Dental Insurance For Family

Dental health is an essential aspect of overall well-being, and ensuring that your family has access to quality dental care is paramount. With the rising costs of dental treatments, having adequate dental insurance becomes a wise investment. This comprehensive guide aims to provide an in-depth analysis of dental insurance for families, covering various aspects to help you make informed decisions for your loved ones' dental health.

Understanding Dental Insurance for Families

Dental insurance for families is a type of health insurance policy specifically designed to cover dental expenses for multiple family members. It provides financial protection against the high costs of dental treatments, ranging from routine check-ups and cleanings to more complex procedures like root canals or orthodontics.

The primary goal of family dental insurance is to encourage regular dental care, which is crucial for maintaining good oral health. By offering coverage for a range of dental services, these plans aim to make dental care more accessible and affordable for families.

Key Benefits of Family Dental Insurance

- Coverage for All Family Members: Family dental plans typically cover everyone under one policy, including spouses, children, and sometimes even extended family members living in the same household.

- Preventive Care: Most plans emphasize the importance of preventive dental care by offering coverage for regular check-ups, cleanings, and X-rays. This helps catch potential issues early on, reducing the need for more extensive (and costly) treatments down the line.

- Major Treatment Coverage: While preventive care is a priority, family dental insurance also provides coverage for more significant procedures like fillings, root canals, extractions, and periodontal treatments.

- Orthodontic Benefits: Many family dental plans include orthodontic coverage, which is especially beneficial for families with children who may require braces or other orthodontic appliances.

- Discounts and Savings: Family dental insurance often comes with negotiated rates and discounts, ensuring that you receive quality dental care at reduced costs.

Choosing the Right Family Dental Insurance Plan

Selecting the appropriate family dental insurance plan requires careful consideration of various factors. Here are some key aspects to evaluate:

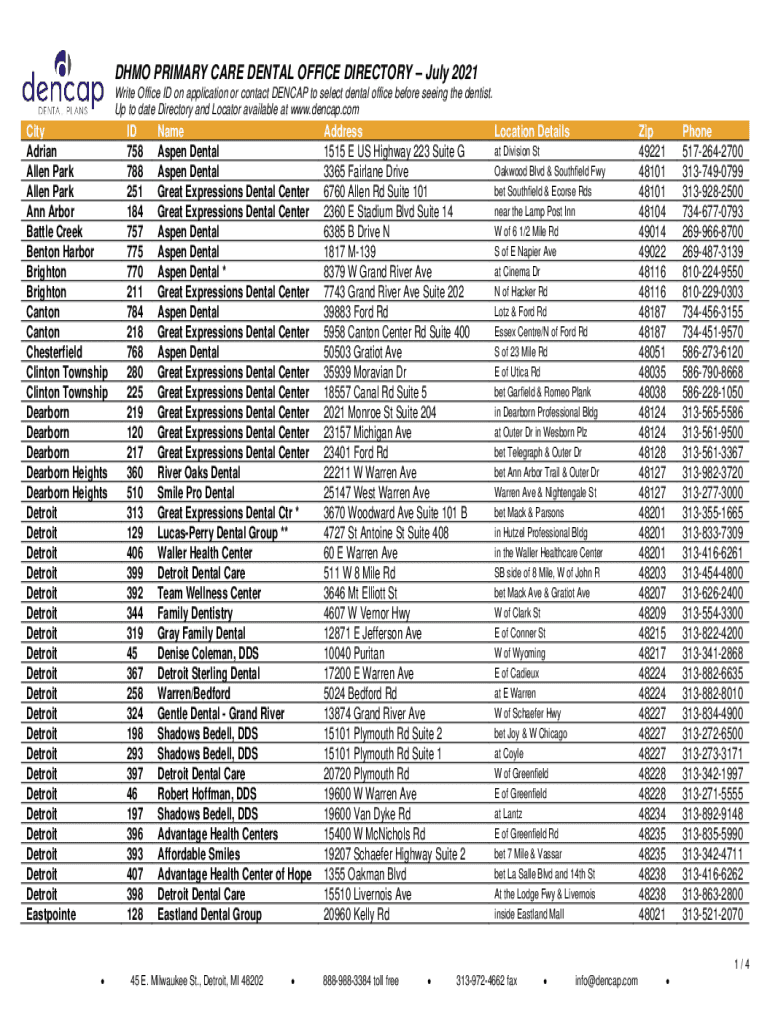

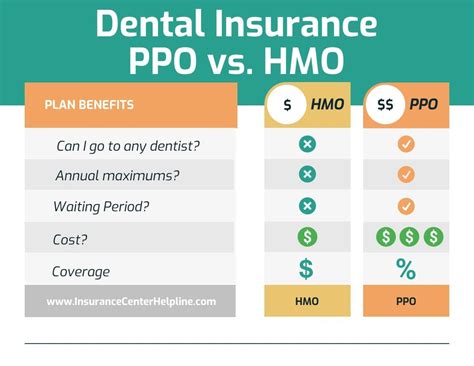

- Network of Dentists: Check the plan's network to ensure that your preferred dental providers are included. A robust network can provide more options and potentially reduce out-of-pocket costs.

- Coverage Details: Review the plan's coverage limits, deductibles, and co-pays. Understand what procedures are covered and at what percentage. Look for plans that offer comprehensive coverage for both preventive and restorative treatments.

- Age and Health Considerations: Consider the age and specific dental needs of your family members. Some plans may offer better coverage for children, while others may cater more towards older adults.

- Cost and Budget: Compare the premiums, deductibles, and overall costs of different plans. Ensure that the plan fits within your family's budget while providing adequate coverage.

- Additional Benefits: Look for plans that offer extra benefits like alternative dental care options, prescription drug coverage, or vision care.

| Plan Type | Coverage Highlights |

|---|---|

| Basic Family Dental Plan | Covers essential preventive care, basic restorative procedures, and limited orthodontic treatment. |

| Enhanced Family Dental Plan | Provides more extensive coverage for restorative treatments and includes orthodontic benefits. |

| Comprehensive Family Dental Plan | Offers the highest level of coverage, including a wide range of restorative procedures and extensive orthodontic benefits. |

Performance Analysis: Impact of Family Dental Insurance

The implementation of family dental insurance plans has had a notable impact on the dental healthcare landscape. Here's an analysis of its performance and key findings:

Increased Access to Dental Care

One of the most significant advantages of family dental insurance is its ability to make dental care more accessible. By covering a wide range of services, these plans reduce the financial burden on families, encouraging regular dental visits. This has led to improved oral health outcomes and reduced the likelihood of severe dental issues.

Focus on Preventive Care

The emphasis on preventive care in family dental plans has resulted in a shift towards proactive dental health management. With coverage for regular check-ups and cleanings, families are more likely to prioritize routine dental examinations, leading to early detection and treatment of potential problems.

Improved Oral Health Outcomes

Studies have shown that individuals with dental insurance are more likely to maintain good oral health. Family dental insurance plans contribute to this by providing coverage for necessary treatments, ensuring that families can access the care they need without financial constraints. This, in turn, leads to better overall oral health and reduced dental-related complications.

Financial Savings

By leveraging the negotiated rates and discounts offered by dental insurance plans, families can save significantly on dental expenses. This is especially beneficial for families with multiple members requiring regular dental care. The savings can be substantial over time, making dental insurance a cost-effective choice.

Evidence-Based Future Implications

As the landscape of dental insurance continues to evolve, several key trends and implications emerge. Here's a look at what the future may hold for family dental insurance:

Expansion of Orthodontic Coverage

With the increasing awareness of the importance of orthodontic care, there is a growing demand for plans that offer comprehensive orthodontic coverage. Expect to see more family dental insurance plans incorporating flexible orthodontic benefits, making braces and other orthodontic treatments more accessible.

Incorporation of Digital Dental Care

The rise of digital dental technologies, such as teledentistry and dental apps, is expected to shape the future of family dental insurance. Plans may start incorporating digital dental care options, providing families with convenient access to dental advice and consultations remotely.

Enhanced Preventive Care Initiatives

Given the success of preventive care initiatives, dental insurance providers are likely to continue emphasizing and investing in programs that promote oral health education and preventive treatments. This could include incentives for regular dental check-ups and expanded coverage for preventive measures.

Personalized Dental Plans

The future may see the development of more personalized dental insurance plans. These plans could be tailored to individual family members, taking into account their unique dental needs and health histories. This level of customization could lead to more efficient and cost-effective coverage.

Frequently Asked Questions (FAQ)

How do I choose the right family dental insurance plan?

+When selecting a family dental insurance plan, consider your family's specific dental needs, the network of dentists covered by the plan, the coverage details (including limits and co-pays), and your budget. Evaluate the plan's focus on preventive care and any additional benefits it offers, such as orthodontic coverage or prescription drug discounts.

<div class="faq-item">

<div class="faq-question">

<h3>Can I add my extended family members to my family dental insurance plan?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The ability to add extended family members to a dental insurance plan depends on the specific plan and insurance provider. Some plans may allow you to add relatives like grandparents, siblings, or in-laws, while others may be limited to immediate family members only. Check with your insurance provider to understand the eligibility criteria for extended family coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I change dental insurance providers mid-year?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Changing dental insurance providers mid-year can have implications for your coverage and benefits. In most cases, you will need to start over with the new provider, which may mean a new deductible and waiting periods for certain procedures. However, some insurance companies may honor previously completed treatments or offer credits for out-of-pocket expenses incurred with the previous provider.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax benefits associated with family dental insurance plans?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The tax benefits associated with family dental insurance plans depend on the specific plan and your tax situation. Some employers may offer dental insurance as part of a flexible spending account (FSA) or health savings account (HSA), allowing you to contribute pre-tax dollars to cover dental expenses. Additionally, if you're self-employed, you may be able to deduct a portion of your dental insurance premiums as a business expense.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should my family visit the dentist with family dental insurance coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>With family dental insurance coverage, it's generally recommended that your family members visit the dentist at least twice a year for routine check-ups and cleanings. This frequency ensures that potential dental issues are detected early and allows for the maintenance of good oral health. However, your dentist may recommend more frequent visits based on individual oral health needs.</p>

</div>

</div>

</div>