Get Insurance Quote Car

In today's fast-paced world, ensuring the safety and security of your possessions, especially your vehicle, is of utmost importance. Obtaining an insurance quote for your car is a crucial step in this process, as it provides you with the necessary information to make informed decisions about your coverage. This comprehensive guide will delve into the intricacies of getting an insurance quote for your car, offering expert advice and insights to help you navigate the process with ease.

Understanding the Need for Car Insurance

Car insurance is a vital financial safeguard that protects you and your vehicle in the event of accidents, theft, or other unforeseen circumstances. It provides a sense of security and peace of mind, knowing that you are covered for potential expenses and liabilities. In many regions, having valid car insurance is also a legal requirement, making it an essential aspect of responsible vehicle ownership.

When it comes to obtaining an insurance quote, several factors come into play. These factors influence the premium you will pay and the level of coverage you can expect. Let's explore these elements in detail.

Factors Influencing Your Insurance Quote

1. Personal Information

Your personal details, such as age, gender, and driving history, play a significant role in determining your insurance quote. Insurance providers assess your risk profile based on these factors. For instance, younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk of accidents. Similarly, a clean driving record with no accidents or traffic violations can lead to more favorable quotes.

| Personal Factor | Impact on Quote |

|---|---|

| Age | Younger drivers may face higher premiums. |

| Gender | Gender can influence quotes in some regions. |

| Driving History | A clean record can result in lower premiums. |

2. Vehicle Details

The type of car you drive and its specifications are crucial factors. High-performance vehicles, sports cars, and luxury models often attract higher insurance costs due to their increased risk of accidents and higher repair expenses. On the other hand, smaller, more economical cars with standard safety features may result in more affordable quotes.

| Vehicle Factor | Impact on Quote |

|---|---|

| Make and Model | Luxury and sports cars may have higher premiums. |

| Age of Vehicle | Newer cars often require higher coverage. |

| Safety Features | Advanced safety systems can reduce premiums. |

3. Coverage Options

The level of coverage you choose is a significant determinant of your insurance quote. Different coverage options provide varying levels of protection, and the more comprehensive your coverage, the higher the premium. It’s essential to strike a balance between the coverage you need and the cost you can afford.

- Liability Coverage: This is the basic level of coverage, protecting you against claims for bodily injury or property damage caused by you to others.

- Collision Coverage: This option covers the cost of repairing or replacing your vehicle if it's damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects against damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Additional Coverages: Depending on your needs, you may opt for add-ons like rental car reimbursement, roadside assistance, or coverage for specific equipment like sound systems.

4. Location and Usage

Your geographical location and how you use your vehicle can also impact your insurance quote. Areas with higher crime rates or a history of frequent accidents may result in higher premiums. Similarly, if you use your car for business purposes or drive long distances regularly, your quote may be affected.

5. Deductibles and Discounts

Choosing a higher deductible (the amount you pay out of pocket before insurance coverage kicks in) can reduce your premium. Additionally, many insurance providers offer discounts for various reasons, such as safe driving records, loyalty, or bundling multiple policies with the same insurer.

The Process of Getting an Insurance Quote

Obtaining an insurance quote for your car is a straightforward process, thanks to the availability of online tools and resources. Here’s a step-by-step guide to help you navigate the process seamlessly.

1. Gather Necessary Information

Before you begin, ensure you have the following details ready:

- Personal information: Your name, date of birth, driver's license number, and social security number (if applicable)

- Vehicle details: Make, model, year, vehicle identification number (VIN), and estimated annual mileage

- Driving history: Any accidents, traffic violations, or claims made in the past few years

- Current or previous insurance: Details of your current or previous insurer, policy number, and coverage limits

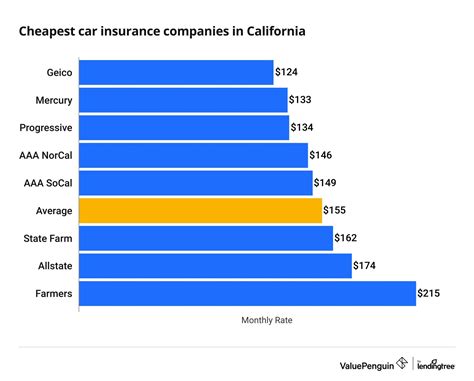

2. Compare Multiple Quotes

It’s advisable to compare quotes from several insurance providers to find the best deal. You can use online comparison tools or directly visit the websites of major insurers. Provide the requested information accurately to ensure you receive precise quotes.

3. Understand the Quote

When you receive a quote, carefully review the coverage details and the associated costs. Ensure you understand the coverage limits, deductibles, and any exclusions or limitations. Don’t hesitate to ask questions if any part of the quote is unclear.

4. Consider Additional Options

While comparing quotes, explore the various coverage options and additional benefits offered by each insurer. Consider your specific needs and budget to determine the most suitable coverage for your situation.

5. Finalize Your Choice

Once you’ve found a quote that meets your needs and budget, you can proceed to purchase the insurance policy. Follow the instructions provided by the insurer to complete the application process and secure your coverage.

Tips for Getting the Best Insurance Quote

To ensure you get the most competitive insurance quote for your car, consider the following expert tips:

- Shop around: Compare quotes from multiple insurers to find the best deal.

- Maintain a clean driving record: A history of safe driving can lead to lower premiums.

- Choose a higher deductible: Opting for a higher deductible can reduce your overall premium.

- Bundle policies: Combining your car insurance with other policies, such as home or renters' insurance, can result in discounts.

- Explore discounts: Many insurers offer discounts for various reasons, such as safe driving, loyalty, or belonging to specific organizations. Inquire about these discounts to maximize your savings.

Conclusion: Making Informed Decisions

Getting an insurance quote for your car is a critical step in ensuring the protection and security of your vehicle. By understanding the factors that influence your quote and following the outlined process, you can make informed decisions about your coverage. Remember, car insurance is an essential investment that provides peace of mind and financial protection in the face of unforeseen circumstances.

FAQs

How often should I review my car insurance policy and quotes?

+It’s recommended to review your car insurance policy and quotes annually, especially when your policy is up for renewal. This allows you to stay updated with any changes in your personal circumstances, vehicle details, or coverage needs. Additionally, reviewing quotes regularly can help you identify opportunities to save money or enhance your coverage.

Can I get an insurance quote without providing my social security number?

+In most cases, providing your social security number is not mandatory when obtaining an insurance quote. However, some insurers may request it to perform a more thorough assessment of your risk profile. You can choose to skip providing this information initially and proceed with the quote process. If your social security number is required later, you can decide whether to proceed or explore other insurers.

What happens if I have a gap in my insurance coverage?

+Having a gap in your insurance coverage can be a concern, especially if you are involved in an accident during that period. In such cases, you may be held personally liable for any damages or injuries caused. It’s crucial to maintain continuous insurance coverage to avoid such situations and ensure you are protected at all times.