Cost Of Renters Insurance

Renters insurance is a vital aspect of financial planning and protection for individuals who rent their living spaces. With the rising costs of living and the increasing prevalence of unexpected events, understanding the cost of renters insurance is essential. In this comprehensive guide, we will delve into the factors that influence the price of renters insurance, provide real-world examples, and offer insights to help you make informed decisions about protecting your belongings and securing your financial future.

Understanding Renters Insurance

Renters insurance is a type of insurance policy designed specifically for individuals who lease or rent residential properties. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on protecting the personal belongings and providing liability coverage for the policyholder. It offers financial protection in the event of various incidents, including theft, fire, natural disasters, and accidental damage.

Coverage Types

Renters insurance typically includes the following coverage types:

- Personal Property Coverage: This coverage reimburses the policyholder for the loss or damage of personal belongings, such as furniture, electronics, clothing, and jewelry, up to the policy’s limits.

- Liability Coverage: Liability insurance protects the policyholder from financial liability if they are found legally responsible for causing bodily injury or property damage to others.

- Additional Living Expenses: In the event of a covered loss that renders the rental unit uninhabitable, this coverage provides reimbursement for additional living expenses incurred during the temporary displacement.

- Medical Payments Coverage: This coverage pays for reasonable and necessary medical expenses for injuries sustained by guests on the rental property, regardless of fault.

Factors Influencing the Cost of Renters Insurance

The cost of renters insurance can vary significantly depending on several factors. Understanding these factors can help you estimate the potential expense and choose a policy that suits your needs and budget.

Location

The geographic location of your rental property plays a significant role in determining the cost of renters insurance. Areas prone to natural disasters, such as hurricanes, earthquakes, or floods, may have higher insurance premiums to account for the increased risk of damage.

| Region | Average Annual Premium |

|---|---|

| Hurricane-prone Coastal Areas | $400 - $800 |

| Urban Centers | $250 - $400 |

| Rural Areas | $200 - $300 |

Value of Personal Belongings

The value of your personal property is a crucial factor in calculating the cost of renters insurance. Insurance companies assess the replacement cost of your belongings to determine the appropriate coverage amount and premium. It is essential to accurately assess the value of your possessions to ensure adequate coverage.

Deductibles and Coverage Limits

Renters insurance policies typically offer a range of deductibles and coverage limits. A higher deductible, which is the amount you pay out of pocket before the insurance coverage kicks in, can lower your premium. However, it’s important to strike a balance between affordability and sufficient coverage to protect your assets.

| Deductible | Average Annual Premium |

|---|---|

| $500 | $150 - $250 |

| $1,000 | $100 - $200 |

| $2,000 | $75 - $150 |

Additional Coverages and Endorsements

Renters insurance policies often allow policyholders to customize their coverage by adding optional endorsements or additional coverages. These can include valuable items coverage for high-value possessions, identity theft protection, or increased liability limits. While these add-ons can enhance your protection, they may also increase the overall cost of the policy.

Real-World Examples of Renters Insurance Costs

To provide a clearer understanding of renters insurance costs, let’s explore some real-world examples:

Example 1: Urban Apartment

Sarah, a young professional living in an apartment in a bustling city, opted for a renters insurance policy with the following coverage:

- Personal Property Coverage: 30,000</li> <li>Liability Coverage: 100,000

- Deductible: 500</li> <li>Additional Living Expenses: 10,000

Based on her location and coverage choices, Sarah’s annual premium amounted to $220. This policy provides her with peace of mind, knowing that her belongings and potential liabilities are protected.

Example 2: Suburban Home

John and Emily, a couple renting a home in a suburban neighborhood, chose a comprehensive renters insurance policy with the following specifications:

- Personal Property Coverage: 50,000</li> <li>Liability Coverage: 300,000

- Deductible: 1,000</li> <li>Valuable Items Coverage: 5,000 (for their engagement rings)

- Identity Theft Protection: Included

Given their higher coverage limits and additional endorsements, John and Emily’s annual premium came to $350. This policy ensures that their valuable possessions and potential liabilities are adequately covered.

Example 3: Student Accommodation

Michael, a college student renting a room in a shared apartment, decided to purchase a basic renters insurance policy to protect his belongings:

- Personal Property Coverage: 10,000</li> <li>Liability Coverage: 50,000

- Deductible: 250</li>

</ul>

<p>Considering his lower coverage limits and the reduced risk associated with student accommodations, Michael's annual premium was a budget-friendly 85. This policy provides essential protection for his possessions and covers potential liability issues.

Tips for Getting the Best Value

To ensure you get the best value for your renters insurance, consider the following tips:

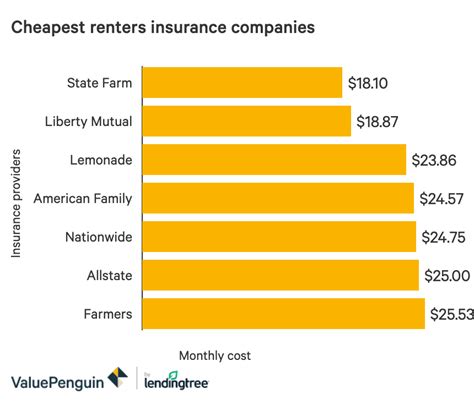

Shop Around and Compare Quotes

Obtain quotes from multiple insurance providers to compare coverage options and premiums. This will help you identify the most suitable policy for your needs at the best price.

Bundle Your Policies

If you already have other insurance policies, such as auto insurance, with the same provider, consider bundling your renters insurance with them. Many insurance companies offer discounts for multiple policy holders.

Understand Your Coverage Needs

Assess your personal belongings and determine the appropriate coverage limits. Overinsuring can lead to unnecessary expenses, while underinsuring may leave you vulnerable. Ensure you have adequate coverage for your valuable items and consider any specific risks associated with your location.

Explore Discounts

Insurance companies often offer discounts for various reasons. Some common discounts include:

- Loyalty Discounts: For staying with the same insurer for multiple years.

- Safety Features Discounts: For installing security systems or smoke detectors in your rental property.

- Payment Method Discounts: For choosing automatic payments or paying the full premium upfront.

The Importance of Renters Insurance

Renters insurance is not just a financial safeguard; it provides peace of mind and protection against unforeseen circumstances. By understanding the factors that influence the cost of renters insurance and making informed choices, you can ensure that your personal belongings and financial well-being are adequately protected.

Protecting Your Possessions

Imagine the loss and stress you would face if your apartment were to catch fire, and all your cherished belongings were destroyed. Renters insurance provides financial assistance to replace or repair your possessions, helping you get back on your feet quickly.

Liability Protection

Accidents can happen, and renters insurance offers liability coverage to protect you from financial ruin. For instance, if a guest trips and falls in your rental unit, causing injuries, your renters insurance can provide the necessary medical payments coverage and protect you from potential lawsuits.

Future Implications and Considerations

As the rental market continues to evolve, renters insurance will play an increasingly vital role in safeguarding tenants. Here are some future considerations:

Changing Rental Trends

With the rise of short-term rentals and co-living spaces, insurance providers are adapting their policies to accommodate these emerging trends. Keep an eye out for specialized renters insurance options tailored to these unique living arrangements.

Technology Integration

Insurance companies are leveraging technology to enhance the renters insurance experience. From digital claims processes to smart home integration for enhanced security, the future of renters insurance promises greater convenience and efficiency.

Environmental Considerations

As climate change continues to impact weather patterns, renters insurance policies may need to adapt to cover new or increased risks associated with natural disasters. Stay informed about any changes in coverage to ensure you are adequately protected.

💡 Remember, renters insurance is a flexible and customizable form of protection. By assessing your needs, comparing options, and staying informed about industry trends, you can secure a policy that provides comprehensive coverage at a competitive price.FAQ

What is the average cost of renters insurance in the United States?

+

The average cost of renters insurance in the United States varies depending on factors such as location, coverage limits, and deductibles. On average, renters insurance policies range from 150 to 300 per year. However, prices can vary significantly based on individual circumstances.

How much renters insurance coverage do I need?

+

The amount of renters insurance coverage you need depends on the value of your personal belongings and your desired level of protection. As a general guideline, it’s recommended to have enough coverage to replace all your possessions. Consider conducting a home inventory to accurately assess the value of your belongings.

Can I get renters insurance if I live in a high-risk area for natural disasters?

+

Yes, you can still obtain renters insurance if you live in a high-risk area for natural disasters. However, it’s important to note that insurance companies may charge higher premiums or exclude certain perils from coverage in such areas. It’s advisable to shop around and compare policies to find the best coverage options for your specific situation.

What are some common exclusions in renters insurance policies?

+

Common exclusions in renters insurance policies may include damage caused by earthquakes, floods, war, and intentional acts of the policyholder. It’s crucial to carefully review the policy’s exclusions to understand what events or damages are not covered.