Direct Auto Car Insurance Quote

Welcome to the ultimate guide on understanding Direct Auto car insurance quotes. With a comprehensive understanding of the process, you can make informed decisions and find the best coverage for your vehicle. This article will delve into the details of Direct Auto's quote process, exploring the factors that influence your quote, the steps to obtain an accurate estimate, and the various coverage options available to meet your unique needs. Whether you're a first-time buyer or looking to switch providers, this guide will provide valuable insights to help you navigate the world of car insurance with confidence.

Understanding the Direct Auto Quote Process

Direct Auto Insurance is a well-known provider in the car insurance industry, offering affordable and flexible coverage options. Their quote process is designed to be straightforward and transparent, ensuring that customers can easily understand and compare their insurance options. By providing a range of factors and personalized information, you can receive an accurate quote tailored to your specific needs.

Factors Influencing Your Quote

Several key factors play a role in determining your Direct Auto car insurance quote. These include:

- Vehicle Type and Age: The make, model, and year of your vehicle significantly impact your quote. Newer and more expensive cars generally have higher insurance rates.

- Coverage Options: The level of coverage you choose will affect your quote. Direct Auto offers various coverage types, including liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

- Deductible Amount: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your monthly premiums, but it also means you’ll pay more in the event of a claim.

- Driver’s Profile: Your driving record, age, gender, and marital status are all considered. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

- Credit Score: In many states, your credit score is a factor in determining your insurance rates. Maintaining a good credit history can help keep your premiums lower.

- Location: The area where you live and primarily drive your vehicle impacts your quote. Areas with higher accident rates or more frequent claims may have higher insurance costs.

Understanding these factors is crucial as they provide a framework for tailoring your insurance coverage to your specific circumstances. By adjusting these variables, you can explore different coverage options and find the best balance between affordability and protection.

Obtaining an Accurate Quote

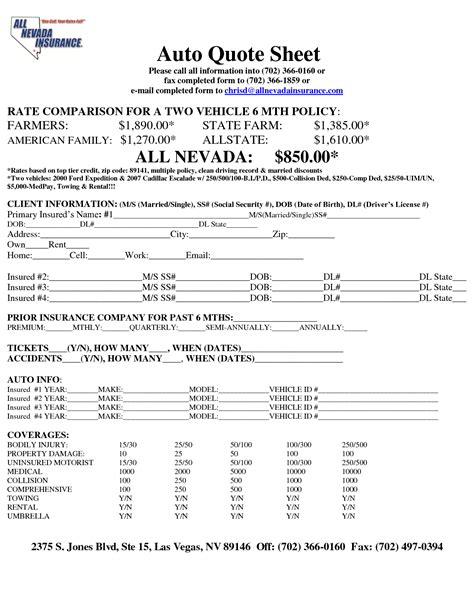

To obtain an accurate Direct Auto car insurance quote, follow these simple steps:

- Gather Information: Before starting the quote process, gather the necessary details about your vehicle, such as make, model, year, and VIN. Additionally, have your driver’s license, social security number, and current insurance information (if applicable) ready.

- Visit Direct Auto’s Website: Go to the Direct Auto Insurance website and navigate to the “Get a Quote” section. Here, you’ll find an online quote form that guides you through the process.

- Enter Vehicle Details: Provide accurate information about your vehicle, including its make, model, year, and any additional features or modifications.

- Select Coverage Options: Choose the type and level of coverage you prefer. Consider your specific needs and the legal requirements in your state. Direct Auto offers customizable coverage options to suit different budgets and preferences.

- Input Personal Information: Enter your personal details, including your name, date of birth, address, and driver’s license number. Be honest and accurate to ensure a precise quote.

- Review and Compare: Once you’ve completed the form, carefully review the quote provided. Direct Auto will display the estimated monthly or annual premium, along with a breakdown of the coverage included. Take the time to compare different coverage options and consider your budget.

- Adjust and Refine : If the initial quote doesn’t align with your expectations, you can adjust various factors to find a more suitable option. Experiment with different deductibles, coverage levels, or even explore discounts to optimize your insurance plan.

- Contact Direct Auto: If you have any questions or need further assistance, don’t hesitate to reach out to Direct Auto’s customer support. Their team is available to provide guidance and ensure you understand the quote process thoroughly.

Coverage Options and Benefits

Direct Auto offers a range of coverage options to cater to diverse customer needs. Understanding these options is essential to choosing the right insurance plan for your vehicle.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance. It protects you financially in the event that you cause an accident resulting in injuries or property damage to others. Direct Auto offers liability coverage to meet the minimum requirements in your state, ensuring you’re covered in case of an at-fault accident.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and compensation for injuries caused to others in an accident you're at fault for. |

| Property Damage Liability | Provides coverage for damage to another person's property, such as their vehicle or personal belongings, caused by an accident you're responsible for. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage options offer protection for your own vehicle. These coverages come into play when your car is damaged due to accidents, vandalism, theft, or natural disasters.

- Collision Coverage: Pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, natural disasters, or collisions with animals.

Additional Coverage Options

Direct Auto provides a range of additional coverage options to enhance your insurance plan and cater to specific needs.

- Uninsured/Underinsured Motorist Coverage: Protects you in the event of an accident with a driver who has no insurance or insufficient insurance coverage.

- Personal Injury Protection (PIP): Provides coverage for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Rental Car Reimbursement: Offers coverage for rental car expenses if your vehicle is in the shop for repairs due to a covered incident.

- Roadside Assistance: Provides emergency services such as towing, flat tire changes, battery jumps, and more, ensuring you’re never stranded on the road.

Performance Analysis and Future Implications

Direct Auto has established itself as a reliable and affordable car insurance provider, consistently delivering competitive quotes to its customers. Their transparent quote process and customizable coverage options have earned them a strong reputation in the industry.

Looking ahead, Direct Auto is well-positioned to continue its growth and success in the car insurance market. With a focus on customer satisfaction and a commitment to providing affordable coverage, they are likely to expand their reach and attract new customers. Their innovative approach to insurance, combined with a strong understanding of customer needs, sets them apart and ensures their long-term viability.

As the insurance landscape evolves, Direct Auto is likely to adapt and enhance its offerings to meet the changing demands of its customers. By staying ahead of industry trends and leveraging technology, they can continue to provide efficient and effective insurance solutions. Their dedication to delivering value and peace of mind to drivers makes them a trusted choice for car insurance.

How do I know if Direct Auto offers the best car insurance rates for me?

+Obtaining quotes from multiple insurance providers is crucial to ensure you’re getting the best rates. Compare quotes from Direct Auto with those of other reputable insurers to find the most competitive and suitable coverage for your needs.

What discounts does Direct Auto offer, and how can I qualify for them?

+Direct Auto provides various discounts, including multi-policy discounts, good student discounts, safe driver discounts, and more. To qualify, you may need to meet specific criteria, such as maintaining a clean driving record or bundling your auto insurance with other policies.

Can I customize my Direct Auto car insurance policy to include specific coverages I need?

+Absolutely! Direct Auto allows you to customize your policy by selecting the coverage options that align with your unique needs and budget. You can choose from a range of coverage types and adjust limits to create a personalized insurance plan.