Define Homeowners Insurance

Homeowners insurance, a fundamental aspect of financial protection, stands as a crucial safeguard for homeowners and renters alike. This comprehensive insurance policy is designed to provide coverage for one of life's most significant investments - a home. It offers a vital layer of protection against various risks and potential liabilities that homeowners may face.

The Essence of Homeowners Insurance

At its core, homeowners insurance serves as a contractual agreement between an insurance provider and a policyholder. This agreement ensures that the insurance company will compensate the policyholder for losses and damages incurred to their property, possessions, and, in some cases, even personal liability. It acts as a safety net, providing financial security and peace of mind to homeowners and renters, who can rest assured knowing they are protected against unforeseen events.

Understanding the Coverage

The coverage provided by homeowners insurance is diverse and can be tailored to meet the specific needs of the policyholder. Here’s a breakdown of the key components:

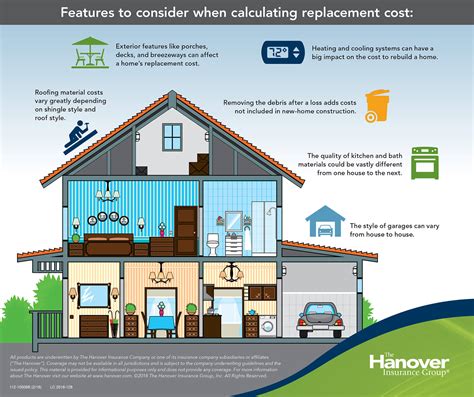

Dwelling Coverage

This is the cornerstone of homeowners insurance, covering the physical structure of the home, including walls, roofs, and permanent fixtures. It ensures that in the event of damage or destruction due to covered perils, the cost of rebuilding or repairing the home will be covered up to the policy limit.

| Peril Coverage | Description |

|---|---|

| Fire | Protection against fire damage, including smoke and flame damage. |

| Windstorm | Coverage for damage caused by high winds, including hurricanes and tornadoes. |

| Hail | Protection against damage from hail, a common peril in certain regions. |

| Explosion | Coverage for damage resulting from an explosion, including natural gas leaks. |

| Riots and Civil Commotion | Protection against damage caused by civil unrest or riots. |

| Aircraft | Coverage for damage caused by aircraft, including planes and helicopters. |

| Vehicles | Protection against damage caused by vehicles, such as cars or trucks. |

| Smoke | Coverage for damage caused by smoke, even if it's not from a fire. |

| Vandalism | Protection against malicious damage to the home. |

Personal Property Coverage

This aspect of homeowners insurance covers the policyholder’s personal belongings, such as furniture, electronics, clothing, and appliances. It provides compensation for losses due to theft, damage, or destruction. However, it’s important to note that certain high-value items, like jewelry or art, may require additional coverage or specific endorsements to be fully protected.

Liability Coverage

Liability coverage is a critical component, offering protection against legal claims and lawsuits arising from bodily injury or property damage caused by the policyholder or their family members. It covers medical expenses, legal defense costs, and potential compensation for damages awarded in court. This coverage is particularly vital, as it safeguards the policyholder’s financial well-being in the event of an unforeseen liability claim.

Additional Living Expenses

In the event that a policyholder’s home becomes uninhabitable due to a covered peril, this coverage steps in to provide reimbursement for additional living expenses, such as hotel stays, restaurant meals, and other temporary housing costs until the home is repaired or rebuilt.

Loss of Use

Similar to additional living expenses, loss of use coverage provides reimbursement for expenses incurred when a policyholder’s home is damaged and they are unable to use it for its intended purposes. This can include costs associated with temporary housing or storage of personal belongings during repairs.

The Importance of Customization

Homeowners insurance policies can be tailored to meet the unique needs of each policyholder. Factors such as the location, size, and construction of the home, as well as the value of personal belongings and the level of liability protection desired, all influence the policy’s coverage and cost. It’s essential to work with an insurance agent or broker to ensure that your policy provides adequate coverage without unnecessary expenses.

Conclusion

In conclusion, homeowners insurance is an indispensable tool for safeguarding one’s financial stability and peace of mind. It offers a comprehensive solution to protect against the unforeseen, providing coverage for the home, personal belongings, and potential liabilities. By understanding the various components of homeowners insurance and customizing a policy to meet specific needs, policyholders can rest assured knowing they are protected against a wide range of risks.

What is the average cost of homeowners insurance?

+The average cost of homeowners insurance varies widely depending on factors such as location, home value, and coverage limits. On average, policyholders can expect to pay between 1,000 and 2,000 annually for a standard policy. However, it’s important to note that costs can fluctuate significantly based on individual circumstances.

Are there any discounts available for homeowners insurance?

+Yes, many insurance companies offer discounts to policyholders who meet certain criteria. Common discounts include multi-policy discounts (bundling homeowners insurance with other policies like auto insurance), loyalty discounts for long-term customers, and safety discounts for homes equipped with certain safety features like smoke detectors or burglar alarms.

How often should I review my homeowners insurance policy?

+It’s recommended to review your homeowners insurance policy annually or whenever significant changes occur in your life or home. These changes could include renovations or additions to your home, purchasing high-value items, or changes in your family structure. Regular reviews ensure that your coverage remains adequate and up-to-date.