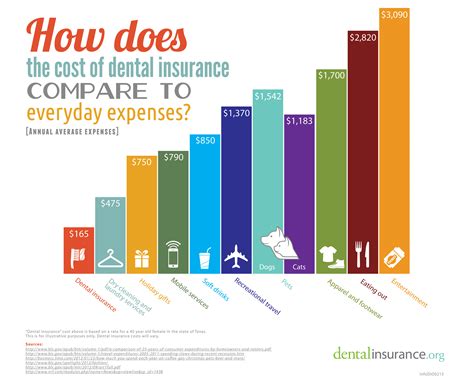

Cost Dental Insurance

The cost of dental insurance is a topic of interest for many individuals and families, especially when considering the financial aspects of maintaining good oral health. Dental insurance plans can vary significantly in terms of coverage, premiums, and out-of-pocket expenses, making it crucial to understand the factors that influence these costs.

In this comprehensive article, we will delve into the world of dental insurance costs, exploring the key elements that impact pricing, the different types of plans available, and the strategies to optimize your dental care expenses. By the end of this guide, you will have a clear understanding of how to navigate the complexities of dental insurance and make informed decisions regarding your oral health and financial well-being.

Understanding the Factors Influencing Dental Insurance Costs

Several factors contribute to the variability in dental insurance costs. By examining these factors, you can gain insight into the pricing structure and make more informed choices when selecting a plan.

Coverage and Benefits

The scope of coverage is a significant determinant of dental insurance costs. Different plans offer varying levels of coverage for preventive, basic, and major dental procedures. Plans with more comprehensive coverage, such as those that include orthodontics or extensive restorative procedures, often come with higher premiums. On the other hand, basic plans that focus on routine check-ups and cleanings may have more affordable monthly premiums.

Additionally, the specific benefits included in a plan can impact costs. For instance, plans that offer coverage for cosmetic dentistry or dental implants may have higher premiums to account for the potentially higher treatment costs associated with these procedures.

Network and Provider Selection

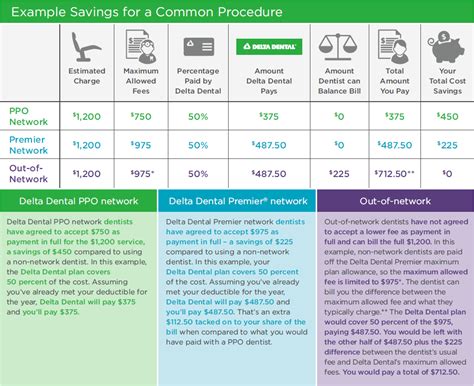

The choice of dental network and individual providers can also affect insurance costs. In-network dentists typically have negotiated rates with insurance companies, resulting in lower costs for patients. Plans that offer a larger network of providers may have slightly higher premiums to accommodate the broader range of dentists. Conversely, plans with a more limited network may have lower premiums but may restrict your choice of dentists.

Furthermore, some plans allow you to choose between in-network and out-of-network providers. While using an out-of-network dentist may provide more flexibility, it often comes at a higher cost, as you may be responsible for a larger portion of the treatment expenses.

Age and Demographic Factors

Dental insurance costs can vary based on age and demographic characteristics. Younger individuals, who generally have fewer dental issues, may be able to find more affordable plans compared to older adults. Additionally, dental insurance premiums may be influenced by factors such as gender, geographic location, and even employment status.

For instance, plans offered through employers may have different rates based on the employee's job role or the size of the company. It's essential to consider these demographic factors when evaluating dental insurance options.

Plan Type and Deductibles

The type of dental insurance plan you choose can significantly impact your costs. Common plan types include Indemnity plans, Preferred Provider Organization (PPO) plans, and Dental Health Maintenance Organization (DHMO) plans. Each plan type has its own cost structure and coverage limitations.

Indemnity plans typically offer the most flexibility but may have higher out-of-pocket costs, as you pay for services upfront and are then reimbursed by the insurance company. PPO plans often have a more comprehensive network of providers and may require you to pay a deductible before your insurance coverage kicks in. DHMO plans, on the other hand, usually have the lowest premiums but may have more restricted provider choices.

Additional Factors

Other factors that can influence dental insurance costs include the inclusion of dental specialties (such as endodontics or periodontics), the plan’s annual maximum benefit limit, and any additional features like vision or prescription drug coverage.

Types of Dental Insurance Plans and Their Costs

Now that we have a clearer understanding of the factors influencing dental insurance costs, let’s explore the different types of plans available and their associated expenses.

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, offer the most flexibility in terms of provider choice. With these plans, you can visit any dentist you prefer, whether they are in-network or out-of-network. However, the trade-off for this flexibility is often higher out-of-pocket costs.

Indemnity plans typically require you to pay for dental services upfront and then submit a claim to your insurance company for reimbursement. The reimbursement amount is usually based on a predetermined fee schedule, and you may be responsible for any amount that exceeds the allowed benefit. The premiums for indemnity plans can vary, but they generally fall on the higher end of the cost spectrum due to the unrestricted provider choice.

Preferred Provider Organization (PPO) Plans

PPO plans provide a balance between flexibility and cost. These plans offer a network of preferred dentists, and you can choose to visit any dentist within this network. By staying within the network, you can take advantage of negotiated rates and potentially lower out-of-pocket expenses.

PPO plans often require you to pay a deductible before your insurance coverage takes effect. Once the deductible is met, the plan typically covers a certain percentage of the cost of dental services, with you responsible for the remaining portion. The premiums for PPO plans can vary based on the size of the network and the specific benefits included in the plan.

Dental Health Maintenance Organization (DHMO) Plans

DHMO plans, also referred to as managed care plans, offer the most affordable premiums among the common dental insurance plan types. These plans have a restricted network of dentists, and you must choose a primary care dentist within this network. Your primary care dentist will coordinate your dental care and refer you to specialists within the DHMO network if needed.

DHMO plans typically have low or no deductibles and may cover a more comprehensive range of services compared to other plan types. However, the trade-off for the lower premiums is the limited provider choice. If you prefer a specific dentist or require specialized dental care, DHMO plans may not be the most suitable option.

Discount Dental Plans

Discount dental plans, sometimes referred to as dental savings plans, are an alternative to traditional dental insurance. These plans do not provide insurance coverage but instead offer discounted rates on dental services through a network of participating dentists. Members pay an annual or monthly fee to access these discounted rates.

Discount dental plans can be a cost-effective option for individuals who require dental care but may not qualify for traditional insurance or prefer a more flexible arrangement. The costs of these plans are typically lower than insurance premiums, but the savings on dental services can vary depending on the plan and the specific treatments needed.

Strategies to Optimize Your Dental Insurance Costs

Understanding the factors that influence dental insurance costs and the different plan types available is the first step toward making informed decisions. However, there are additional strategies you can employ to optimize your dental care expenses and get the most value from your insurance plan.

Compare Plans and Shop Around

When selecting a dental insurance plan, it’s crucial to compare multiple options to find the best fit for your needs and budget. Different insurance companies and plans may offer varying levels of coverage and pricing, so shopping around can help you identify the most cost-effective option.

Consider using online tools and resources that allow you to compare plans side by side. Look for plans that offer the coverage you require at a price that aligns with your financial situation. Don't hesitate to contact insurance providers directly to discuss their plans and negotiate the best terms.

Choose an In-Network Dentist

If your plan offers a network of preferred dentists, opting for an in-network provider can save you money. In-network dentists have negotiated rates with the insurance company, which means you will typically pay less out of pocket for their services. Additionally, in-network providers are more likely to be familiar with the specific coverage and benefits of your plan, making the claims process smoother.

If you have a preferred dentist who is not in your plan's network, it's worth considering switching to an in-network provider to take advantage of the cost savings. However, if you have a strong relationship with your current dentist and they are willing to work with your insurance company, you may still be able to receive services at a reasonable cost.

Understand Your Plan’s Coverage and Limitations

Familiarize yourself with the specifics of your dental insurance plan, including the covered procedures, deductibles, and any limitations or exclusions. This knowledge will help you manage your expectations and plan for potential out-of-pocket expenses.

Review the plan's schedule of benefits, which outlines the coverage percentages for different types of dental procedures. This information will allow you to estimate the cost of specific treatments and make informed decisions about your oral health care.

Take Advantage of Preventive Care

Most dental insurance plans cover preventive care services, such as routine check-ups, cleanings, and X-rays, at little to no cost to you. Taking advantage of these preventive services can help identify potential dental issues early on, potentially saving you from more extensive and costly treatments down the line.

Regular dental check-ups and cleanings are essential for maintaining good oral health and can help prevent issues like cavities, gum disease, and tooth loss. By staying on top of your preventive care, you can reduce the likelihood of needing costly restorative procedures in the future.

Consider Dental Savings Accounts

If you have a flexible spending account (FSA) or a health savings account (HSA) through your employer, you may be able to use these accounts to cover certain dental expenses. FSAs and HSAs allow you to set aside pre-tax dollars to pay for qualified medical and dental expenses.

By contributing to these accounts, you can reduce your taxable income and potentially save money on your overall healthcare costs. Check with your employer or financial advisor to understand the specific rules and limitations of your FSA or HSA regarding dental expenses.

Negotiate Treatment Costs

In some cases, you may be able to negotiate the cost of dental treatments, especially if you are paying out of pocket or have a high deductible plan. Discuss your financial situation and concerns with your dentist, and they may be willing to work with you to find a payment plan or offer a discounted rate.

Dentists understand that dental care can be expensive, and many are open to discussing payment options to make treatment more accessible. Don't be afraid to ask about discounts, especially if you are a loyal patient or have a good relationship with your dentist.

The Future of Dental Insurance: Trends and Innovations

The dental insurance industry is continually evolving, and several trends and innovations are shaping the future of oral health care coverage.

Integration of Technology

Technology is playing an increasingly significant role in the dental insurance landscape. Many insurance companies are adopting digital platforms and mobile apps to streamline the claims process and enhance the overall customer experience. These digital tools can make it easier for patients to submit claims, track their benefits, and receive real-time updates on their insurance coverage.

Additionally, the integration of technology in dentistry is leading to more efficient and accurate diagnoses, which can benefit both patients and insurance providers. For example, digital imaging and 3D printing are revolutionizing the way dental treatments are planned and executed, potentially reducing costs and improving outcomes.

Focus on Preventive Care and Wellness

There is a growing emphasis on preventive care and oral health wellness within the dental insurance industry. Insurance providers are recognizing the long-term benefits of promoting good oral hygiene and regular dental check-ups. As a result, many plans are expanding their coverage for preventive services and offering incentives for patients who prioritize their oral health.

This shift towards preventive care is not only beneficial for patients but also for insurance companies, as it can help reduce the need for more expensive restorative procedures in the future. By encouraging patients to take a proactive approach to their oral health, insurance providers can potentially lower their overall costs and improve the overall health of their policyholders.

Expansion of Dental Networks

Dental insurance companies are working to expand their networks of preferred providers to offer greater flexibility and choice to their policyholders. A larger network of dentists can provide more options for patients, especially those with specific dental needs or preferences.

Furthermore, the expansion of dental networks can lead to increased competition among dentists, potentially driving down costs and improving the overall quality of care. Patients may benefit from a wider range of providers to choose from, ensuring they can find a dentist who meets their individual needs and preferences.

Collaborative Care Models

The traditional dental office model is evolving, with an increasing focus on collaborative care. This approach involves dentists working closely with other healthcare professionals, such as physicians and specialists, to provide more comprehensive and coordinated care for patients.

Collaborative care models can lead to better overall health outcomes for patients, as oral health is closely linked to systemic health. By integrating dental care into a patient's overall healthcare plan, insurance providers can potentially reduce costs associated with managing chronic conditions and improve the overall well-being of their policyholders.

Personalized Treatment Plans

The future of dental insurance is moving towards more personalized treatment plans. With advancements in technology and a better understanding of individual patient needs, insurance providers can offer customized coverage options that cater to specific dental conditions and goals.

Personalized treatment plans can lead to more efficient and effective dental care, as patients receive the specific treatments they require without unnecessary procedures. This approach can potentially reduce costs for both patients and insurance providers, as it focuses on providing the right care at the right time.

Conclusion: Making Informed Decisions for Your Dental Health

Understanding the cost of dental insurance is a crucial step in taking control of your oral health and financial well-being. By examining the factors that influence dental insurance costs, exploring the different plan types, and employing strategies to optimize your expenses, you can make informed decisions that align with your needs and budget.

Remember, dental insurance is not just about the cost of premiums; it's about the long-term benefits of maintaining good oral health. By prioritizing preventive care, staying informed about your plan's coverage, and taking advantage of the innovations and trends shaping the dental insurance industry, you can ensure that you receive the best possible care while managing your dental care expenses effectively.

What is the average cost of dental insurance per month?

+The average monthly cost of dental insurance can vary widely depending on factors such as the type of plan, coverage, and location. Indemnity plans typically have higher premiums, ranging from 30 to 50 per month for an individual and up to 100 for a family. PPO plans often fall within a similar range, while DHMO plans may have slightly lower premiums, starting around 20 per month for an individual. It’s essential to consider the specific plan and its coverage when assessing the average cost.

How can I reduce my out-of-pocket dental expenses?

+There are several strategies to reduce out-of-pocket dental expenses. Choosing an in-network dentist can save you money, as they have negotiated rates with your insurance provider. Understanding your plan’s coverage and limitations can help you plan for potential costs. Taking advantage of preventive care services, which are often covered at little to no cost, can prevent more expensive issues later on. Additionally, negotiating treatment costs with your dentist and considering dental savings accounts can further reduce your expenses.

Are there any government programs that offer dental insurance?

+Yes, there are government programs that provide dental insurance or assistance for eligible individuals. For example, Medicaid, a government-funded health insurance program, may cover dental services for low-income individuals and families. Additionally, some states have their own programs, such as the Children’s Health Insurance Program (CHIP), which may offer dental coverage for children from low-income families. It’s essential to check your eligibility and understand the specific coverage and limitations of these programs.

Can I get dental insurance if I have pre-existing dental conditions?

+Yes, you can still obtain dental insurance even if you have pre-existing dental conditions. While some plans may exclude coverage for certain conditions or limit benefits for a specific period, there are options available for individuals with pre-existing conditions. It’s crucial to carefully review the plan’s details, including any waiting periods or exclusions, to ensure you receive the coverage you need.