Cheap Car Insurance In Nj

Finding cheap car insurance in New Jersey can be a challenging task, given the state's notoriously high insurance rates. However, with a bit of knowledge and strategic planning, it is possible to secure affordable coverage. This comprehensive guide will delve into the factors influencing insurance costs in the Garden State and provide expert insights on securing the best rates.

Understanding New Jersey’s Insurance Landscape

New Jersey is known for having one of the highest average insurance premiums in the nation. This is primarily due to a combination of factors, including a high population density, frequent traffic congestion, and a history of expensive car accidents. Additionally, the state’s unique no-fault insurance system, which mandates Personal Injury Protection (PIP) coverage, can contribute to higher overall costs.

Despite these challenges, there are ways to navigate the market and find competitive rates. By understanding the key factors that influence insurance premiums and taking advantage of available discounts, drivers can significantly reduce their insurance costs.

Key Factors Affecting Insurance Rates

Several factors play a role in determining insurance premiums in New Jersey. These include:

- Driving Record: A clean driving history is crucial. Tickets, accidents, and DUI convictions can significantly increase insurance rates.

- Vehicle Type: The make, model, and year of your vehicle can impact your premium. Generally, newer and more expensive vehicles cost more to insure.

- Coverage Limits: The amount of coverage you choose directly affects your premium. Higher coverage limits mean higher costs.

- Deductibles: Opting for a higher deductible can lower your premium, but it means you’ll pay more out-of-pocket if you file a claim.

- Location: Where you live and work matters. Areas with high crime rates or frequent accidents typically have higher insurance rates.

- Age and Gender: Younger drivers and males often face higher premiums due to statistically higher risk profiles.

By being aware of these factors, drivers can make informed decisions when choosing insurance coverage and potentially reduce their premiums.

Discounts and Savings Opportunities

Insurance companies in New Jersey offer a variety of discounts to help drivers save on their premiums. Some common discounts include:

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Good Driver Discount: Maintaining a clean driving record for a certain period often qualifies you for a discount.

- Safe Driver Programs: Some insurance companies offer programs that track your driving habits and reward safe driving with lower premiums.

- Student Discounts: Full-time students with good grades may be eligible for discounts.

- Membership Discounts: Belonging to certain organizations, such as AAA or AARP, can provide access to exclusive insurance discounts.

It's important to explore all available discounts and discuss them with your insurance agent to ensure you're taking advantage of every opportunity to save.

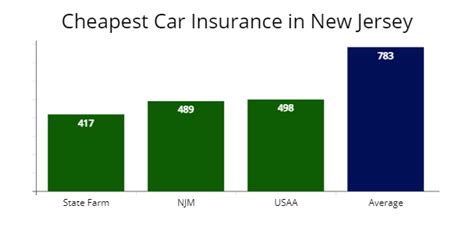

Comparing Insurance Companies in New Jersey

With numerous insurance companies operating in New Jersey, it can be daunting to choose the right one. Here’s a comparison of some of the top providers in the state:

| Insurance Company | Average Annual Premium | Notable Discounts |

|---|---|---|

| State Farm | $2,450 | Good Student Discount, Safe Driver Discount, Multi-Policy Discount |

| GEICO | $2,100 | Military Discount, Good Student Discount, Emergency Deployment Discount |

| Progressive | $2,250 | Snapshot Discount (based on driving habits), Multi-Policy Discount |

| Allstate | $2,550 | Safe Driver Bonus Check, Multi-Policy Discount, Good Student Discount |

| Esurance | $2,000 | Online Discount, Switch & Save Discount, Good Student Discount |

These figures are based on average rates and should be used as a general guide. Actual premiums can vary significantly based on individual factors.

Tips for Choosing an Insurance Provider

When selecting an insurance company, consider the following tips:

- Compare rates from multiple providers to find the best deal.

- Check the financial stability and customer service ratings of the companies you’re considering.

- Read reviews and ask for recommendations from friends and family.

- Ensure the company offers the coverage options you need.

- Consider the company’s claims process and response times.

By carefully evaluating these factors, you can make an informed decision and choose an insurance provider that offers both competitive rates and excellent service.

Maximizing Savings with Shopping Strategies

To further reduce your insurance costs, consider implementing these shopping strategies:

Shop Around and Compare

Insurance rates can vary significantly between companies. By obtaining quotes from multiple providers, you can identify the most competitive rates for your specific situation. Online quote comparison tools can be a convenient way to quickly gather multiple quotes.

Understand Your Coverage Needs

Different drivers have varying insurance needs. Consider your individual requirements and choose a policy that provides adequate coverage without unnecessary add-ons. For instance, if you have an older vehicle, you may not need comprehensive or collision coverage.

Consider Usage-Based Insurance

Some insurance companies offer usage-based insurance programs that track your driving habits and provide discounts for safe driving. These programs can be a great way to save if you’re a cautious driver.

Maintain a Good Driving Record

A clean driving record is essential for keeping insurance premiums low. Avoid tickets, accidents, and DUI convictions. If you have a minor violation on your record, consider taking a defensive driving course to potentially remove points from your license and reduce your insurance rates.

Bundle Policies

If you have multiple insurance needs, such as auto, homeowners, or renters insurance, consider bundling them with the same provider. Bundling policies often leads to substantial savings.

Expert Tips for Lowering Your Premium

In addition to the strategies mentioned above, here are some expert tips to help you lower your insurance premium:

Increase Your Deductible

Opting for a higher deductible can significantly reduce your premium. However, ensure you can afford the higher out-of-pocket expense if you need to file a claim.

Explore Group Discounts

Some insurance companies offer group discounts for members of certain organizations or employees of specific companies. Check with your employer or any organizations you’re affiliated with to see if you’re eligible for any group discounts.

Maintain a Good Credit Score

Insurance companies often use credit scores as a factor in determining premiums. Maintaining a good credit score can help you secure lower rates.

Consider Telematics Devices

Telematics devices, which track your driving behavior, can lead to discounts if you drive safely. However, these devices may also monitor your location, so consider the trade-offs before opting for one.

Future Implications and Emerging Trends

The insurance industry is constantly evolving, and New Jersey is no exception. Here are some emerging trends and future implications to consider:

Autonomous Vehicles

As self-driving cars become more prevalent, insurance coverage will need to adapt. It’s expected that liability will shift from individual drivers to vehicle manufacturers, which could lead to changes in insurance policies and rates.

Telematics and Usage-Based Insurance

Usage-based insurance programs are likely to become more common, providing opportunities for drivers to save by demonstrating safe driving habits.

Climate Change and Natural Disasters

With the increasing frequency and severity of natural disasters due to climate change, insurance rates may rise to account for the higher risk of claims. This could particularly impact coastal areas of New Jersey.

Regulatory Changes

Changes in state regulations, such as modifications to the no-fault insurance system or mandatory coverage requirements, could significantly impact insurance rates and coverage options.

Technological Advancements

Advancements in vehicle safety features and technology may lead to lower insurance rates as these features reduce the risk of accidents and severity of claims.

Stay informed about these emerging trends and how they might impact your insurance costs in the future.

How often should I review my insurance policy to ensure I’m getting the best rate?

+

It’s a good idea to review your insurance policy annually, especially if your circumstances have changed. This includes changes in your driving record, vehicle, address, or personal life. Regular reviews can help you identify opportunities to save or adjust your coverage as needed.

Are there any discounts available for electric or hybrid vehicles in New Jersey?

+

Yes, some insurance companies offer discounts for electric or hybrid vehicles. These discounts typically reward the reduced risk associated with these types of vehicles, which often have advanced safety features and lower fuel consumption.

Can I get insurance if I have a poor driving record or past insurance claims?

+

Yes, insurance companies cater to drivers with various profiles, including those with less-than-perfect driving records. However, a poor driving record or past insurance claims may result in higher premiums. It’s still worthwhile to shop around and compare rates, as some companies may offer more competitive rates for high-risk drivers.

What is the average cost of car insurance in New Jersey for a young driver?

+

The average cost of car insurance for a young driver in New Jersey can be significantly higher than for more experienced drivers. It’s not uncommon for young drivers to pay upwards of 3,000 to 4,000 annually for insurance, although rates can vary based on individual circumstances and the insurance company.

Are there any government programs or initiatives to help reduce insurance costs in New Jersey?

+

Currently, there are no state-specific government programs aimed at reducing insurance costs for New Jersey residents. However, the state does regulate insurance companies to ensure they comply with consumer protection laws and maintain fair pricing practices.