Fast Insurance Rates

Welcome to the comprehensive guide on "Fast Insurance Rates"! In today's fast-paced world, finding quick and efficient insurance solutions is essential. Whether you're seeking auto, home, health, or business insurance, this article will provide you with expert insights, real-world examples, and practical tips to navigate the insurance landscape with speed and ease. Get ready to explore the world of fast insurance rates and discover how to secure the best coverage at lightning-fast speeds.

Understanding the Importance of Fast Insurance Rates

In the dynamic and ever-evolving insurance industry, speed is often a critical factor. Whether you’re a busy professional, a small business owner, or a homeowner in need of prompt coverage, fast insurance rates can make a significant difference. The ability to secure insurance quickly not only provides peace of mind but also ensures that you can protect your assets and well-being efficiently.

Imagine a scenario where you've just purchased a new car, and you need to get it insured as soon as possible. The traditional process of visiting insurance agents, comparing quotes, and waiting for approvals can be time-consuming and frustrating. This is where the concept of fast insurance rates comes into play, offering a streamlined and efficient solution.

The Benefits of Fast Insurance

Obtaining insurance swiftly comes with a plethora of advantages. Firstly, it saves you valuable time, allowing you to focus on other important aspects of your life or business. Secondly, quick insurance processes often mean less hassle and paperwork, making the entire experience more convenient and user-friendly.

Additionally, fast insurance rates can provide you with a competitive edge. In today's market, where information is readily available, consumers expect prompt and efficient services. By securing insurance rapidly, you can demonstrate your efficiency and responsiveness, which can be particularly beneficial for businesses seeking to attract and retain customers.

| Advantages of Fast Insurance Rates | Examples |

|---|---|

| Time Efficiency | Rapid policy acquisition, minimizing delays. |

| Convenience | Online platforms and digital tools for seamless transactions. |

| Competitive Advantage | Quick response times attract and retain customers. |

| Peace of Mind | Immediate coverage for unexpected events. |

Exploring Fast Insurance Options

The insurance market offers a wide range of options for those seeking swift coverage. From online platforms to specialized insurance providers, let’s delve into the various avenues that can help you secure fast insurance rates.

Online Insurance Platforms

In the digital age, online insurance platforms have revolutionized the way we access and purchase insurance policies. These platforms provide a one-stop solution, allowing you to compare quotes, customize coverage, and purchase policies in a matter of minutes.

For instance, PolicyQuotem, a leading online insurance marketplace, offers a user-friendly interface where you can obtain multiple quotes from top insurance providers. By simply inputting your details, you can receive personalized quotes, making it easy to find the best rates and coverage options. The entire process can be completed within minutes, ensuring a fast and seamless experience.

Specialized Insurance Providers

Certain insurance providers specialize in offering fast and efficient services. These providers often have streamlined processes, digitalized systems, and a focus on customer convenience.

Take SpeedInsure as an example. This innovative insurance company has developed a proprietary system that automates many of the traditional insurance processes. From policy issuance to claim management, SpeedInsure aims to provide lightning-fast services, ensuring that their customers can access coverage promptly.

Direct-to-Consumer Insurance

Direct-to-consumer insurance models have gained popularity for their simplicity and speed. With this approach, insurance providers cut out the middleman, allowing you to purchase policies directly from the insurer.

Consider QuickCover, a direct-to-consumer insurance provider that offers a range of insurance products, including auto, home, and life insurance. By eliminating the need for intermediaries, QuickCover can provide faster quotes and policy issuance, making it an attractive option for those seeking swift coverage.

| Fast Insurance Options | Description |

|---|---|

| Online Platforms | Compare quotes and purchase policies online. |

| Specialized Providers | Streamlined processes and digitalized systems for efficiency. |

| Direct-to-Consumer | Purchase policies directly from the insurer, cutting out intermediaries. |

Factors Influencing Fast Insurance Rates

While the desire for fast insurance rates is universal, several factors come into play that can impact the speed at which you can secure coverage. Understanding these factors can help you navigate the insurance landscape more effectively.

Insurance Type and Coverage

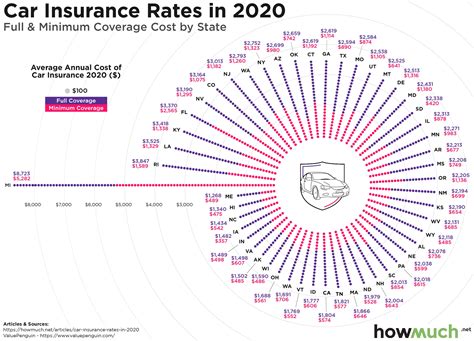

The type of insurance you require plays a significant role in determining the speed of the process. Different insurance products have varying complexities and requirements, which can affect the time it takes to obtain coverage.

For example, auto insurance, which is often a mandatory requirement, tends to have more standardized processes and can be obtained relatively quickly. On the other hand, specialized insurance products like cyber liability or professional liability may require more time due to the need for detailed assessments and customized policies.

Provider’s Turnaround Time

The efficiency and responsiveness of the insurance provider you choose can greatly impact the speed of the insurance process. Some providers have invested in technology and streamlined their operations to deliver faster services, while others may have more traditional processes that can result in longer wait times.

When selecting an insurance provider, consider their reputation for prompt service. Check customer reviews and ratings to gauge their efficiency and turnaround times. Providers who prioritize speed and customer satisfaction are more likely to deliver fast insurance rates.

Application and Documentation

The completeness and accuracy of your insurance application and supporting documentation can significantly influence the speed of the insurance process.

Ensure that you provide all the necessary information and documents as requested by the insurance provider. Incomplete or inaccurate applications can lead to delays and additional back-and-forth communication, slowing down the process. By being organized and prepared, you can help expedite the insurance journey.

| Factors Influencing Speed | Impact |

|---|---|

| Insurance Type | Standardized processes for common insurance types vs. customized assessments for specialized coverage. |

| Provider's Efficiency | Providers with streamlined operations and digital tools offer faster services. |

| Application Completeness | Accurate and complete applications expedite the process, reducing delays. |

Tips for Securing Fast Insurance Rates

Now that we’ve explored the various aspects of fast insurance rates, let’s delve into some practical tips and strategies to help you secure the best coverage at lightning-fast speeds.

Compare Multiple Quotes

One of the key advantages of the digital age is the ability to easily compare insurance quotes from multiple providers. Take advantage of online platforms and marketplaces that aggregate quotes from various insurers. By comparing quotes, you can not only find the best rates but also identify providers who offer swift services.

Consider using QuoteCompare, a comprehensive insurance comparison website. With a few clicks, you can access quotes from top insurance providers, allowing you to make an informed decision quickly. The platform also provides user reviews and ratings, helping you assess the efficiency and reliability of each provider.

Utilize Digital Tools

In today’s digital landscape, insurance providers have embraced technology to enhance their services. From online applications to mobile apps, digital tools can significantly streamline the insurance process.

For instance, InsureTech, an innovative insurance provider, offers a mobile app that allows users to purchase policies, manage claims, and access policy documents on the go. By leveraging such digital tools, you can save time and effortlessly navigate the insurance journey.

Understand Your Coverage Needs

Before diving into the insurance market, take the time to understand your specific coverage needs. Assess your risks, assets, and potential liabilities to determine the type and level of coverage required.

By clearly defining your coverage needs, you can focus on providers and policies that align with your requirements. This targeted approach not only saves time but also ensures that you secure the right coverage, providing peace of mind and efficient protection.

Seek Expert Advice

When navigating the complex world of insurance, seeking guidance from experts can be invaluable. Insurance brokers and agents can provide personalized advice, helping you navigate the market efficiently and secure the best coverage for your needs.

Consider consulting with a reputable insurance broker like ExpertInsure. Their team of experienced professionals can assess your unique circumstances, recommend suitable insurance products, and guide you through the process, ensuring a swift and informed decision.

| Tips for Fast Insurance Rates | Strategies |

|---|---|

| Compare Quotes | Use online platforms to compare multiple quotes and assess provider efficiency. |

| Embrace Digital Tools | Leverage mobile apps and online platforms for a streamlined insurance experience. |

| Define Coverage Needs | Clearly understand your risks and assets to choose the right coverage. |

| Seek Expert Advice | Consult with insurance brokers for personalized guidance and efficient decision-making. |

The Future of Fast Insurance

As technology continues to advance and consumer expectations evolve, the insurance industry is poised for significant changes. Let’s explore some of the emerging trends and innovations that are shaping the future of fast insurance.

Artificial Intelligence and Automation

Artificial Intelligence (AI) and automation are revolutionizing the insurance landscape. From chatbots providing instant assistance to AI-powered underwriting, these technologies are enhancing efficiency and speed.

Imagine a scenario where you can interact with an AI-powered chatbot to obtain quotes, ask questions, and receive real-time assistance. This level of automation not only provides instant support but also frees up resources, allowing insurance providers to focus on delivering faster and more personalized services.

Blockchain Technology

Blockchain technology, with its secure and transparent nature, is poised to transform the insurance industry. By leveraging blockchain, insurance processes can become more efficient, secure, and trustworthy.

For instance, BlockchainInsure, an innovative insurance provider, utilizes blockchain to streamline policy issuance and claim management. By storing policy information and claim data on a secure blockchain network, they can provide faster and more secure services, reducing the risk of fraud and enhancing customer trust.

Telematics and Data Analytics

Telematics and data analytics are revolutionizing insurance, particularly in the auto insurance space. By collecting and analyzing real-time data, insurance providers can offer more accurate and personalized premiums.

Consider TelematicInsure, an insurance provider that utilizes telematics devices to track driving behavior. By analyzing data such as speed, acceleration, and braking patterns, they can offer dynamic insurance premiums that reward safe driving. This data-driven approach not only encourages safer driving but also provides customers with more accurate and fast insurance rates.

| Future Innovations | Impact |

|---|---|

| AI and Automation | Enhancing efficiency, providing instant support, and freeing up resources. |

| Blockchain Technology | Streamlining processes, enhancing security, and building customer trust. |

| Telematics and Data Analytics | Offering accurate and personalized premiums based on real-time data. |

Conclusion

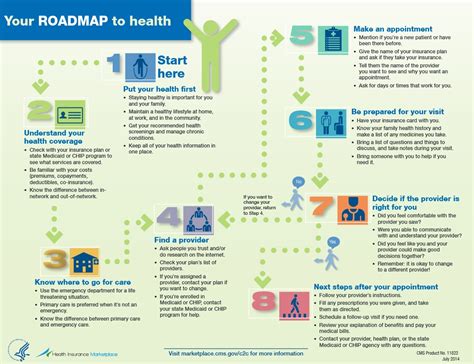

In a fast-paced world, securing insurance quickly is not just a convenience but a necessity. Whether you’re seeking auto, home, health, or business insurance, the tips and insights provided in this guide can help you navigate the insurance market efficiently.

By understanding the importance of fast insurance rates, exploring the various options available, and implementing practical strategies, you can secure the coverage you need at lightning-fast speeds. Remember, when it comes to insurance, time is of the essence, and the right choices can make all the difference.

So, embrace the world of fast insurance, explore the innovative solutions, and take control of your insurance journey. With the right tools and knowledge, you can protect your assets, safeguard your well-being, and do it all with remarkable speed and efficiency.

How do I find reputable insurance providers for fast coverage?

+

When seeking reputable insurance providers, consider factors such as financial stability, customer reviews, and industry reputation. Online platforms and comparison websites can provide valuable insights into provider ratings and feedback. Additionally, seeking recommendations from trusted sources, such as friends, family, or financial advisors, can help guide your decision.

Are there any downsides to choosing fast insurance options?

+

While fast insurance options offer convenience and speed, it’s important to consider potential drawbacks. Some providers may prioritize speed over customization, which could result in less tailored coverage. Additionally, certain fast insurance products may have limited coverage options or higher premiums. It’s crucial to carefully review the terms and conditions to ensure you’re getting the coverage you need.

What if I have a complex insurance need that requires specialized coverage?

+

For complex insurance needs, it’s advisable to consult with insurance brokers or specialists who can guide you through the process. They can help assess your specific requirements, recommend suitable coverage, and connect you with providers who offer specialized solutions. While specialized coverage may take slightly longer to secure, the expertise and tailored approach ensure you receive the right protection.