Fl Home Insurance Companies

The Florida home insurance market is a complex landscape, with numerous companies vying for the attention of homeowners. Understanding the intricacies of this market is essential for anyone seeking comprehensive coverage and competitive rates. In this in-depth exploration, we delve into the world of Florida home insurance companies, shedding light on key players, coverage options, and industry trends. By the end of this article, you'll have a clearer understanding of the market and be better equipped to make informed decisions about your home insurance needs.

Navigating the Florida Home Insurance Market

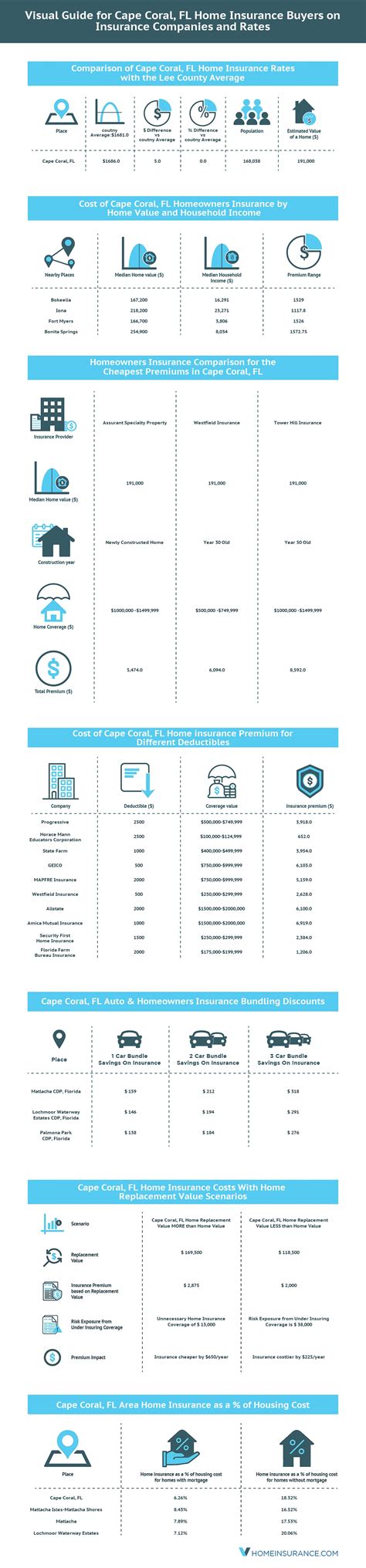

Florida, known for its unique climate and susceptibility to natural disasters, presents a challenging environment for homeowners and insurance providers alike. The state’s exposure to hurricanes, storms, and flooding events necessitates a tailored approach to home insurance. Here, we break down the market, providing insights into the factors that influence coverage and rates.

Key Players in the Florida Home Insurance Arena

Florida boasts a diverse range of insurance companies, each with its own strengths and coverage offerings. From established national carriers to smaller, specialized insurers, the market is diverse. Some of the prominent players include:

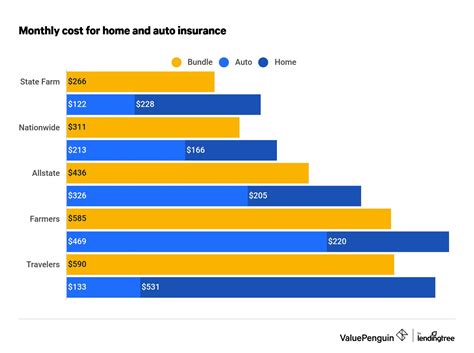

- State Farm: A leading national insurer, State Farm offers comprehensive home insurance policies tailored to Florida’s unique needs. They provide coverage for a range of perils, including hurricanes and wind damage.

- Allstate: With a strong presence in Florida, Allstate offers customizable home insurance plans. Their policies often include additional coverages for specific Florida risks, such as hurricane deductibles.

- Progressive: Progressive’s home insurance policies in Florida are designed to offer flexibility and competitive rates. They provide various coverage options, including endorsements for specific Florida hazards.

- The Hartford: Known for its strong financial stability, The Hartford provides home insurance policies that cater to Florida homeowners. Their policies often include additional coverage for water backup and sewer overflow.

- Citizens Property Insurance Corporation: As Florida’s insurer of last resort, Citizens provides coverage to homeowners who cannot obtain insurance from private carriers. While they offer basic coverage, their policies may have limited options and higher rates.

Each of these companies has its own underwriting guidelines, risk assessment methodologies, and pricing strategies. Understanding their unique offerings can help homeowners make more informed choices.

Coverage Options and Customization

Florida home insurance policies come in various forms, offering different levels of coverage and customization. Here’s a breakdown of some common coverage options:

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Provides protection for the physical structure of your home, including walls, roofs, and permanent fixtures. |

| Personal Property Coverage | Covers the contents of your home, such as furniture, electronics, and clothing. |

| Liability Coverage | Protects you against lawsuits and claims for bodily injury or property damage caused to others. |

| Additional Living Expenses | Covers the costs of temporary housing and other expenses if your home becomes uninhabitable due to a covered loss. |

| Hurricane Deductibles | A special deductible that applies specifically to hurricane-related damage. It can be a percentage of your home’s value or a set amount. |

| Windstorm Deductibles | Similar to hurricane deductibles, these apply to damage caused by wind, including storms and hurricanes. |

| Flood Insurance | A separate policy, often through the National Flood Insurance Program (NFIP), is necessary for comprehensive flood coverage. |

Additionally, many insurers offer optional endorsements or riders that can be added to a base policy to provide coverage for specific risks. These might include:

- Water backup and sump pump failure coverage

- Identity theft protection

- Coverage for high-value items like jewelry or art

- Personal liability for pool or trampoline-related injuries

The ability to customize your policy is crucial, especially in Florida's unique risk environment.

Risk Assessment and Pricing Strategies

Insurance companies in Florida employ various risk assessment methods to determine premiums. These assessments consider factors such as:

- Location: Coastal properties are often at higher risk for hurricane and wind damage, which can influence rates.

- Construction and Age of the Home: Older homes or those with outdated construction materials may be considered higher risk.

- Claim History: Insurers consider the homeowner’s claim history, as frequent claims can impact future premiums.

- Hurricane Mitigation Measures: Homes with hurricane shutters, impact-resistant windows, or reinforced roofs may qualify for premium discounts.

- Deductible Selection: Choosing a higher deductible can lower premiums, but it also means you’ll pay more out-of-pocket in the event of a claim.

Pricing strategies vary among insurers, with some offering more competitive rates for specific risks while others may have a broader approach. Understanding your risk factors and shopping around can help you find the best coverage at the right price.

Industry Trends and Future Outlook

The Florida home insurance market is influenced by various factors, including regulatory changes, natural disasters, and economic shifts. Here are some key trends to consider:

- Hurricane Season Preparedness: As Florida’s hurricane season becomes more active, insurers are increasingly focused on risk mitigation and preparedness. This includes offering discounts for hurricane-resistant features and encouraging homeowners to take proactive measures.

- Digital Transformation: Many insurers are investing in digital tools and platforms to enhance the customer experience. From online policy management to digital claim submissions, the industry is moving towards more efficient and accessible services.

- Rising Premiums: With the increased frequency and severity of natural disasters, insurers are facing higher claim payouts. This can lead to rising premiums, especially in high-risk areas. Homeowners should be prepared for potential premium increases over time.

- Competition and Innovation: The market is seeing an influx of new insurers, particularly those focused on niche markets or innovative coverage options. This increased competition can benefit homeowners by driving down prices and offering more diverse coverage choices.

Staying informed about these trends can help homeowners make proactive decisions about their insurance coverage and risk management strategies.

FAQs

How do I find the best Florida home insurance company for my needs?

+

Finding the best insurer involves researching multiple companies, comparing coverage options and prices, and considering your specific needs. Review policy details, read customer reviews, and seek recommendations from trusted sources. Also, consider the insurer’s financial stability and claims handling reputation.

What factors influence home insurance rates in Florida?

+

Rates are influenced by factors such as location, home construction, claim history, and the presence of hurricane mitigation measures. Insurers also consider the age of the home and its replacement cost. Shopping around and negotiating coverage options can help you find more affordable rates.

How can I save money on my Florida home insurance policy?

+

You can save money by choosing a higher deductible, bundling your home and auto insurance, and taking advantage of discounts for hurricane-resistant features. Maintaining a good credit score and shopping around for the best rates can also lead to savings.

What should I look for in a Florida home insurance policy?

+

Ensure your policy provides adequate coverage for your home’s structure and contents. Look for options to customize your policy, such as adding endorsements for specific risks. Consider your liability needs and ensure you have adequate coverage for potential lawsuits. Also, understand your policy’s hurricane and windstorm deductibles.

How often should I review my Florida home insurance policy?

+

It’s recommended to review your policy annually or whenever you make significant changes to your home, such as renovations or additions. Regular reviews ensure your coverage remains adequate and up-to-date with your needs.