguards against damages caused by accidents, theft, or natural disasters to liability insurance that covers injuries and property damage caused to others, Grange Insurance ensures you have the necessary protection.

| Policy Type | Coverage Highlights |

|---|---|

| Comprehensive | Collision, theft, natural disasters, and vandalism |

| Liability | Bodily injury and property damage liability |

| Personal Injury Protection | Medical expenses and lost wages for the policyholder |

| Uninsured/Underinsured Motorist | Coverage for accidents involving uninsured or underinsured drivers |

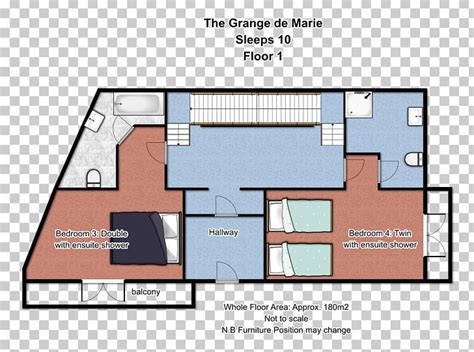

Homeowners Insurance

As a homeowner, you need protection for your home and its contents. Grange Insurance provides a range of homeowners insurance policies tailored to your specific needs. From coverage for your home’s structure to personal belongings and liability protection, Grange Insurance ensures you’re adequately insured.

| Coverage Type | Key Features |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home |

| Personal Property | Covers the cost of replacing personal belongings |

| Liability Protection | Provides coverage for legal expenses and damages arising from accidents or injuries on your property |

| Additional Living Expenses | Covers temporary living expenses if your home becomes uninhabitable due to a covered loss |

Life Insurance

Grange Insurance understands the importance of protecting your loved ones and securing their financial future. Its life insurance policies offer peace of mind, ensuring that your family is provided for in the event of your untimely demise. With a range of term and permanent life insurance options, Grange Insurance allows you to choose a policy that aligns with your specific needs and budget.

Business Insurance

For business owners, Grange Insurance provides a comprehensive suite of commercial insurance products. From general liability insurance to protect against third-party claims to property insurance for your business premises and contents, Grange Insurance ensures your business is safeguarded against potential risks.

| Business Insurance Type | Coverage Highlights |

|---|---|

| General Liability | Covers bodily injury, property damage, and personal injury claims |

| Commercial Property | Protects your business premises and its contents against damage or loss |

| Business Interruption | Provides financial support during periods when your business is unable to operate due to a covered loss |

| Workers' Compensation | Covers medical expenses and lost wages for employees injured on the job |

The Grange Insurance Customer Experience

At the heart of Grange Insurance's success is its unwavering commitment to delivering an exceptional customer experience. The company understands that insurance can be complex, and it strives to simplify the process for its customers. From the moment you engage with Grange Insurance, you'll benefit from personalized service, expert guidance, and a seamless digital experience.

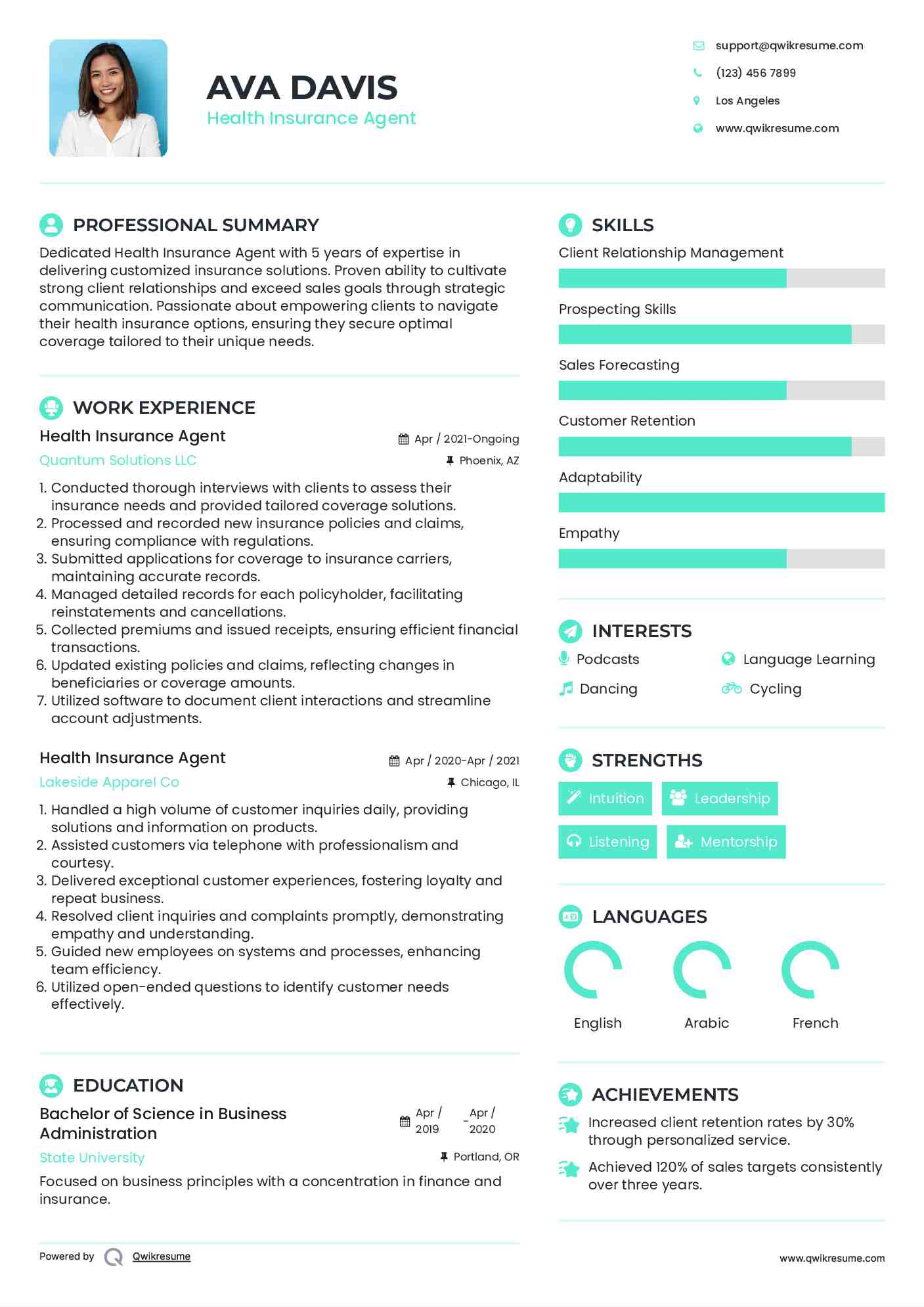

Personalized Service

Grange Insurance prides itself on providing tailored insurance solutions that meet the unique needs of each customer. Whether you’re a first-time insurance buyer or a seasoned policyholder, the company’s experienced agents take the time to understand your circumstances and recommend the most suitable coverage options. With a focus on personalized service, Grange Insurance ensures that you receive the right level of protection without unnecessary costs.

Digital Convenience

In today’s fast-paced world, convenience is a priority. Grange Insurance recognizes this and has invested in a robust digital platform to enhance the customer experience. Through its user-friendly website and mobile app, customers can easily access their policy information, make payments, file claims, and even receive real-time updates on the status of their claims. The digital tools provided by Grange Insurance empower customers to manage their insurance needs efficiently and conveniently.

Claim Support

When it comes to claims, Grange Insurance excels in providing prompt and efficient support. The company understands that a claim can be a stressful experience, and it aims to alleviate this burden by offering a seamless and transparent claims process. With a dedicated claims team, Grange Insurance ensures that customers receive timely assistance, accurate assessments, and fair settlements. The company’s commitment to customer satisfaction is evident in its efficient claims handling process.

Industry Recognition and Future Prospects

Grange Insurance's dedication to excellence has not gone unnoticed. The company has received numerous accolades and industry recognition for its outstanding performance and customer satisfaction. Some of the notable awards and achievements include:

- J.D. Power Award for Outstanding Customer Satisfaction

- National Insurance Producer Registry (NIPR) Innovation Award

- A.M. Best Financial Strength Rating of A- (Excellent)

Looking ahead, Grange Insurance is well-positioned for continued growth and success. The company's focus on innovation, customer-centricity, and digital transformation ensures that it remains at the forefront of the insurance industry. With a strong foundation built on trust, reliability, and a customer-first approach, Grange Insurance is poised to deliver even more value to its customers in the years to come.

Conclusion

Grange Insurance has established itself as a trusted partner for individuals and businesses seeking comprehensive insurance coverage. With a rich history, a diverse product portfolio, and a customer-centric approach, the company has earned its reputation as a leading insurance provider. Whether you're looking for auto, homeowners, life, or business insurance, Grange Insurance offers tailored solutions that provide the protection and peace of mind you deserve.

As you navigate the complex world of insurance, consider Grange Insurance as your partner in safeguarding what matters most. With its commitment to innovation, personalized service, and customer satisfaction, Grange Insurance is dedicated to helping you protect your future and secure your financial well-being.

How can I obtain a quote for Grange Insurance products?

+Obtaining a quote for Grange Insurance products is a straightforward process. You can start by visiting the company’s official website and using the online quote tool. Simply provide some basic information about yourself and your insurance needs, and you’ll receive a personalized quote. Alternatively, you can reach out to a licensed Grange Insurance agent who can guide you through the process and provide tailored recommendations.

What sets Grange Insurance apart from other insurance providers?

+Grange Insurance stands out for its commitment to personalized service and customer satisfaction. The company takes the time to understand your unique needs and provides tailored insurance solutions accordingly. Additionally, Grange Insurance’s focus on innovation and digital transformation ensures that customers benefit from a seamless and convenient experience throughout their insurance journey.

Is Grange Insurance financially stable and reliable?

+Absolutely! Grange Insurance has a strong financial foundation and has consistently demonstrated its stability and reliability. The company holds an A- (Excellent) Financial Strength Rating from A.M. Best, which is a testament to its ability to meet its financial obligations and provide long-term security to its policyholders. This rating provides assurance to customers that their insurance investments are safe and protected.