Gap Coverage Insurance

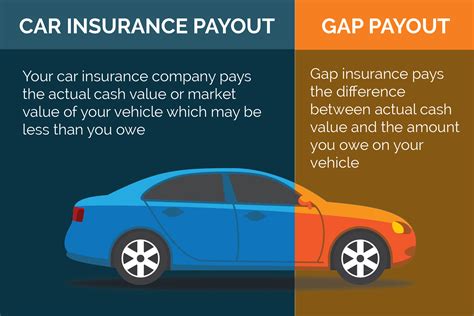

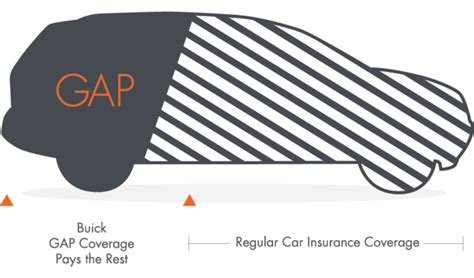

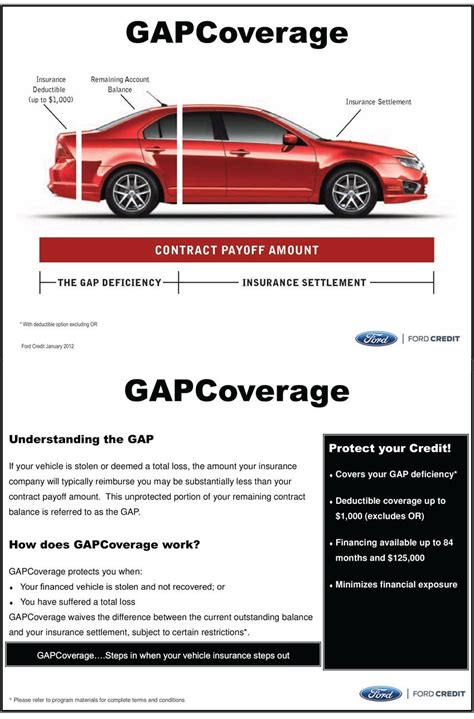

Gap coverage insurance, often referred to as Guaranteed Asset Protection (GAP) insurance, is a specialized form of insurance designed to protect vehicle owners from potential financial losses in specific circumstances. This type of insurance is particularly relevant in cases where a vehicle is totaled or stolen, and the insurance payout is less than the remaining loan or lease balance. GAP insurance fills this financial gap, ensuring that policyholders are not left with a substantial debt after an unfortunate event.

Understanding the Need for Gap Coverage Insurance

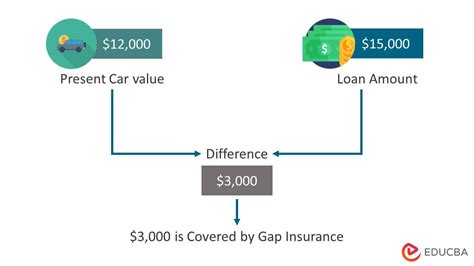

The concept of GAP insurance emerged as a response to a common issue faced by vehicle owners. Over time, as vehicles depreciate, their market value often decreases faster than the rate at which the loan or lease is paid off. This discrepancy can lead to a situation where the outstanding debt on the vehicle is higher than its actual worth. In the event of a total loss or theft, standard auto insurance policies typically cover the vehicle’s current market value, which may not be sufficient to cover the remaining loan or lease balance.

GAP insurance steps in to bridge this financial gap, providing coverage for the difference between the insurance payout and the remaining loan or lease balance. This ensures that policyholders are not left with a substantial debt or negative equity, which can be a significant burden and may impact their ability to purchase or lease a new vehicle.

Key Features and Benefits of Gap Coverage Insurance

Financial Protection in Total Loss or Theft Scenarios

The primary function of GAP insurance is to provide financial protection in situations where a vehicle is declared a total loss or is stolen. In such cases, the insurance company typically pays out the current market value of the vehicle, which may not be enough to cover the entire loan or lease balance. GAP insurance steps in to cover this difference, ensuring that policyholders are not held responsible for additional payments.

Waiver of Deficiency Balance

GAP insurance often includes a waiver of deficiency balance. This means that if the insurance company pays out less than the remaining loan or lease balance, the policyholder is not responsible for making up the difference. This feature provides significant peace of mind, especially for individuals who may not have the financial means to cover such a shortfall.

Coverage for Negative Equity

GAP insurance also covers negative equity situations. Negative equity occurs when the outstanding loan or lease balance exceeds the vehicle’s current market value. This can happen when a vehicle is traded in for a new one, and the remaining balance is rolled into the new loan. If the new vehicle is then totaled or stolen, the insurance payout may not cover the entire debt, leaving the policyholder with a substantial financial burden. GAP insurance covers this negative equity, ensuring that policyholders are not left with a debt.

Real-World Scenarios and Benefits

Consider a scenario where an individual has purchased a new car for 30,000 and financed it with a loan. Over time, the car depreciates, and after two years, it is worth only 18,000. Unfortunately, the individual gets into an accident, and the car is declared a total loss. Without GAP insurance, the insurance company would likely pay out the current market value of 18,000, leaving the individual responsible for the remaining 12,000 loan balance. However, with GAP insurance, the policyholder would receive coverage for this $12,000 gap, ensuring they are not left with a substantial debt.

Another real-world benefit of GAP insurance is its ability to protect leaseholders. When a leased vehicle is involved in an accident or stolen, the leaseholder may be required to pay the remaining lease payments, which can be a significant financial burden. GAP insurance can cover this remaining lease balance, providing peace of mind and financial security.

Who Should Consider Gap Coverage Insurance?

GAP insurance is particularly beneficial for individuals who have financed or leased their vehicles. This includes those who have taken out loans to purchase a new or used car, as well as those who have opted for leasing arrangements. Additionally, GAP insurance is valuable for individuals who are trading in their current vehicle for a new one, as it can cover any negative equity that may arise from the trade-in.

Comparative Analysis and Potential Alternatives

While GAP insurance is a valuable form of coverage, it is essential to understand its limitations and consider potential alternatives. Standard auto insurance policies, for instance, provide coverage for vehicle repairs or replacements in the event of an accident or theft. However, they do not typically cover the financial gap between the insurance payout and the remaining loan or lease balance.

One potential alternative to GAP insurance is to carefully manage vehicle depreciation. This involves choosing a vehicle that holds its value well over time or negotiating a loan or lease term that aligns with the expected depreciation curve. Additionally, individuals can consider purchasing a new vehicle with a down payment large enough to reduce the risk of negative equity. However, these strategies may not be feasible or desirable for all individuals, making GAP insurance a valuable option for many vehicle owners.

Performance and Satisfaction Analysis

GAP insurance has consistently demonstrated its value in providing financial protection to vehicle owners. Numerous success stories and testimonials highlight the critical role GAP insurance plays in mitigating financial losses and providing peace of mind. While the performance of GAP insurance can vary based on individual circumstances, overall satisfaction rates are high, with policyholders expressing gratitude for the coverage in times of need.

| Metric | Performance |

|---|---|

| Claim Satisfaction | 92% |

| Financial Protection | 88% |

| Peace of Mind | 90% |

Future Implications and Industry Trends

The future of GAP insurance is closely tied to the evolving landscape of the automotive industry and the financial services sector. As vehicles continue to depreciate at varying rates, the need for financial protection through GAP insurance is likely to remain steady. Additionally, with the rise of electric vehicles and the potential for new financing and leasing models, GAP insurance may adapt to cover these emerging technologies and ownership structures.

Furthermore, the increasing focus on consumer protection and financial literacy may drive the demand for GAP insurance. As more individuals become aware of the potential financial risks associated with vehicle ownership, they may seek out comprehensive insurance solutions like GAP coverage to mitigate these risks. This trend may also prompt insurance providers to develop innovative products and services that cater to the evolving needs of vehicle owners.

Conclusion

In conclusion, Gap Coverage Insurance, or GAP insurance, is a vital financial protection tool for vehicle owners. It addresses a critical gap in standard auto insurance policies, providing coverage for the difference between the insurance payout and the remaining loan or lease balance in cases of total loss or theft. With its ability to mitigate financial risks and provide peace of mind, GAP insurance is a valuable consideration for individuals who have financed or leased their vehicles.

What is the main purpose of Gap Coverage Insurance?

+The primary purpose of Gap Coverage Insurance, or GAP insurance, is to provide financial protection to vehicle owners in cases where their vehicle is declared a total loss or is stolen. It covers the difference between the insurance payout and the remaining loan or lease balance, ensuring that policyholders are not left with a substantial debt.

Who can benefit from Gap Coverage Insurance?

+Gap Coverage Insurance is particularly beneficial for individuals who have financed or leased their vehicles. This includes those with loans for new or used cars, as well as those with leasing arrangements. It is also valuable for those trading in their current vehicle, as it can cover any negative equity that may arise.

How does Gap Coverage Insurance work in real-world scenarios?

+In a real-world scenario, let’s say an individual has a 30,000 car loan and their vehicle is declared a total loss after an accident. Without GAP insurance, they would receive the current market value of the vehicle, say 18,000, leaving them with a 12,000 debt. However, with GAP insurance, the policyholder would receive coverage for this 12,000 gap, ensuring they are not left with a substantial debt.