Comparing Health Insurance Coverage Options

Health insurance is a vital aspect of modern healthcare systems, providing individuals and families with financial protection and access to essential medical services. With a multitude of coverage options available, understanding the differences and making informed choices is crucial. This comprehensive guide aims to delve into the world of health insurance, offering a detailed comparison of various coverage options to empower individuals in making the right decisions for their healthcare needs.

Understanding Health Insurance Coverage

Health insurance serves as a safety net, ensuring that individuals can afford necessary medical treatments, surgeries, medications, and preventive care. It plays a critical role in promoting overall well-being and mitigating the financial risks associated with unexpected health issues. In this section, we will explore the fundamentals of health insurance coverage, its importance, and the key factors to consider when selecting a plan.

The Purpose of Health Insurance

At its core, health insurance is designed to provide financial coverage for medical expenses, which can vary significantly depending on an individual’s health status and the services required. By spreading the financial burden across a large group of policyholders, insurance companies can offer affordable premiums to their members. This shared responsibility model ensures that everyone has access to healthcare, regardless of their current health conditions.

Health insurance not only provides financial protection but also encourages preventive care and early intervention. With the right coverage, individuals are more likely to seek regular check-ups, screenings, and vaccinations, which can help detect potential health issues early on and prevent more serious, costly conditions down the line. This proactive approach to healthcare is a key benefit of comprehensive insurance plans.

Key Factors to Consider in Coverage Options

When comparing health insurance plans, several factors come into play. Understanding these elements is essential for making an informed decision. Here are some critical considerations:

- Premiums and Deductibles: Premiums are the regular payments made to maintain insurance coverage, while deductibles are the out-of-pocket expenses an individual must pay before the insurance coverage kicks in. Balancing these costs is crucial, as lower premiums often come with higher deductibles, and vice versa.

- Coverage Limits and Networks: Insurance plans have limits on the types of services and treatments covered, as well as networks of healthcare providers. It's important to review these limits and ensure that your preferred doctors and hospitals are within the network to avoid unexpected out-of-network charges.

- Co-Payments and Co-Insurance: Co-payments are fixed amounts paid by the insured at the time of service, while co-insurance is a percentage of the total cost that the insured is responsible for. These additional costs can vary depending on the plan and the type of service received.

- Prescription Drug Coverage: Prescription medications can be a significant expense, so understanding the plan's coverage for drugs is essential. Some plans have separate tiers for different types of medications, with varying cost-sharing arrangements.

- Specialty Care and Chronic Condition Management: If you have specific health needs or chronic conditions, it's crucial to choose a plan that covers the necessary specialty care and provides adequate support for managing your condition.

Types of Health Insurance Coverage

The health insurance landscape is diverse, offering a range of coverage options to cater to different needs and preferences. In this section, we will explore some of the most common types of health insurance plans, providing an in-depth analysis of their features and suitability for various individuals and families.

Private Health Insurance Plans

Private health insurance is typically offered by commercial insurance companies and is the most common form of coverage in many countries. These plans provide a wide range of options, allowing individuals to choose the level of coverage and benefits that suit their needs and budget.

Private insurance plans often come with a variety of networks, from preferred provider organizations (PPOs) that offer flexibility in choosing doctors and hospitals, to health maintenance organizations (HMOs) that require members to select a primary care physician and stay within a designated network. Point-of-service (POS) plans combine elements of both PPOs and HMOs, providing flexibility with some network restrictions.

Key features of private health insurance plans include:

- Flexible coverage options with customizable benefits.

- Choice of network providers and specialists.

- May offer additional benefits like vision and dental coverage.

- Premiums and deductibles can vary significantly.

Government-Sponsored Health Insurance

In many countries, governments play a significant role in providing health insurance coverage to their citizens. These government-sponsored plans often have lower premiums and provide comprehensive benefits, making healthcare more accessible to a wider population.

Some common government-sponsored health insurance programs include:

- Medicare: Typically for individuals aged 65 and older, people with certain disabilities, and those with end-stage renal disease. Medicare provides hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D), along with supplemental plans (Medigap) to cover additional costs.

- Medicaid: A joint federal and state program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Medicaid offers comprehensive benefits, including doctor visits, hospital stays, lab tests, and prescription drugs.

- Children's Health Insurance Program (CHIP): This program provides low-cost health coverage to children in families that earn too much to qualify for Medicaid but cannot afford private insurance. CHIP covers routine check-ups, immunizations, doctor visits, dental care, and vision care.

Employer-Sponsored Health Insurance

Many employers offer health insurance as a benefit to their employees, making it an attractive option for those in the workforce. These plans are often more affordable due to the group nature of the coverage and can provide a range of benefits tailored to the specific needs of the company’s workforce.

Employer-sponsored health insurance plans typically offer:

- Competitive premiums, often with employer contributions.

- Customized benefits packages to meet the needs of the workforce.

- Access to a network of preferred providers.

- May include additional benefits like wellness programs and flexible spending accounts.

Specialized Health Insurance Plans

In addition to the standard coverage options, there are specialized health insurance plans designed to cater to specific needs. These plans often focus on a particular aspect of healthcare or provide coverage for individuals with unique circumstances.

Some specialized health insurance plans include:

- Short-Term Health Insurance: These plans offer temporary coverage for individuals between jobs or those waiting for other insurance plans to take effect. They typically have lower premiums but may have limited benefits and shorter coverage periods.

- Catastrophic Health Insurance: Designed for young adults or those with limited financial means, these plans have low premiums but high deductibles. They provide essential coverage for catastrophic events like accidents or serious illnesses.

- Dental and Vision Insurance: Separate plans that cover dental and vision care, often with annual maximums and co-payments. These plans are ideal for individuals who require frequent dental or eye care but may not need extensive medical coverage.

- Long-Term Care Insurance: This type of insurance provides coverage for individuals who require extended care due to chronic illnesses or disabilities. It covers services like nursing home care, home healthcare, and assisted living facilities.

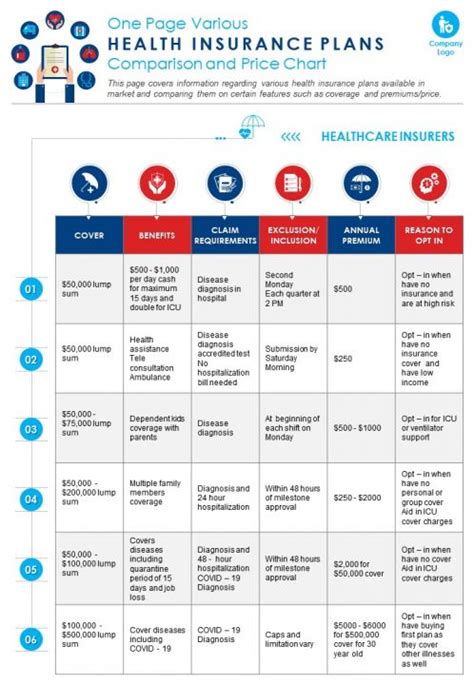

Comparing Coverage Options: A Detailed Analysis

Now that we have explored the various types of health insurance coverage, it’s time to delve deeper into the specific features and benefits of each option. In this section, we will conduct a comprehensive comparison, highlighting the strengths and potential drawbacks of each plan to assist readers in making an informed choice.

Private Health Insurance Plans: A Comprehensive Overview

Private health insurance plans offer a high degree of flexibility and customization, making them a popular choice for individuals and families. These plans are designed to cater to a wide range of healthcare needs and preferences, providing an extensive network of providers and a variety of coverage options.

One of the key advantages of private health insurance is the ability to choose the level of coverage that aligns with your specific needs. Whether you require comprehensive coverage for chronic conditions or prefer a more basic plan with lower premiums, private insurers offer a range of options to suit different budgets and health requirements.

Private health insurance plans typically offer the following features:

- Flexible Networks: With PPO plans, you have the freedom to choose any doctor or hospital, providing maximum flexibility. HMO plans, on the other hand, require you to select a primary care physician and use in-network providers, but they often have lower out-of-pocket costs.

- Customizable Benefits: Private insurers allow you to tailor your coverage to include additional benefits like vision, dental, and prescription drug coverage. You can also opt for plans with higher deductibles and lower premiums, or vice versa, depending on your financial situation and healthcare needs.

- Variety of Premiums: Private health insurance plans offer a wide range of premium options, allowing you to find a plan that fits your budget. While some plans may have higher premiums for more comprehensive coverage, others offer affordable options with basic benefits.

- Specialty Care Options: If you have specific healthcare needs, such as ongoing treatment for a chronic condition or access to specialty care, private insurance plans can provide the necessary coverage. These plans often have networks that include a wide range of specialists, ensuring you have access to the care you need.

Government-Sponsored Health Insurance: Benefits and Considerations

Government-sponsored health insurance programs, such as Medicare, Medicaid, and CHIP, are designed to provide comprehensive coverage to specific populations, including the elderly, low-income individuals, and children. These programs play a crucial role in ensuring that everyone has access to quality healthcare, regardless of their financial situation.

Medicare, for example, is a federal program that provides health insurance for individuals aged 65 and older, as well as those with certain disabilities. It offers a range of benefits, including hospital insurance, medical insurance, and prescription drug coverage. Medicare Advantage plans, which are offered by private insurance companies, provide an alternative to original Medicare and often include additional benefits like vision and dental coverage.

Medicaid, on the other hand, is a joint federal and state program that provides health coverage to eligible low-income adults, children, pregnant women, and individuals with disabilities. Medicaid offers a comprehensive benefits package, covering a wide range of services, including doctor visits, hospital stays, lab tests, and prescription drugs. Eligibility for Medicaid is based on income and other factors, making it a vital resource for those who may not be able to afford private insurance.

The Children's Health Insurance Program (CHIP) is another government-sponsored program that focuses on providing low-cost health coverage to children in families that earn too much to qualify for Medicaid but cannot afford private insurance. CHIP covers essential services like routine check-ups, immunizations, doctor visits, dental care, and vision care, ensuring that children have access to the healthcare they need to grow and thrive.

Employer-Sponsored Health Insurance: Group Coverage Benefits

Employer-sponsored health insurance is a common benefit offered by many companies to their employees. These plans are often more affordable due to the group nature of the coverage and can provide a range of benefits tailored to the specific needs of the company’s workforce.

One of the key advantages of employer-sponsored health insurance is the contribution made by the employer towards the premiums. This can significantly reduce the cost of coverage for employees, making healthcare more accessible and affordable. Additionally, these plans often come with a comprehensive benefits package, including access to a network of preferred providers and additional perks like wellness programs and flexible spending accounts.

Employer-sponsored health insurance plans typically offer the following benefits:

- Competitive Premiums: With employer contributions, the premiums for these plans are often more affordable compared to individual plans. This makes it easier for employees to access quality healthcare without straining their finances.

- Customized Benefits: Employers can work with insurance providers to design a benefits package that meets the unique needs of their workforce. This may include coverage for specific health conditions, access to specialized care, or additional benefits like vision and dental coverage.

- Network Access: These plans often have a network of preferred providers, including doctors, hospitals, and specialists. Employees can access these providers at a discounted rate, making healthcare more affordable and convenient.

- Wellness Programs: Many employer-sponsored health insurance plans include wellness initiatives and incentives to encourage employees to maintain a healthy lifestyle. These programs may offer discounts on gym memberships, provide access to health coaches, or offer incentives for reaching certain health goals.

Specialized Health Insurance Plans: Filling Unique Needs

In addition to the standard coverage options, specialized health insurance plans are designed to cater to specific needs and circumstances. These plans offer targeted benefits and can provide essential coverage for individuals who may not qualify for traditional health insurance or require specialized care.

Short-term health insurance plans, for example, offer temporary coverage for individuals between jobs or those waiting for other insurance plans to take effect. These plans typically have lower premiums but may have limited benefits and shorter coverage periods. They can be a cost-effective solution for individuals who need coverage for a specific period of time.

Catastrophic health insurance plans are designed for young adults or those with limited financial means. These plans have low premiums but high deductibles, providing essential coverage for catastrophic events like accidents or serious illnesses. They are a cost-effective option for individuals who want basic protection against unexpected health emergencies.

Dental and vision insurance plans are separate from standard health insurance plans and provide coverage for dental and eye care. These plans often have annual maximums and co-payments, but they can be a valuable addition for individuals who require frequent dental or eye care but may not need extensive medical coverage. They ensure that individuals can access the necessary dental and vision services without incurring high out-of-pocket costs.

Performance Analysis and Future Implications

As we conclude our comprehensive guide to health insurance coverage options, it’s essential to reflect on the performance and impact of these plans in the healthcare landscape. In this section, we will analyze the effectiveness of different coverage options and discuss the potential future implications for healthcare access and affordability.

Performance Analysis of Coverage Options

Health insurance coverage options have evolved significantly over the years, with various plans aiming to meet the diverse needs of individuals and families. Let’s take a closer look at the performance of each type of coverage and assess their impact on healthcare access and outcomes.

Private health insurance plans have traditionally offered a high degree of flexibility and customization, allowing individuals to choose the level of coverage that aligns with their needs and budget. These plans have a wide network of providers and often include additional benefits like vision, dental, and prescription drug coverage. While private insurance plans provide comprehensive coverage, they can be more expensive, especially for individuals with pre-existing conditions or those who require specialized care.

Government-sponsored health insurance programs, such as Medicare, Medicaid, and CHIP, have played a critical role in ensuring access to healthcare for specific populations. Medicare provides comprehensive coverage for individuals aged 65 and older, as well as those with certain disabilities, offering hospital insurance, medical insurance, and prescription drug coverage. Medicaid, on the other hand, focuses on providing coverage to low-income individuals, children, and pregnant women, ensuring that they have access to essential healthcare services. The Children's Health Insurance Program (CHIP) further expands access to healthcare for children in families that may not qualify for Medicaid but cannot afford private insurance.

Employer-sponsored health insurance plans are a popular choice for many individuals, as they often come with competitive premiums and comprehensive benefits. These plans are designed to meet the needs of the company's workforce, providing access to a network of preferred providers and additional perks like wellness programs and flexible spending accounts. With employer contributions, these plans can be more affordable, making healthcare more accessible for employees.

Specialized health insurance plans, such as short-term, catastrophic, dental, and vision plans, fill unique needs and provide targeted coverage. Short-term plans offer temporary coverage for individuals between jobs or waiting for other plans, while catastrophic plans provide essential protection against unexpected health emergencies. Dental and vision plans ensure that individuals have access to necessary dental and eye care without incurring high costs. These specialized plans cater to specific circumstances and can be a cost-effective solution for those with limited financial means or unique healthcare needs.

Future Implications and Industry Trends

As the healthcare landscape continues to evolve, several trends and developments are shaping the future of health insurance coverage. Here are some key implications and industry trends to consider:

- Focus on Value-Based Care: The healthcare industry is shifting towards value-based care models, which emphasize the quality and outcomes of healthcare services rather than the quantity of services provided. This shift is expected to impact insurance coverage, with insurers incentivizing providers to deliver high-quality, cost-effective care.

- Telehealth and Virtual Care: The COVID-19 pandemic has accelerated the adoption of telehealth and virtual care services. Insurance companies are increasingly covering these services, recognizing their potential to improve access to healthcare and reduce costs