Genereal Insurance

Welcome to an in-depth exploration of General Insurance, a fundamental aspect of risk management and financial protection. In today's world, where unforeseen events can have significant financial implications, understanding the intricacies of insurance is crucial. This article aims to delve into the world of General Insurance, providing a comprehensive guide to its principles, applications, and importance in our daily lives.

The Essence of General Insurance

General Insurance, often referred to as non-life or property and casualty insurance, is a broad category encompassing various types of insurance policies that protect against potential losses other than those arising from life insurance or health insurance. It serves as a safeguard against financial risks associated with everyday life, offering coverage for a wide range of assets and liabilities.

A Diverse Portfolio of Policies

The realm of General Insurance is vast, comprising an array of policies tailored to different needs. Here’s an overview of some key types:

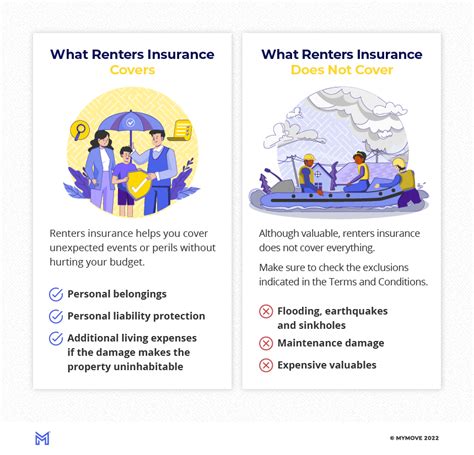

- Property Insurance: This category includes policies like home insurance, covering damages to residential properties, and commercial property insurance, which protects businesses against property-related risks.

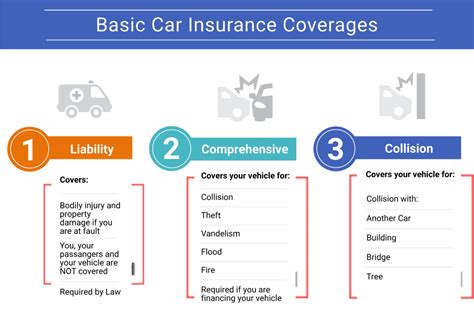

- Motor Insurance: An essential form of protection, motor insurance covers vehicles such as cars, motorcycles, and trucks, providing financial coverage in the event of accidents or theft.

- Liability Insurance: Designed to protect individuals and businesses from legal liabilities, this type of insurance is crucial for professionals and those engaged in high-risk activities.

- Travel Insurance: A popular choice for travelers, this policy provides coverage for medical emergencies, trip cancellations, lost luggage, and other travel-related risks.

- Marine Insurance: With a focus on maritime activities, marine insurance covers cargo, ships, and other marine assets, ensuring financial security for those involved in sea trade and transportation.

- Crop Insurance: Specifically tailored for agricultural needs, crop insurance safeguards farmers against potential losses due to adverse weather conditions, pests, or other natural disasters.

| Insurance Type | Coverage |

|---|---|

| Property Insurance | Residential and commercial properties |

| Motor Insurance | Vehicles and road-related risks |

| Liability Insurance | Legal and professional liabilities |

| Travel Insurance | Medical, trip, and luggage-related risks |

| Marine Insurance | Maritime assets and sea trade |

| Crop Insurance | Agricultural risks and weather-related damages |

The Benefits and Applications

General Insurance policies provide numerous benefits and applications, making them an indispensable tool for financial security and peace of mind. Let’s explore some key advantages and real-world scenarios where General Insurance plays a vital role.

Financial Protection and Peace of Mind

One of the primary benefits of General Insurance is the financial protection it offers. In the face of unexpected events, such as a house fire, a car accident, or a medical emergency during travel, having the right insurance policy can provide significant financial relief. It ensures that policyholders are not left with overwhelming costs and can recover more quickly.

For instance, consider a small business owner who invests in liability insurance. This policy safeguards the business against potential lawsuits, providing coverage for legal fees and any damages awarded. In an industry where accidents or product defects can lead to costly legal battles, this insurance becomes a vital safeguard, allowing the business to continue operations without financial strain.

Risk Mitigation and Management

General Insurance plays a crucial role in risk mitigation and management. By identifying potential risks and purchasing appropriate insurance coverage, individuals and businesses can minimize the financial impact of adverse events. This proactive approach to risk management allows for better planning and preparedness.

Take the example of a farmer who invests in crop insurance. By understanding the potential risks associated with farming, such as droughts or pest infestations, the farmer can secure insurance coverage. In the event of a crop failure due to adverse weather conditions, the insurance policy provides financial support, helping the farmer recover and continue operations.

Encouraging Innovation and Growth

General Insurance is not just about risk coverage; it also plays a role in fostering innovation and economic growth. By providing a safety net, insurance policies encourage individuals and businesses to take calculated risks, knowing that they have a financial backup. This promotes entrepreneurial ventures, new business initiatives, and technological advancements.

Consider the case of a tech startup developing a cutting-edge product. With the right liability and product insurance in place, the startup can focus on innovation and market penetration without constant worry about potential liabilities. The insurance policy acts as a catalyst for growth, allowing the startup to pursue its vision confidently.

The Importance of Tailored Solutions

While General Insurance offers a wide range of policies, it is crucial to understand that each individual or business has unique needs. A one-size-fits-all approach may not provide adequate coverage. This is where the expertise of insurance professionals becomes invaluable.

Understanding Individual Needs

Insurance brokers and agents play a vital role in guiding individuals and businesses toward the most suitable insurance policies. By conducting a thorough assessment of the client’s needs, risks, and potential liabilities, these professionals can recommend tailored solutions.

For instance, a homeowner with valuable artwork may require additional coverage beyond a standard home insurance policy. An insurance broker can advise on specialty insurance for fine arts, ensuring that the homeowner's unique assets are adequately protected.

Customized Risk Assessment

Every business operates in a unique environment with its own set of risks. A construction company, for example, faces different challenges compared to a software development firm. General Insurance policies must be customized to address these specific risks.

A construction company may require a combination of liability insurance, workers' compensation, and equipment insurance. An insurance expert can guide the company in selecting the right policies, ensuring that all potential risks are covered, from on-site accidents to equipment theft.

The Future of General Insurance

As technology advances and the world becomes increasingly interconnected, the landscape of General Insurance is evolving. New risks emerge, and traditional insurance models are being reimagined to meet the changing needs of policyholders.

Emerging Trends and Innovations

The insurance industry is embracing digital transformation, leveraging technology to enhance efficiency and customer experience. Online platforms and mobile apps are making it easier for individuals to compare policies, obtain quotes, and manage their insurance portfolios.

Additionally, the rise of parametric insurance is gaining traction. This innovative approach to insurance pays out based on predefined parameters, such as wind speed or rainfall, rather than waiting for an actual loss to occur. It offers a faster and more efficient claims process, particularly for natural disaster-related risks.

Adapting to Changing Needs

The future of General Insurance lies in its ability to adapt to evolving risks and changing consumer expectations. With the rise of climate change and extreme weather events, insurance policies will need to address these new realities.

For instance, insurance companies are developing climate-resilient policies that provide coverage for specific climate-related risks, such as flooding or extreme heat. These policies aim to protect policyholders and encourage resilience and adaptation in the face of a changing climate.

What is the difference between General Insurance and Life Insurance?

+General Insurance, or non-life insurance, covers a wide range of risks other than those associated with life or health. It includes policies like property, motor, liability, and travel insurance. On the other hand, Life Insurance focuses solely on providing financial protection to the policyholder's beneficiaries upon their death, ensuring a financial safety net for loved ones.

How does General Insurance benefit businesses?

+General Insurance offers businesses a crucial layer of protection against various risks. It can cover property damage, legal liabilities, and business interruption, ensuring financial stability and continuity. By mitigating risks, businesses can focus on growth and innovation without the fear of financial ruin.

What are some common misconceptions about General Insurance?

+One common misconception is that General Insurance is unnecessary or an unnecessary expense. However, it provides essential financial protection against unforeseen events. Another misconception is that all policies are the same; in reality, insurance policies must be tailored to individual needs to provide adequate coverage.

In conclusion, General Insurance is a vital component of our financial landscape, offering protection and peace of mind in an uncertain world. By understanding the diverse range of policies, their benefits, and the importance of tailored solutions, individuals and businesses can make informed decisions to safeguard their assets and future.