Cheap Health Insurance In Georgia

Georgia, a state known for its vibrant cities, beautiful landscapes, and diverse population, presents a unique challenge when it comes to finding affordable health insurance. With a focus on providing valuable insights, this article aims to guide Georgians towards understanding and accessing cheap health insurance options tailored to their needs.

Understanding the Health Insurance Landscape in Georgia

Georgia’s healthcare market is diverse, offering a range of insurance plans to cater to its residents. From major metropolitan areas like Atlanta and Savannah to rural communities, the state’s healthcare system presents a complex web of options. Understanding this landscape is crucial for individuals and families seeking affordable coverage.

One of the key factors influencing insurance costs in Georgia is the state's demographic makeup. With a population of over 10 million, Georgia's diverse demographics impact insurance premiums. For instance, areas with a higher concentration of young, healthy individuals may see lower average premiums, while regions with an aging population or higher rates of chronic illnesses may experience higher costs.

Another crucial aspect is the state's healthcare infrastructure. Georgia boasts a robust network of hospitals, clinics, and healthcare providers, but the distribution of these resources varies across the state. Residents in more remote areas may face challenges in accessing certain specialized services, which can impact their insurance choices and costs.

Additionally, Georgia's political and regulatory environment plays a significant role. The state's approach to healthcare legislation and its participation in federal programs like Medicaid and the Affordable Care Act (ACA) marketplace influence the availability and cost of insurance plans.

Key Factors Affecting Insurance Costs

- Demographics: Age, gender, and health status significantly impact insurance premiums.

- Healthcare Utilization: The frequency of doctor visits, hospital stays, and prescription drug use affects insurance costs.

- Plan Type: Different plan types, such as HMO, PPO, and EPO, offer varying levels of coverage and cost.

- Provider Network: In-network providers are typically more cost-effective than out-of-network options.

- Location: Insurance costs can vary based on the cost of living and healthcare resources in different regions.

By understanding these factors, Georgians can make more informed decisions when choosing health insurance. It's essential to consider not only the initial premium but also the potential out-of-pocket costs, deductibles, and co-pays associated with different plans.

Exploring Affordable Insurance Options in Georgia

For Georgians seeking affordable health insurance, several avenues present themselves. One of the primary options is the Georgia Health Benefit Exchange, also known as HealthCare.gov, which offers a range of insurance plans during the open enrollment period.

The exchange provides a platform for individuals and families to compare plans from various insurance carriers, making it easier to find an affordable option. It's important to note that the open enrollment period typically runs from November to December, so staying aware of these dates is crucial for securing coverage.

In addition to the exchange, Medicaid and Medicare programs offer comprehensive coverage for eligible individuals. Medicaid, in particular, has expanded its coverage in Georgia, providing healthcare access to low-income individuals and families. Understanding the eligibility criteria and applying for these programs can be a viable option for those in need.

For young adults, the Catastrophic Plan option under the ACA may be a suitable choice. This plan offers basic coverage at a lower cost, making it an attractive option for those who prioritize affordability over extensive coverage.

Insurance Plans and Their Costs

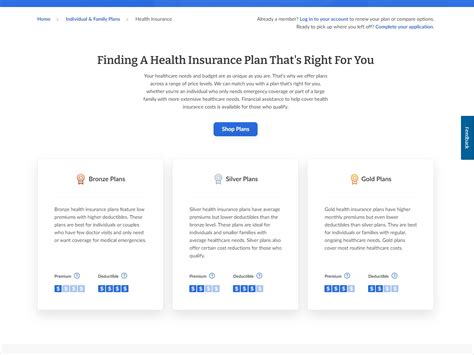

When exploring insurance options, it’s essential to understand the different types of plans and their associated costs. Here’s a breakdown of some common plan types and their potential costs in Georgia:

| Plan Type | Description | Average Premium (Per Month) |

|---|---|---|

| Bronze Plan | Lowest premiums, higher deductibles and co-pays | $350 - $450 |

| Silver Plan | Balanced premiums and out-of-pocket costs | $400 - $550 |

| Gold Plan | Higher premiums, lower deductibles and co-pays | $500 - $650 |

| Platinum Plan | Most expensive, with comprehensive coverage | $600 - $800 |

It's important to note that these are approximate averages and actual costs may vary based on individual circumstances and the insurance carrier. Additionally, factors like age, tobacco use, and family size can impact the final premium.

Tips for Finding Cheap Health Insurance in Georgia

Navigating the health insurance landscape in Georgia can be daunting, but with the right strategies, it’s possible to find affordable coverage. Here are some expert tips to help Georgians secure cheap health insurance:

Compare Plans and Providers

The key to finding the best deal is comparison. Utilize online tools and resources to compare plans from different providers. Look beyond just the premium and consider deductibles, co-pays, and coverage limits. Some providers may offer more comprehensive coverage at a similar cost, so it’s worth exploring all options.

Consider High-Deductible Plans with HSAs

High-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) can be a cost-effective option. HDHPs typically have lower premiums, making them affordable for many Georgians. HSAs allow individuals to save money pre-tax for qualified medical expenses, providing an additional financial advantage.

Explore Short-Term Plans

For those between jobs or seeking temporary coverage, short-term health insurance plans can be a viable option. These plans offer coverage for a specified period, typically ranging from one to twelve months. While they may have limited benefits and may not cover pre-existing conditions, they can provide essential coverage during transitional periods.

Look for Employer-Sponsored Plans

If you’re employed, explore the options offered by your employer. Many companies provide health insurance as part of their benefits package. These plans often come with discounted rates, making them an attractive option. Additionally, some employers offer flexible spending accounts (FSAs) or health reimbursement arrangements (HRAs), which can further reduce out-of-pocket costs.

Consider Group Plans

Group health insurance plans, offered through organizations like churches, alumni associations, or professional groups, can provide affordable coverage. These plans often leverage the collective buying power of the group to negotiate lower rates. While the coverage may not be as comprehensive as individual plans, they can be a cost-effective option for those seeking basic healthcare coverage.

Conclusion: Affordable Healthcare for All

Finding cheap health insurance in Georgia is a complex but achievable task. By understanding the healthcare landscape, exploring various options, and employing strategic tips, Georgians can secure affordable coverage. Whether through the Health Benefit Exchange, Medicaid, or alternative plans, there are options available to meet diverse needs and budgets.

It's essential to stay informed, compare plans diligently, and seek expert advice when needed. With the right approach, affordable healthcare can be within reach for all Georgians, ensuring access to essential medical services without breaking the bank.

What is the average cost of health insurance in Georgia?

+The average cost of health insurance in Georgia varies depending on factors such as age, location, and plan type. According to recent data, the average monthly premium for an individual plan in Georgia is around 450, while family plans average around 1,200. These figures can vary significantly based on individual circumstances.

Are there any discounts or subsidies available for health insurance in Georgia?

+Yes, Georgia residents may be eligible for discounts or subsidies through programs like the Affordable Care Act (ACA). Income-based subsidies are available for individuals and families who meet certain criteria, helping to reduce the cost of insurance premiums. Additionally, some insurance carriers offer discounts for healthy lifestyle choices or loyalty programs.

Can I purchase health insurance outside of the open enrollment period in Georgia?

+Yes, it is possible to purchase health insurance outside of the open enrollment period in Georgia. However, this is typically limited to qualifying life events such as losing your job, getting married, or having a baby. These events are known as Special Enrollment Periods (SEPs), and they allow individuals to enroll in a new plan or make changes to their existing coverage.