Car Insurance Prices By State

When it comes to car insurance, the cost of coverage can vary significantly depending on where you live. Each state in the United States has its own unique set of factors that influence insurance rates, making it crucial for drivers to understand the specifics of their region. This comprehensive guide will delve into the intricate details of car insurance prices by state, shedding light on the key considerations and providing valuable insights for policyholders and prospective buyers alike.

Understanding the State-Specific Factors Affecting Car Insurance Prices

The landscape of car insurance rates across the United States is shaped by a myriad of factors, each with its own impact on the overall cost of coverage. These factors can be broadly categorized into three main areas: demographic considerations, local laws and regulations, and regional risk assessments.

Demographic Factors

Demographics play a pivotal role in determining car insurance rates. Population density, for instance, can have a direct impact on insurance costs. States with higher population densities often experience more frequent claims due to increased traffic congestion and the higher likelihood of accidents. As a result, insurance companies may set higher premiums to account for the elevated risk.

Additionally, the age distribution of a state’s population can influence insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher insurance premiums in states with a substantial youth population. Conversely, states with an older demographic may enjoy lower rates due to the reduced risk associated with more experienced drivers.

Local Laws and Regulations

The legal framework of each state significantly affects car insurance prices. State laws dictate the minimum level of coverage that drivers must carry, with some states requiring more comprehensive insurance than others. For example, while some states mandate only liability coverage, others may require personal injury protection (PIP) or uninsured/underinsured motorist coverage. The more extensive the required coverage, the higher the average insurance premium.

Furthermore, local laws pertaining to drunk driving, speeding, and other traffic violations can impact insurance rates. States with stricter laws and more severe penalties for these offenses may experience lower insurance rates due to the deterrent effect on risky driving behaviors.

Regional Risk Assessments

Insurance companies assess the risk associated with insuring vehicles in different regions, taking into account factors such as weather conditions, crime rates, and road quality. States prone to severe weather events like hurricanes, tornadoes, or frequent flooding may face higher insurance premiums due to the increased risk of damage to vehicles.

Similarly, states with higher crime rates, particularly those with a higher incidence of car theft or vandalism, often have higher insurance costs. Insurance companies factor in these risks when determining rates, as they directly impact the likelihood and cost of claims.

Car Insurance Prices by State: A Comprehensive Analysis

To provide a detailed understanding of car insurance prices across the United States, let’s delve into a state-by-state analysis, examining the key factors that influence rates and offering valuable insights for drivers.

California

California, known for its diverse landscapes and bustling cities, presents a unique insurance landscape. The state’s vast size and varying demographics contribute to a wide range of insurance rates. In urban areas like Los Angeles and San Francisco, where traffic congestion and accident rates are high, insurance premiums tend to be higher. Conversely, rural areas may enjoy lower rates due to reduced traffic and a lower risk of accidents.

Additionally, California’s strict insurance laws, including the requirement for Personal Injury Protection (PIP) coverage, influence insurance costs. The state’s focus on comprehensive coverage ensures that policyholders are adequately protected, but it also contributes to slightly higher average premiums.

Texas

Texas, with its diverse geography and vibrant cities, offers a varied insurance landscape. Urban centers like Houston and Dallas, known for their heavy traffic and high accident rates, often command higher insurance premiums. On the other hand, rural areas in Texas tend to have lower insurance costs due to reduced traffic and a lower risk of accidents.

The state’s insurance laws, which require liability coverage but not comprehensive or collision insurance, provide policyholders with flexibility. However, this also means that drivers may need to carefully assess their coverage needs to ensure they are adequately protected.

New York

New York, a bustling metropolis with a dense population, presents a unique insurance challenge. The high volume of traffic and the congestion in cities like New York City and Buffalo contribute to increased accident rates, leading to higher insurance premiums. Additionally, the state’s stringent insurance laws, which require comprehensive coverage, further impact insurance costs.

However, New York’s insurance market is highly competitive, offering drivers a range of options to find affordable coverage. By comparing quotes and understanding their coverage needs, drivers in New York can navigate the complex insurance landscape and secure the best rates.

Florida

Florida, with its sunny climate and abundant coastline, attracts millions of residents and tourists each year. However, the state’s insurance landscape is shaped by its susceptibility to severe weather events, particularly hurricanes. As a result, insurance premiums in Florida can be significantly higher than in other states.

Florida’s insurance laws, which require Personal Injury Protection (PIP) coverage, aim to provide comprehensive protection for policyholders. However, the high risk associated with severe weather events means that drivers must carefully assess their coverage to ensure they are adequately protected.

Illinois

Illinois, known for its vibrant cities and diverse landscapes, offers a range of insurance rates. Urban areas like Chicago, with their high population density and busy streets, often command higher insurance premiums due to increased accident risks. In contrast, rural areas in Illinois may enjoy lower insurance costs due to reduced traffic and a lower likelihood of accidents.

The state’s insurance laws, which require liability coverage and provide options for additional coverage, offer policyholders flexibility. However, drivers must carefully evaluate their coverage needs to ensure they have the right protection at the best rates.

Other States

Each state in the United States has its own unique insurance landscape, shaped by a combination of demographic factors, local laws, and regional risk assessments. Here’s a glimpse into the insurance dynamics of a few more states:

| State | Key Insurance Factors |

|---|---|

| Washington | High accident rates in urban areas, strict insurance laws |

| Massachusetts | Expensive insurance market, comprehensive coverage required |

| Pennsylvania | Varying insurance rates based on region, liability coverage required |

| Ohio | Competitive insurance market, liability and PIP coverage required |

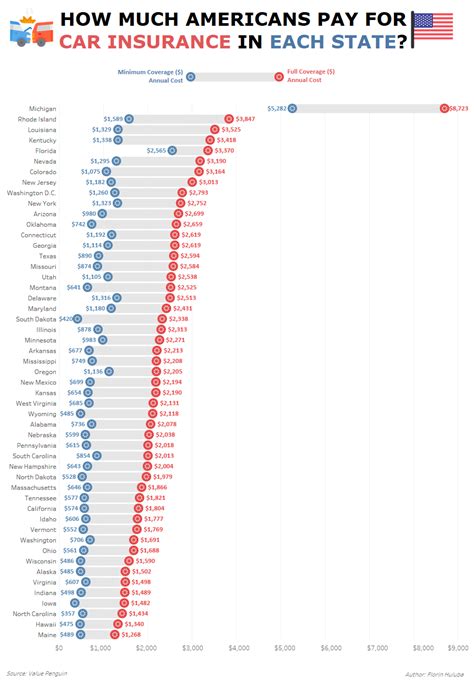

| Michigan | High insurance costs due to no-fault insurance laws |

Navigating the Complex World of Car Insurance Rates

Understanding the intricate dynamics of car insurance prices by state is crucial for drivers to make informed decisions about their coverage. By considering the unique factors that influence insurance rates in their region, policyholders can better assess their needs and secure the most cost-effective coverage.

Here are some key takeaways to help navigate the complex world of car insurance rates:

- Demographics play a significant role in determining insurance rates. Population density, age distribution, and traffic congestion are key factors to consider.

- Local laws and regulations directly impact insurance costs. Understanding the minimum coverage requirements and any additional mandates is essential.

- Regional risk assessments, including weather conditions, crime rates, and road quality, influence insurance rates. Policyholders should assess these factors to ensure they have adequate coverage.

- Comparing quotes from multiple insurance providers is crucial to finding the best rates. Online tools and broker services can simplify the comparison process.

- Understanding one’s coverage needs is essential. Policyholders should assess their risk tolerance and tailor their coverage accordingly.

The Future of Car Insurance Prices: Trends and Predictions

The landscape of car insurance rates is constantly evolving, influenced by technological advancements, changing consumer behaviors, and evolving regulatory frameworks. Here’s a glimpse into the future of car insurance prices and the trends that are shaping the industry:

Telematics and Usage-Based Insurance

Telematics, the technology that enables insurance companies to track driving behavior, is gaining traction. Usage-based insurance (UBI) programs, which use telematics data to offer discounts to safe drivers, are becoming more prevalent. This trend is expected to continue, with insurance companies increasingly leveraging data to offer personalized rates based on actual driving behavior.

Digital Transformation

The digital transformation of the insurance industry is well underway, with online quote comparisons, digital policy management, and claims processing becoming the norm. This trend is likely to accelerate, making it easier for consumers to shop for insurance and manage their policies online.

Regulatory Changes

State and federal regulatory bodies play a critical role in shaping the insurance landscape. Changes in insurance laws, such as modifications to minimum coverage requirements or the introduction of new regulations, can significantly impact insurance rates. Staying informed about these changes is essential for policyholders to understand how they may affect their premiums.

Electric Vehicles and Autonomous Cars

The rise of electric vehicles (EVs) and the impending arrival of autonomous cars are poised to revolutionize the insurance industry. EVs may experience different accident patterns and repair costs, potentially impacting insurance rates. Similarly, the introduction of autonomous vehicles could lead to a reduction in accident rates, influencing insurance premiums.

Data Analytics and Artificial Intelligence

Insurance companies are increasingly leveraging advanced data analytics and artificial intelligence (AI) to improve risk assessment and pricing accuracy. These technologies enable insurers to make more informed decisions, leading to more precise insurance rates. As these technologies evolve, their impact on insurance pricing is expected to grow.

Conclusion

Car insurance prices are influenced by a myriad of factors, each unique to the state in which you reside. Understanding these factors and staying informed about industry trends is essential for policyholders to make informed decisions about their coverage. By navigating the complex world of car insurance rates, drivers can secure the best protection at the most competitive prices.

Frequently Asked Questions

How do I find the best car insurance rates in my state?

+To find the best car insurance rates in your state, compare quotes from multiple providers. Utilize online comparison tools and consult with insurance brokers to understand the unique factors influencing rates in your region. Additionally, assess your coverage needs and tailor your policy accordingly.

Are there any ways to lower my car insurance premiums?

+Yes, there are several strategies to lower your car insurance premiums. These include maintaining a clean driving record, taking advantage of discounts (such as for safe driving or bundling policies), and increasing your deductible. Additionally, staying informed about local insurance trends and shopping around for the best rates can help reduce your premiums.

What factors influence the cost of car insurance in my state?

+The cost of car insurance in your state is influenced by various factors, including demographic considerations (such as population density and age distribution), local laws and regulations (minimum coverage requirements), and regional risk assessments (weather conditions, crime rates, and road quality). Understanding these factors is key to assessing your insurance needs.

How do I know if I have adequate car insurance coverage?

+Assessing your car insurance coverage involves understanding your specific needs and risks. Consider factors such as the value of your vehicle, your driving record, and the likelihood of accidents or other incidents in your area. It’s essential to review your policy regularly and make adjustments as your circumstances change.

What impact do telematics and usage-based insurance have on car insurance rates?

+Telematics and usage-based insurance (UBI) programs offer discounts to safe drivers by tracking their driving behavior. These programs are becoming more prevalent, and their impact on insurance rates is expected to grow. Policyholders who drive safely and responsibly may benefit from lower premiums through UBI programs.