Find Insurance Car

Unveiling the Best Strategies to Locate the Perfect Car Insurance: A Comprehensive Guide

In the vast landscape of car insurance options, finding the ideal coverage can be a challenging quest. This guide aims to navigate you through the intricate world of automotive insurance, offering practical strategies to ensure you secure the best deal tailored to your unique needs.

From understanding the intricacies of coverage types to leveraging online tools and expert advice, we'll provide you with the necessary tools to make informed decisions. Whether you're a seasoned driver or a novice behind the wheel, this comprehensive guide will empower you to make the right choices when it comes to protecting your vehicle and your finances.

Understanding Car Insurance: The Basics and Beyond

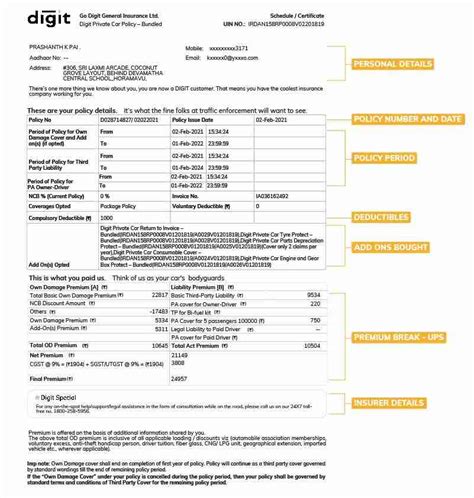

At its core, car insurance is a contract between you and an insurance provider. It's a financial safety net that ensures you're protected in the event of accidents, theft, or other unforeseen circumstances involving your vehicle. However, the world of car insurance is multifaceted, offering a range of coverage options that can be overwhelming for many.

To begin your journey towards finding the perfect car insurance, it's essential to grasp the fundamental types of coverage available. This includes liability insurance, which covers damages you cause to others; comprehensive insurance, which provides protection against non-collision events like theft or natural disasters; and collision insurance, which covers damages to your vehicle in the event of a collision.

Additionally, there are various add-ons and endorsements that can be included in your policy to cater to specific needs. For instance, roadside assistance, rental car reimbursement, and gap insurance are popular options that provide extra layers of protection and convenience.

Unraveling the Factors that Impact Your Car Insurance Rates

One of the key challenges in finding the right car insurance is understanding the myriad of factors that influence your rates. These factors can vary significantly depending on your location, driving history, the type of vehicle you own, and even your personal demographics.

For instance, younger drivers, particularly those under 25, often face higher insurance premiums due to their perceived higher risk on the road. Similarly, certain vehicle types, especially high-performance sports cars, may attract higher rates due to their association with increased speed and potential for accidents.

However, it's not all doom and gloom. There are strategies you can employ to mitigate these factors and potentially reduce your insurance premiums. For example, maintaining a clean driving record, taking defensive driving courses, and installing safety features in your vehicle can all contribute to lowering your insurance costs.

Exploring the Digital Landscape: Online Tools for Car Insurance Comparison

In today's digital age, the internet has revolutionized the way we search for and compare car insurance options. Online comparison tools and insurance marketplaces have emerged as powerful resources, offering a convenient and efficient way to shop for insurance.

These platforms allow you to input your details and receive quotes from multiple insurance providers, often within minutes. You can easily compare rates, coverage options, and customer reviews to make an informed decision. Additionally, many of these tools provide helpful articles and guides to educate you about the nuances of car insurance, ensuring you're well-equipped to make the right choice.

However, it's important to note that while these online tools are incredibly useful, they should not be your sole source of information. It's always beneficial to supplement your research with expert advice and personalized recommendations.

Seeking Expert Guidance: The Role of Insurance Brokers and Agents

While online tools can provide a wealth of information, there's no substitute for the expertise and personalized advice offered by insurance brokers and agents. These professionals have extensive knowledge of the insurance market and can provide valuable insights tailored to your specific circumstances.

Insurance brokers, in particular, work with multiple insurance providers, giving them a broader perspective on the market. They can shop around on your behalf, ensuring you get the best coverage at the most competitive rates. Additionally, brokers can often provide insights into discounts and other cost-saving opportunities that may not be readily apparent to the average consumer.

On the other hand, insurance agents typically represent a single insurance company. While they may not have the same breadth of options as brokers, they can provide in-depth knowledge of the specific products and services offered by their affiliated company. This can be advantageous if you already have a preference for a particular insurance provider.

Tailoring Your Car Insurance: Customizing Coverage to Fit Your Needs

Every driver's situation is unique, and as such, a one-size-fits-all approach to car insurance is rarely the best solution. It's crucial to tailor your insurance coverage to align with your specific needs and circumstances. This involves assessing factors such as your daily driving habits, the value of your vehicle, and the level of risk you're comfortable with.

For instance, if you have an older vehicle that has minimal monetary value, you may opt for liability-only coverage, which provides protection against damages you cause to others but doesn't cover damages to your own vehicle. On the other hand, if you have a brand-new, expensive car, you'll likely want more comprehensive coverage to protect your investment.

Additionally, consider your personal circumstances. If you have a long commute or frequently drive in high-risk areas, you may want to prioritize insurance options that offer robust roadside assistance or rental car reimbursement.

The Fine Print: Decoding Car Insurance Policies and Contracts

When you've found an insurance policy that seems to fit your needs, it's crucial to delve into the fine print. Car insurance policies can be complex documents, filled with legalese and technical jargon that can be daunting to decipher.

However, understanding the terms and conditions of your policy is essential to ensure you're fully aware of what's covered and what's not. This includes understanding any exclusions, limitations, and conditions that may apply to your coverage.

For instance, many insurance policies have specific clauses related to accident forgiveness, which can waive rate increases after an at-fault accident. Understanding these clauses can be critical in mitigating the financial impact of an accident.

Renewal and Reevaluation: Staying Ahead in the Ever-Changing Insurance Landscape

Car insurance is not a static product. Insurance rates and coverage options can change over time, influenced by various factors such as market trends, regulatory changes, and your own personal circumstances.

Therefore, it's important to regularly reevaluate your insurance needs and shop around for the best deals. This doesn't necessarily mean switching insurance providers every year, but rather staying informed and ensuring you're always getting the most competitive rates and the best coverage for your money.

Many insurance providers offer loyalty discounts or other incentives to keep customers, but it's always beneficial to compare rates and coverage to ensure you're not missing out on better deals elsewhere.

Conclusion: Navigating the Road to Perfect Car Insurance Coverage

Finding the perfect car insurance coverage is a journey that requires careful consideration, research, and an understanding of your unique needs. By grasping the fundamentals of car insurance, exploring the factors that influence rates, leveraging online tools and expert advice, and tailoring your coverage to your circumstances, you can navigate the complex world of automotive insurance with confidence.

Remember, car insurance is a vital aspect of responsible driving, providing financial protection and peace of mind. With the right approach and a thorough understanding of your options, you can ensure you're adequately protected on the road ahead.

What are some common discounts available with car insurance providers?

+Many car insurance providers offer a range of discounts to attract and retain customers. Common discounts include multi-policy discounts (for bundling your car insurance with other types of insurance), safe driver discounts (for maintaining a clean driving record), loyalty discounts (for staying with the same provider for an extended period), and good student discounts (for young drivers who maintain a certain GPA or higher). Additionally, some providers offer discounts for specific safety features in your vehicle, such as anti-theft devices or advanced driver assistance systems.

How do no-fault car insurance laws impact insurance rates and claims processes?

+No-fault car insurance laws, in place in some states, require drivers to carry insurance that covers their own injuries and damages regardless of who is at fault in an accident. These laws are designed to streamline the claims process and reduce the number of lawsuits arising from car accidents. While no-fault insurance can provide quicker compensation for accident victims, it can also lead to higher insurance rates as it often results in higher overall claim payouts. Additionally, in no-fault states, the process for filing a claim for damages to another driver’s vehicle can be more complex and may involve seeking a settlement directly from the other driver’s insurance company.

What should I do if I’m involved in a car accident and need to file an insurance claim?

+If you’re involved in a car accident, the first priority is to ensure the safety of yourself and others involved. Call emergency services if needed. Once the situation is under control, it’s important to gather as much information as possible at the scene of the accident, including taking photos of the damage, collecting contact and insurance details from the other driver(s), and obtaining statements from any witnesses. Notify your insurance provider as soon as possible to initiate the claims process. They will guide you through the necessary steps, which may include filing a police report and providing a detailed account of the accident.