Cost Of Ozempic With Insurance

The cost of prescription medications, including Ozempic, can vary significantly based on factors such as insurance coverage, location, and pharmacy prices. Understanding the costs associated with Ozempic and how insurance can impact these expenses is crucial for individuals seeking treatment for type 2 diabetes. This article aims to provide an in-depth analysis of the cost of Ozempic with insurance, shedding light on the financial aspects of this popular diabetes medication.

Understanding Ozempic and Its Benefits

Ozempic, also known by its generic name, semaglutide, is a prescription medication used to improve glycemic control in adults with type 2 diabetes. It belongs to a class of drugs called glucagon-like peptide-1 (GLP-1) receptor agonists, which work by stimulating insulin production and reducing glucagon secretion. Ozempic has gained attention for its effectiveness in managing blood sugar levels and its potential to promote weight loss in some patients.

The medication is typically administered once weekly via a subcutaneous injection. It comes in pre-filled pens or vials, providing convenience and accuracy for patients. Ozempic has been clinically proven to lower HbA1c levels and improve overall diabetes management, making it a valuable treatment option for many individuals.

The Cost of Ozempic: A Comprehensive Overview

The cost of Ozempic can vary depending on several factors, including the dosage strength, the quantity prescribed, and the specific pharmacy or retailer. Without insurance coverage, the out-of-pocket cost for Ozempic can be significant. Here’s a breakdown of the potential costs:

- Brand-Name Ozempic: The list price for a single Ozempic pen (1 mg) can range from $700 to $900, depending on the retailer. This price may be even higher for higher-strength doses, such as the 2 mg pen.

- Generic Semaglutide: The availability of generic semaglutide can vary, but when accessible, it offers a more affordable option. The cost of generic semaglutide can be significantly lower than the brand-name medication, potentially saving patients a considerable amount of money.

- Manufacturer Coupons and Discounts: Ozempic's manufacturer, Novo Nordisk, offers various coupons and patient assistance programs. These discounts can reduce the out-of-pocket cost for eligible patients, making the medication more accessible.

It's essential to note that these prices may not reflect the actual cost covered by insurance. Insurance plans often have negotiated rates with pharmaceutical companies, leading to potentially lower costs for insured individuals.

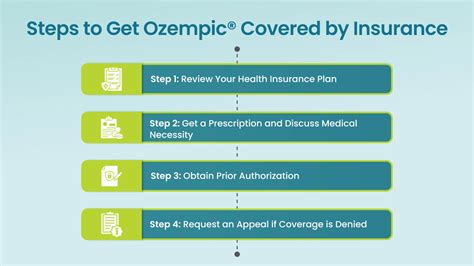

Navigating Insurance Coverage for Ozempic

Insurance coverage for Ozempic can vary based on the specific plan and provider. Understanding the details of your insurance plan is crucial to determining the cost of Ozempic with your coverage.

Insurance Plan Considerations

- Formulary Status: Insurance plans typically have a formulary, which is a list of medications they cover. Ozempic may be included in the formulary, but its coverage and cost-sharing may vary. Some plans may categorize Ozempic as a preferred or non-preferred medication, impacting its cost.

- Tiered Pricing: Many insurance plans use a tiered pricing system for medications. Ozempic may fall into a specific tier, such as Tier 2 or Tier 3, which determines the patient’s cost-sharing responsibility. Higher tiers often result in higher out-of-pocket expenses.

- Prior Authorization: Some insurance plans may require a prior authorization for Ozempic. This means the prescribing physician must obtain approval from the insurance company before the medication can be covered. Prior authorization processes can be complex and may involve additional paperwork or specific medical justifications.

Calculating Cost with Insurance

To estimate the cost of Ozempic with insurance, individuals should review their insurance plan’s summary of benefits or contact their insurance provider directly. The cost can be calculated based on the following factors:

- Deductible: If an insurance plan has a deductible, patients may need to meet this amount before the insurance coverage kicks in. Until the deductible is met, the cost of Ozempic may be the full price.

- Copay or Coinsurance: After meeting the deductible (if applicable), patients may be responsible for a copay or coinsurance. A copay is a fixed dollar amount, while coinsurance is a percentage of the medication's cost. For example, a 20% coinsurance means the patient pays 20% of the medication's price, and the insurance covers the remaining 80%.

- Maximum Out-of-Pocket: Many insurance plans have a maximum out-of-pocket limit, which is the maximum amount a patient will pay for covered services or medications within a specified period, typically a year. Once this limit is reached, the insurance plan covers 100% of the cost.

Strategies to Reduce the Cost of Ozempic

While insurance coverage can significantly reduce the cost of Ozempic, there are additional strategies individuals can employ to further minimize their expenses.

Manufacturer Coupons and Patient Assistance Programs

As mentioned earlier, Novo Nordisk offers various patient assistance programs and coupons for Ozempic. These programs can provide significant discounts or even cover the entire cost of the medication for eligible patients. It’s worth exploring these options, as they can make Ozempic more affordable for those facing financial challenges.

Generic Alternatives

The availability of generic semaglutide can vary, but when accessible, it offers a more cost-effective option. Generic medications are typically much cheaper than their brand-name counterparts, and patients can save a considerable amount by opting for the generic version.

Comparing Pharmacy Prices

Pharmacy prices for Ozempic can vary, so it’s beneficial to compare prices at different pharmacies or retailers. Some online pharmacies may offer competitive pricing, and patients can often find discounts or promotions that can further reduce the cost. It’s important to ensure the pharmacy is reputable and provides legitimate medications.

Mail-Order Pharmacies

Many insurance plans offer mail-order pharmacy services, which can provide convenience and potential cost savings. Mail-order pharmacies often have negotiated rates with insurance companies, resulting in lower prices for medications like Ozempic. Additionally, the convenience of home delivery can save patients time and effort.

Real-World Examples: Cost of Ozempic with Insurance

To illustrate the potential costs of Ozempic with insurance, let’s explore a few real-world examples based on different insurance plans and scenarios.

Example 1: High-Deductible Health Plan

Sarah has a high-deductible health plan with a deductible of $2,000. Her insurance plan categorizes Ozempic as a Tier 3 medication, resulting in a 40% coinsurance. Here’s how her cost may break down:

| Cost Component | Amount |

|---|---|

| List Price (1 mg Pen) | $750 |

| Sarah's Cost before Deductible | $750 |

| Deductible | $2,000 |

| Coinsurance (40%) | $300 |

| Total Cost with Insurance | $300 |

In this scenario, Sarah would need to pay the full list price ($750) until she meets her deductible. Once her deductible is met, her insurance would cover 60% of the cost, resulting in a $300 out-of-pocket expense for each Ozempic pen.

Example 2: Preferred Provider Organization (PPO) Plan

John has a PPO insurance plan with a $500 deductible and a 20% coinsurance for Tier 2 medications. Ozempic is categorized as a Tier 2 medication in his plan. Here’s how his cost may break down:

| Cost Component | Amount |

|---|---|

| List Price (1 mg Pen) | $800 |

| John's Cost before Deductible | $800 |

| Deductible | $500 |

| Coinsurance (20%) | $160 |

| Total Cost with Insurance | $160 |

John would pay the full list price ($800) until he meets his deductible. After meeting the deductible, his insurance would cover 80% of the cost, resulting in a $160 out-of-pocket expense for each Ozempic pen.

Example 3: Health Maintenance Organization (HMO) Plan

Emily has an HMO insurance plan with a 1,000 deductible and a fixed copay of 50 for Tier 2 medications. Ozempic is categorized as a Tier 2 medication in her plan. Here’s how her cost may break down:

| Cost Component | Amount |

|---|---|

| List Price (1 mg Pen) | $780 |

| Emily's Cost before Deductible | $780 |

| Deductible | $1,000 |

| Copay | $50 |

| Total Cost with Insurance | $50 |

Emily would pay the full list price ($780) until she meets her deductible. Once the deductible is met, her insurance would cover the majority of the cost, resulting in a $50 copay for each Ozempic pen.

Conclusion: Empowering Patients with Cost Knowledge

Understanding the cost of Ozempic with insurance is essential for individuals managing type 2 diabetes. By navigating insurance coverage, exploring manufacturer discounts, and considering generic alternatives, patients can make informed decisions about their treatment options. The examples provided offer a glimpse into the potential costs, but it’s crucial to consult one’s insurance plan and healthcare provider for accurate and personalized cost estimates.

As the landscape of healthcare and insurance continues to evolve, staying informed about medication costs and coverage options becomes increasingly important. With the right knowledge and strategies, patients can access effective treatments like Ozempic while managing their financial well-being.

Can I get Ozempic for free with insurance coverage?

+In some cases, insurance coverage may result in minimal or no out-of-pocket costs for Ozempic. This is particularly true for patients who have met their deductible and have a low coinsurance or copay. Additionally, manufacturer coupons and patient assistance programs can further reduce or eliminate the cost.

Are there any alternatives to Ozempic that are more affordable?

+Yes, there are alternatives to Ozempic that may be more affordable. Generic semaglutide, when available, is typically less expensive than the brand-name medication. Additionally, there are other GLP-1 receptor agonists on the market, such as liraglutide and exenatide, which may have different cost structures and insurance coverage.

How often do I need to pay for Ozempic if I have insurance coverage?

+The frequency of payment for Ozempic with insurance coverage depends on your specific insurance plan and the medication’s cost-sharing structure. Some plans may require a copayment or coinsurance for each refill, while others may have a fixed deductible or a maximum out-of-pocket limit. Understanding your insurance plan’s details is crucial for managing costs effectively.