Dept Of Insurance Texas

The Texas Department of Insurance (TDI) is a crucial state agency that plays a vital role in regulating and overseeing the insurance industry within the state of Texas. With a rich history dating back to the late 19th century, the TDI has evolved into a comprehensive regulatory body, ensuring the protection of consumers and the stability of the insurance market.

A Historical Perspective: The Evolution of Insurance Regulation in Texas

The roots of insurance regulation in Texas can be traced back to 1876 when the state passed its first insurance law, the Insurance Act. This act laid the foundation for the creation of the Insurance Commissioner’s Office, which was established in 1907. Over the years, the responsibilities and scope of insurance regulation expanded, leading to the formation of the Texas Department of Insurance in 1957.

Since its inception, the TDI has been dedicated to safeguarding the interests of Texas residents by enforcing insurance laws, promoting fair practices, and ensuring the solvency of insurance companies operating within the state. The department's regulatory framework has continually adapted to address emerging challenges and keep pace with the evolving insurance landscape.

Key Functions and Responsibilities of the Texas Department of Insurance

The Texas Department of Insurance is a multifaceted organization with a wide range of critical functions and responsibilities. These include:

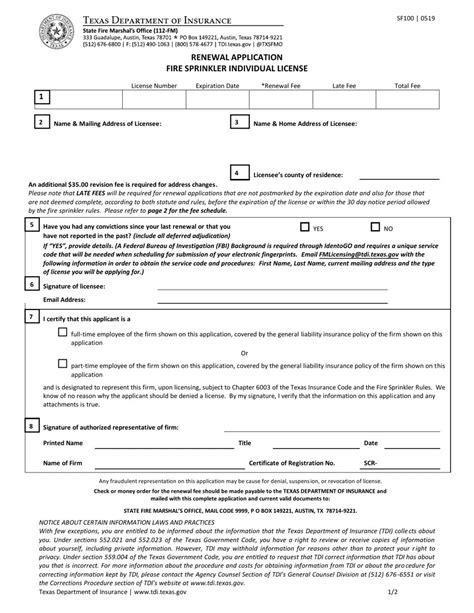

- Regulatory Oversight: The TDI is responsible for regulating and supervising all aspects of the insurance industry in Texas. This encompasses licensing and monitoring insurance companies, agents, and adjusters, as well as ensuring compliance with state laws and regulations.

- Consumer Protection: A primary focus of the TDI is consumer protection. The department provides resources and education to help consumers understand their insurance options and rights. It also investigates and resolves consumer complaints, ensuring fair treatment and prompt resolution of disputes.

- Market Conduct Examinations: The TDI conducts regular market conduct examinations to assess the financial stability and compliance of insurance companies. These examinations involve reviewing financial records, policies, and practices to ensure companies are operating ethically and in the best interest of policyholders.

- Rate and Form Filings: Insurance companies must submit rate and form filings to the TDI for approval. The department reviews these filings to ensure rates are fair, reasonable, and not excessive, and that policy forms comply with state regulations and provide clear and accurate information to consumers.

- Fraud Prevention and Investigation: The TDI plays a crucial role in preventing and investigating insurance fraud. The department's special investigations unit works closely with law enforcement agencies to identify and prosecute fraudulent activities, protecting both consumers and the insurance industry.

- Industry Education and Training: The TDI offers a range of educational programs and resources for insurance professionals. These initiatives aim to enhance industry knowledge, promote best practices, and ensure that professionals are equipped with the skills needed to serve consumers effectively.

Texas Insurance Laws and Regulations: A Comprehensive Overview

The insurance laws and regulations in Texas are extensive and cover a broad spectrum of insurance-related activities. Some key aspects of Texas insurance law include:

- Insurance Code: The Texas Insurance Code is the primary legislative framework governing insurance practices in the state. It outlines the powers and duties of the TDI, defines the scope of insurance regulation, and establishes consumer protections.

- Solvency Requirements: Texas law imposes strict solvency requirements on insurance companies to ensure their financial stability. These requirements include minimum capital and surplus standards, as well as ongoing reporting and disclosure obligations.

- Unfair Claims Settlement Practices: Texas has stringent regulations prohibiting unfair claims settlement practices. These rules ensure that insurance companies handle claims promptly, fairly, and in good faith, providing consumers with the benefits they are entitled to under their policies.

- Consumer Rights: Texas law grants consumers significant rights and protections. These include the right to receive clear and accurate policy information, the right to a fair and timely claims process, and the right to appeal adverse decisions made by insurance companies.

- Agent and Adjuster Licensing: All insurance agents and adjusters operating in Texas must obtain a license from the TDI. Licensing requirements include passing examinations, meeting education standards, and maintaining professional conduct.

Texas Insurance Market: An Industry Analysis

The insurance market in Texas is one of the largest and most diverse in the United States. With a wide range of insurance providers, from large national carriers to smaller, regional companies, Texas offers consumers a competitive and robust insurance marketplace.

Key statistics for the Texas insurance market include:

| Metric | Value |

|---|---|

| Number of Licensed Insurance Companies | Over 2,500 |

| Total Premiums Written | $79.2 billion (as of 2022) |

| Top Insurance Lines | Property and Casualty, Life and Health, Workers' Compensation |

| Market Share | Texas accounts for approximately 8% of the national insurance market |

Navigating the Texas Insurance Landscape: Consumer Resources and Support

The Texas Department of Insurance provides an array of resources and support to help consumers navigate the insurance landscape. These resources include:

- Consumer Guides: The TDI offers a comprehensive library of consumer guides covering various insurance topics, from understanding different types of insurance to filing claims and resolving disputes.

- Online Tools: The department's website features interactive tools and calculators to help consumers compare insurance rates, estimate coverage needs, and understand the cost of insurance.

- Consumer Complaint Process: If consumers have issues or disputes with their insurance provider, they can file a complaint with the TDI. The department investigates these complaints and works to resolve them in a timely manner.

- Education and Outreach Programs: The TDI conducts public awareness campaigns and educational initiatives to inform consumers about their insurance rights and responsibilities. These programs aim to empower consumers to make informed insurance decisions.

- Insurance Agent and Adjuster Search: The TDI maintains a searchable database of licensed insurance agents and adjusters, allowing consumers to verify the credentials of professionals they are considering working with.

Industry Insights: Trends and Innovations Shaping the Future of Insurance in Texas

The insurance industry in Texas, like its counterparts across the nation, is experiencing significant transformations driven by technological advancements and changing consumer expectations. Key trends and innovations include:

- Digital Transformation: Insurance companies are increasingly embracing digital technologies to enhance their operations and improve the customer experience. This includes online policy management, mobile apps for claims filing, and the use of artificial intelligence for risk assessment and fraud detection.

- Telematics and Usage-Based Insurance: Telematics technology is gaining traction in Texas, particularly in the auto insurance market. Usage-based insurance programs allow drivers to link their driving behavior to insurance premiums, offering potential discounts for safe driving.

- Data Analytics and Predictive Modeling: Advanced data analytics and predictive modeling techniques are being employed by insurers to better understand risks and price insurance products more accurately. This helps insurers offer more competitive rates and tailored coverage options to consumers.

- Cyber Insurance and Cybersecurity Measures: With the rise of cyber threats, there is a growing demand for cyber insurance coverage. Insurers are developing specialized policies to protect businesses and individuals from cyber risks, and they are also investing in cybersecurity measures to safeguard their own operations.

The Texas Department of Insurance: A Key Player in Insurance Regulation and Consumer Protection

In conclusion, the Texas Department of Insurance stands as a cornerstone of the state’s insurance industry, ensuring a fair and stable marketplace for both insurers and consumers. Through its comprehensive regulatory framework, consumer protection initiatives, and industry support, the TDI plays a pivotal role in maintaining the integrity and sustainability of the insurance sector.

As the insurance landscape continues to evolve, the TDI remains committed to adapting its regulatory approach, fostering innovation, and promoting best practices. With its dedication to consumer protection and industry oversight, the Texas Department of Insurance is well-positioned to navigate the challenges and opportunities that lie ahead.

Frequently Asked Questions

How can I verify the license of an insurance agent or adjuster in Texas?

+

You can verify the license of an insurance agent or adjuster in Texas by visiting the Texas Department of Insurance’s website and using the “Search for an Agent/Adjuster” tool. This tool allows you to search by name, license number, or other identifying information to ensure the professional you are working with is licensed and in good standing.

What should I do if I have a complaint about my insurance company or agent in Texas?

+

If you have a complaint about your insurance company or agent in Texas, you should first try to resolve the issue directly with the company or agent. If this is unsuccessful, you can file a complaint with the Texas Department of Insurance. The TDI will investigate your complaint and work to resolve it in a timely manner.

Are there any resources available to help me understand my insurance options and rights in Texas?

+

Yes, the Texas Department of Insurance provides a wealth of resources to help consumers understand their insurance options and rights. These resources include consumer guides, online tools, and educational materials. You can access these resources on the TDI’s website to make informed decisions about your insurance coverage.