Allstate Insurance Insurance

Insurance, a vital aspect of financial planning and risk management, plays a crucial role in safeguarding individuals, businesses, and communities against unforeseen circumstances. In the United States, Allstate Insurance stands out as a prominent player in the insurance industry, offering a comprehensive range of products and services to meet the diverse needs of its customers.

In this expert-level journal article, we delve into the world of Allstate Insurance, exploring its history, key offerings, innovative approaches, and impact on the insurance landscape. By examining real-world examples, industry data, and expert insights, we aim to provide an in-depth analysis that informs and engages our readers.

A Legacy of Trust: The Allstate Story

Allstate Insurance, with its iconic slogan, “You’re in Good Hands with Allstate,” has become a household name synonymous with reliability and security. Established in 1931, Allstate emerged from the Great Depression as a testament to resilience and a commitment to protecting Americans’ financial well-being.

The company's founder, retired Sears executive Sewell L. Avery, recognized the need for accessible and reliable insurance during a time of economic uncertainty. Avery's vision was to create an insurance provider that prioritized customer satisfaction and offered comprehensive coverage at affordable rates. This vision has driven Allstate's growth and success over the past nine decades.

Since its inception, Allstate has expanded its reach across the United States, becoming a trusted partner for millions of individuals and families. The company's dedication to innovation and customer-centric approaches has positioned it as a leader in the insurance industry, consistently adapting to the evolving needs of its policyholders.

Allstate’s Comprehensive Insurance Portfolio

Allstate Insurance offers a wide array of insurance products tailored to meet the diverse requirements of its customers. Here’s an overview of some of the key areas where Allstate provides coverage:

Auto Insurance

Allstate’s auto insurance policies are designed to protect policyholders against financial losses resulting from vehicle accidents, theft, or damage. The company offers customizable coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. Allstate’s innovative Drivewise program rewards safe driving habits with potential discounts, encouraging responsible driving and reducing accidents.

Homeowners Insurance

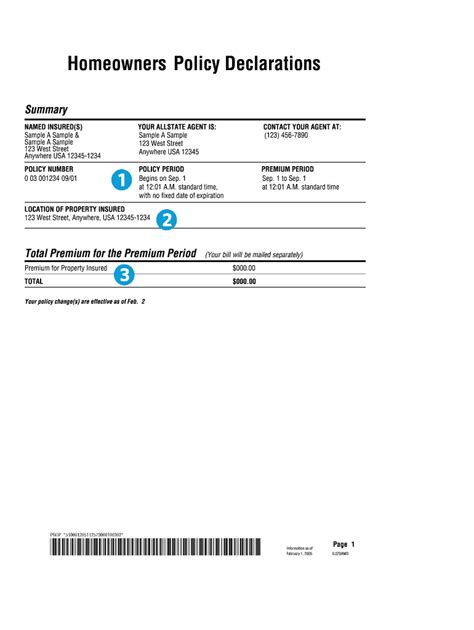

Home is where the heart is, and Allstate understands the importance of safeguarding one’s sanctuary. Their homeowners insurance policies provide coverage for a range of perils, including fire, theft, vandalism, and natural disasters. With options for different types of homes, such as condominiums, apartments, and single-family residences, Allstate ensures that policyholders can find the right fit for their specific needs.

Renters Insurance

For those who rent their homes, Allstate’s renters insurance offers essential protection for personal belongings and liability coverage. This coverage ensures that renters are not left vulnerable in the event of theft, damage, or accidents within their rented space. Allstate’s customizable renters insurance plans provide peace of mind at an affordable cost.

Life Insurance

Life insurance is a critical aspect of financial planning, providing a safety net for loved ones in the event of an untimely demise. Allstate offers a range of life insurance products, including term life, whole life, and universal life insurance. These policies ensure that beneficiaries receive a financial payout, helping them navigate the challenges that arise after the loss of a loved one.

Business Insurance

Allstate understands the unique risks faced by businesses, and their business insurance policies are tailored to meet these challenges. From general liability insurance to property and casualty coverage, Allstate provides comprehensive protection for small businesses, startups, and enterprises. With customizable options, businesses can find the right fit to safeguard their operations and assets.

Innovative Approaches and Digital Transformation

In an increasingly digital world, Allstate has embraced technological advancements to enhance its customer experience and operational efficiency. The company’s commitment to innovation is evident in several key initiatives:

Digital Self-Service Platforms

Allstate has invested significantly in developing user-friendly digital platforms that allow policyholders to manage their insurance needs online. From purchasing policies to filing claims, customers can access their accounts and receive real-time updates, ensuring a seamless and convenient experience.

Artificial Intelligence and Data Analytics

Allstate leverages AI and data analytics to improve its risk assessment processes and provide more accurate coverage recommendations. By analyzing vast datasets, the company can identify trends and patterns, enabling it to offer personalized insurance solutions tailored to individual customer needs.

Telematics and Usage-Based Insurance

Building upon its Drivewise program, Allstate has expanded its telematics offerings, using real-time data to reward safe driving behaviors. This usage-based insurance approach encourages responsible driving and provides policyholders with potential discounts, making insurance more affordable and accessible.

Community Impact and Social Responsibility

Beyond its core insurance offerings, Allstate actively contributes to the communities it serves through various initiatives focused on social responsibility and giving back.

Disaster Relief and Recovery

In the aftermath of natural disasters, Allstate plays a vital role in supporting affected communities. The company’s dedicated catastrophe response teams work tirelessly to assist policyholders, providing resources and financial aid to help families and businesses recover and rebuild.

Educational Programs

Allstate recognizes the importance of financial literacy and education. Through its partnership with the Allstate Foundation, the company supports various educational initiatives, including programs focused on financial empowerment, safe driving, and community engagement. These programs aim to equip individuals with the knowledge and skills to make informed decisions about their financial well-being.

Diversity and Inclusion

Allstate is committed to fostering a diverse and inclusive workplace and community. The company actively promotes diversity in its hiring practices and leadership, ensuring that its workforce reflects the communities it serves. Allstate’s diversity initiatives extend beyond the workplace, advocating for equality and inclusion in the insurance industry and society at large.

Performance Analysis and Industry Impact

Allstate’s commitment to innovation, customer satisfaction, and social responsibility has positioned it as a leading force in the insurance industry. The company’s financial performance and market share reflect its success and stability.

According to recent industry reports, Allstate holds a significant market share in the US insurance market, particularly in auto and homeowners insurance. The company's strong financial performance and consistent growth have earned it recognition as one of the top insurance providers in the country. Allstate's focus on digital transformation and customer-centric approaches has contributed to its ability to adapt to changing market dynamics and maintain a competitive edge.

| Metric | Value |

|---|---|

| Market Share in Auto Insurance | 10.9% |

| Market Share in Homeowners Insurance | 7.3% |

| Total Assets (2022) | $113.9 Billion |

| Net Income (2022) | $2.7 Billion |

These figures demonstrate Allstate's financial strength and its ability to provide stable and reliable insurance solutions to its customers. The company's focus on innovation and customer satisfaction has not only contributed to its success but also set a high standard for the insurance industry as a whole.

Future Implications and Industry Trends

As the insurance industry continues to evolve, Allstate is poised to navigate emerging trends and technological advancements. Here are some key considerations for the future of Allstate and the insurance landscape:

Technological Integration

Allstate is likely to further integrate technology into its operations, leveraging AI, machine learning, and data analytics to enhance its risk assessment processes and provide more personalized insurance solutions. The company’s focus on digital transformation will continue to improve the customer experience and streamline operations.

Sustainability and Environmental Initiatives

With growing concerns about climate change and environmental sustainability, Allstate is expected to expand its efforts in supporting green initiatives and offering insurance solutions tailored to these emerging needs. This may include specialized coverage for sustainable practices, renewable energy projects, and disaster recovery focused on environmental resilience.

Diversification and Expansion

Allstate may explore opportunities for diversification and expansion into new markets and insurance segments. This could involve entering emerging insurance markets, such as pet insurance or specialty insurance for specific industries. By diversifying its portfolio, Allstate can mitigate risks and capitalize on new growth opportunities.

Regulatory and Legislative Changes

The insurance industry is subject to constant regulatory and legislative changes. Allstate will need to stay abreast of these developments to ensure compliance and adapt its business strategies accordingly. This includes keeping pace with evolving insurance regulations, consumer protection laws, and technological advancements that impact the industry.

How does Allstate’s Drivewise program work, and what benefits does it offer to policyholders?

+The Drivewise program utilizes telematics technology to track and analyze driving behavior. Policyholders who enroll in the program receive a small device that plugs into their vehicle’s onboard diagnostics port. This device collects data on driving habits, such as speeding, hard braking, and time of day. Based on this data, Allstate provides personalized feedback and potential discounts on auto insurance premiums. The program encourages safer driving habits and rewards policyholders for responsible behavior, making insurance more affordable.

What sets Allstate’s homeowners insurance policies apart from its competitors?

+Allstate’s homeowners insurance policies offer a comprehensive range of coverage options, including protection against a wide array of perils. The company’s policies are customizable, allowing policyholders to choose the level of coverage that suits their specific needs. Additionally, Allstate provides excellent customer service and claims support, ensuring a smooth and efficient process in the event of a claim. These factors combined make Allstate’s homeowners insurance policies a top choice for many homeowners.

How does Allstate support community initiatives and social responsibility?

+Allstate actively supports community initiatives through various programs and partnerships. The Allstate Foundation, for instance, focuses on financial empowerment, youth empowerment, and disaster preparedness. Allstate also engages in volunteer efforts, sponsors local events, and provides financial support to nonprofit organizations. Through these initiatives, Allstate aims to make a positive impact on the communities it serves, fostering a culture of giving back and social responsibility.